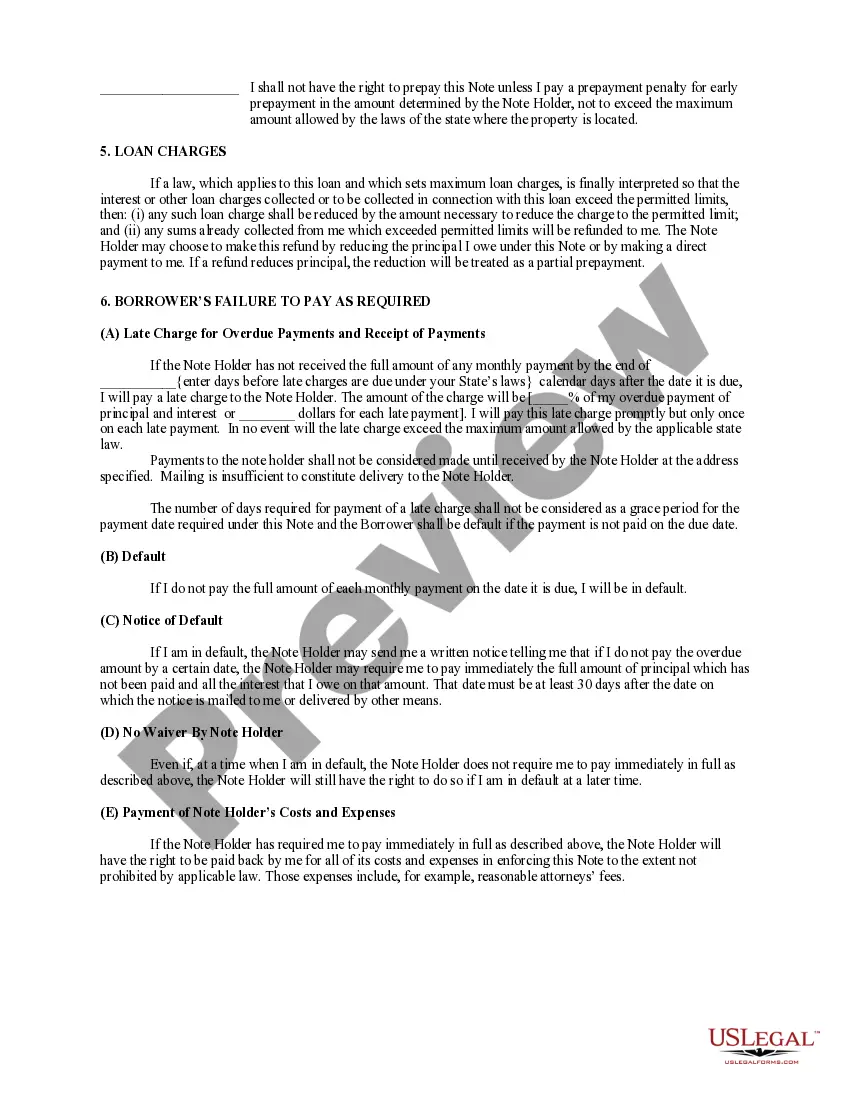

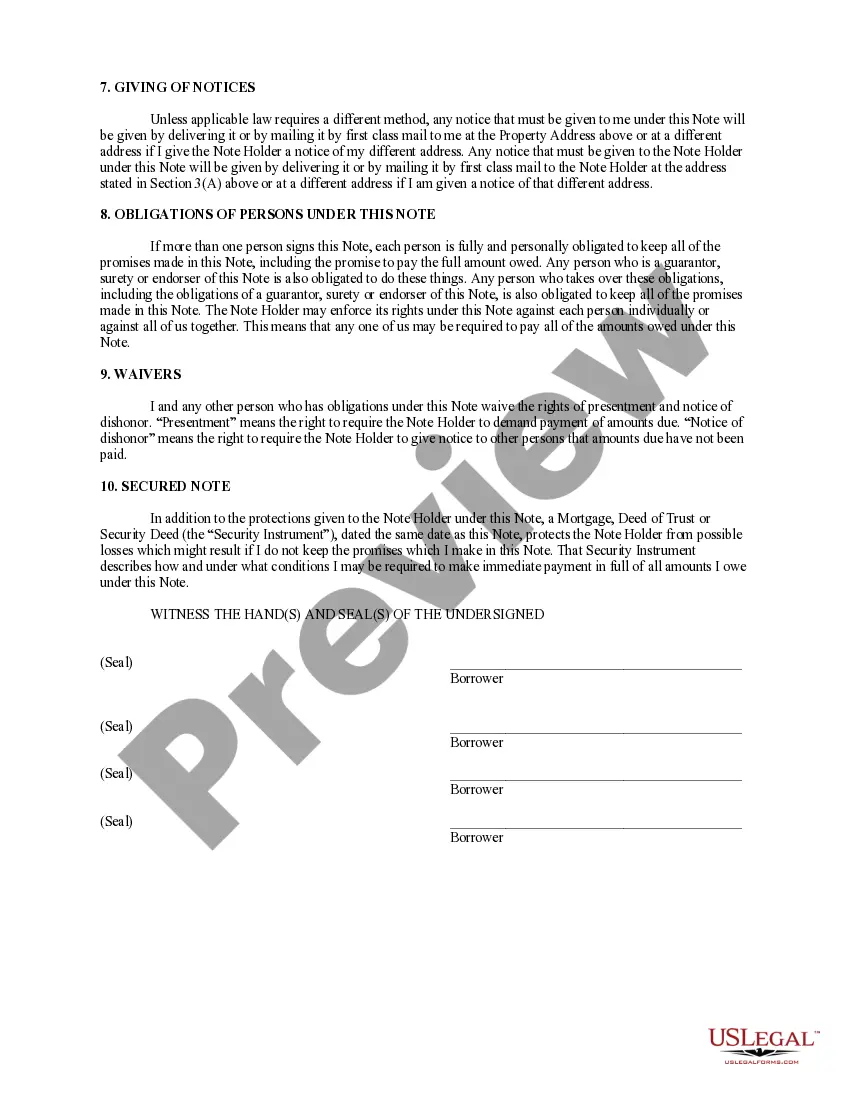

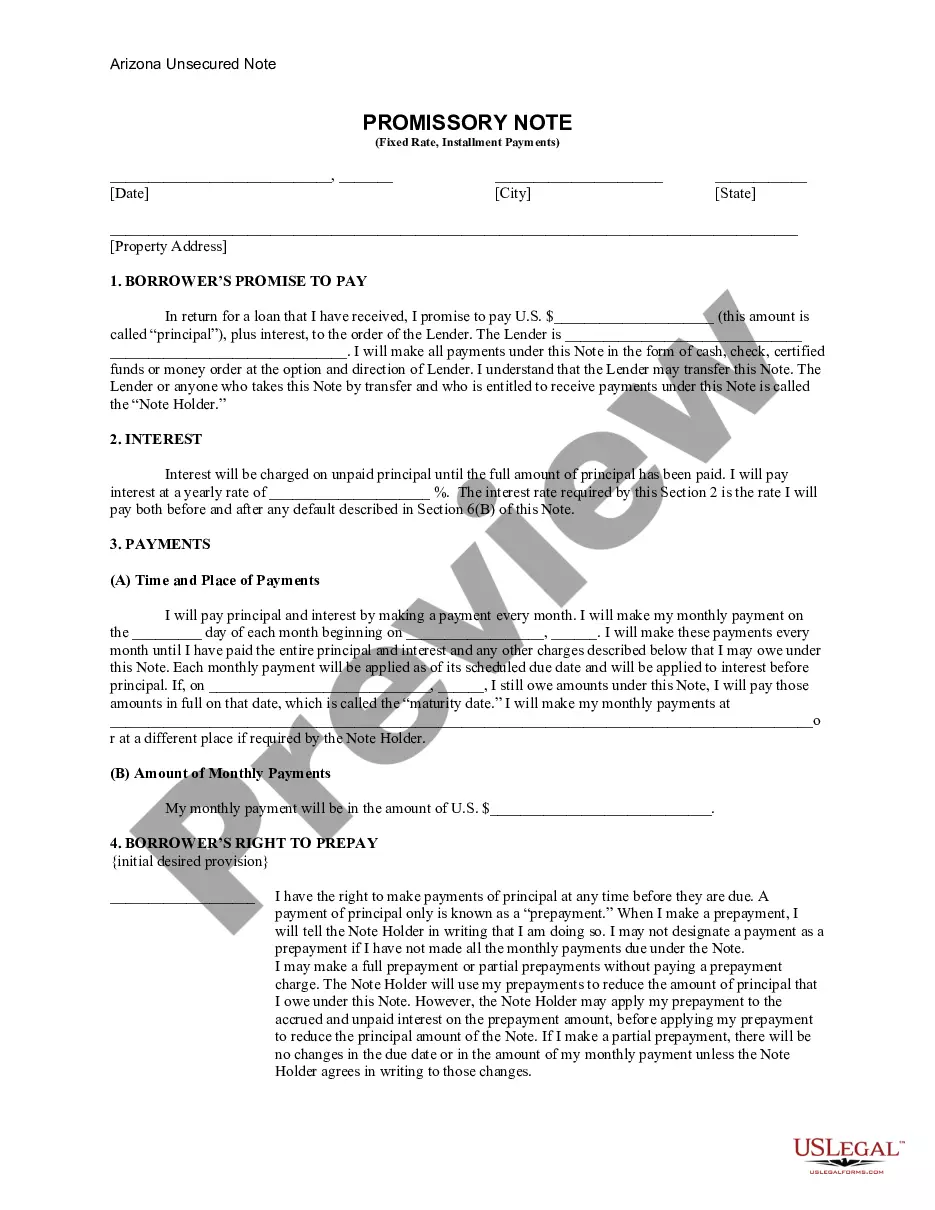

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Arizona Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you have previously made use of our service, Log In to your profile and retrieve the Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have lifelong access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to reuse them. Leverage the US Legal Forms service to effortlessly locate and store any template for your personal or professional needs!

- Confirm you have located an appropriate document. Browse through the description and utilize the Preview option, if available, to determine if it aligns with your requirements. If it falls short, use the Search tab above to discover the right one.

- Purchase the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and finalize your payment. Provide your credit card information or opt for the PayPal method to complete your transaction.

- Obtain your Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Select the file format for your document and save it to your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

In the Philippines, a promissory note typically does not require notarization to be valid. However, notarizing the document can lend it more credibility and can be beneficial in case of legal disputes. If you are dealing with a Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, consulting legal advice may be a good step.

In Arizona, a promissory note does not legally require notarization to be enforceable. However, notarization can help establish authenticity and protect against disputes. If you are using a Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it may be wise to have it notarized as an additional precaution.

An example of an on-demand promissory note is a document stating that the borrower will repay a specified amount upon the lender's request. Typically, these notes do not have a set repayment schedule, which allows flexibility. When linked to Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it can enhance security for the lender.

While a Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate can be beneficial, it does have downsides. Borrowers may face high-interest rates if their creditworthiness is low, and lenders take a risk if the borrower defaults. Additionally, each party should understand state regulations regarding enforcement and collection. US Legal Forms provides comprehensive resources to help navigate these factors effectively.

A Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is generally enforceable as long as it meets specific legal requirements. For instance, the note should clearly outline the terms, such as the repayment schedule and interest rate. If a borrower defaults, the lender can take legal action to recover the owed amount. Consulting with a legal professional can help ensure your note is properly structured.

Typically, the lender holds the Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate during the repayment term. This ensures that the lender has the legal right to collect payments and enforce the terms of the note. Once the borrower fulfills their obligations, the lender will transfer the note to the borrower, releasing their claim. If you're unsure about the process, US Legal Forms provides clear templates and guidance to help.

When you hold a note, you are the lender, which means you have provided funds to a borrower in return for their promise to repay. This role can provide a steady income through interest payments. In the context of a Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, your rights include receiving payments as per the agreed schedule. This role carries responsibilities, so being informed about your rights is crucial for success.

'Holding paper' means you own a promissory note and have the right to receive payments on it. This term is often used in real estate financing and refers to your position as the creditor in a Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate. By holding paper, you gain initial income streams from monthly payments, showcasing the potential benefits of this investment strategy. It's important to manage this correctly to ensure stable returns.

To get a promissory note, you typically have to negotiate terms with the borrower. This is often done in the context of a Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensuring both parties agree on the repayment schedule and interest rates. You can draft a note using templates available through platforms like USLegalForms to simplify the process. It's essential to ensure the document meets state requirements to protect your investment.

Holding a note in real estate refers to owning a documented promise by another party to repay a debt, usually secured by property. This is a common arrangement in transactions involving a Gilbert Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate. As a holder, you have the right to receive payments and can take action if the borrower defaults. It’s vital to understand your rights and responsibilities with such arrangements.