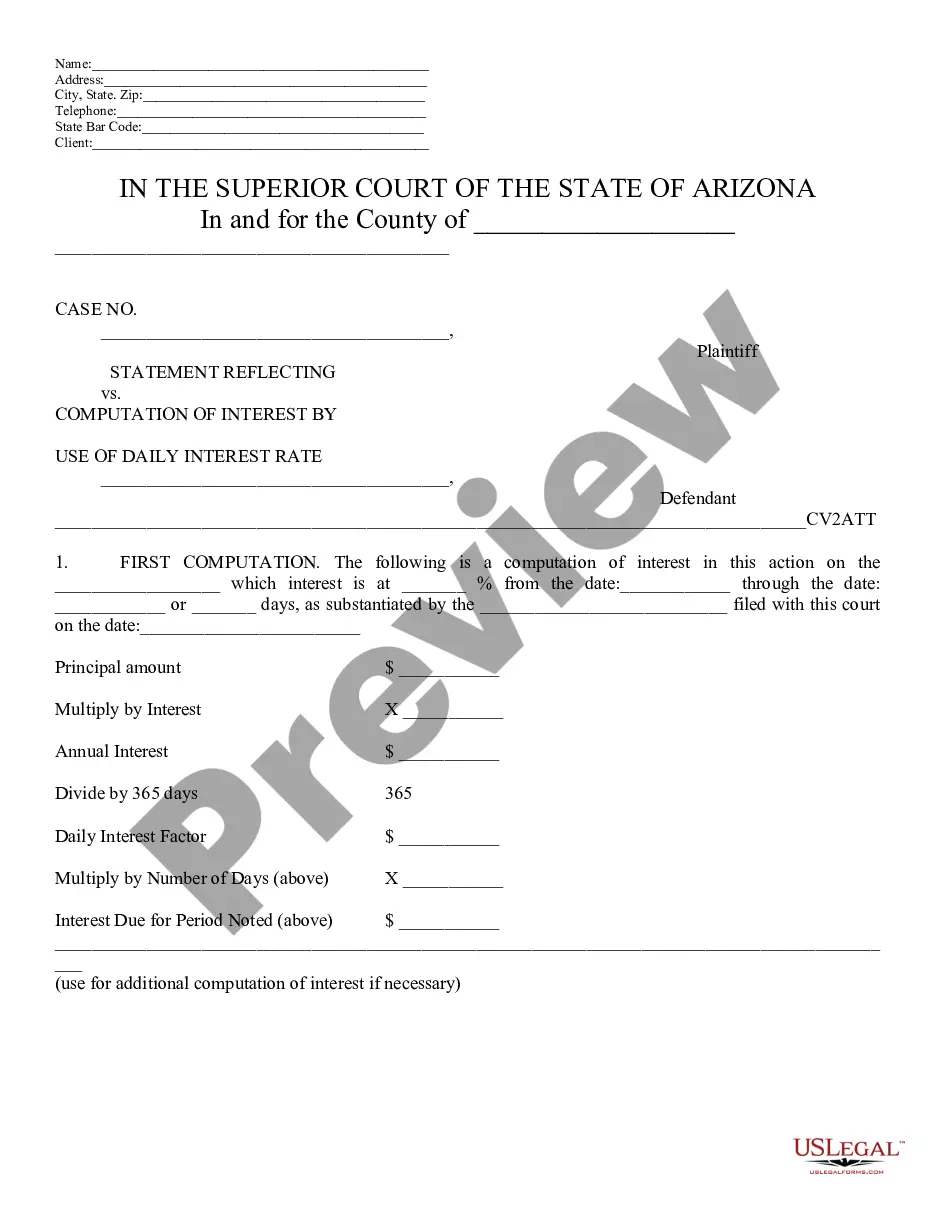

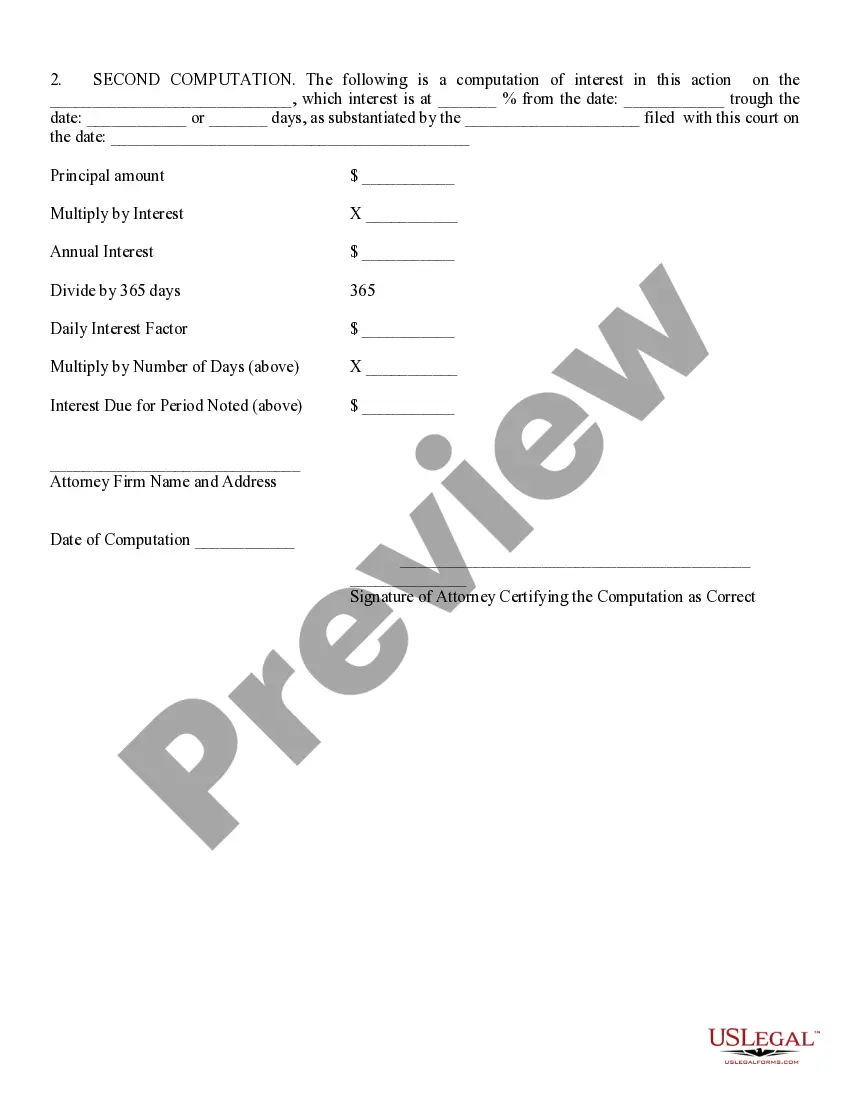

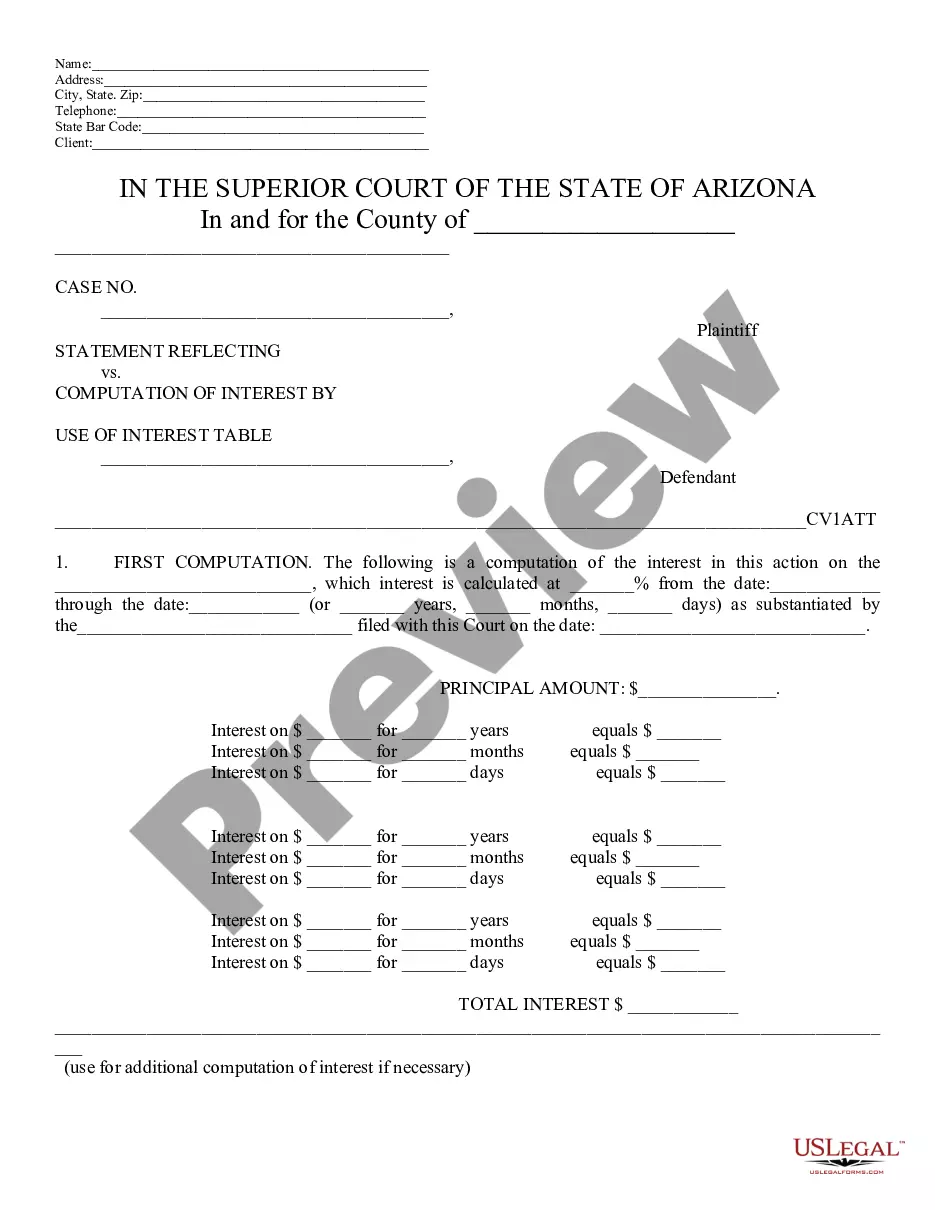

Statement Reflecting Computation of Interest By Daily Interest Rate: This statement reflects the way an attorney arrived at the total amount for damages, attorney's fees,e tc. It displays his/ her mathmatical equation, as well as the exact interest rate he/ she used in their findings. This form is available in both Word and Rich Text formats.

Mesa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate

Description

How to fill out Arizona Statement Reflecting Computation Of Interest By Daily Interest Rate?

Utilize the US Legal Forms and gain prompt access to any document you require.

Our user-friendly website, filled with an extensive collection of templates, enables you to locate and acquire nearly any document sample you need.

You can download, complete, and sign the Mesa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate in just minutes, rather than spending hours online searching for an appropriate template.

Using our library is an excellent method to enhance the security of your record submissions.

Additionally, you can retrieve previously saved documents from the My documents section.

If you haven't yet created an account, follow the steps below.

- Our experienced attorneys routinely review all documents to ensure that the templates are applicable for specific regions and adhere to the latest laws and regulations.

- How can you access the Mesa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

- If you already possess an account, simply Log In to your profile. The Download feature will be available for all documents you browse.

Form popularity

FAQ

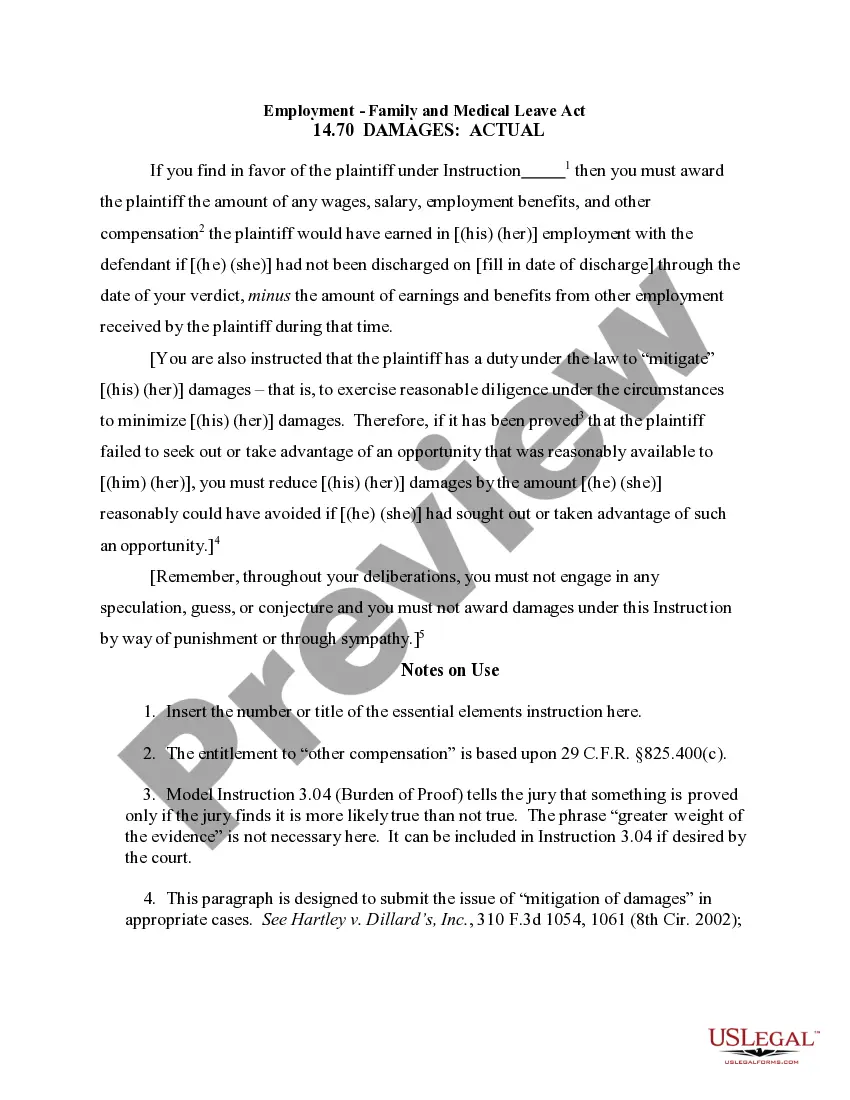

In California, for example, post-judgment interest is 10% simple per year, as specified in California Code of Civil Procedure section 685.010(a).

Divide your interest rate by the number of payments you'll make that year. If you have a 6 percent interest rate and you make monthly payments, you would divide 0.06 by 12 to get 0.005. Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month.

Work out the daily interest: divide your yearly interest from step 1 by 365 (the number of days in a year). Work out the total amount of interest: multiply the daily interest from step 2 by the number of days the debt has been overdue.

Multiply your principal loan balance by your interest rate to get a total (18,000 x 0.10 = 1800). Divide the total by days in a year to get your daily interest charges (1800 / 365 = 4.93).

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

The post-judgment interest rate for judgments entered from October 3 through October 9, 2022 is: 4.07%. 2022 rates may be found here. Historic rates from 2000 - 2021 can be found here.

You first take the annual interest rate on your loan and divide it by 365 to determine the amount of interest that accrues on a daily basis. Say you owe $10,000 on a loan with 5% annual interest. You'd divide that rate by 365 (i.e., 0.05 ÷ 365) to arrive at a daily interest rate of 0.000137.

A daily periodic interest rate generally is used to calculate interest by multiplying the rate by the amount owed at the end of each day. This interest amount is then added to the previous day's balance, which means that interest is compounding on a daily basis.

Interest is allowed on most judgments entered in the federal courts from the date of judgment until paid.

Your daily periodic interest can be calculated by dividing your Annual Percentage Rate (APR) by the number of days that are taken into account for the year, this is typically 360 or 365 days depending on your credit card issuer.