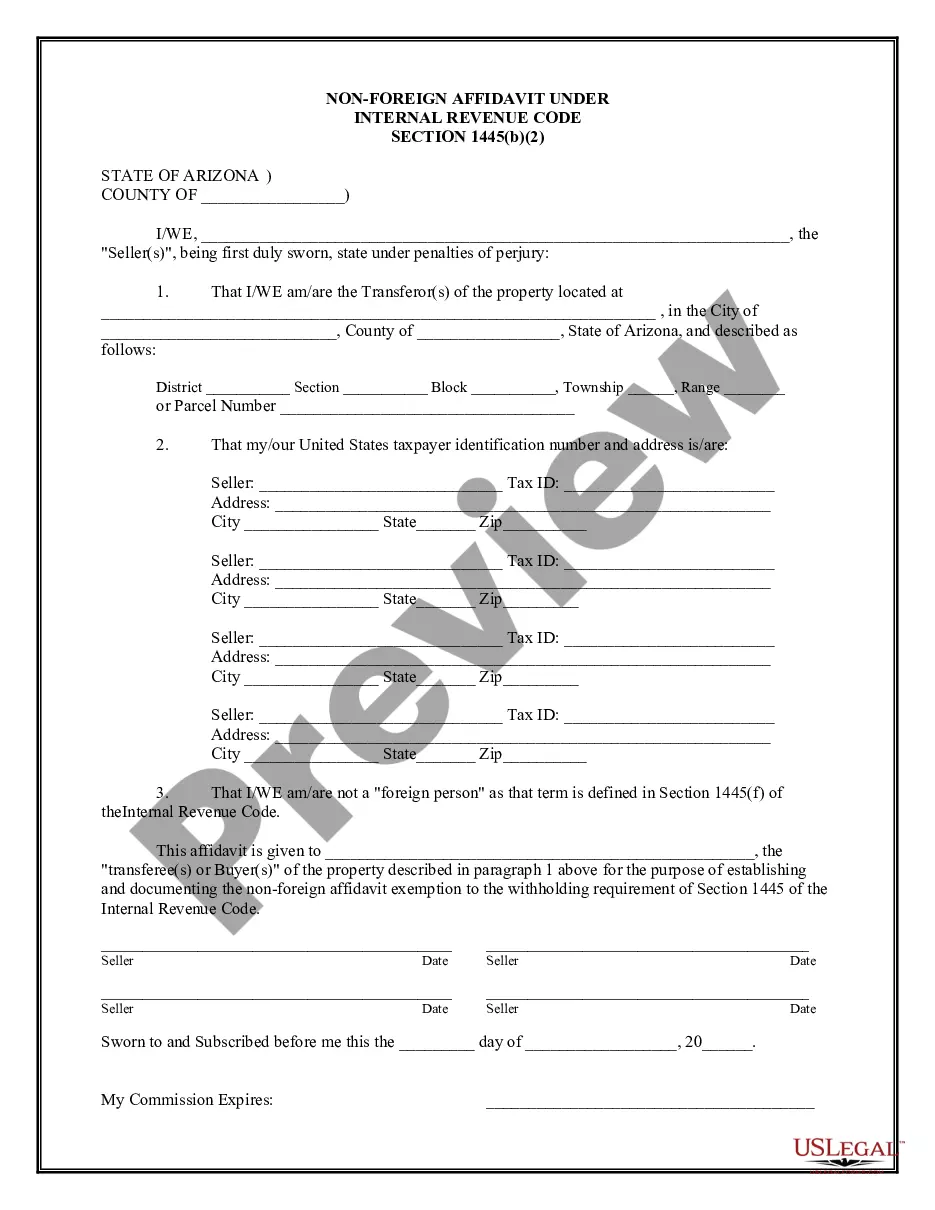

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Mesa Arizona Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Arizona Non-Foreign Affidavit Under IRC 1445?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our user-friendly platform with numerous templates helps you locate and acquire nearly any document example you require.

You can save, complete, and sign the Mesa Arizona Non-Foreign Affidavit Under IRC 1445 in just a few minutes, rather than spending hours searching online for a suitable template.

Leveraging our library is an excellent method to enhance the security of your form submissions.

If you do not have an account yet, follow the steps outlined below.

Open the page with the template you need. Confirm that it is the right template: verify its title and description, and use the Preview feature when available. Otherwise, utilize the Search field to find the required one.

- Our skilled legal experts routinely review all documents to ensure that the templates are suitable for a specific area and adhere to current laws and regulations.

- How can you obtain the Mesa Arizona Non-Foreign Affidavit Under IRC 1445.

- If you possess a subscription, simply Log In to your account.

- The Download button will be activated on all the samples you browse.

- Additionally, you can access all the previously saved documents in the My documents section.

Form popularity

FAQ

In order to potentially avoid FIRPTA withholding, the foreign seller, the Form 8288-B and a contract for the purchase of the replacement property, must be submitted to the IRS on or before the replacement property's closing following the procedures discussed in Rev. Rroc.

If you're buying property, you should make sure the seller signs a FIRPTA Affidavit to protect yourself. You shouldn't take the seller's word for it ? or you could face serious penalties for not abiding by FIRPTA rules if they apply. A buyer can be penalized for not determining or disclosing a foreign seller.

A foreign corporation that distributes a U.S. real property interest must withhold a tax equal to 21% of the gain it recognizes on the distribution to its shareholders.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an authorized officer of Borrower, stating (a) that Borrower is not a ?foreign corporation,? ?foreign partnership,? ?foreign trust,? or ?foreign estate,? as those terms are defined in the Code and the regulations promulgated

The Foreign Investment in Real Property Tax Act (FIRPTA) is a tax imposed on the amount realized from the sale of real property owned by a foreign seller. There are exceptions to this tax-withholding requirement.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.