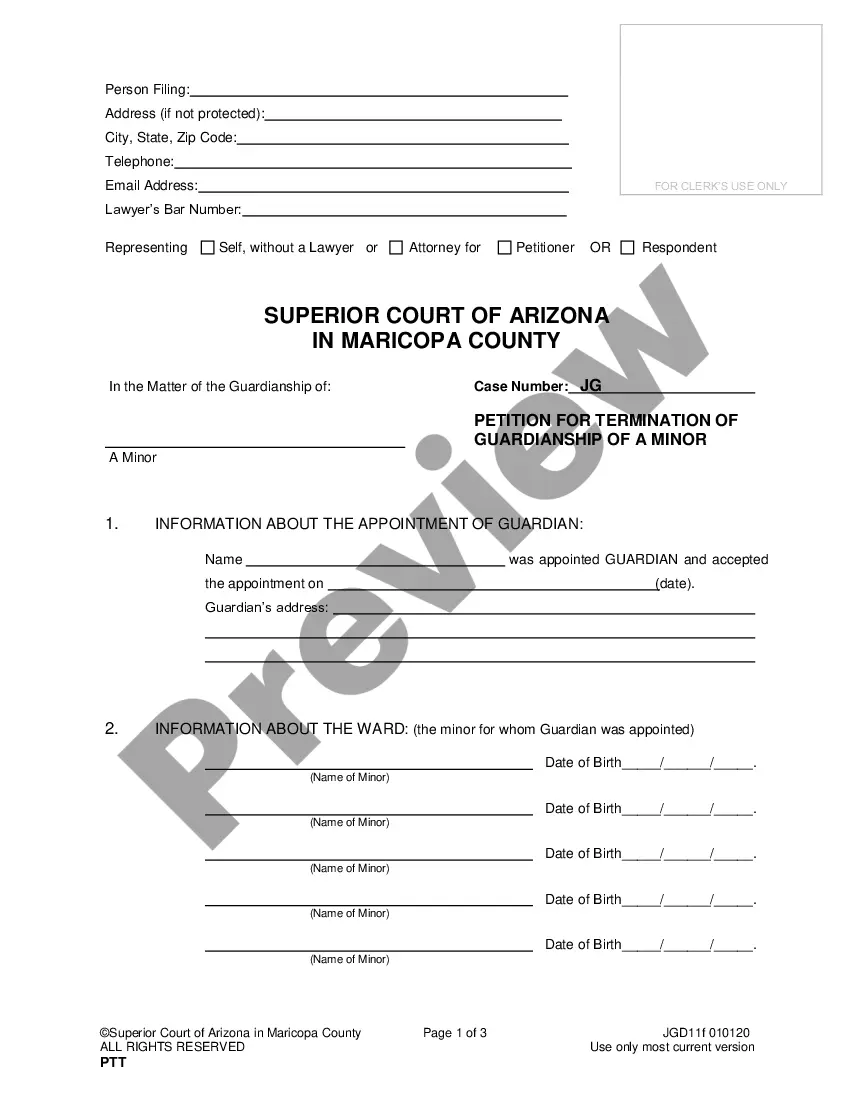

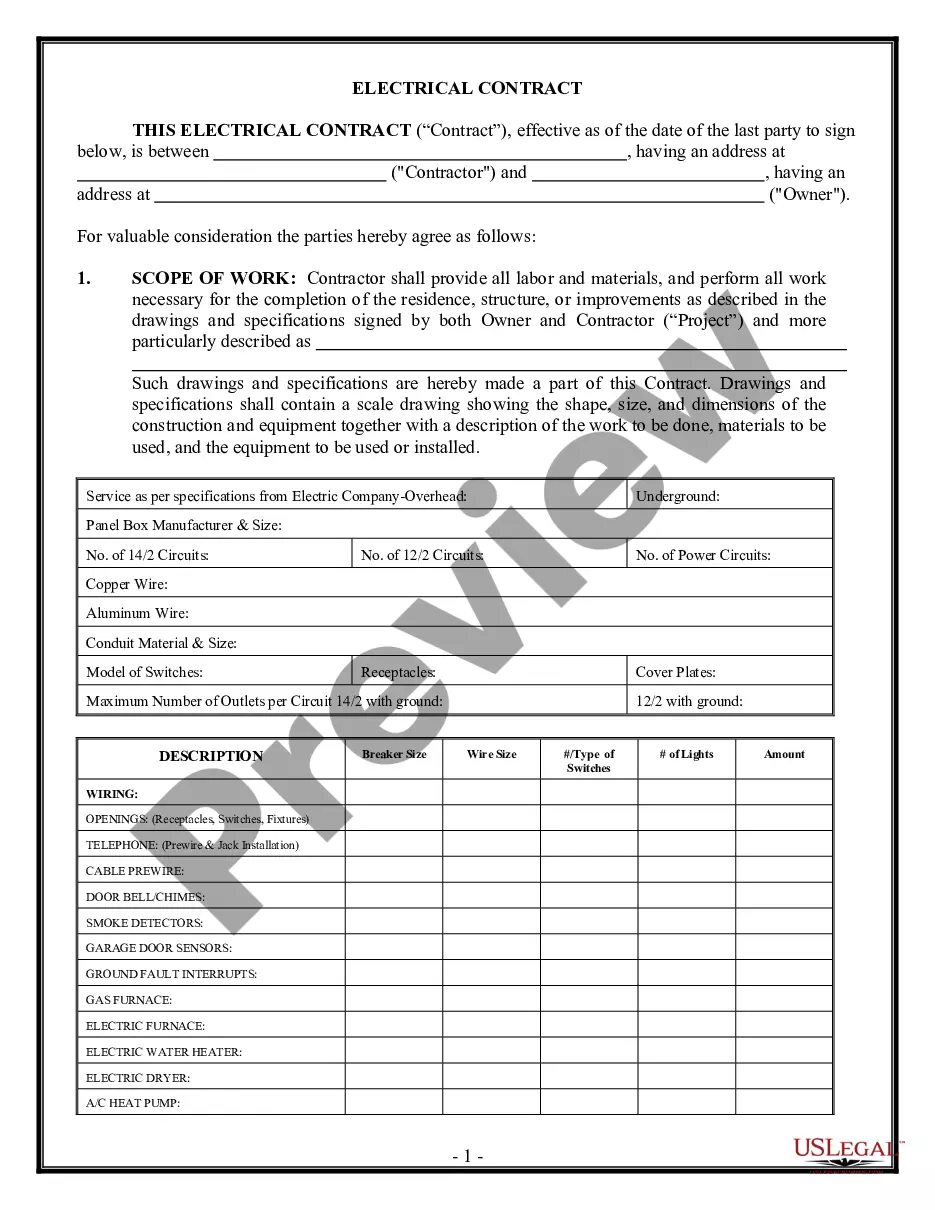

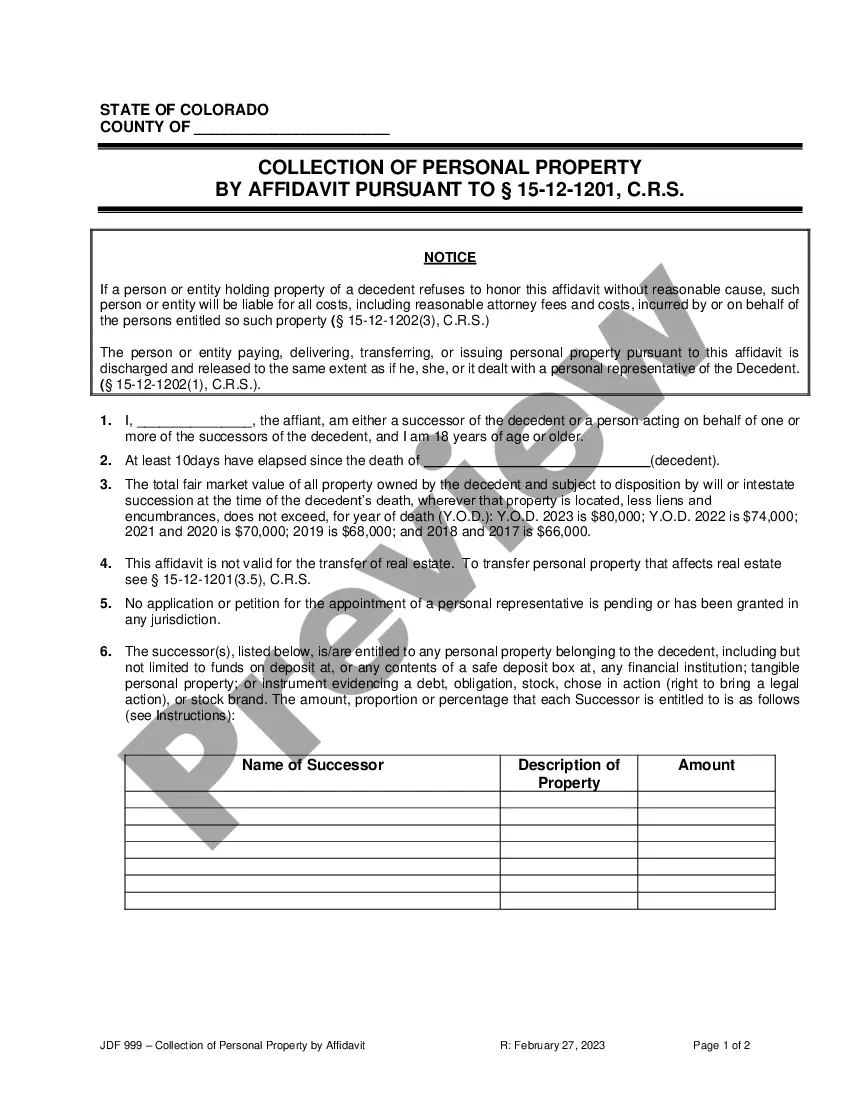

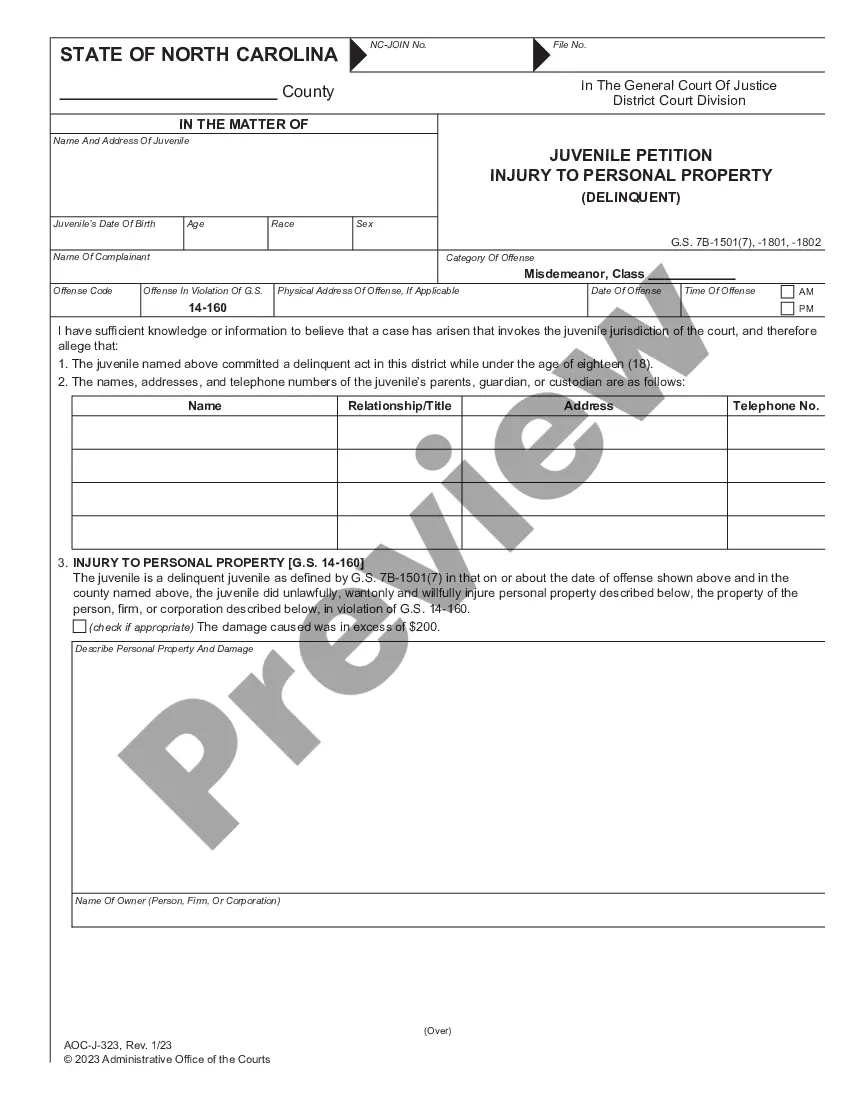

This Living Trust for Individual as single, divorced or widow(er) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children

Description

How to fill out Arizona Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children?

If you are in search of a pertinent document, it’s challenging to locate a more user-friendly service than the US Legal Forms site – one of the most extensive libraries available online.

Here you can find a vast array of templates for professional and personal use categorized by types and states, or keywords.

With our sophisticated search feature, acquiring the most current Glendale Arizona Living Trust for Individuals who are Single, Divorced, or Widowed without Children is as simple as 1-2-3.

Complete the payment process. Utilize your credit card or PayPal account to finish the registration steps.

Acquire the template. Select the file format and save it to your device. Edit. Complete, modify, print, and sign the obtained Glendale Arizona Living Trust for Individuals who are Single, Divorced, or Widowed without Children.

- Additionally, the relevance of each document is affirmed by a group of expert attorneys who routinely review the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our system and possess an account, all that is necessary to obtain the Glendale Arizona Living Trust for Individuals who are Single, Divorced, or Widowed without Children is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the guidelines provided below.

- Ensure you have selected the document you desire. Review its description and take advantage of the Preview option (if available) to examine its contents. If it doesn’t satisfy your needs, employ the Search field at the top of the page to locate the required document.

- Confirm your choice. Hit the Buy now button. Then, choose your desired pricing plan and provide the necessary information to sign up for an account.

Form popularity

FAQ

When one spouse dies, a living trust typically becomes irrevocable, meaning it cannot be changed. The trust will then dictate the distribution of assets according to the terms established, which can provide a clear path for the surviving spouse. For those with a Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children, this can minimize disputes and streamline the transfer of assets during a difficult time.

To record a living trust in Arizona, you typically do not file the trust itself with the county clerk. Instead, you may need to transfer the assets into the trust through various means, such as deeds for real estate. If you are uncertain about the process, using a reliable service like uslegalforms simplifies your experience and ensures that you adhere to all necessary protocols.

Yes, you can establish a living trust without your spouse in Arizona. In fact, if you are single, divorced, or a widow or widower with no children, creating a Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children can be a smart move for managing your assets. This allows you to dictate how your property should be treated in your absence, giving you peace of mind.

When one spouse dies, the surviving spouse may need to update their Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children. This may involve changing the ownership of assets or modifying beneficiary designations. Don’t forget to consult with an estate planning professional who can provide you with the best guidance for this important transition.

Yes, you can write your own trust in Arizona. However, if you want to create a Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children, you should ensure that it meets all legal requirements. Consider using a trusted platform like uslegalforms to guide you through the process. This can help you avoid potential mistakes that could impact your trust's validity.

In Arizona, a living trust does not need to be recorded with a government office like a will would. Instead, the trust document remains private and is only disclosed if there is a need related to the trust’s assets. However, it is crucial to maintain accurate records of the trust and ensure that assets are properly titled in the name of the trust. Utilizing resources from USLegalForms can help you accurately navigate the requirements for setting up a Glendale Arizona Living Trust for Individuals as Single, Divorced, or Widow or Widower with No Children.

While it is possible to set up a trust without an attorney in Arizona, it is often advisable to seek professional guidance. An attorney can ensure that your living trust complies with state laws, especially in complex situations. Using platforms like US Legal Forms can also help you navigate the setup process efficiently if you choose to handle it independently, particularly for a Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children.

Yes, a living trust can help you avoid probate in Arizona, which simplifies the distribution of your assets. When you pass away, your assets held in the trust are transferred directly to your beneficiaries without going through the probate process. This feature is particularly beneficial for those considering a Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children, as it provides a smoother transition for your loved ones.

Certain items cannot be held in a trust. For example, retirement accounts like IRAs typically cannot be directly placed into a trust, although there are exceptions. It's important to consult with professionals to ensure that all your key assets are appropriately managed, especially when working on a Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children.

A living trust in Arizona operates by allowing you to transfer your assets into the trust while you are alive. As the trust's creator, you maintain control over these assets, deciding how they will be managed during your lifetime and distributed after your passing. This process makes it simpler to pass on your estate, especially for individuals in situations like the Glendale Arizona Living Trust for Individual as Single, Divorced or Widow or Widower with No Children.