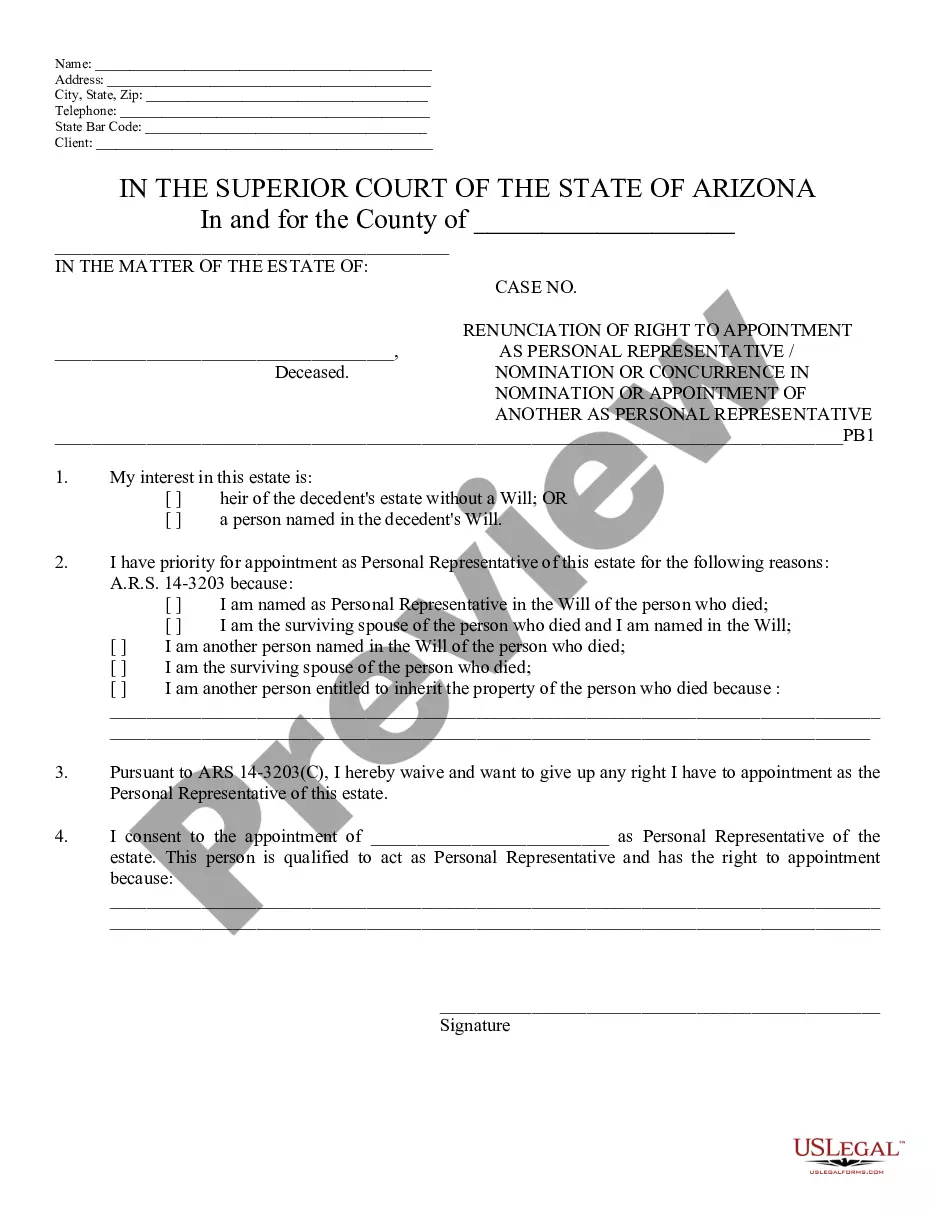

Renunciation of Right to Appointment of Personal Representative: This form is used when an appointed representative for an estate, wishes to relinquish his/her rights. After stating his/her reasons for the renunciation, the form should be signed in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Renunciation of Right to Appointment of Personal Representative

Description

Form popularity

FAQ

That is accomplished by filing with the local Probate Court a pleading called an Application for Informal Probate of Will and Appointment of Personal Representative. Alternatively, in the case of an intestate decedent, the pleading is called an Application for Informal Appointment of Personal Representative.

You can make an application to remove an Executor either before a Grant of Probate has been issued or after. Generally, if such an application is made after the issue of a Grant of Probate, it would be made to the High Court under Section 50 of the Administration of Justice Act 1985.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Whether you have been named the executor or you're petitioning to be the administrator, the path to becoming a personal representative is the same?you'll need to submit a petition with the county court. A hearing will be scheduled to validate the will (if the decedent has one) and appoint the personal representative.

A person interested in the estate may petition for removal of a personal representative for cause at any time. Once the petition is filed the court will set a time and place for a hearing. Notice shall be given by the petitioner to the personal representative, and to other persons as the court may order.

Once the Grant has been received the personal representative has a duty to collect in the assets of the deceased, pay the liabilities and distribute the estate to the beneficiaries. They have many powers to assist them when dealing with an estate e.g. power to sell property, insure property and invest monies, etc.

The basic steps in probate vary from case to case, but essentially boil down to these steps: Will Validation. Appointment of Personal Representative. Gathering Decedent's Assets. Settling Liabilities. Distributing Assets. Closing the Estate.

Common Probate Fees in Arizona Attorney fees (if you use a probate lawyer) Executor compensation (averaging anywhere from around $25 - $50/hour; Arizona is a reasonable compensation state)

Whether you have been named the executor or you're petitioning to be the administrator, the path to becoming a personal representative is the same?you'll need to submit a petition with the county court. A hearing will be scheduled to validate the will (if the decedent has one) and appoint the personal representative.

When is a probate action required in Arizona? Under Arizona law, the general rule is that if the deceased person owned more than $100,000 of equity in real estate, or more than $75,000 of personal property (including physical possessions and money), then a probate action is required to transfer the assets to the heirs.