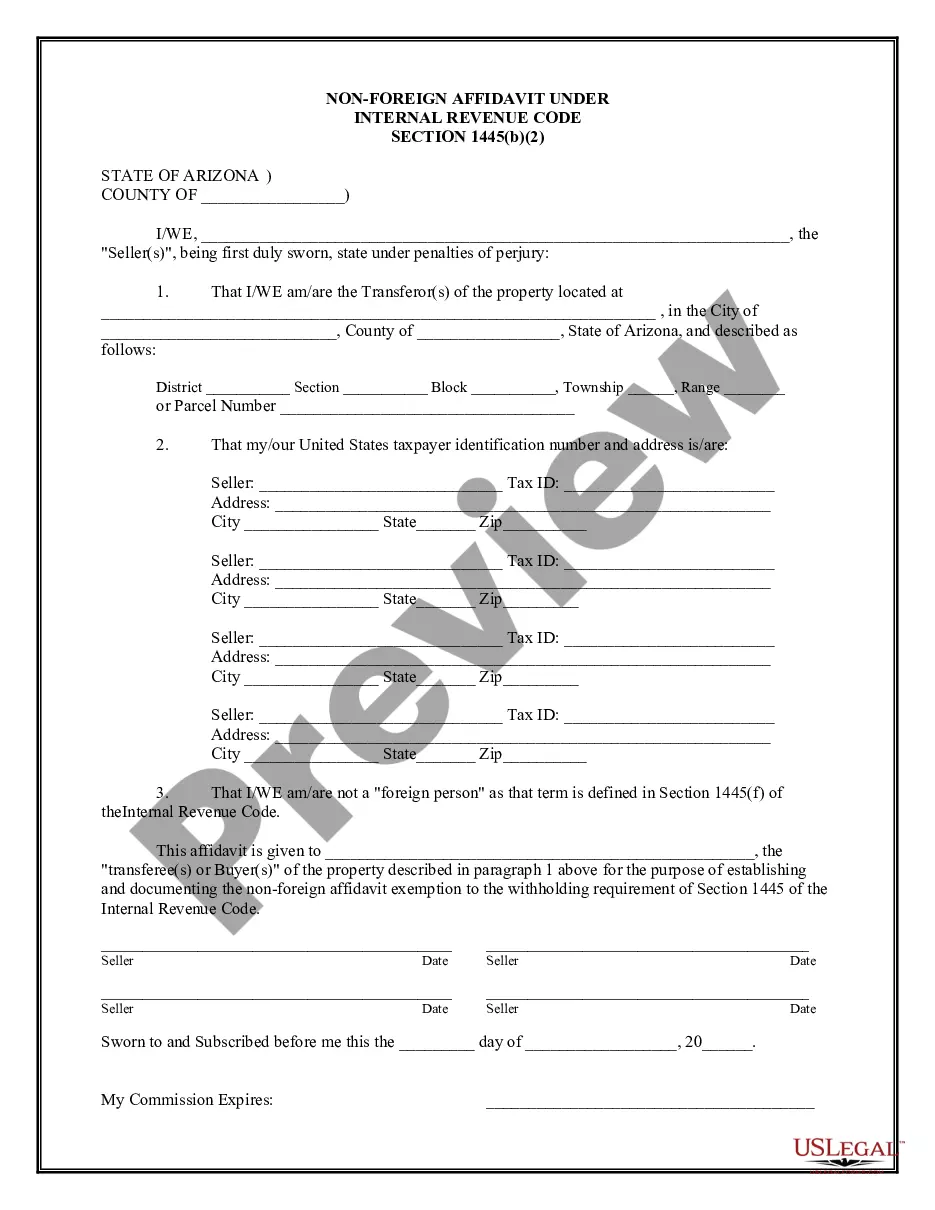

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Arizona Non-Foreign Affidavit Under IRC 1445?

If you are searching for a legitimate form template, it’s challenging to discover a superior source than the US Legal Forms website – one of the most substantial online repositories.

With this repository, you can locate a vast array of document examples for both business and personal use by categories and locations, or keywords.

With our enhanced search feature, finding the latest Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 is as simple as 1-2-3.

Obtain the form. Select the file format and download it to your device.

Edit. Fill out, adjust, print, and sign the obtained Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 is to Log In to your account and click the Download button.

- If it’s your first time using US Legal Forms, just adhere to the instructions below.

- Ensure you have accessed the form you need. Review its description and utilize the Preview option (if available) to examine its content. If it does not fulfill your requirements, utilize the Search option at the top of the page to find the desired document.

- Confirm your decision. Hit the Buy now button. Then, choose your preferred subscription plan and provide details to register for an account.

- Complete the payment. Utilize your credit card or PayPal to finalize the registration process.

Form popularity

FAQ

Yes, foreigners who sell property in the US are generally subject to US capital gains tax on any profit made from the sale. This tax applies regardless of whether the individual is a resident or non-resident. Using a Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 can provide clarity and aid in tax reporting obligations. Being informed about these tax implications will help you navigate the selling process effectively.

When a foreign person sells US property, the IRS typically withholds 15% of the gross proceeds from the sale. This is in line with FIRPTA regulations, aiming to ensure tax compliance on gains realized by non-residents. However, filing a Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 can effectively eliminate this withholding requirement. Using a platform like uslegalforms can help navigate this process smoothly and efficiently.

US real property interest refers to any interest in real property located in the United States. This could include land, buildings, and certain rights associated with property ownership. Understanding these interests is crucial, especially for foreign investors looking to buy or sell property. Utilizing resources like a Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 ensures you are well-informed and compliant in your real estate endeavors.

If a transferor realizes zero on the transfer of a US real property interest, it typically occurs in a scenario where the property's value is offset by debts or liabilities. In such cases, filing a Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 can help clarify tax implications for the IRS. This documentation assists in ensuring compliance while addressing the intricacies of real estate transactions. Hence, proper paperwork can protect your interests.

Getting around FIRPTA, or the Foreign Investment in Real Property Tax Act, involves strategic planning. A Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 allows sellers to certify their non-foreign status, therefore avoiding the withholding tax. You may need to provide specific documentation, and using a reliable platform like uslegalforms can simplify the process. Ensuring proper compliance can make transactions smoother and more beneficial.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an individual General Partner of the Company, by a responsible officer of a corporate General Partner of the Company (or of the Company, if the Company is a corporation), or by the trustee, executor, or equivalent fiduciary of

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests. A disposition means ?disposition? for any purpose of the Internal Revenue Code. This includes but is not limited to a sale or exchange, liquidation, redemption, gift, transfers, etc.

If you're buying property, you should make sure the seller signs a FIRPTA Affidavit to protect yourself. You shouldn't take the seller's word for it ? or you could face serious penalties for not abiding by FIRPTA rules if they apply. A buyer can be penalized for not determining or disclosing a foreign seller.