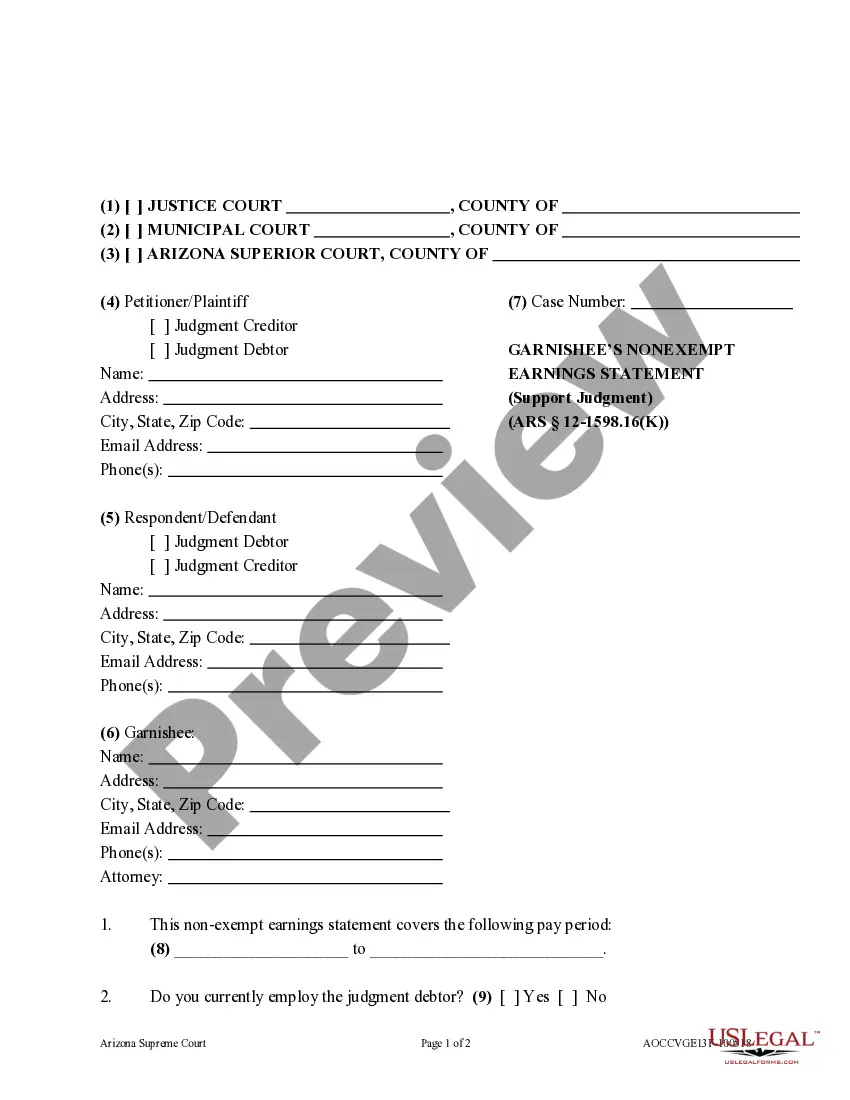

Non Expempt Earnings Statement - Non-Support: This statement gives an employer the calculation to use when garnishing an employee's wages. After he/she completes this form, they are to send a copy to both the Debtor and Creditor. This form is available for download in both Word and Rich Text formats.

Tucson Arizona Garnishee's Nonexempt Earnings Statement (Not for Support of a Person)

Description

How to fill out Arizona Garnishee's Nonexempt Earnings Statement (Not For Support Of A Person)?

If you’ve previously executed our service, Log In to your account and store the Tucson Arizona Garnishee's Nonexempt Earnings Statement - Nonsupport on your device by clicking the Download button. Ensure your subscription is active. If not, renew it per your payment plan.

If this is your initial interaction with our service, follow these uncomplicated steps to acquire your document.

You have continuous access to all your purchased documents: you can locate them in your profile under the My documents section whenever you need to access them again. Utilize the US Legal Forms service to swiftly find and store any template for your personal or business needs!

- Ensure you’ve located the correct document. Review the description and use the Preview feature, if available, to verify if it satisfies your requirements. If it doesn’t suit you, use the Search tab above to find the suitable one.

- Purchase the document. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and process the payment. Use your credit card information or the PayPal method to finalize the transaction.

- Retrieve your Tucson Arizona Garnishee's Nonexempt Earnings Statement - Nonsupport. Choose the file format for your document and download it to your device.

- Fill out your form. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

In many states, some IRS-designated trust accounts may be exempt from creditor garnishment. This includes individual retirement accounts (IRAs), pension accounts and annuity accounts. Assets (including bank accounts) held in what's known as an irrevocable living trust cannot be accessed by creditors.

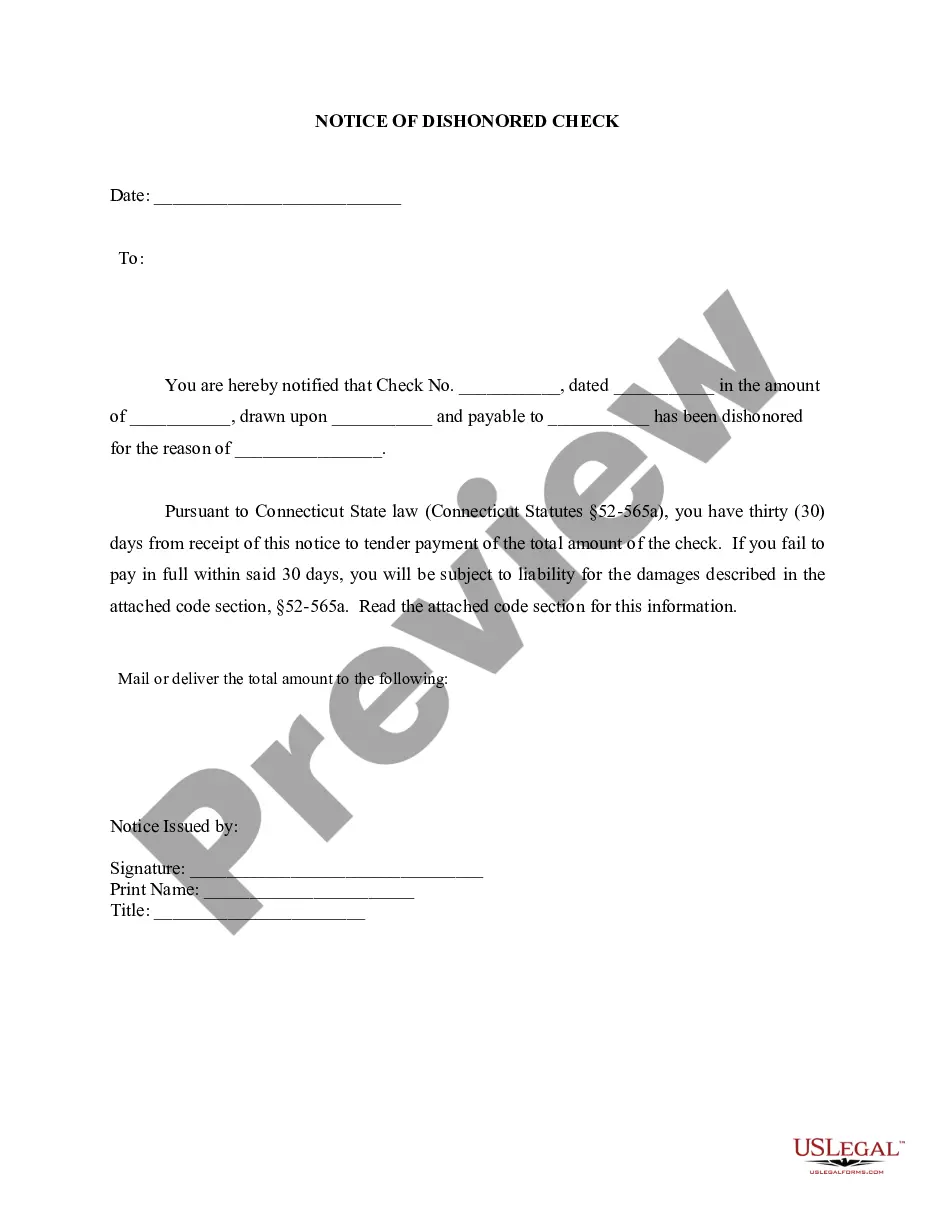

Typically, judgment creditors collect outstanding debts through wage garnishments, but our laws do allow for levying bank accounts and/or non-exempt property.

Garnishment procedures are governed by Arizona law and are extremely complicated. All parties involved must follow these procedures correctly. The Court may issue an order for monetary penalties against any party who does not proceed properly, including the judgment creditor.

Nonexempt earnings are earnings which are not exempt from wage garnishment pursuant to this Rule, and computation thereof for any pay period or periods which end during the 30 day period beginning the date the order is served shall be made in accordance with the directions accompanying the garnishee's answer form

For example, when it comes to wages, in Arizona, only 25% of disposable earnings can be garnished. Disposable earnings are wages or salary (including bonuses and commissions) left after deductions required by law, such as taxes.

Typically, judgment creditors collect outstanding debts through wage garnishments, but our laws do allow for levying bank accounts and/or non-exempt property.

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

The wage garnishment laws in Arizona are generally the same as federal wage garnishment laws, with a few added protections. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court.

Typically, judgment creditors collect outstanding debts through wage garnishments, but our laws do allow for levying bank accounts and/or non-exempt property.