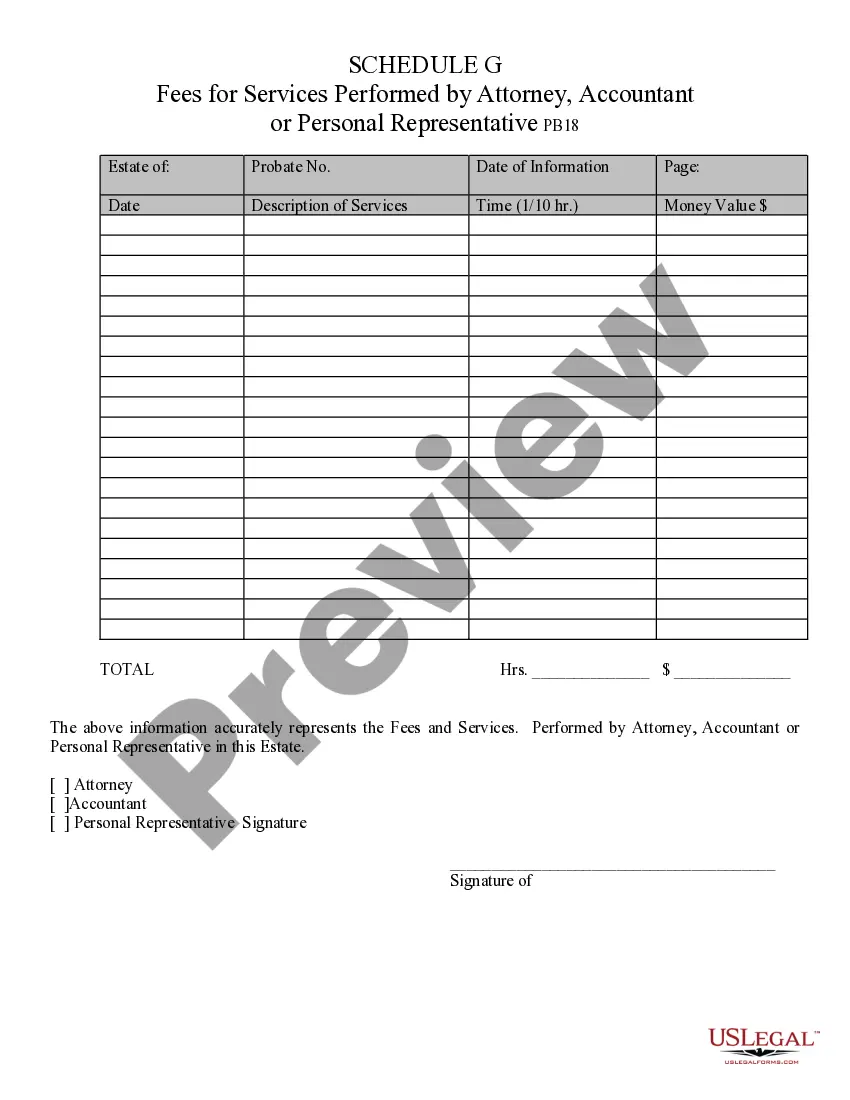

Fees for Services Performed by Attorney, Accountant, or Personal Representative - Arizona: This form is used when an administrator of an estate is called upon to list all the fees of any professional services, such as attorney or accountant fees, paid by the estate. It states the amount of the fee, as well as the duties performed for that amount. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative

Description

How to fill out Arizona Fees For Services Performed By Attorney, Accountant, Or Personal Representative?

We consistently endeavor to minimize or avert legal challenges when engaging with intricate law-related or financial matters.

To achieve this, we seek legal remedies that are generally very costly.

Nonetheless, not all legal issues are that intricate.

Many of them can be managed by us independently.

Leverage US Legal Forms whenever you require to locate and download the Phoenix Arizona Fees for Services Performed by Attorney, Accountant, or Personal Representative or any other document swiftly and securely.

- US Legal Forms is a digital repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to take control of your affairs without resorting to legal advice.

- We grant access to legal document templates that are not always freely accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

An executor cannot claim for the time they have incurred; however they are entitled to be reimbursed for the reasonable costs of the administration.

How Long Does Probate Take in Arizona. According to Arizona law, probate proceedings must be kept open for at least 4 months to allow any creditors to make their claims. Informal probates typically last between 6-8 months, depending on how quickly the Personal Representative completes their required duties.

Compensation for an Arizona Personal Representative Generally personal representatives receive reasonable compensation paid at $25 to $50 per hour.

When someone dies, their beneficiaries have up to two years to open probate. Once probate is opened, there aren't any time limits that will cause the case to expire.

Once the Grant has been received the personal representative has a duty to collect in the assets of the deceased, pay the liabilities and distribute the estate to the beneficiaries. They have many powers to assist them when dealing with an estate e.g. power to sell property, insure property and invest monies, etc.

Compensation for an Arizona Personal Representative Generally personal representatives receive reasonable compensation paid at $25 to $50 per hour.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Generally, personal representative (executor) compensation is based on a reasonable $25 to $50 hourly rate standard.