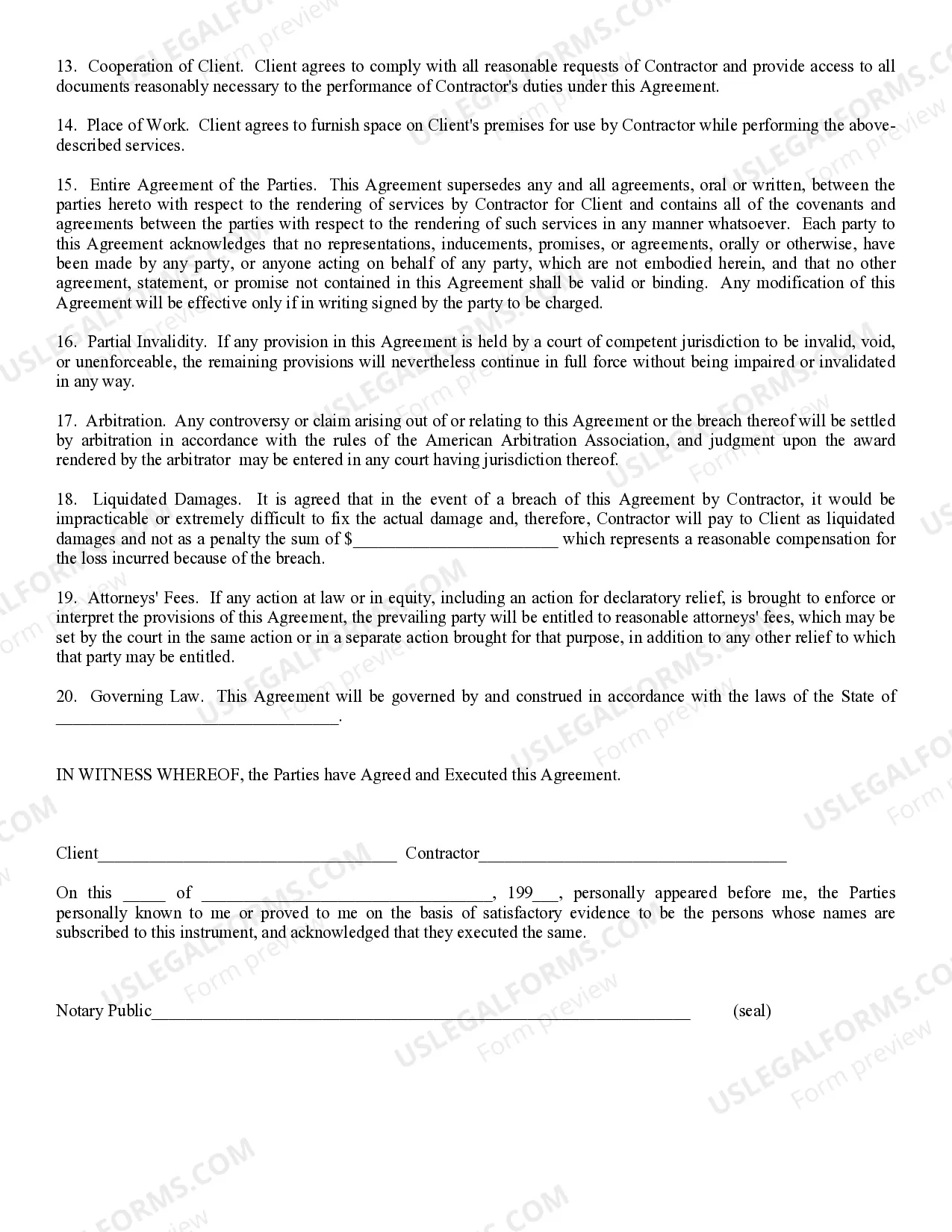

Independent Contractor: This is a contract to be used by an independent contractor. The independent contractor uses this type of contract before beginning a job with either a sub-contractor and/or Owner of a parcel of land. This form is available in both Word and Rich Text formats.

Glendale Arizona Self-Employed Independent Contractor Agreement

Description

How to fill out Arizona Self-Employed Independent Contractor Agreement?

We consistently aspire to reduce or prevent legal harm when navigating intricate law-related or financial issues.

To achieve this, we enroll in legal services that are typically very expensive.

Nonetheless, not all legal situations are equally complicated. Many can be handled independently.

US Legal Forms is an online repository of current DIY legal paperwork ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform empowers you to manage your affairs independently without needing to consult legal professionals. We provide access to legal form templates that aren’t always readily accessible. Our templates are tailored to specific states and regions, which greatly streamlines the search process.

Ensure to verify that the Glendale Arizona Self-Employed Independent Contractor Agreement complies with the laws and regulations of your state and locality. Additionally, it is crucial to review the form’s outline (if available), and if you see any inconsistencies with what you initially sought, look for an alternative form. Once you’ve confirmed that the Glendale Arizona Self-Employed Independent Contractor Agreement is appropriate for your needs, you can choose a subscription plan and proceed to payment. Then you may download the document in any preferred format. For over 24 years in the industry, we’ve assisted millions of individuals by offering ready-to-customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!

- Benefit from US Legal Forms whenever you need to obtain and download the Glendale Arizona Self-Employed Independent Contractor Agreement or any other form quickly and securely.

- Simply Log In to your account and click the Get button next to it.

- If you happen to misplace the document, you can always re-download it from the My documents section.

- The procedure is also straightforward if you’re new to the platform! You can establish your account in just a few minutes.

Form popularity

FAQ

Yes, you can work as an unlicensed contractor in Arizona for certain types of jobs that do not require licensing. However, it's crucial to understand your limitations and responsibilities. Utilizing a Glendale Arizona Self-Employed Independent Contractor Agreement can help outline your project scope and protect you legally, even if you are unlicensed.

In Arizona, some contractors must hold specific licenses, often dependent on the nature of the work they perform. While independent contractors in certain trades must be licensed, others may operate legally without one. The Glendale Arizona Self-Employed Independent Contractor Agreement can help establish your status and clarify your work scope, but check local regulations to ensure you meet any required licensing standards.

As an independent contractor, you should complete essential details like your name, address, and the services you offer on the Glendale Arizona Self-Employed Independent Contractor Agreement. Additionally, include payment terms and any deadlines associated with your work. This documentation protects both you and your client by providing clarity and a mutual understanding of expectations.

Filling out a contract agreement involves several steps, starting with the identification of the parties involved. You should clearly outline the scope of work, payment terms, and duration of the agreement. The Glendale Arizona Self-Employed Independent Contractor Agreement provides a straightforward template that makes it easier to ensure all necessary details are included, reducing potential misunderstandings.

In Arizona, independent contractors typically do not require a business license unless their specific profession mandates it. However, obtaining a Glendale Arizona Self-Employed Independent Contractor Agreement can clarify your business terms and protect your interests. It’s wise to research your local regulations or consult a professional to ensure compliance with any licensing requirements.

Collecting unemployment as a 1099 employee in Arizona can be challenging, as independent contractors are generally not eligible for unemployment benefits. However, special programs, such as those established during the pandemic, have provided some support to self-employed individuals. Always keep abreast of current legislation that may affect your eligibility. A comprehensive Glendale Arizona Self-Employed Independent Contractor Agreement can help you better understand your rights and obligations.

In Arizona, there is no specified minimum payroll amount that triggers workers' compensation requirements for independent contractors. However, if you employ others or exceed certain thresholds, you may need to consider obtaining coverage. Understanding these regulations is crucial for your business. Using a Glendale Arizona Self-Employed Independent Contractor Agreement can help you navigate these financial obligations efficiently.

Typically, 1099 employees in Arizona do not need workers' compensation insurance. This lack of requirement stems from the classification of independent contractors versus traditional employees. Nevertheless, you should be aware of the risks involved and consider your coverage options. Drafting a Glendale Arizona Self-Employed Independent Contractor Agreement can protect your interests and delineate potential liabilities.

Certain groups are exempt from workers' compensation coverage in Arizona. For example, sole proprietors, LLC members, and certain corporate officers often do not require coverage unless they choose to opt for it. It's essential to examine your specific classification as a self-employed individual. A Glendale Arizona Self-Employed Independent Contractor Agreement can help clarify your coverage options and responsibilities.

In Arizona, 1099 employees, or independent contractors, are generally not required to carry workers' compensation insurance. However, this can vary depending on the nature of the work and the contractual agreement in place. If you are a self-employed individual working in Glendale, Arizona, it is wise to review your specific situation. A Glendale Arizona Self-Employed Independent Contractor Agreement may include clauses regarding insurance requirements.