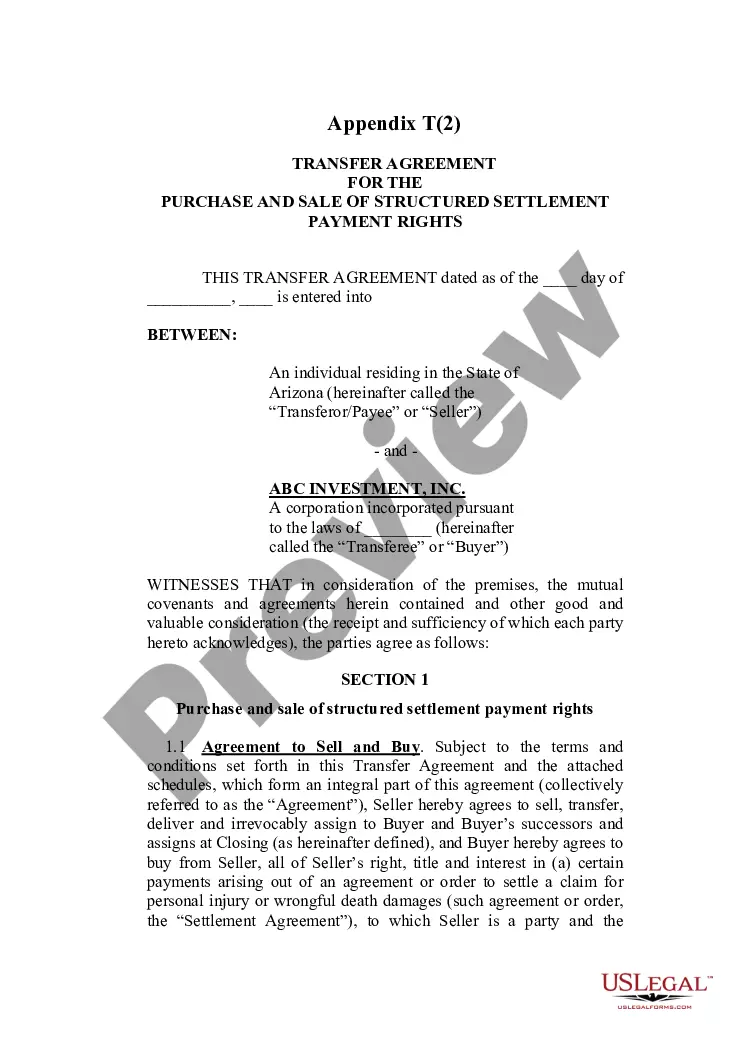

State specific form for Arizona. This form is submitted by parties for the Court to use to order approval of a transfer of structured payment rights pursuant to the Arizona Structured Settlement Transfer Act, A.R.S. § 12-2901 et seq., .

Tucson Arizona Order Approving Transfer of Structured Settlement Payment Rights

Description

How to fill out Arizona Order Approving Transfer Of Structured Settlement Payment Rights?

If you have previously utilized our service, Log In to your account and acquire the Tucson Arizona Order Approving Transfer of Structured Settlement Payment Rights on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to all the documents you have purchased: you can find them in your profile under the My documents section whenever you wish to retrieve them. Benefit from the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Ensure you have found the correct document. Review the details and use the Preview option, if provided, to verify if it meets your needs. If it isn't suitable for you, use the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and finalize your payment. Utilize your credit card information or the PayPal method to complete the transaction.

- Obtain your Tucson Arizona Order Approving Transfer of Structured Settlement Payment Rights. Choose the file format for your document and store it on your device.

- Fill out your sample. Print it or use professional online editors to complete it and sign it digitally.

Form popularity

FAQ

Structured settlement annuities are not taxable ? they're completely tax-exempt. It's a common question that we are asked by personal injury attorneys, and in certain situations, the tax-exempt nature of structured settlement annuities results in significant tax savings to the client.

Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.

A structured settlement factoring transaction means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration.

The lump sum you receive from the buyer, or factoring company, can be as low as 50 percent of your total future payments, but typically will be between 60 and 80 percent. So if you get $1,000 a month through your structured settlement, you could sell each payment for anywhere from $500 to $800.

Cashing out a structured settlement involves a court approval process which takes about 45 to 90 days. Selling future payments offers more flexibility. Interest rates are rising for annuities in 2022, making purchasing an annuity more intriguing for buying companies.

Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.

You cannot borrow against your structured settlement, but you can sell all or a portion of it for a lump sum of cash. You can also seek pre-settlement funding or lawsuit advances to cover legal bills prior to a lawsuit settlement.

Put simply, a structured settlement is not a loan or a bank account, and the only way to receive money from your settlement is to stick to your payment schedule or sell part or all of your payments to a reputable company for a lump sum of cash.

Structured settlement companies, also known as factoring companies, will buy your structured settlement or annuity payments for a lump sum of cash.