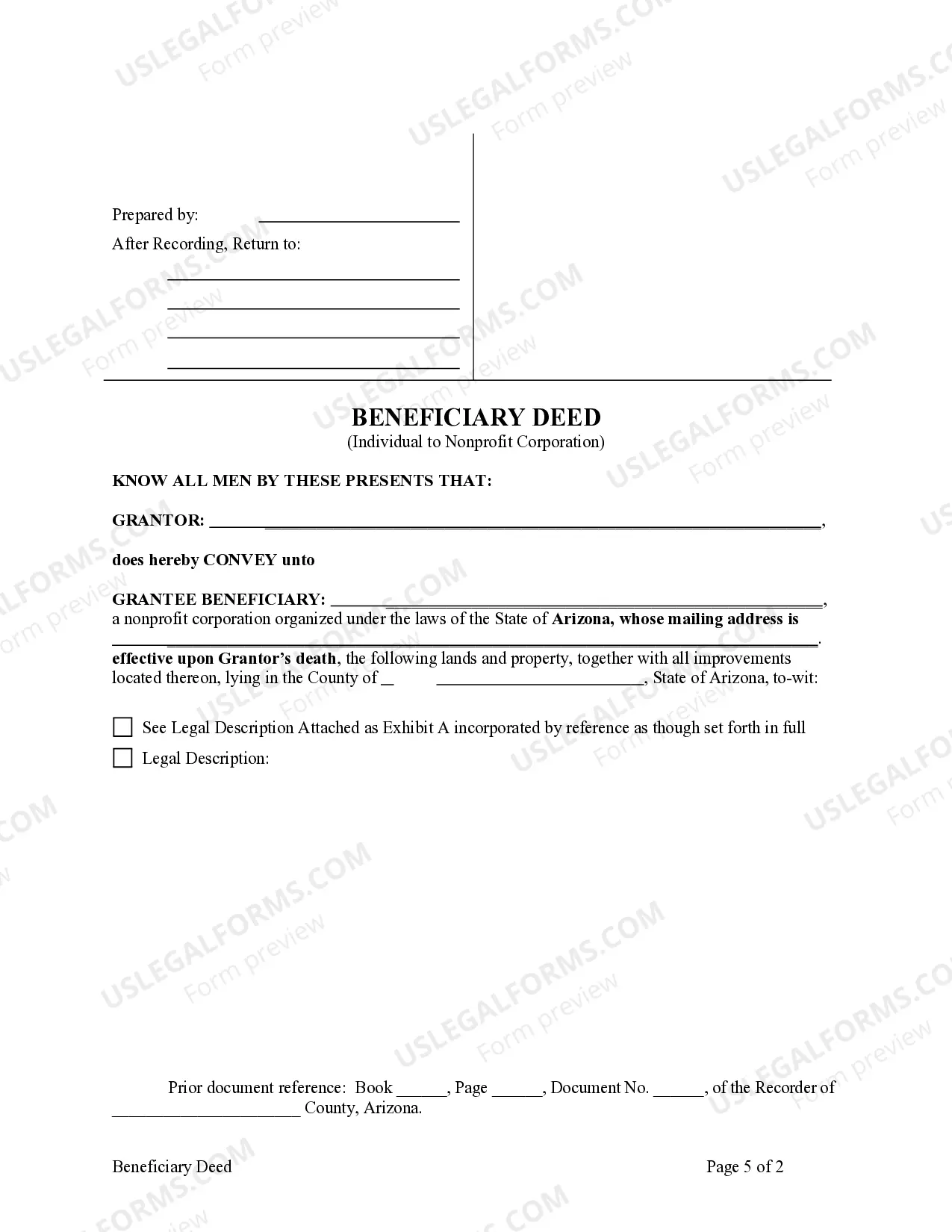

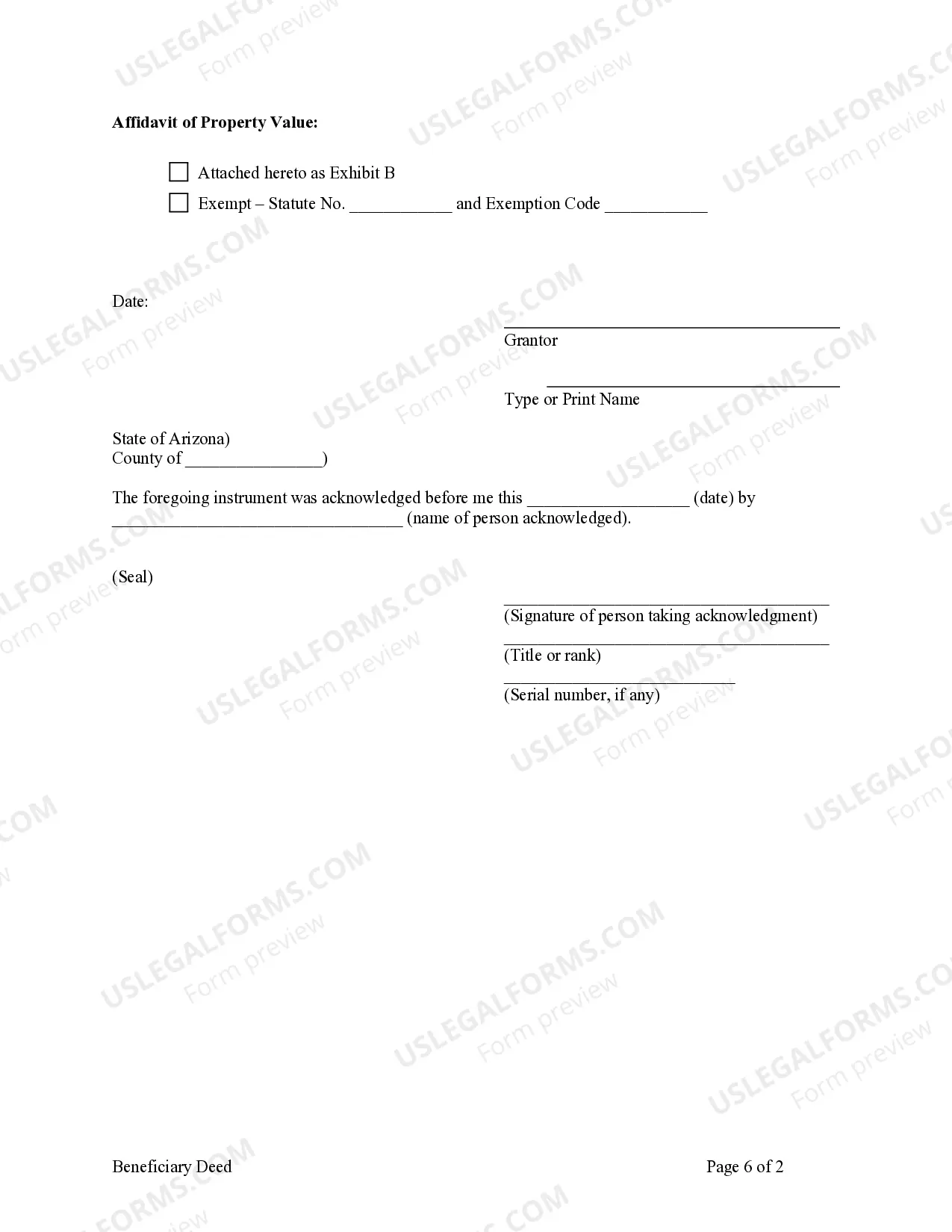

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Maricopa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

We consistently endeavor to minimize or evade legal complications when engaging with intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically quite costly.

Nonetheless, not every legal issue is as convoluted.

The majority can be managed by ourselves.

Utilize US Legal Forms whenever you need to locate and download the Maricopa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary or any other document promptly and securely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to manage your affairs independently without relying on legal advisors.

- We provide access to legal document templates that aren't always publicly available.

- Our templates are specific to states and regions, which significantly eases the search process.

Form popularity

FAQ

One disadvantage of a transfer on death deed is that it does not provide control over the property during the owner's lifetime. This means that if the beneficiary does not share your wishes or if circumstances change, there may be no way to adjust the arrangement. Additionally, any debts associated with the property could complicate the transfer. Consulting with a platform like US Legal Forms can offer clarity on potential issues.

Yes, a transfer on death deed is legal in Arizona. This allows individuals to designate a beneficiary, like a nonprofit corporation, to receive property after their death, providing a simple way to transfer ownership without going through probate. It is important to ensure the deed meets state requirements to be valid. Using a legal service like US Legal Forms can help streamline this process.

To get a transfer on death deed in Arizona, you can acquire a template from an online legal resource like US Legal Forms. Ensure the form is appropriate for your situation and follows guidelines specific to Maricopa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary. After completing the deed, be sure to have it recorded at your local county recorder's office to make the transfer official and valid.

Writing a beneficiary deed involves clearly outlining the property details, owner's information, and naming the beneficiary directly in the deed. You must also ensure that the language reflects your intent that the property will transfer upon your passing. For a successful process that meets legal standards, particularly for a Maricopa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, using tools like US Legal Forms can streamline your efforts.

To fill out a transfer on death designation affidavit, start by downloading the correct form from your local government resources or US Legal Forms for convenience. Clearly state your name, the property details, and the designated beneficiary's information. It's crucial to ensure that the affidavit aligns with the stipulations of a Maricopa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, to prevent any issues during the property transfer.

Filing a transfer on death deed in Arizona requires you to prepare the form and have it recorded with your local county recorder's office. Ensure that you complete the deed accurately, identifying yourself as the owner and your chosen beneficiary. This process allows for the seamless transfer of your property, specifically under the guidelines provided for a Maricopa Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary. Consider using platforms, like US Legal Forms, for guiding you through the required documentation.

One disadvantage of a Transfer on Death deed is its inability to cover or manage debts associated with the property. Creditors can still pursue the property's value, which means beneficiaries may inherit property subject to financial obligations. Additionally, if there are no named beneficiaries at the time of the owner’s death, the property may end up in probate. Understanding these risks is crucial, and leveraging services like US Legal Forms can guide you through the necessary steps to create effective estate planning.

While Transfer on Death deeds have many advantages, there are potential negatives to consider. One drawback is that the deed does not provide any asset protection during the owner's lifetime; creditors may still have claims against those assets. Furthermore, if the beneficiary predeceases the owner, the property could complicate matters if not addressed. Being aware of these issues and consulting resources like US Legal Forms can help you plan effectively.

Transfer on Death accounts can create complications if there are disputes among beneficiaries or if the account holder’s wishes are unclear. Additionally, if multiple beneficiaries are named, disagreements over the distribution may arise, causing friction. It's also essential to maintain updated designations in a TOD account to ensure that your intentions are accurately reflected. Consulting with a legal expert can help mitigate potential issues you might encounter.

A Transfer on Death deed does not automatically avoid inheritance tax. While the property transferred via a TOD deed typically bypasses probate, the rules surrounding estate and inheritance taxes can vary by state and individual circumstances. In some cases, the value of the estate may still be subject to taxation. Utilizing tools such as US Legal Forms can help you navigate the complexities of taxes related to the transfer of property.