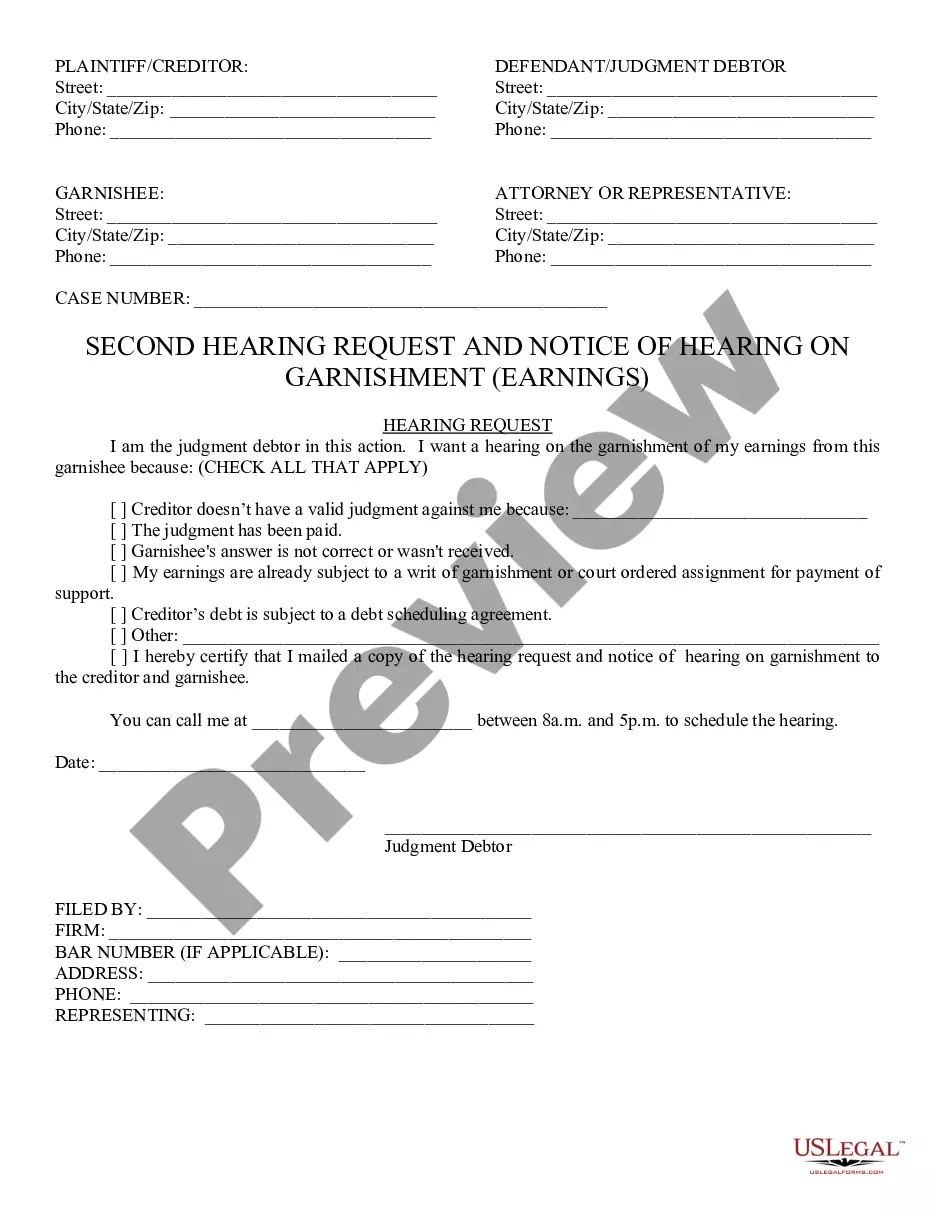

Second Notice to Judgment Debtor of Garnishment Earnings: This is a Second Notice to a Judgment Debtor that his/her wages are to be garnished until his/her debt is satisfied. Further, it states that if he/she desires a hearing on the matter, they must file a Request for Hearing within 10 days from service. This form is available in both Word and Rich Text formats.

Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings

Description

How to fill out Arizona 2nd Notice To Judgment Debtor Of Garnishment Earnings?

If you have previously utilized our service, sign in to your account and retrieve the Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings on your device by selecting the Download button. Ensure your subscription is active. If it isn’t, renew it as per your payment scheme.

If this is your initial interaction with our service, adhere to these straightforward steps to acquire your document.

You have continual access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to swiftly find and store any template for your personal or professional requirements!

- Confirm you’ve located a suitable document. Review the description and utilize the Preview option, if available, to determine if it meets your needs. If it doesn’t fit, utilize the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Apply your credit card information or select the PayPal option to finalize the transaction.

- Retrieve your Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings. Choose the file format for your document and download it to your device.

- Complete your template. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To stop wage garnishment in Arizona, you can either negotiate with the creditor or file an objection in the court where the garnishment order was issued. A hearing may be scheduled to review the situation, and you may present your case. The uslegalforms platform offers various forms and instructional materials to help you effectively manage this process, especially when dealing with a Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings.

The IRS can garnish up to 25% of your disposable income, similar to state garnishment laws. However, if you have multiple garnishments, the total amount garnished cannot exceed this limit. If you receive a Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings, be aware that federal laws also protect a portion of your income from garnishment, ensuring you have sufficient funds for living expenses.

To stop wage garnishment in Arizona, you can file a motion in court, arguing that the garnishment is not valid or that it exceeds legal limits. Additionally, you may seek to resolve the debt directly with the creditor. Utilizing resources like the uslegalforms platform can provide you with the necessary forms and guidance to help navigate this process, especially when responding to a Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings.

The maximum garnishment in Arizona is designed to protect a debtor's income while allowing creditors to recover amounts owed. Typically, it is limited to 25% of your disposable earnings. Keep this in mind when receiving a Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings, as it outlines how much can be legally deducted from your wages.

In Arizona, the garnishment limit is set based on the debtor’s disposable earnings. Generally, creditors can take a maximum of 25% of your disposable income or the amount by which your weekly earnings exceed 30 times the federal minimum wage, whichever is less. Understanding these limits is crucial, especially when dealing with a Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings. This information helps you navigate your financial obligations effectively.

The most that can be garnished from wages in Arizona is generally about 25% of your disposable income. However, certain exceptions apply based on different types of debts, with special cases resulting in varied limits. The Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings will provide you with specific insights into your circumstances.

When you receive a writ of garnishment, it's essential to review the document carefully and understand your options. You may want to seek legal advice, especially if you believe the garnishment is incorrect. Taking action promptly can help you manage your situation surrounding the Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings effectively.

To stop wage garnishment in Arizona, you can file a motion with the court to vacate the garnishment order. Additionally, negotiating a settlement with the creditor may help ease the pressure. Utilizing resources provided by platforms like US Legal Forms can guide you in managing the Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings effectively.

In the context of garnishment, a writ is an official order from the court that enables a creditor to collect a debt from a debtor's earnings. It serves as the foundation for the legal garnishment procedure. Understanding the Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings ensures you are informed about this process and your rights.

In Arizona, a writ of garnishment is valid for up to six months from the date it is issued. After this period, if the debt remains unresolved, a creditor may need to renew the writ. The Scottsdale Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings will provide further details on maintaining compliance within this timeframe.