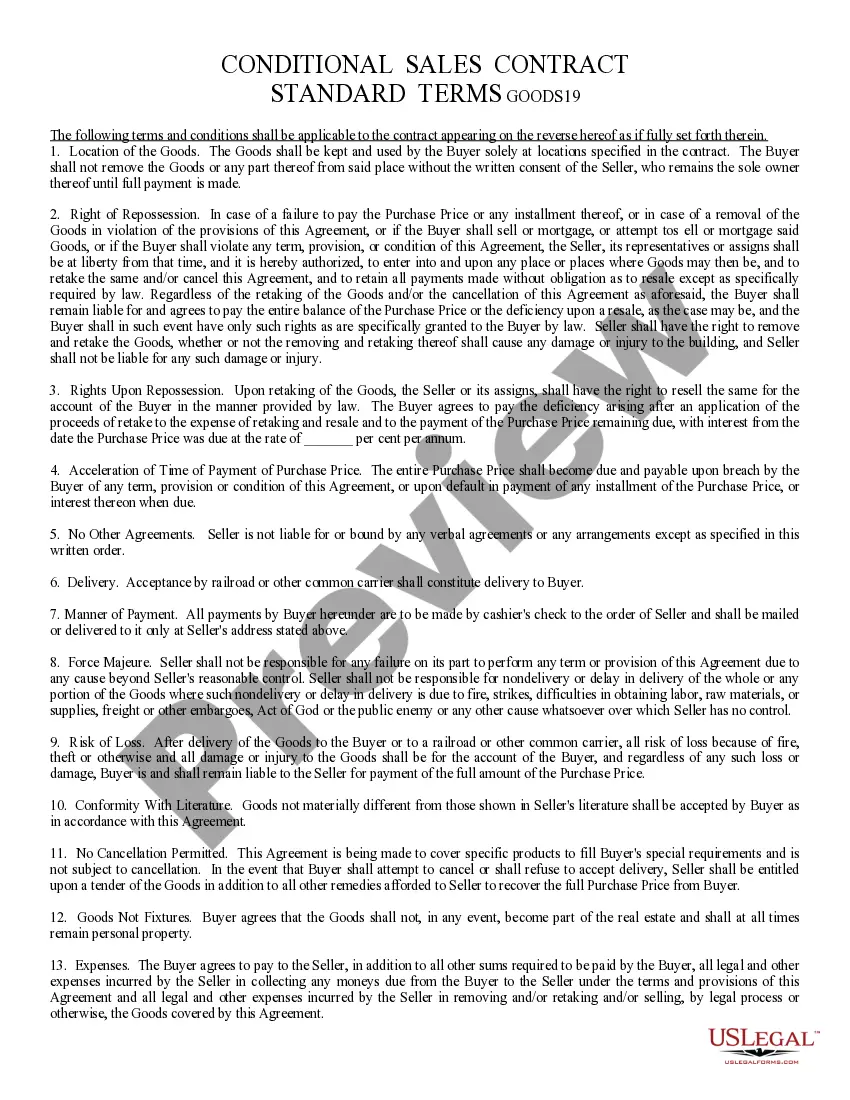

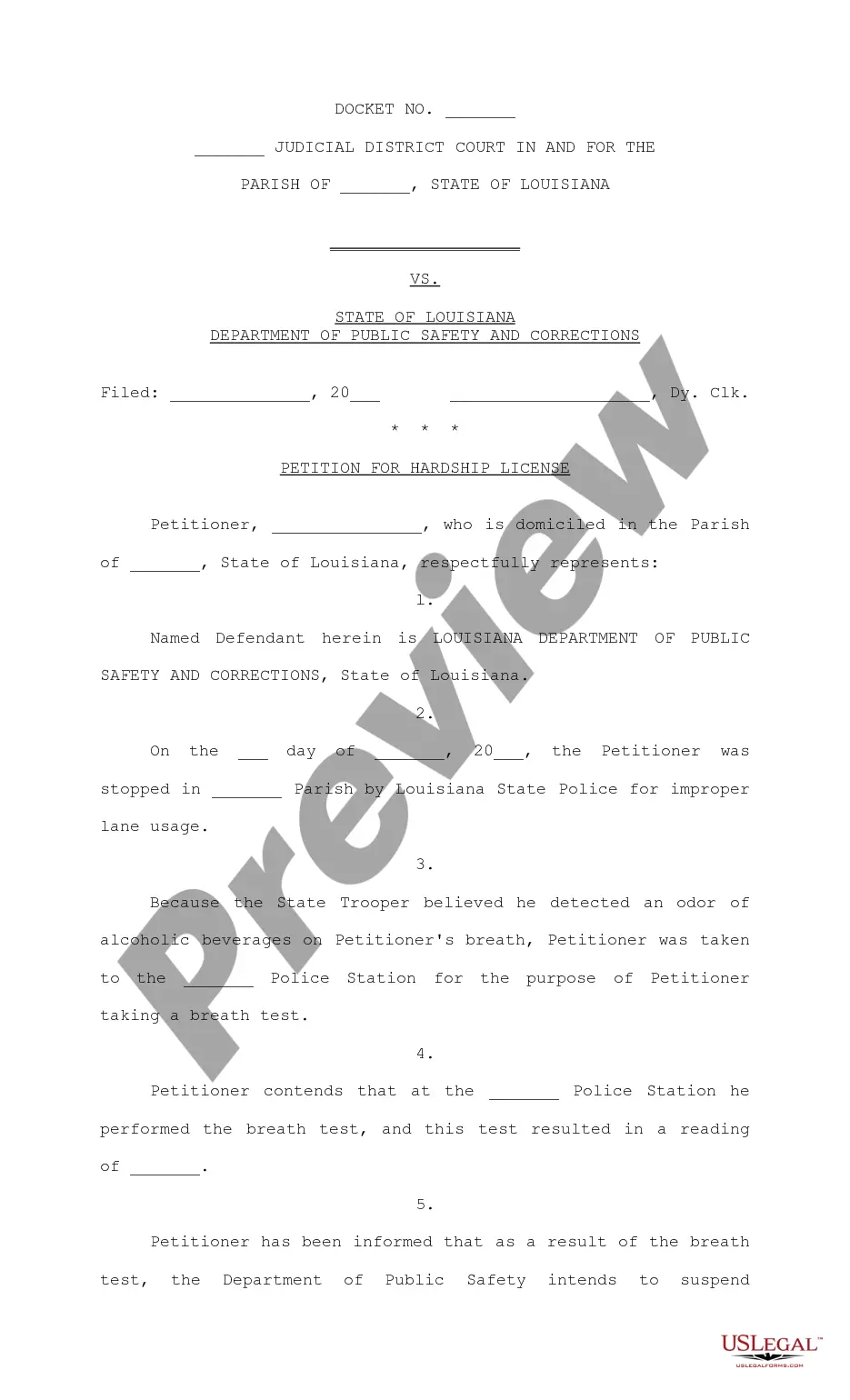

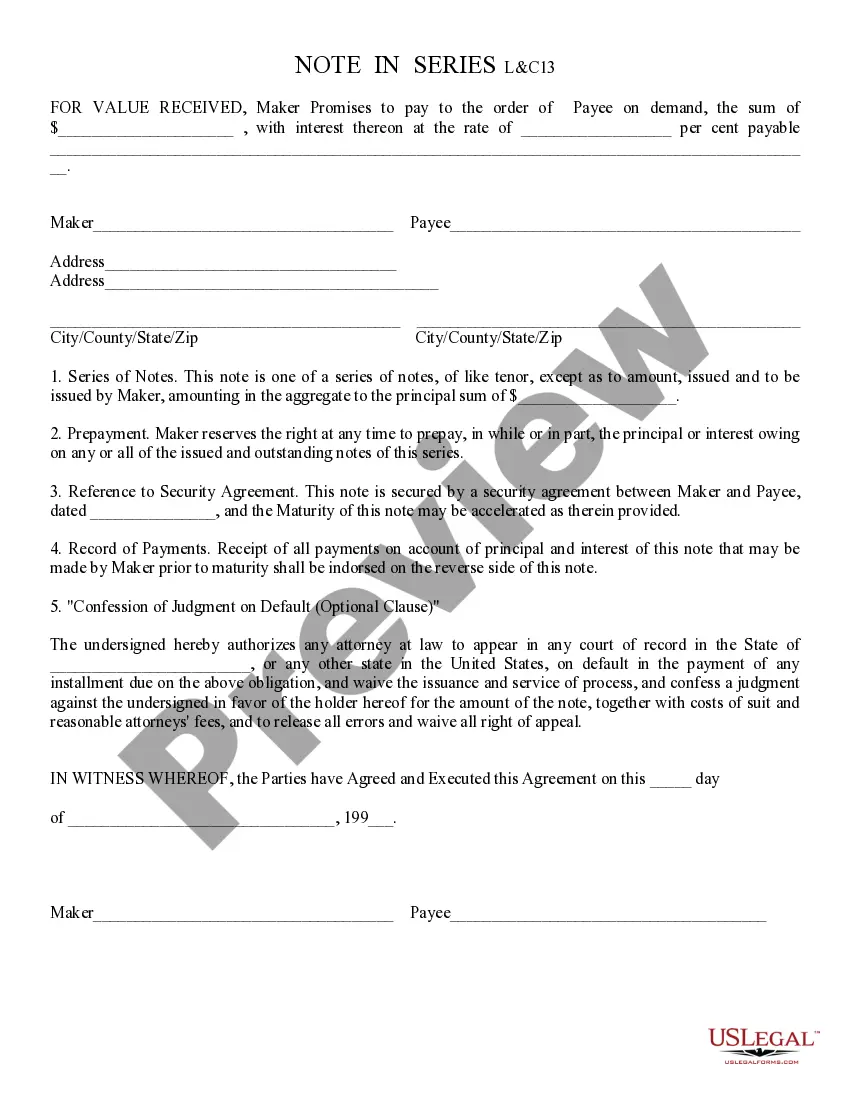

Note In Series: A Note in Series is most commonly used when the Payor and Payee are going to have a continual relationship. In other words, if the Payor and Payee are going to continue buying and selling with each other, either on a weekly or monthly basis, each Note for goods or services would be a Note in Series. This form is available for download in both Word and Rich Text formats.

Phoenix Arizona Note In Series

Description

How to fill out Arizona Note In Series?

Regardless of one’s social or occupational rank, finalizing legal paperwork is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly unfeasible for an individual without legal expertise to create such documents from scratch, primarily because of the intricate vocabulary and legal nuances they encompass.

This is where US Legal Forms proves to be beneficial.

Verify that the form you have selected is appropriate for your region, as the regulations of one jurisdiction are not applicable to another.

After reviewing the form and reading a brief description (if available) of the scenarios for which the document can be utilized, if the chosen form does not fulfill your needs, you may restart your search for the required form.

- Our platform provides an extensive array of over 85,000 ready-to-use state-specific forms that are suitable for virtually any legal situation.

- US Legal Forms is also an invaluable resource for associates or legal advisors aiming to enhance their efficiency with our DIY documents.

- Whether you require the Phoenix Arizona Note In Series or any other paperwork applicable to your jurisdiction, US Legal Forms has got you covered.

- Here’s how you can quickly obtain the Phoenix Arizona Note In Series using our reliable service.

- If you are an existing subscriber, you can quickly Log In to access the necessary form.

- However, if you aren’t familiar with our repository, make sure to follow these steps before downloading the Phoenix Arizona Note In Series.

Form popularity

FAQ

All 1099 forms must be submitted to the IRS and the recipient, but some forms must also be submitted to the Department of Revenue for certain states. With the 1099-NEC being part of the Combined Federal and State Filing program in tax year 2021, we expect changes to some states' filing requirements.

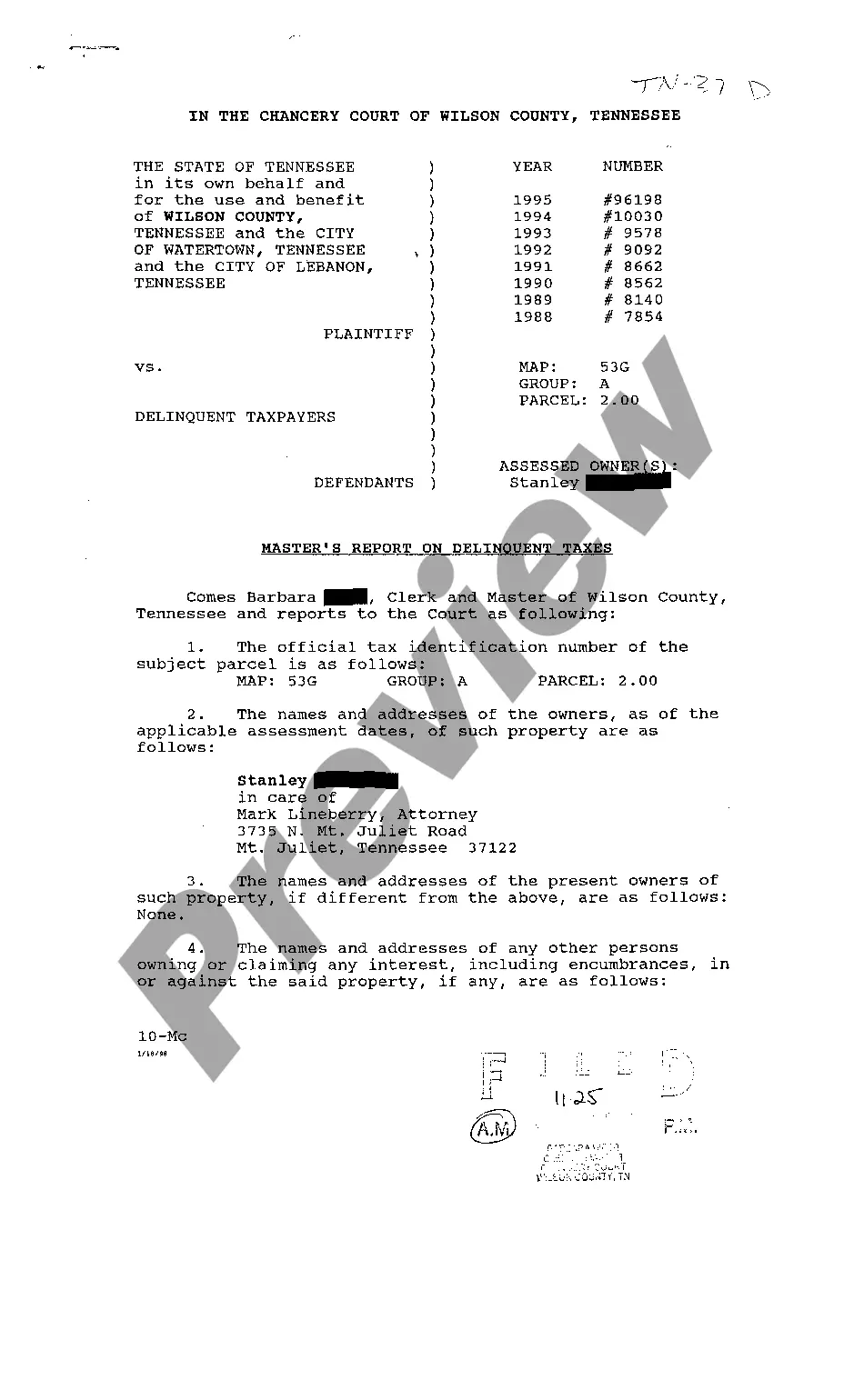

In Maricopa County, Arizona, you can do this at either the main office in Phoenix, at 111 S. Third Avenue, or in Mesa at 222 E. Javelina Avenue. The recorder will need your original deed or a legible copy with original signatures.

For Arizona filing purposes, full-year residents figure their gross income the same way they do for federal income tax filing purposes....Income Tax Filing Requirements. Individuals must file if they are:AND gross income is more than:Single$12,550Married filing joint$25,1002 more rows

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

As the buyer of a property, you are the one responsible for recording the deed. Deeds for real estate need to be filed directly with the municipality or county where the property is located. The documents must be signed, witnessed, and notarized in order to be registered.

Document recording feesAll documents (except plats and surveys)$30.00Plats and surveys first page$24.00Plats and surveys additional per page$20.00Military Discharge (per ARS 11-465)Free3 more rows

ADOR only requires submission of Form 1099 that report Arizona income tax withheld. Taxpayers only need to submit Form 1099-NEC if there is Arizona withheld.

When filing state copies of forms 1099 with Arizona department of revenue, the agency contact information is: Arizona Department of Revenue, 1600 W. Monroe, Phoenix, Arizona 85007-2650. Compliance rules: You may file the Arizona state 1099 copies on paper or on optical media.

One is filing online at the Arizona Department of Revenue. Payment can also be remitted through this online system. You can also file manually through the mail, using Form TPT-1. However, it must be noted that if your tax liability from the previous year is greater than one million dollars, then you must file online.

The Public Records Office is open 8 a.m. to 5 p.m. Monday through Friday except state holidays and is on the first floor at 1616 W. Adams St., Phoenix, AZ 85007. The telephone number is 602-542-4631.