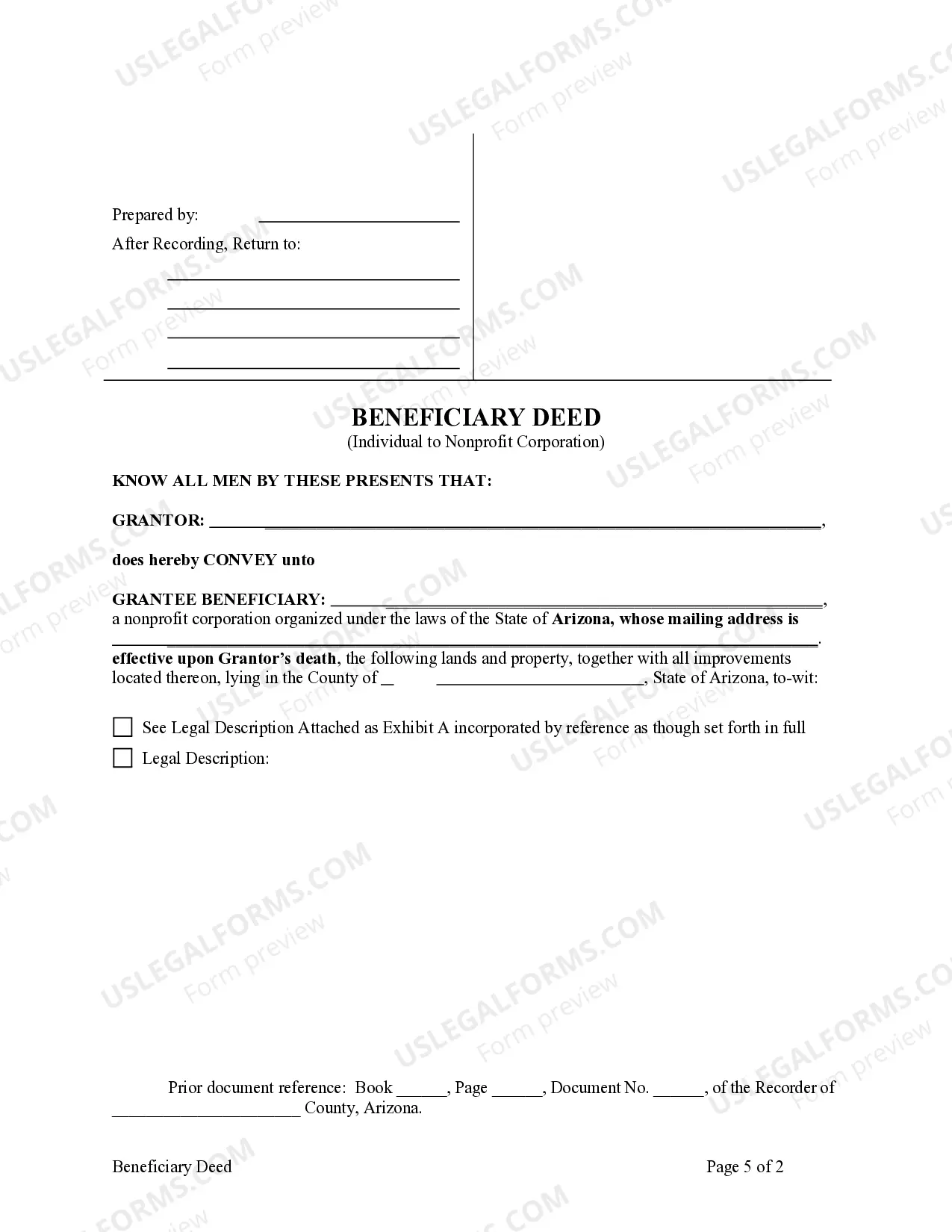

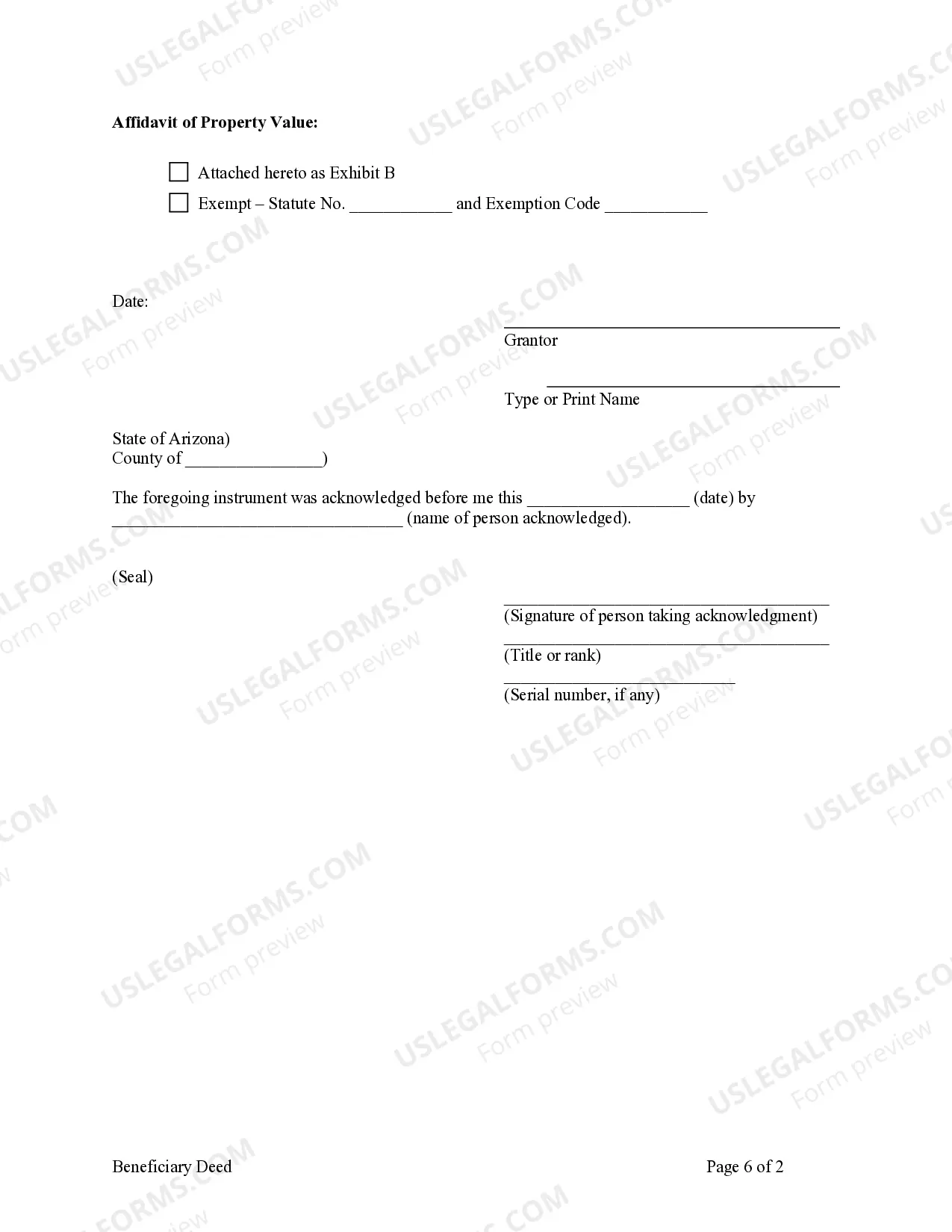

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

Are you in search of a trustworthy and affordable legal forms provider to purchase the Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary? US Legal Forms is your preferred option.

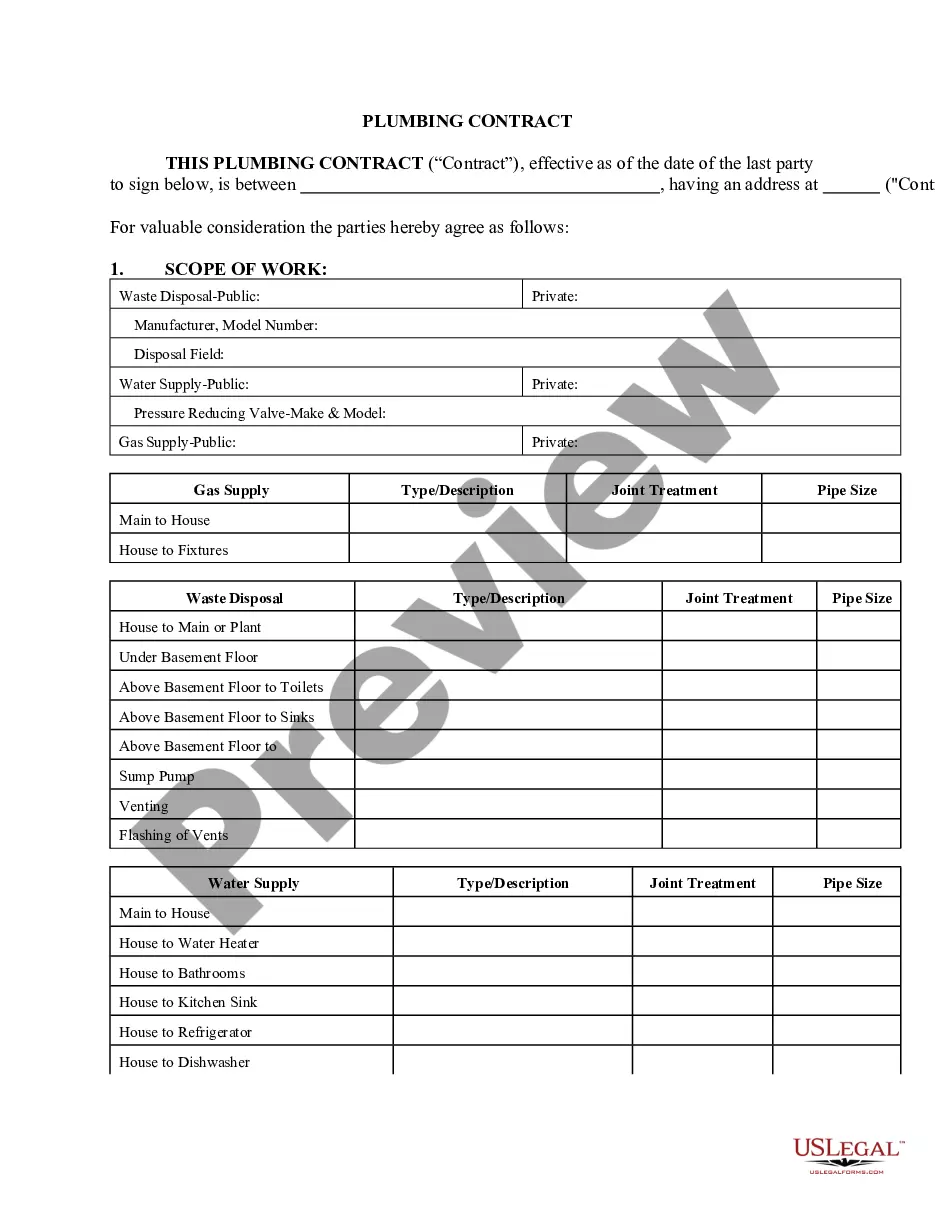

Whether you need a simple contract to establish rules for living with your partner or a collection of forms to facilitate your divorce through the court system, we are here to assist you. Our platform features over 85,000 current legal document templates for personal and business purposes. All templates we provide are specifically tailored and crafted according to the rules of particular states and regions.

To obtain the document, you must Log In to your account, find the desired form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any moment from the My documents section.

Is this your first time visiting our site? No problem. You can create an account swiftly, but before that, make sure to do the following.

Now you can register your account. Then select the subscription plan and move on to payment. Once the payment is completed, download the Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary in any available file format. You can revisit the website whenever needed and redownload the document free of charge.

Acquiring the latest legal forms has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time searching for legal documents online.

- Verify that the Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary complies with the laws of your state and locality.

- Review the details of the form (if available) to understand who and what the document is directed towards.

- Restart the search if the form does not suit your legal context.

Form popularity

FAQ

Yes, a beneficiary deed must be recorded in Arizona to ensure its effectiveness. This recording provides public notice of the transfer upon the owner's death, streamlining the process for the beneficiary, in this case, a nonprofit corporation. Recording the deed helps prevent any disputes regarding property ownership in the future. To simplify this process, you may want to consider using US Legal Forms, which offers resources and guidance for creating and recording a Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary.

To fill out a beneficiary deed in Arizona, begin by obtaining the correct form, which is the Arizona Beneficiary Deed. Next, provide accurate information about the individual owner and the nonprofit corporation designated as the beneficiary. It is essential to clearly define the property in question and ensure all necessary details are included. This process allows you to effectively create a Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary.

Transfer-on-death deeds are indeed available in Arizona, providing significant benefits for property owners. They allow individuals to designate a beneficiary who will automatically receive the property title upon death. This method not only simplifies the estate process but also reduces legal complications. You can find templates and guidance on executing these deeds through uslegalforms.

Yes, Arizona does allow for transfer-on-death deeds. This legal mechanism simplifies the transfer of property title upon death, avoiding the probate process. It is a valuable tool for individuals looking to designate a Scottsdale Arizona beneficiary, including nonprofit corporations, without the need for complicated legal proceedings. For your convenience, uslegalforms offers detailed information regarding this deed type.

Transferring property title to a family member in Arizona can be accomplished through a standard deed transfer or a transfer-on-death deed. If using a transfer-on-death deed, you can name the family member as the beneficiary, allowing for a seamless transfer without probate. To access the right forms and ensure compliance, uslegalforms can be a helpful resource.

To change a deed on a house after the death of a spouse in Arizona, you typically need to execute a new deed transferring the property to the surviving spouse, heirs, or beneficiaries. If the deceased spouse had a transfer-on-death deed, the property can pass to the named beneficiary directly. For assistance with the necessary paperwork, you can explore the resources available at uslegalforms.

To transfer title upon death in Arizona, you can utilize a transfer-on-death deed. This deed allows you to designate a beneficiary who will receive the property without going through probate. It is essential to properly execute and record this deed to ensure your intentions are honored. You may want to consult uslegalforms for guidance on this process and to access the necessary documents.

To transfer a title from a deceased person in Arizona, you must first gather necessary documentation including the death certificate and title deed. Then, implement a Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, which allows direct transfer of property upon the owner's passing. It is important to file the deed with the county recorder to ensure the title is legally updated. Utilizing resources like uslegalforms can simplify this process and provide forms tailored to your situation.

When a house owner dies without a will in AZ, the property typically undergoes probate, and its distribution is governed by state law. This process can be lengthy and may not align with the deceased's intentions. The Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary provides an alternative route, allowing for direct transfers when structured properly. Using platforms like uslegalforms can help ensure that your property transitions smoothly, avoiding the complications of probate.

Transferring a property deed from a deceased relative in AZ involves gathering significant documents, such as the death certificate and current title information. The Scottsdale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary simplifies this process, allowing for a smooth transfer without the need for lengthy legal proceedings. For clarity and efficiency, consider using uslegalforms, which provides the necessary forms and guidance to complete the deed transfer correctly.