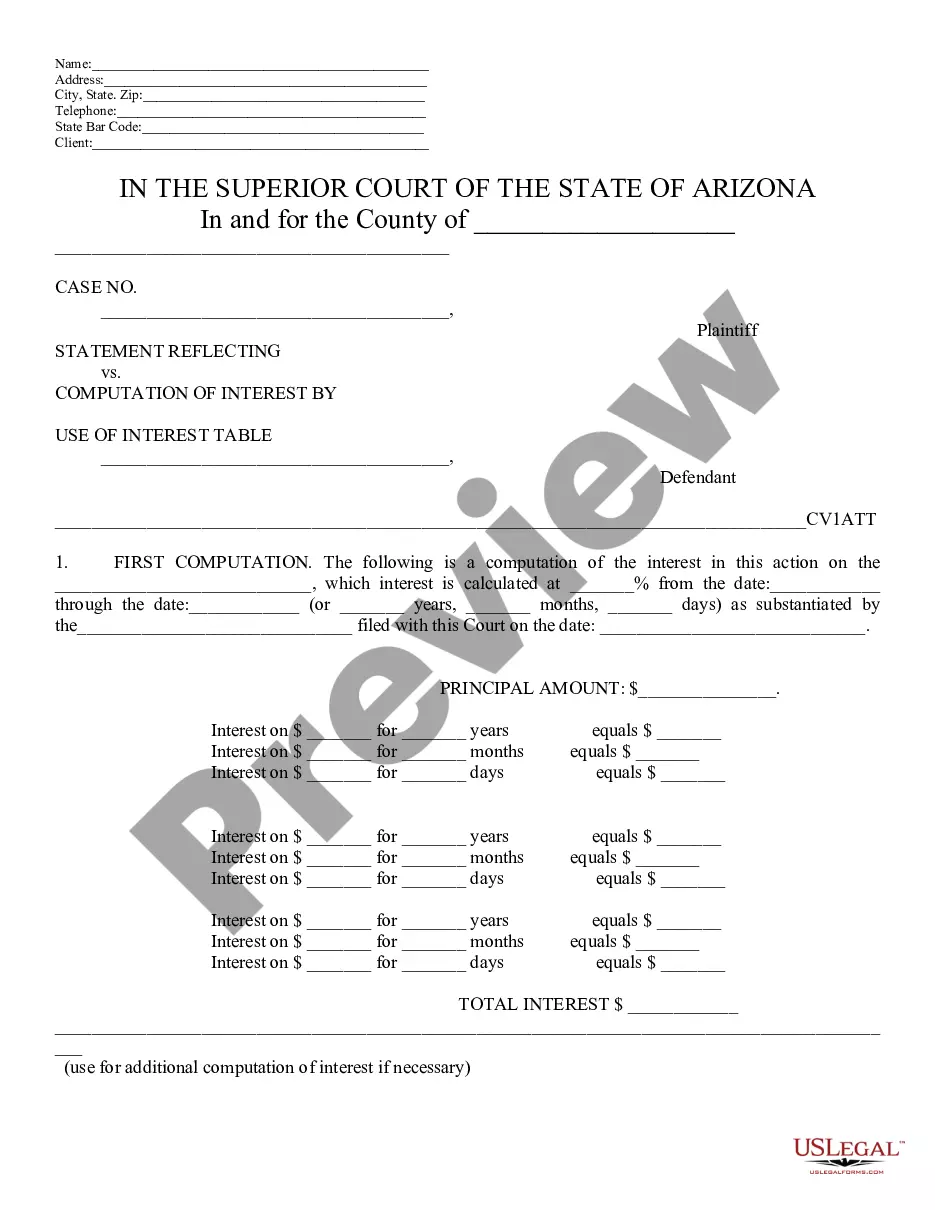

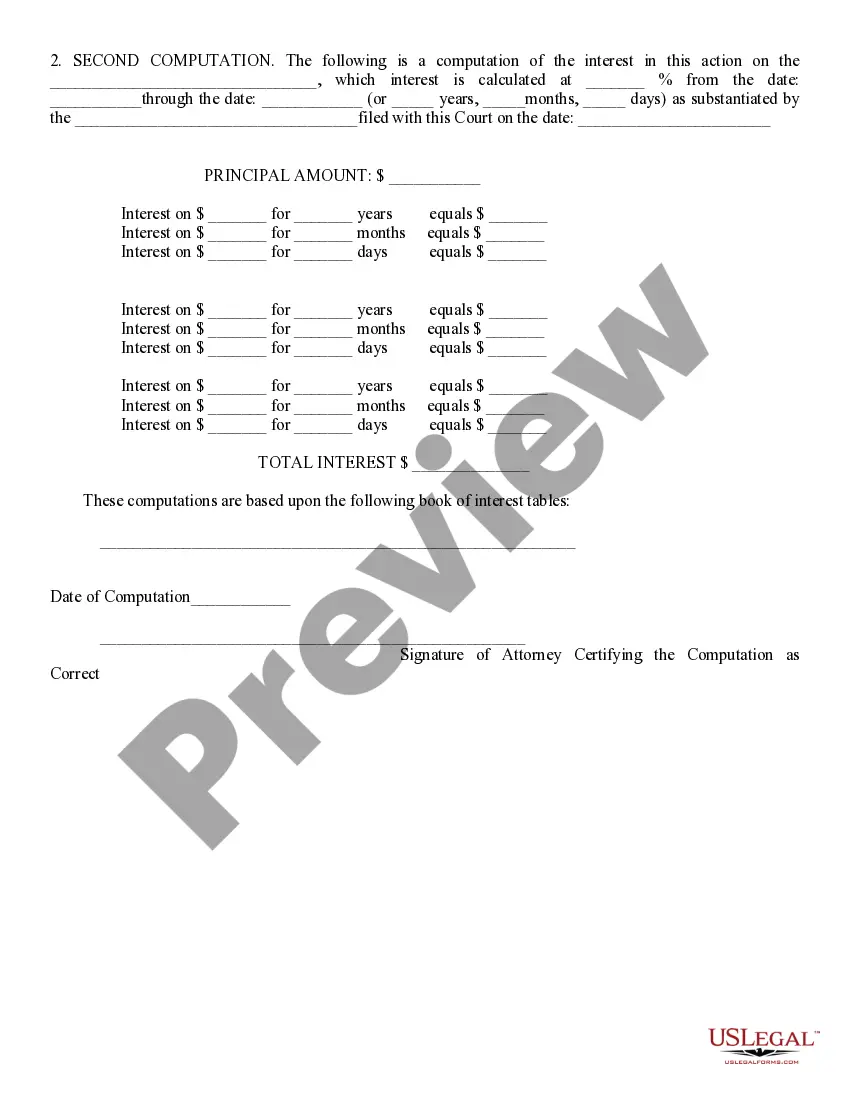

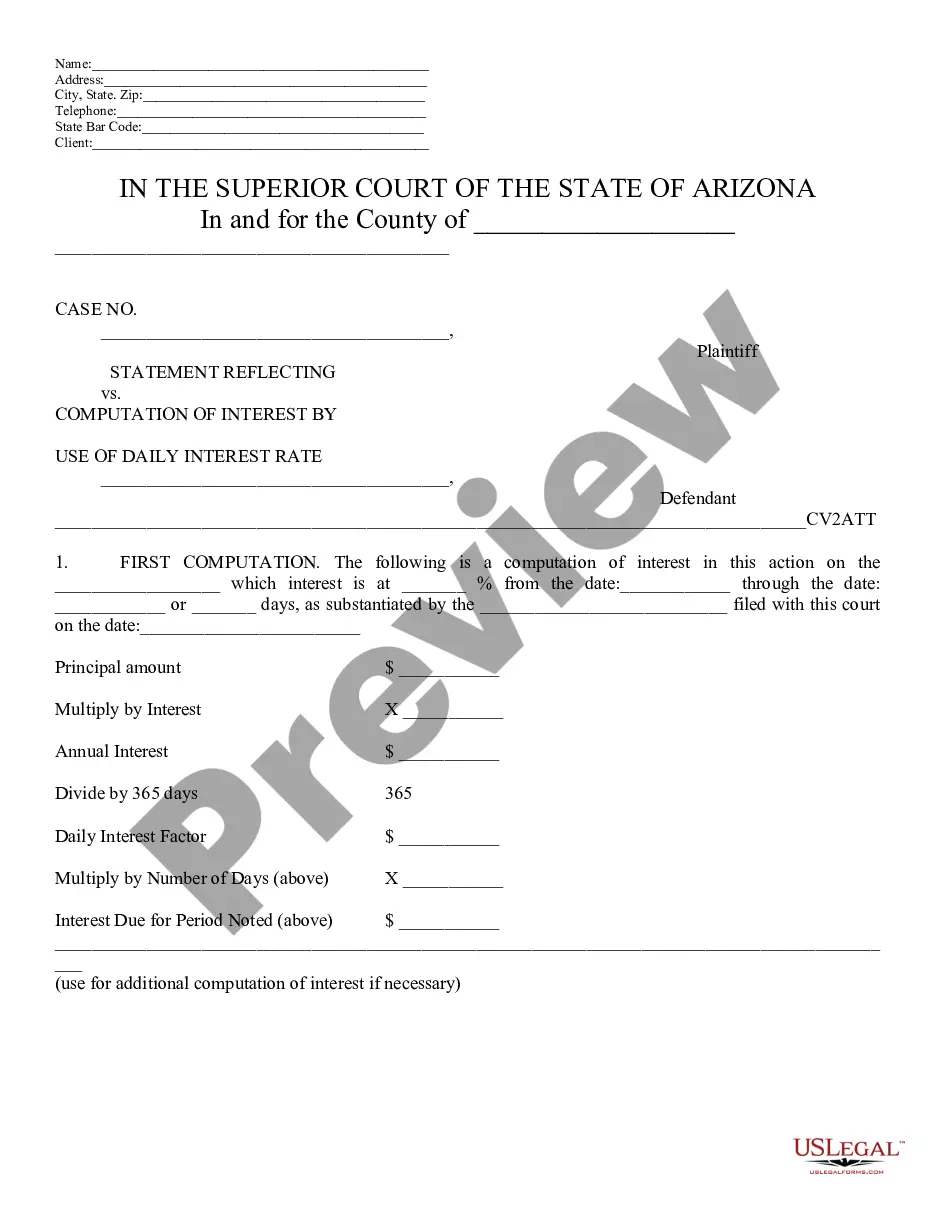

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table

Description

How to fill out Arizona Statement Reflecting Computation Of Interest Using Interest Table?

Utilize the US Legal Forms and gain instant access to any form you require.

Our user-friendly website featuring a vast collection of documents streamlines the process of locating and obtaining nearly any document sample you may need.

You can export, fill out, and validate the Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table in just a few minutes rather than spending hours online searching for the suitable template.

Using our collection is an excellent approach to enhance the security of your document submissions.

Locate the template you need. Ensure it is the form you were searching for: review its title and description, and utilize the Preview feature when available. Otherwise, use the Search bar to find the desired one.

Initiate the download process. Click Buy Now and select the pricing plan you wish. Then, create an account and pay for your order using a credit card or PayPal.

- Our knowledgeable attorneys routinely examine all documents to verify that the forms are pertinent to a specific region and adhere to current laws and regulations.

- How can you acquire the Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table.

- If you possess a profile, simply Log In to your account. The Download option will display on all documents you review.

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven't created an account yet, follow the instructions outlined below.

Form popularity

FAQ

Yes, interest income is generally taxable in Arizona. This includes interest earned from savings accounts, bonds, and other financial products. Understanding how this income affects your overall tax liability is crucial, and a Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table can help clarify any associated interest calculations.

Yes, Arizona allows residents to file their taxes online, making the process more efficient. Various platforms offer this service, ensuring that your information is processed swiftly and securely. When filing online, it's advisable to reference a Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table to verify any interest calculations that may impact your total tax due.

Business code 029 in Arizona relates to specific types of business activities, such as agricultural services. Identifying the correct business code is crucial for tax reporting. Utilizing a Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table can aid in understanding any interest calculations related to your business activities under this code.

Arizona Form 285 should be sent to the Arizona Department of Revenue via mail or fax depending on your specific situation. It is essential to check the latest instructions on the department's website to ensure proper submission. If applicable, you may want to verify interest owed using a Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table to submit accurate payments and avoid penalties.

You can file your Arizona Transaction Privilege Tax (TPT) online through the Arizona Department of Revenue's website. This process is simple and helps ensure that your return is timely and accurate. By utilizing a Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table, you can ensure that any interest amounts are correctly calculated and reported.

In Arizona, taxable income includes wages, salaries, and self-employment income. Additionally, rental income and interest from savings accounts are also taxable. These categories can affect your calculations, which is why a Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table is useful to understand potential interest liabilities.

In Arizona, several items are exempt from taxation, including most food items for home consumption. Additionally, certain medical services and prescription medications are not subject to tax. It's always a good practice to consult the Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table, as it helps clarify any interest that might accrue if payment of taxes is involved.

Yes, Arizona allows for electronic filing of amended returns. This is a convenient method that streamlines the process and reduces the chance of errors. Make sure to reference the Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table to ensure that all interest calculations are accurate in your amended return.

In Arizona, the penalty for late payment of Transaction Privilege Tax (TPT) can be substantial. Typically, a penalty can range from 5% to 25% of the unpaid tax amount based on how late the payment is. Keeping accurate records and using a Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table may help you understand the implications of late payments more clearly.

The statutory rate of interest in Arizona is set at 10% per annum. This rate applies unless a different rate is specified in a contract. Understanding this rate is crucial when preparing a Chandler Arizona Statement Reflecting Computation of Interest Using Interest Table, as it influences how interest is calculated on late payments.