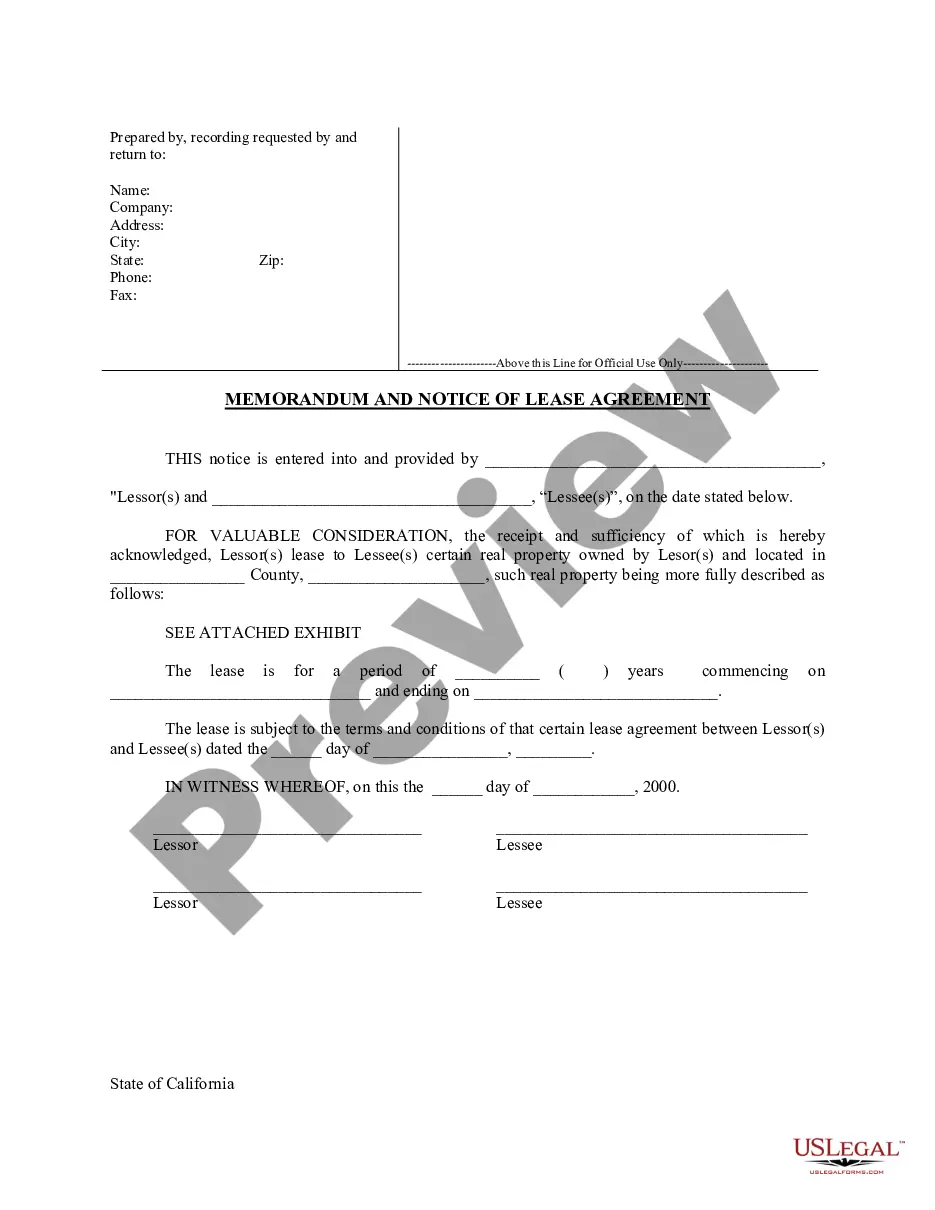

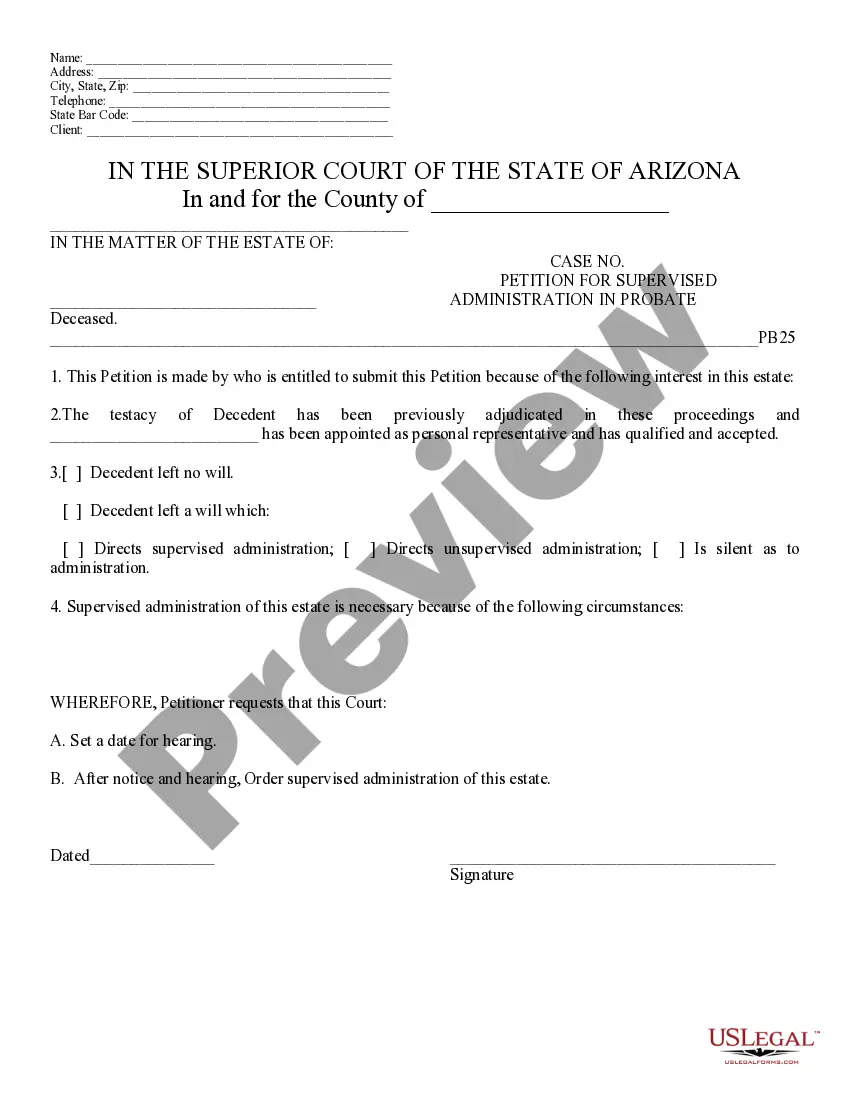

This model form, a Petition for Supervised Administration in Probate - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Mesa Arizona Petition for Supervised Administration in Probate

Description

How to fill out Arizona Petition For Supervised Administration In Probate?

If you have previously availed yourself of our service, sign in to your account and download the Mesa Arizona Petition for Supervised Administration in Probate to your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to swiftly locate and acquire any template for your personal or business requirements!

- Verify you’ve found the correct document. Browse the description and utilize the Preview option, if available, to ensure it suits your needs. If it doesn’t match your requirements, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and finalize the payment. Enter your credit card information or select the PayPal option to complete the purchase.

- Receive your Mesa Arizona Petition for Supervised Administration in Probate. Choose the file format for your document and store it on your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

How to Start Probate for an Estate Open the Decedent's Last Will and Testament.Determine Who Will be the Personal Representative.Compile a List of the Estate's Interested Parties.Take an Inventory of the Decedent's Assets.Calculate the Decedent's Liabilities.Determine if Probate is Necessary.Seek a Waiver of Bond.

Settling an Estate in Arizona The first step is to file the will and a petition for probate with the county court where the deceased person lived or where they had property if they lived out of state. A personal representative is appointed by the court, which is usually the person named in the will.

The average cost of probate in Arizona can vary depending on a number of circumstances, but legal fees alone can range, on average, anywhere from $2,000 to about $5,000.

Generally, personal representative (executor) compensation is based on a reasonable $25 to $50 hourly rate standard.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Assuming probate is necessary, there can be a number of consequences for not petitioning to open probate: Individually-titled assets will remain frozen in the decedent's name. The estate's assets are subject to losses. Another interested party may petition to open probate.

How Long Do You Have to File Probate After Death in Arizona? According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Common Probate Fees in Arizona Attorney fees (if you use a probate lawyer) Executor compensation (averaging anywhere from around $25 - $50/hour; Arizona is a reasonable compensation state)

When someone dies, their beneficiaries have up to two years to open probate. Once probate is opened, there aren't any time limits that will cause the case to expire.

The executor is entitled to the following fee: on the gross value of assets in an estate: 3,5%; on income accrued and collected after death of the deceased: 6%