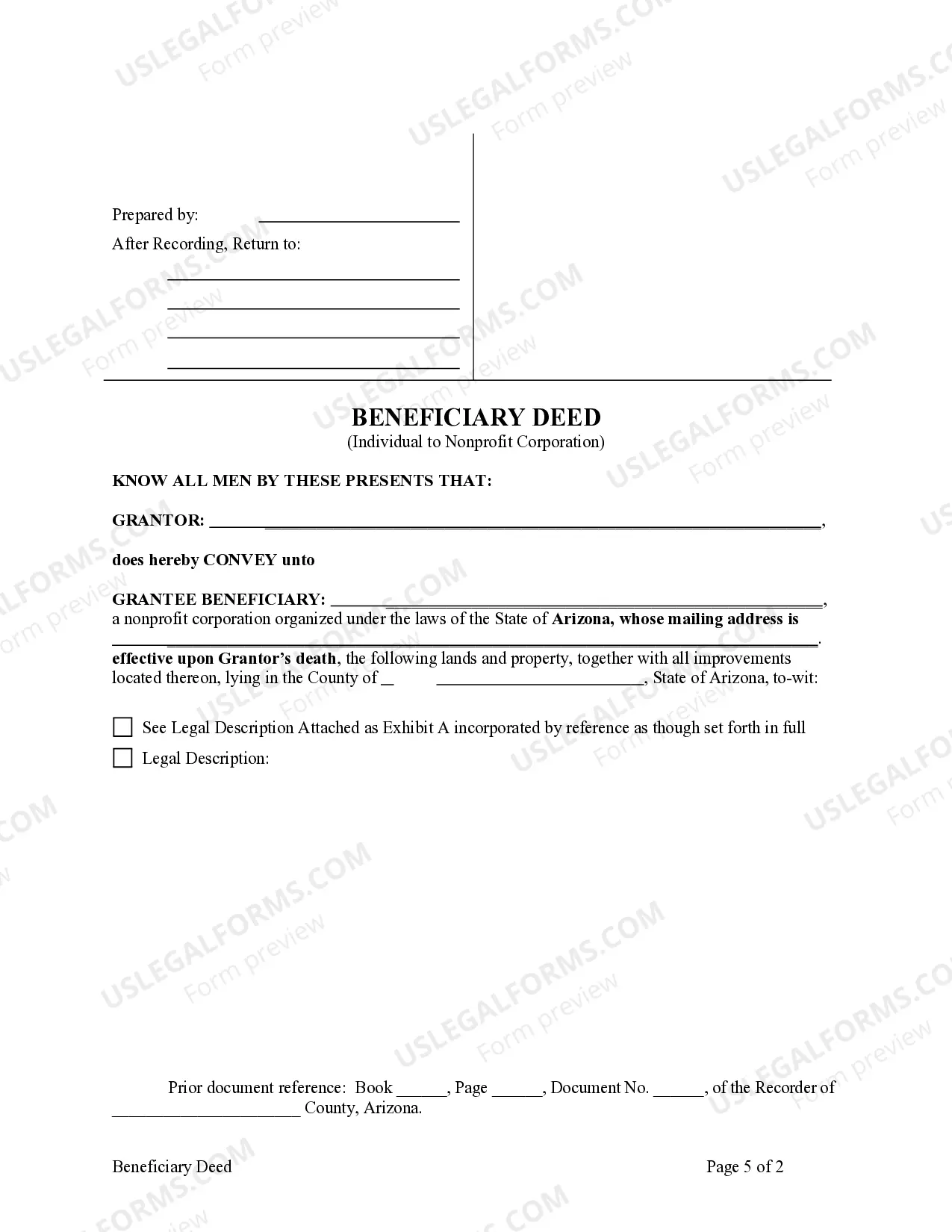

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Mesa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

We consistently aim to minimize or avert legal repercussions when handling intricate legal or financial matters.

To achieve this, we seek legal options that, generally speaking, are quite expensive.

However, not every legal issue is of equal intricacy. A majority of them can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it from within the My documents tab. The process is just as straightforward if you’re new to the website! You can establish your account in just a few minutes. Ensure to verify if the Mesa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary adheres to the laws and regulations of your state and area. Additionally, it is essential to review the form’s description (if available), and if you notice any inconsistencies with what you were seeking initially, look for an alternative form. Once you’ve confirmed that the Mesa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary suits your needs, you can choose a subscription plan and proceed to payment. Following that, you can download the document in any available file format. With more than 24 years of experience in the market, we’ve assisted millions by providing customizable and up-to-date legal documents. Make the most of US Legal Forms now to conserve time and resources!

- Our platform enables you to manage your affairs without needing an attorney.

- We offer access to legal document templates that are not always readily available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you require the Mesa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary or any other document swiftly and securely.

Form popularity

FAQ

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

Arizona inheritance laws specify that a decedent's property passes to their spouse and/or descendants. Qualifying descendants could include: Children, including adopted children or ones conceived before marriage. Grandchildren and great-grandchildren.

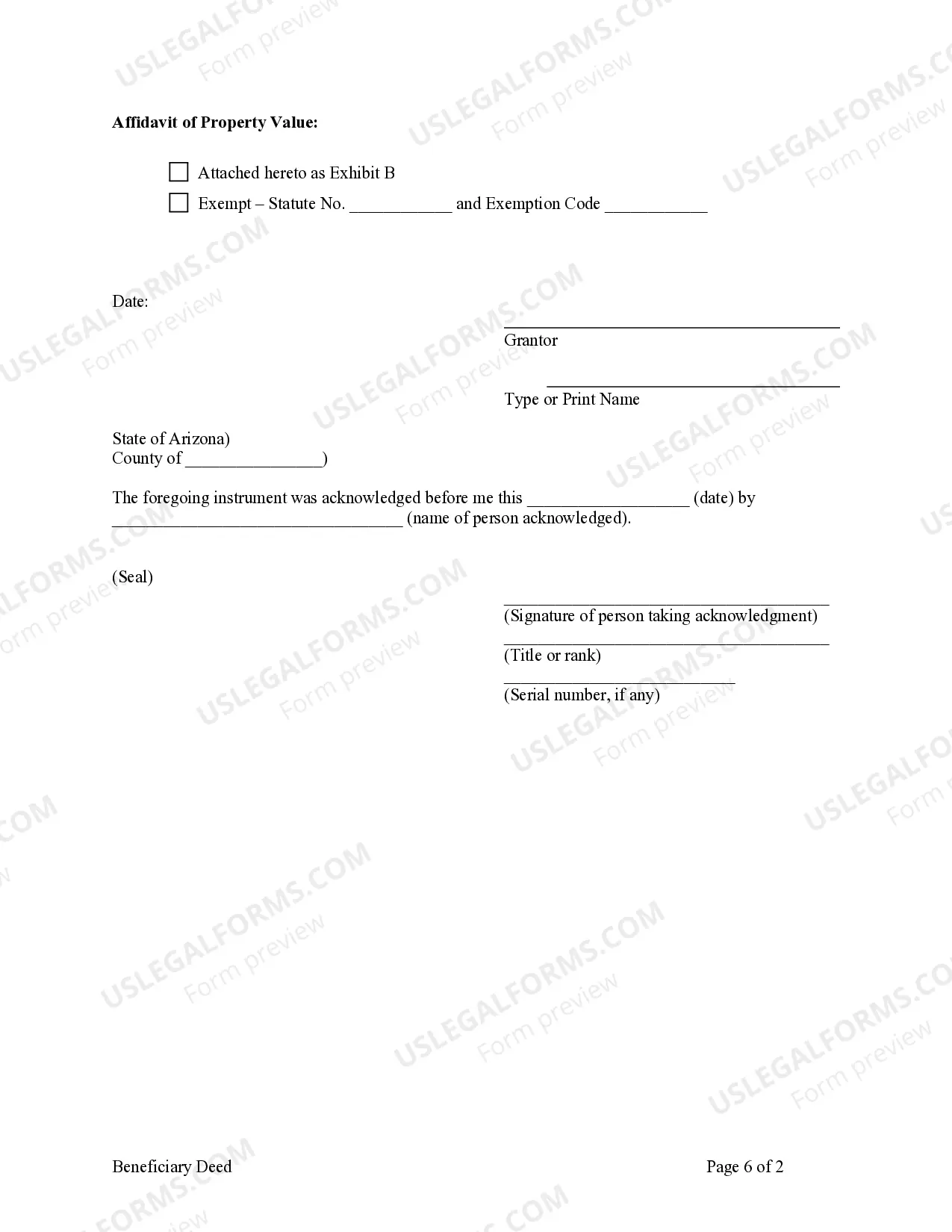

Arizona real estate is transferred using a legal document called a deed....The process involves four general steps: Locate the Prior Deed to the Property.Get a New Deed to the Property.Sign and Notarize the New Deed.Record the New Deed in the Land Records.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

You may create life estates or any other form of ownership recognized in Arizona. Beneficiary deeds work well when the title will pass to a single individual or to a few individuals all of whom share a common vision of what to do with the property.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

Arizona real estate is transferred using a legal document called a deed....The process involves four general steps: Locate the Prior Deed to the Property.Get a New Deed to the Property.Sign and Notarize the New Deed.Record the New Deed in the Land Records.