Independent Contractor: This is a contract to be used by an independent contractor. The independent contractor uses this type of contract before beginning a job with either a sub-contractor and/or Owner of a parcel of land. This form is available in both Word and Rich Text formats.

Tucson Arizona Self-Employed Independent Contractor Agreement

Description

How to fill out Arizona Self-Employed Independent Contractor Agreement?

Locating authenticated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements, as well as various real-world situations.

All the files are appropriately categorized by field of application and legal jurisdictions, making it simple and quick to find the Tucson Arizona Self-Employed Independent Contractor Agreement.

Maintaining organized documentation that complies with legal standards is crucial. Take advantage of the US Legal Forms library to always have essential document templates readily available for any needs!

- Examine the Preview mode and document details. Ensure you have chosen the correct one that fits your specifications and fully aligns with your local jurisdictional necessities.

- Search for an alternative template if required. If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your criteria, advance to the following step.

- Purchase the document. Press the Buy Now button and choose the subscription option that suits you best. You must register for an account to gain access to the collection’s resources.

- Complete your transaction. Enter your credit card information or utilize your PayPal account to settle for the service.

- Download the Tucson Arizona Self-Employed Independent Contractor Agreement. Store the template on your device to continue with its completion and retrieve it in the My documents section of your profile whenever you require it again.

Form popularity

FAQ

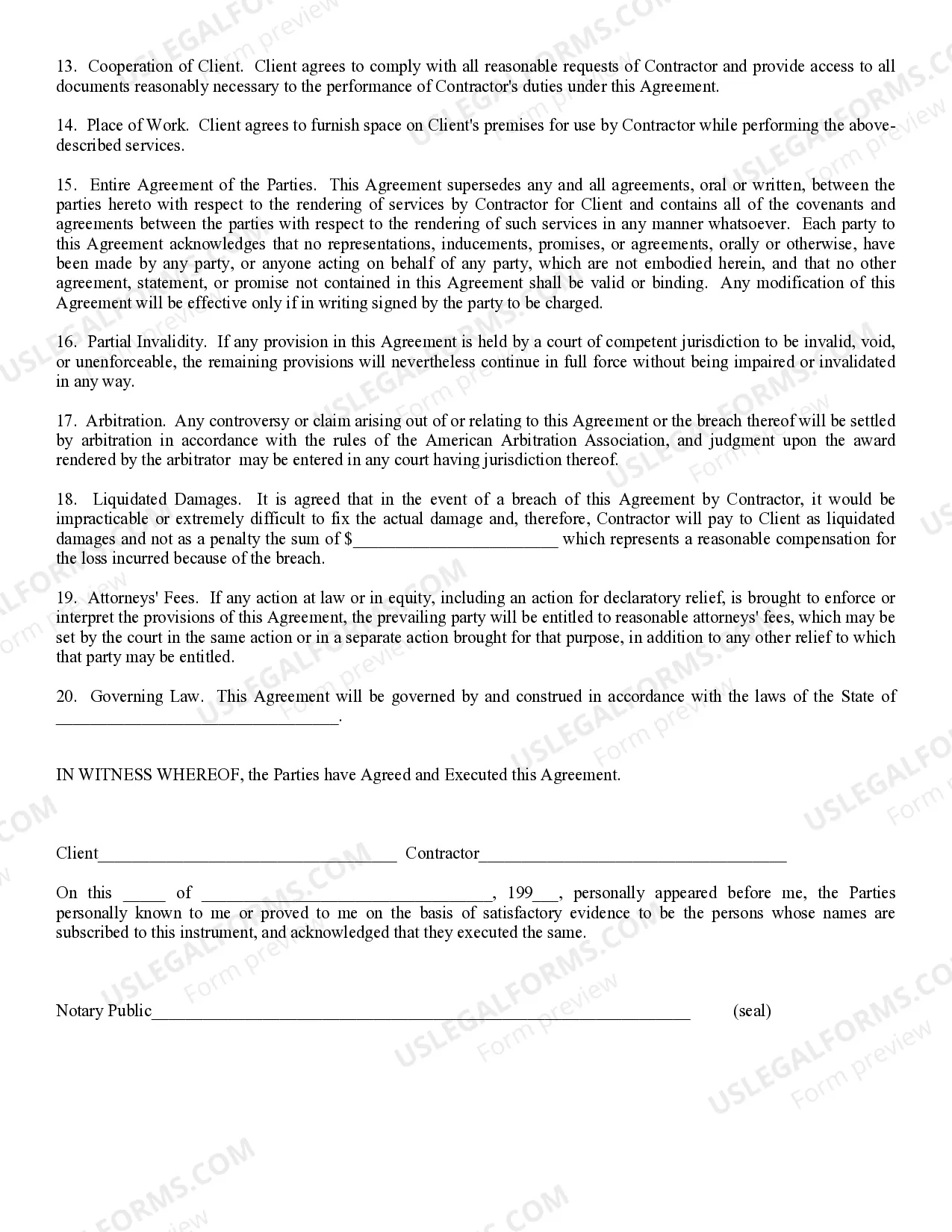

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The general rule is that an individual is an independent contractor if you, the person for whom the services are performed, have the right to control or direct only the result of the work, and not the means and methods of accomplishing the result.

Calculating Your Income Taxes as an Independent Contractor Start by calculating your taxable income after deductions. Take your $100,000 in earnings and subtract $7,065 (half your $14,130 self-employment tax). Then, subtract $12,950 (the standard deduction for single taxpayers in 2022).

A contract should contain everything agreed upon by you and your licensed contractor. It should detail the work, price, when payments will be made, who gets the necessary building permits, and when the job will be finished. The contract also must identify the contractor, and give his/her address and license number.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

There are three key documents you need from an independent contractor: a W-9 form, a written contract, and documentation of payment information. In the case of an IRS audit, it's important to keep thorough documentation on your independent contractors.

Paying Taxes as an Independent Contractor You'll need to file a tax return with the IRS if your net earnings from self-employment are $400 or more. Along with your Form 1040, you'll file a Schedule C to calculate your net income or loss for your business.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

You are required to file a federal Nonemployee Compensation (Form 1099-NEC) or a Miscellaneous Information (Form 1099-MISC) for the services performed by the independent contractor. You pay the independent contractor $600 or more or enter into a contract for $600 or more.