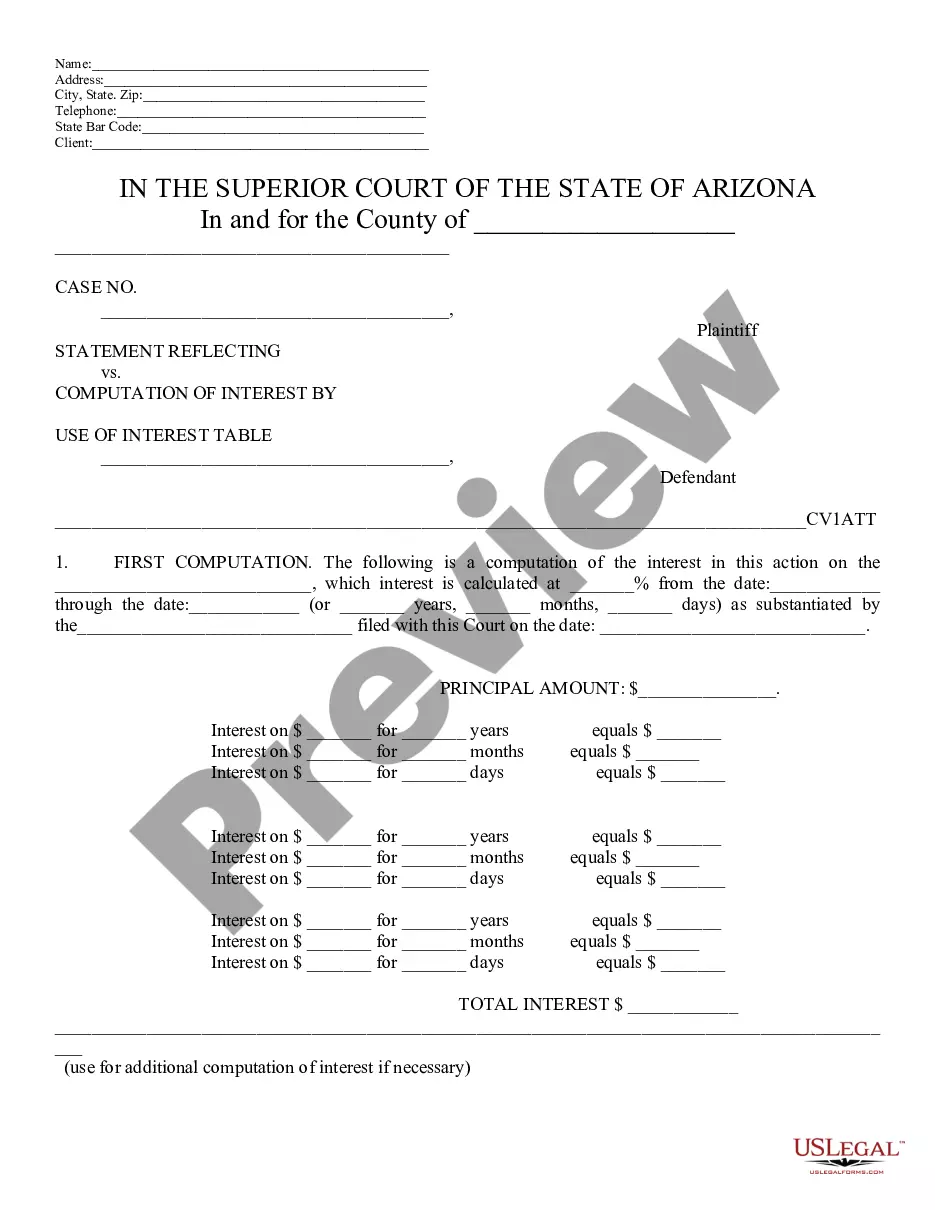

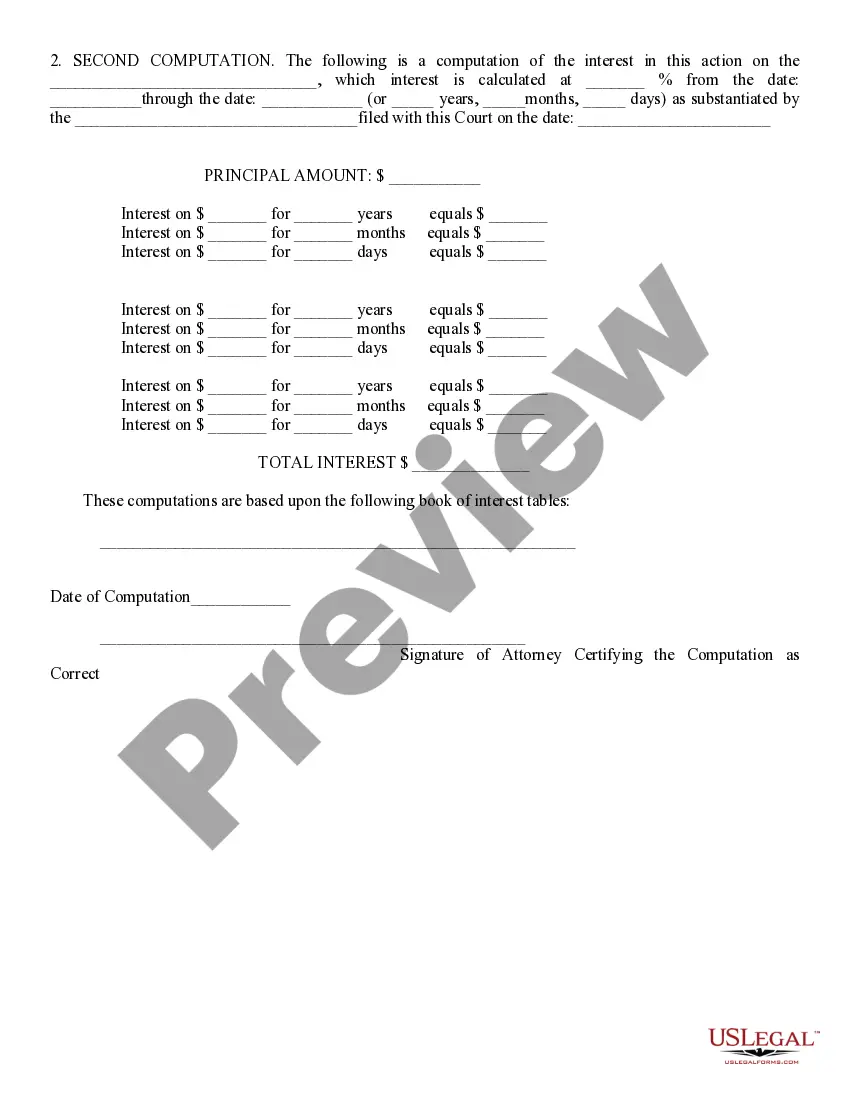

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Mesa Arizona Statement Reflecting Computation of Interest Using Interest Table

Description

How to fill out Arizona Statement Reflecting Computation Of Interest Using Interest Table?

If you have previously made use of our service, sign in to your account and keep the Mesa Arizona Statement Reflecting Computation of Interest Using Interest Table on your device by hitting the Download button. Ensure your subscription is active. If it is not, renew it as per your payment arrangement.

If this is your first time using our service, follow these straightforward steps to obtain your document.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to access it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Verify you’ve located a suitable document. Review the description and utilize the Preview feature, if available, to determine if it fits your requirements. If it does not suit you, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and make a payment. Provide your credit card information or use the PayPal option to finalize the purchase.

- Retrieve your Mesa Arizona Statement Reflecting Computation of Interest Using Interest Table. Choose the file format for your document and store it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

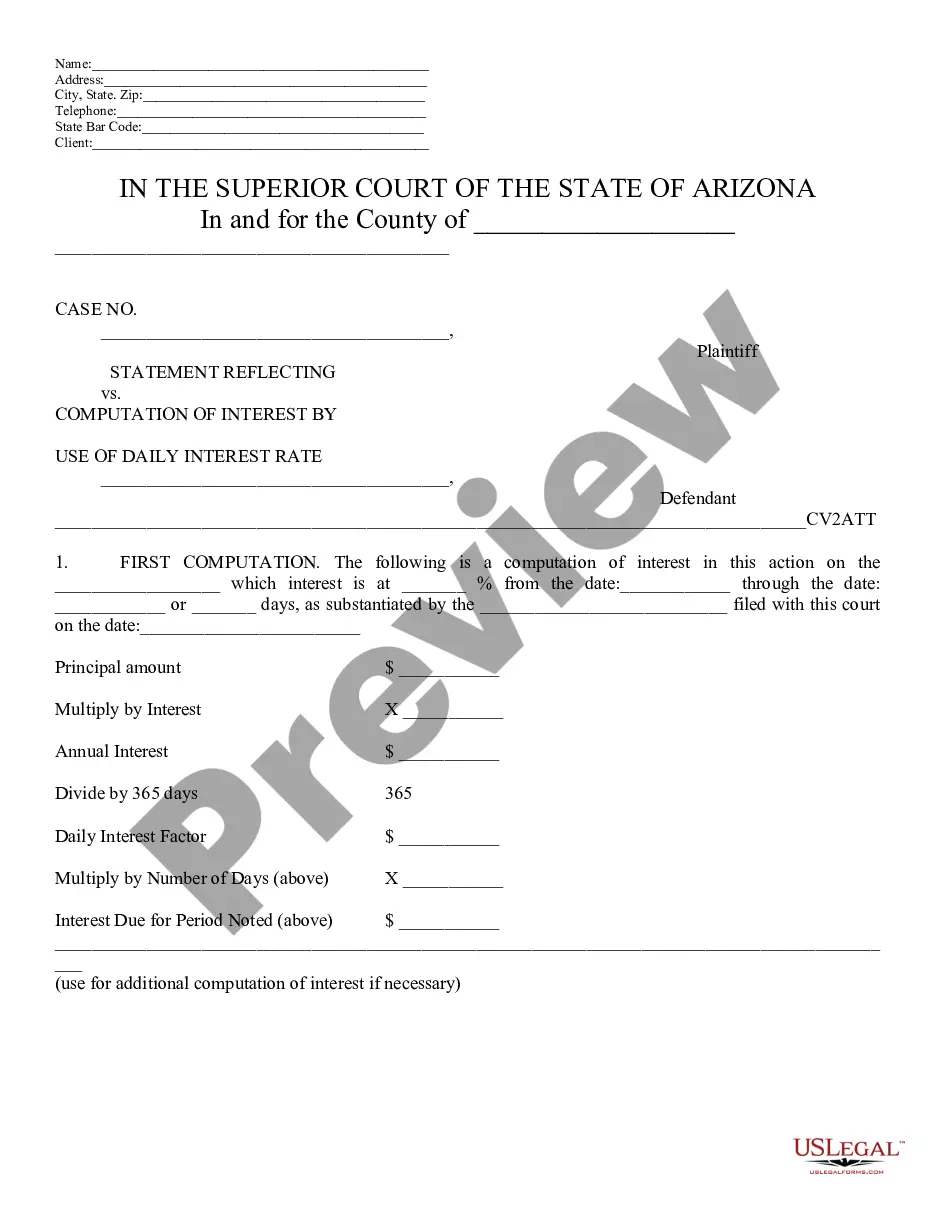

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

How are my Property Taxes computed? The Assessed Value divided by 100, times the tax rate (set in August of each year) determines property tax billed in September. The County Treasurer bills, collects and distributes the property taxes.

Simple Interest It is calculated by multiplying the principal, rate of interest and the time period. The formula for Simple Interest (SI) is ?principal x rate of interest x time period divided by 100? or (P x Rx T/100).

Property taxes in Arizona are imposed on both real and personal property.

How are my Property Taxes computed? The Assessed Value divided by 100, times the tax rate (set in August of each year) determines property tax billed in September. The County Treasurer bills, collects and distributes the property taxes.

Arizona Property Tax Rates CountyMedian Home ValueAverage Effective Property Tax RateMaricopa County$242,7000.61%Mohave County$151,1000.63%Navajo County$118,8000.77%Pima County$173,5001.01%11 more rows ?

Example: If your judgment is $5,000: $5,000 (total judgment) x 0.10 (10% interest) = $500 (yearly interest) Divide by 365: $500 (yearly interest) ÷ 365 (days in a year) = $1.37 (daily interest) Multiply the daily interest by the number of days since the court entered the judgment.

Arizona property taxes on owner-occupied residences are levied based on the Assessed Value, not current market value.

On average, the tax rate in Arizona before all exemptions and potential rebates is usually between around . 87% and 1.5% of the market value. You can find this amount by calculation the percentage in your location based on the home's assessed value.

For most types of debt, the rate is usually 8%. To calculate this, use the steps below: Work out the yearly interest: take the amount you're claiming and multiply it by 0.08 (which is 8%). Work out the daily interest: divide your yearly interest from step 1 by 365 (the number of days in a year).