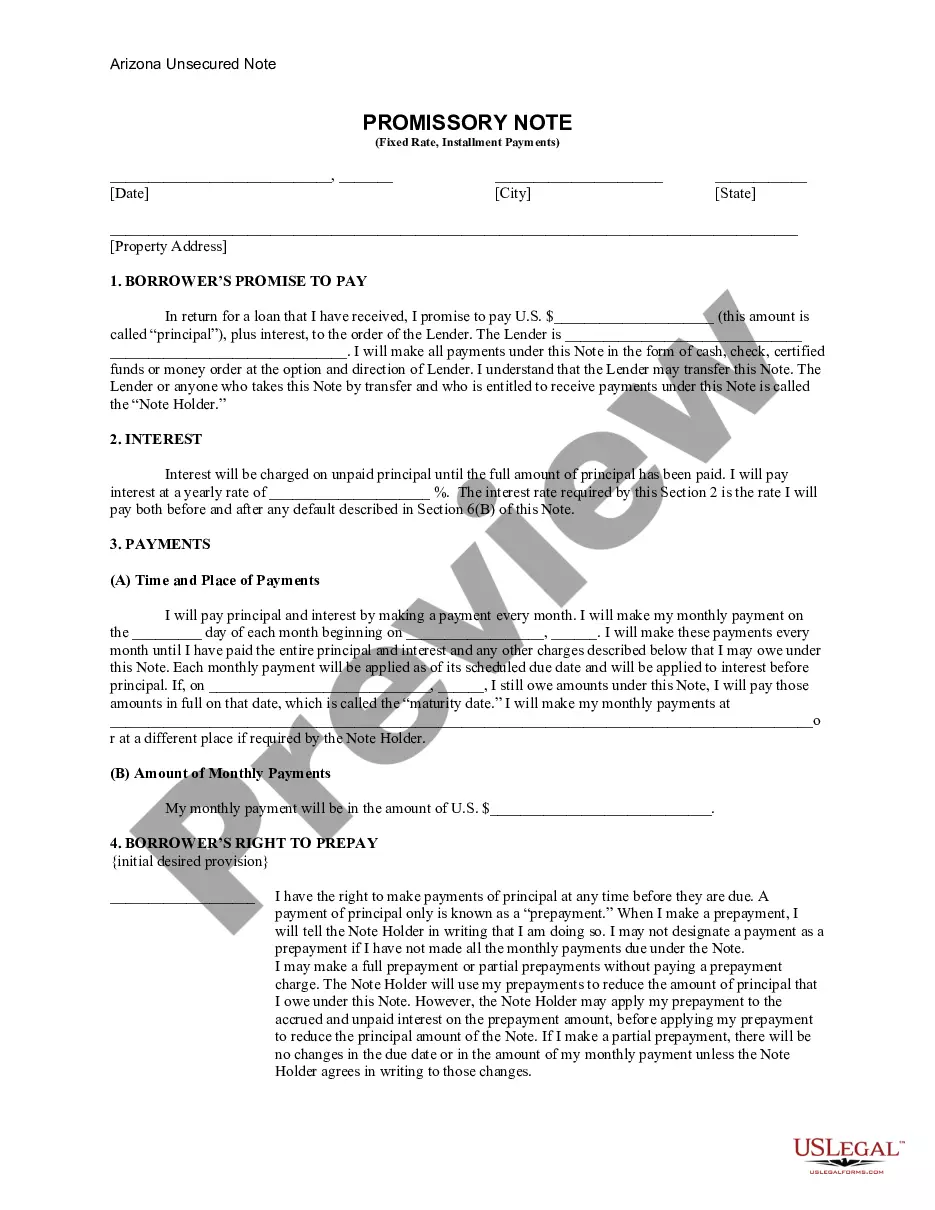

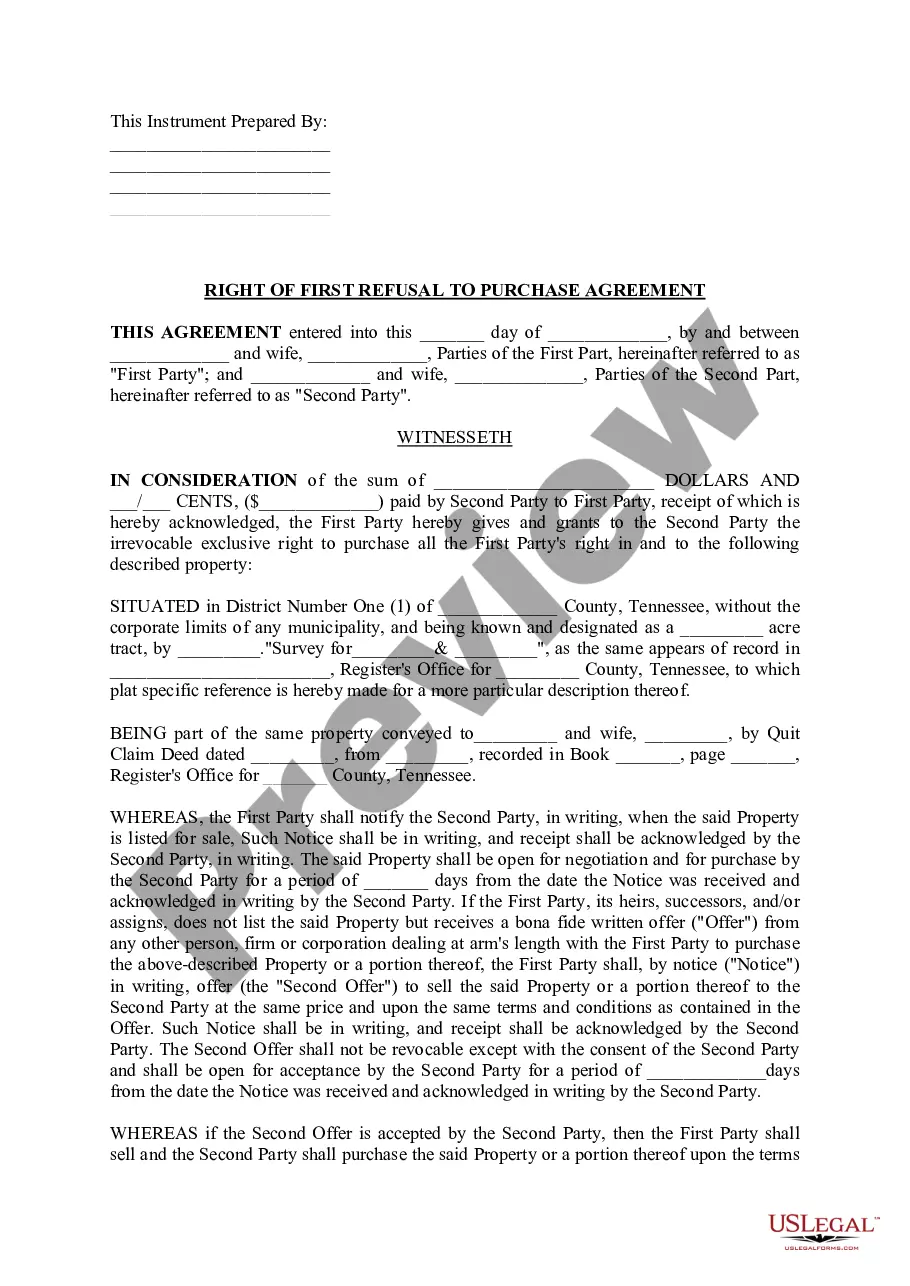

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Phoenix Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Arizona Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Do you require a dependable and cost-effective supplier of legal forms to purchase the Phoenix Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate? US Legal Forms is your ideal choice.

Whether you need a fundamental agreement to establish rules for living together with your partner or a collection of forms to facilitate your divorce through the court, we have you covered. Our platform offers more than 85,000 current legal document templates for personal and business purposes. All templates we provide access to are not generic and are tailored to the specifications of specific states and regions.

To acquire the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Is it your first time visiting our site? No problem. You can create an account in a few minutes, but first, ensure you do the following.

You can now set up your account. Then select the subscription option and continue to payment. After the payment is completed, download the Phoenix Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in any available format. You can revisit the website anytime to redownload the document at no additional cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time learning about legal documents online once and for all.

- Verify if the Phoenix Arizona Installments Fixed Rate Promissory Note Secured by Commercial Real Estate complies with the laws of your state and local jurisdiction.

- Review the form’s description (if available) to understand who and what the document is intended for.

- Repeat the search if the form does not suit your particular situation.

Form popularity

FAQ

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

The promissory note, a contract separate from the mortgage, is the document that creates the loan obligation. This document contains the borrower's promise to repay the amount borrowed. If you sign a promissory note, you're personally liable for repaying the loan.

Only the borrower signs the promissory note, whereas both the lender and the borrower sign a loan agreement. The signed document means that the borrower agrees to pay back the loan.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Alternative names for promissory notes include: IOU, personal notes, loan agreements, notes payable, note, promissory note form, promise to pay, secured or unsecured notes, demand notes, or commercial paper.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.