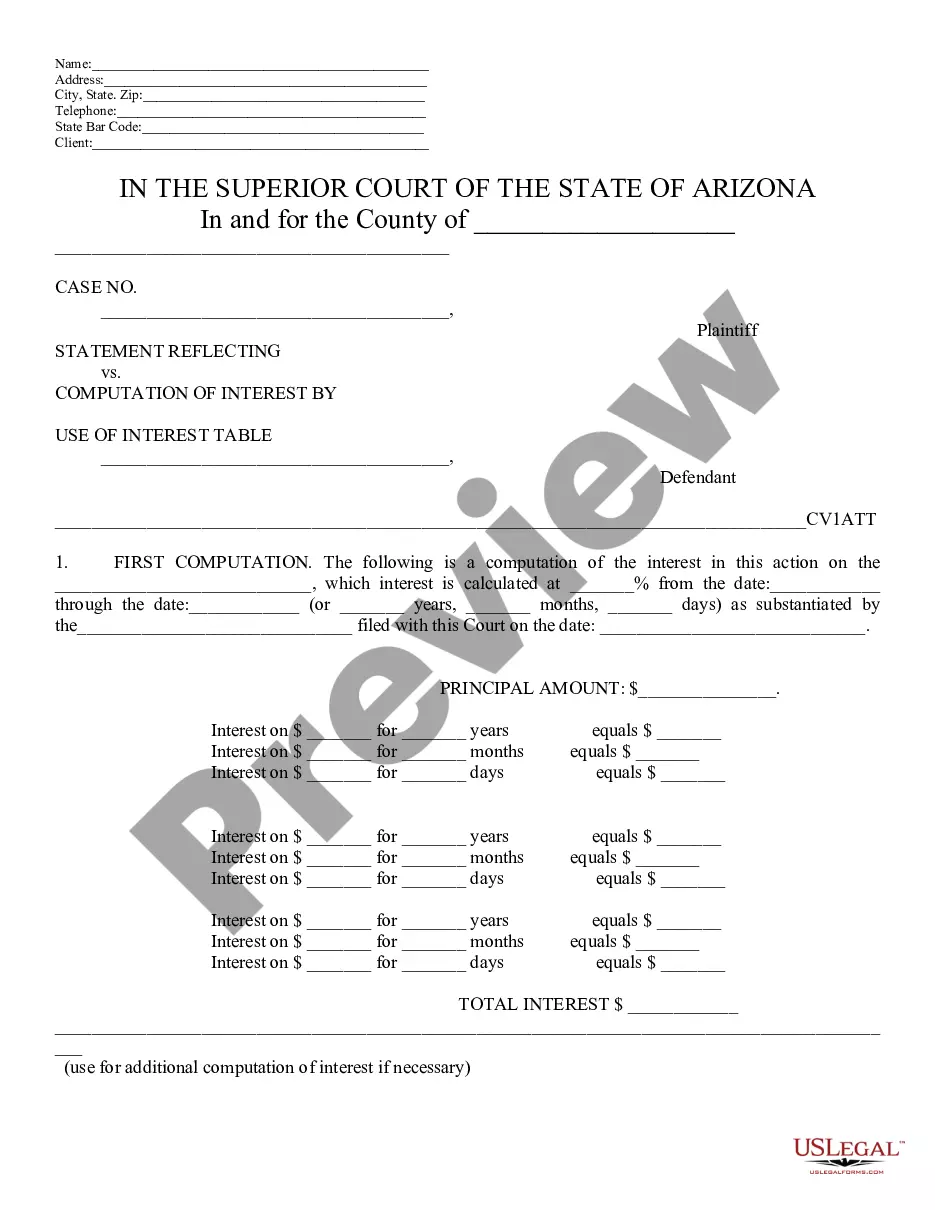

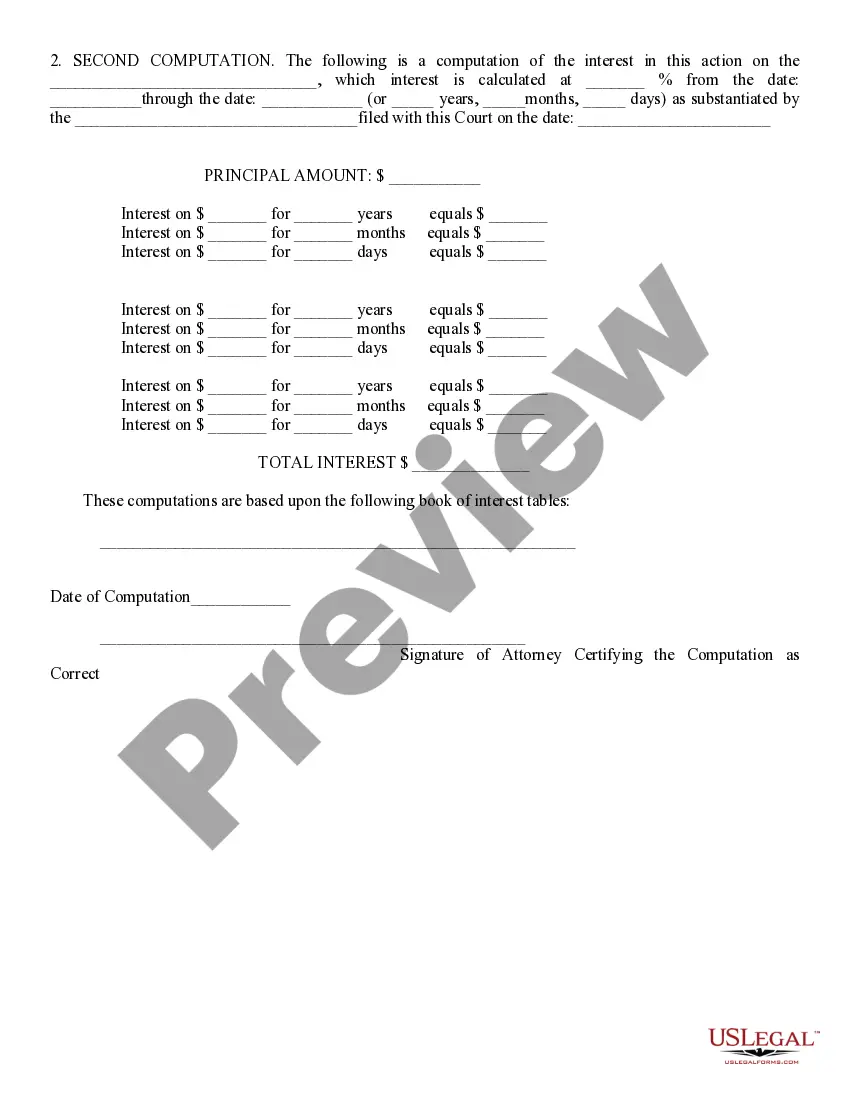

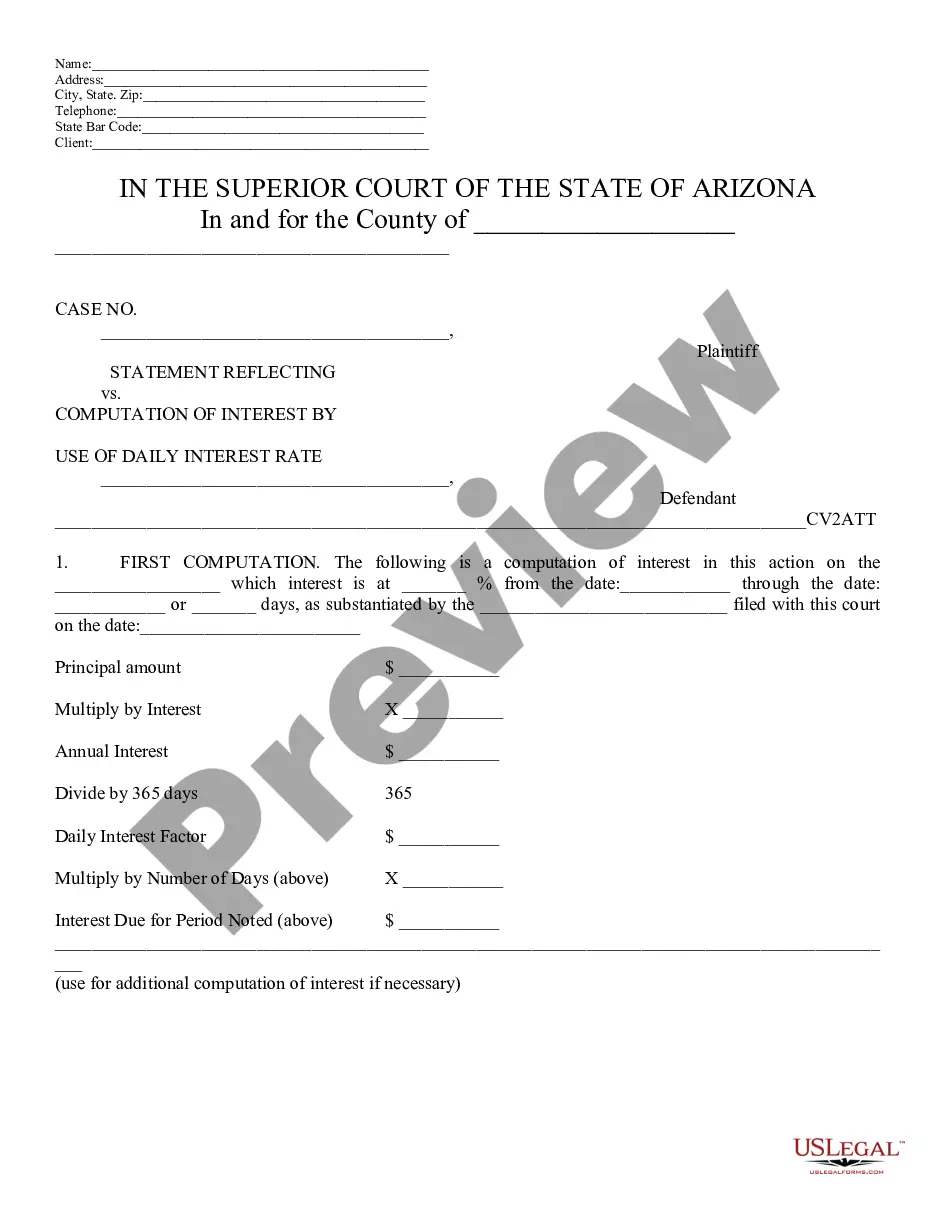

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table

Description

How to fill out Arizona Statement Reflecting Computation Of Interest Using Interest Table?

Finding validated formats that comply with your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements and various real-world scenarios.

All the files are correctly sorted by area of utilization and jurisdiction categories, making it as simple as pie to search for the Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table.

Maintaining organized paperwork that adheres to legal specifications is crucial. Leverage the US Legal Forms library to consistently access necessary document templates for any requirements at your fingertips!

- Examine the Preview mode and document description.

- Ensure you’ve chosen the appropriate one that fulfills your needs and aligns completely with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the right one.

- If it meets your needs, proceed to the following step.

Form popularity

FAQ

Property tax in Maricopa County is calculated by applying the assessed value of a property to the local tax rate. Several factors, including zoning and property use, influence this calculation. By referencing the Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table, you can better understand how various elements contribute to your overall property tax calculation.

The assessed value in Maricopa County is determined by the county assessor based on the property's fair market value and mandated assessment ratios. This process ensures that property taxes remain equitable and reflective of true property values. Tools like the Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table can walk you through these evaluations, ensuring you stay informed about your taxable property value.

Land value in Maricopa County is typically calculated using a combination of market data and property characteristics. The county uses a systematic approach, assessing each parcel based on factors like location and market performance. The Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table can help you understand how different variables affect your land value assessments.

In Arizona, the assessed value of a property is calculated by multiplying the fair market value by the assessment ratio, which varies by property type. This process ensures a consistent approach to taxation, administered by the county assessor's office. Additionally, the Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table can provide insights into how interest on property taxes might accumulate over time.

To determine land value in Arizona, you'll need to consider several factors including location, comparable sales, and zoning regulations. The county assessor usually provides a breakdown of these values, which can be accessed through public records. Utilizing the Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table can aid in visually representing these calculations and their implications.

Rule B in Maricopa County pertains to the calculation of property taxes specifically for agricultural and vacant lands. This rule helps determine a more accurate tax rate based on the land's productivity and potential use. With tools like the Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table, property owners can grasp how those rates influence their overall tax responsibilities.

Land value tax in Maricopa County is calculated based on the assessed value of the land. This value reflects factors like location, market trends, and property use. It’s important for homeowners to understand this process, as the Maricopa Arizona Statement Reflecting Computation of Interest Using Interest Table can illustrate how changes in value may impact your tax obligations.