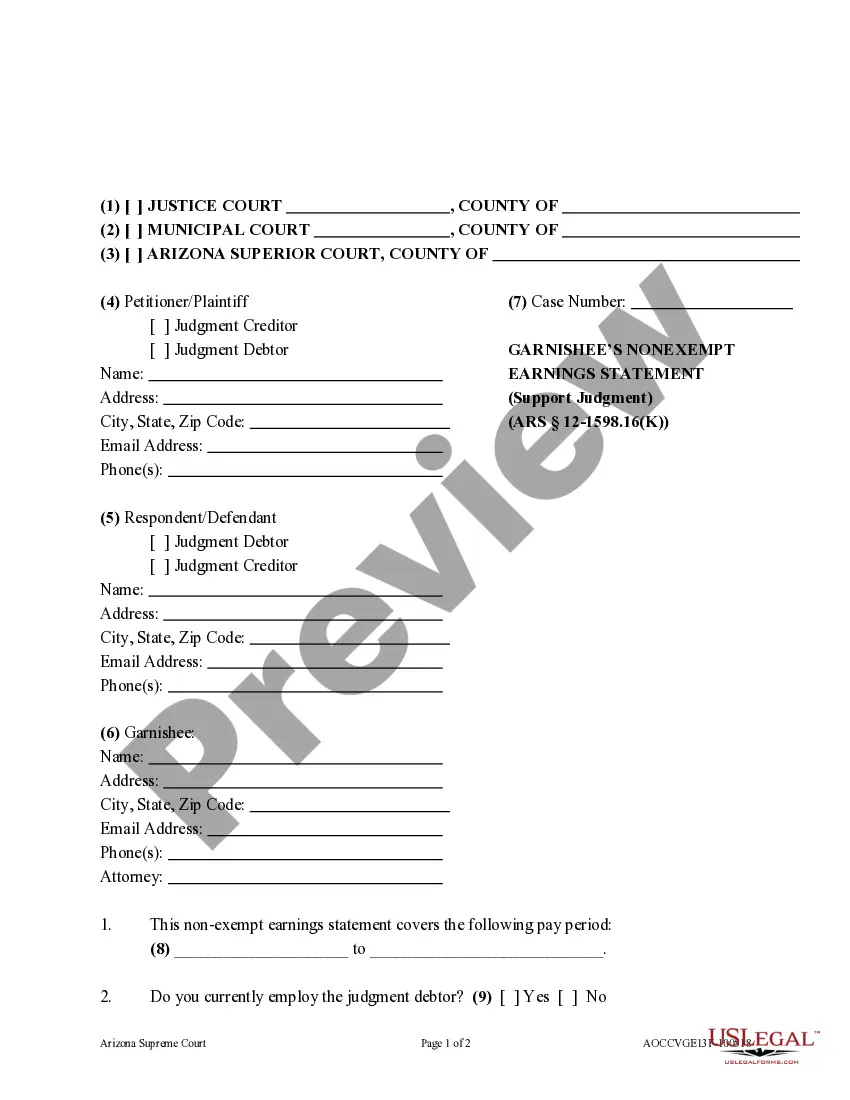

Non Expempt Earnings Statement - Non-Support: This statement gives an employer the calculation to use when garnishing an employee's wages. After he/she completes this form, they are to send a copy to both the Debtor and Creditor. This form is available for download in both Word and Rich Text formats.

Pima Arizona Garnishee's Nonexempt Earnings Statement (Not for Support of a Person)

Description

How to fill out Arizona Garnishee's Nonexempt Earnings Statement (Not For Support Of A Person)?

Are you in need of a trustworthy and affordable provider for legal forms to obtain the Pima Arizona Garnishee's Nonexempt Earnings Statement - Nonsupport? US Legal Forms is your ideal choice.

Whether you require a simple agreement to establish guidelines for living with your partner or a bundle of documents to facilitate your divorce proceedings in court, we have you taken care of.

Our website features over 85,000 current legal document templates suitable for personal and business usage.

All templates we provide are not generic but tailored to meet the requirements of specific state and county laws.

Review the form’s specifics (if available) to understand who the document is intended for and its purposes.

Initiate your search again if the template doesn’t suit your legal needs. After that, you can register your account. Choose the subscription plan and proceed to the payment process. Once payment is completed, download the Pima Arizona Garnishee's Nonexempt Earnings Statement - Nonsupport in any supported format. You can revisit the website anytime to retrieve the document again at no additional cost.

- To access the document, you must sign in to your account, find the necessary template, and hit the Download button adjacent to it.

- Please be aware that you can retrieve your previously acquired form templates at any moment from the My documents section.

- Are you unfamiliar with our platform? No problem.

- You can easily create an account, but first, ensure you do the following.

- Check to see if the Pima Arizona Garnishee's Nonexempt Earnings Statement - Nonsupport aligns with the laws in your state and locality.

Form popularity

FAQ

You can STOP the garnishment any time by paying the Clerk's Office what you owe. The Clerk will give you a receipt. Take the receipt to your employer right away. They should stop taking money from your pay as soon as they get the receipt.

A garnishment is a legal process by which one party (the judgment creditor) may collect money from another (the judgment debtor) after a monetary judgment has been entered. A garnishment becomes necessary if the judgment debtor fails to pay voluntarily.

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in accordance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.

The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court.

Nonexempt earnings are earnings which are not exempt from wage garnishment pursuant to this Rule, and computation thereof for any pay period or periods which end during the 30 day period beginning the date the order is served shall be made in accordance with the directions accompanying the garnishee's answer form

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

The garnishment law allows up to 50% of a worker's disposable earnings to be garnished for these purposes if the worker is supporting another spouse or child, or up to 60% if the worker is not. An additional 5% may be garnished for support payments more than l2 weeks in arrears.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).