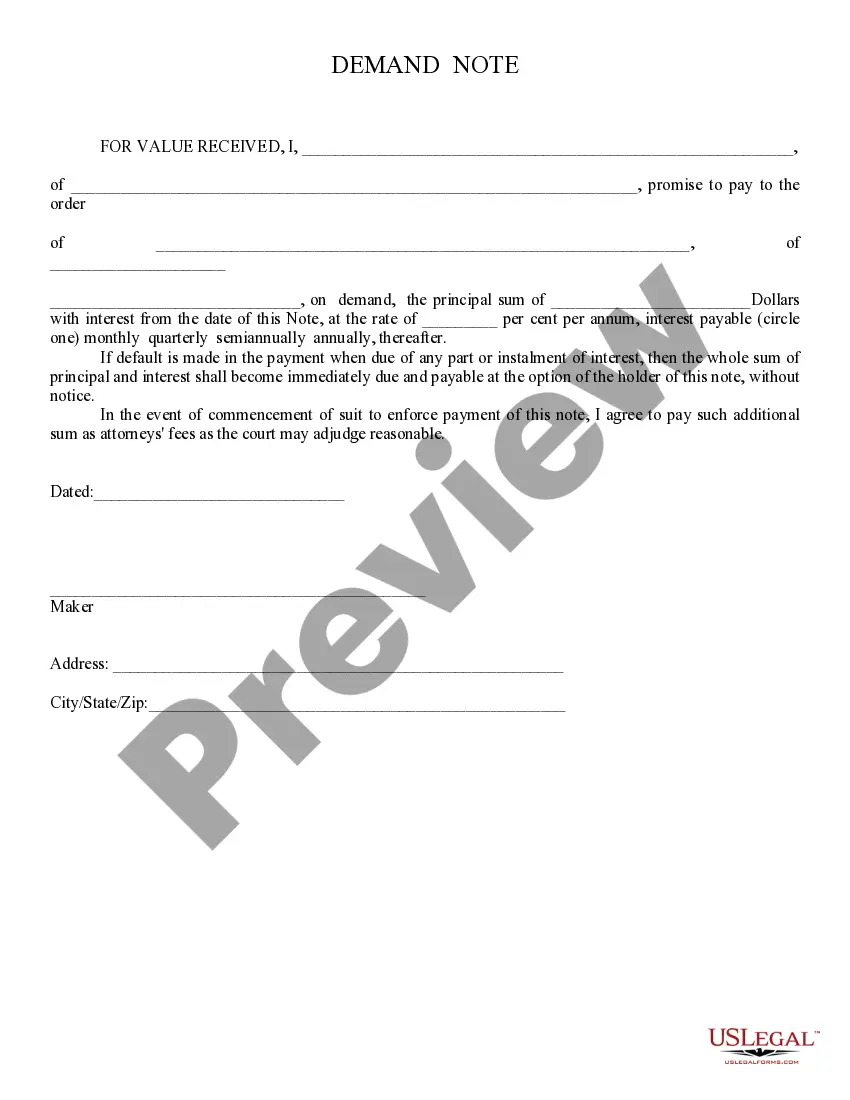

Demand Note: A Demand Note is signed by both the Borrower and the Lender. The note details and explains that if the Borrower misses any payments, the Lender can ask that he/she pay the entire amount, with interest, without prior warning. This form is available for download in both Word and Rich Text formats.

Phoenix Arizona Demand Note

Description

How to fill out Arizona Demand Note?

Finding validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal documents for personal and professional purposes as well as various real-world situations.

All the paperwork is appropriately classified by area of application and jurisdictional territories, making the search for the Phoenix Arizona Demand Note as quick and simple as one-two-three.

Maintaining documents organized and compliant with legal standards is critically important. Leverage the US Legal Forms library to have necessary document templates for any requirements readily available!

- Review the Preview mode and document description.

- Confirm you’ve selected the correct one that fulfills your needs and completely aligns with your local jurisdiction criteria.

- Seek another template, if necessary.

- Should you encounter any discrepancies, use the Search tab above to locate the appropriate one.

- If it fits your needs, proceed to the next step.

Form popularity

FAQ

For closed installment accounts, the statute of limitations runs 6 years after the final payment date. For open accounts, such as credit cards, the statute of limitations begins 6 years from the first uncured missed payment, whether or not there is an acceleration clause.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

In Arizona, your statute of limitations ?clock? begins when the creditor ?accelerates the debt,? or demands payment in full. The statute of limitations on written contracts, which includes most debt, is six years.

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

There is no clear statute regarding limitations for a lawsuit to collect a credit card debt in Arizona. At least two relevant statutes may be applicable in this state: One for ?open accounts? (three years from default) and one for ?written contracts? (six years from default).

I. In Arizona, a judgment is initially effective for ten years after the date of its entry, and execution must be accomplished within that period. A.R.S. § 12-1551(B).

A promissory note is enforceable for up to 6 years after the due date of the payment, according to Arizona state law. If no action has been taken to collect payment prior to 6 years, the statute of limitations has run out and the contract can no longer be enforced through legal action.

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.