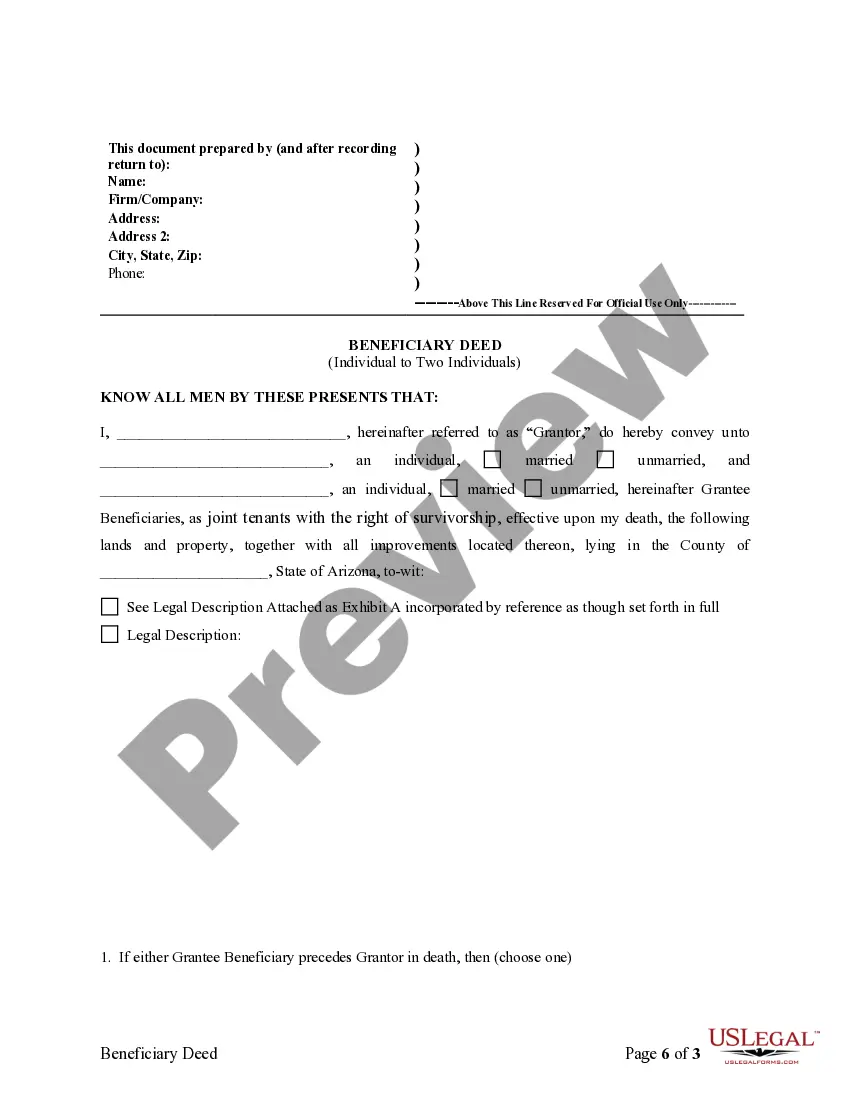

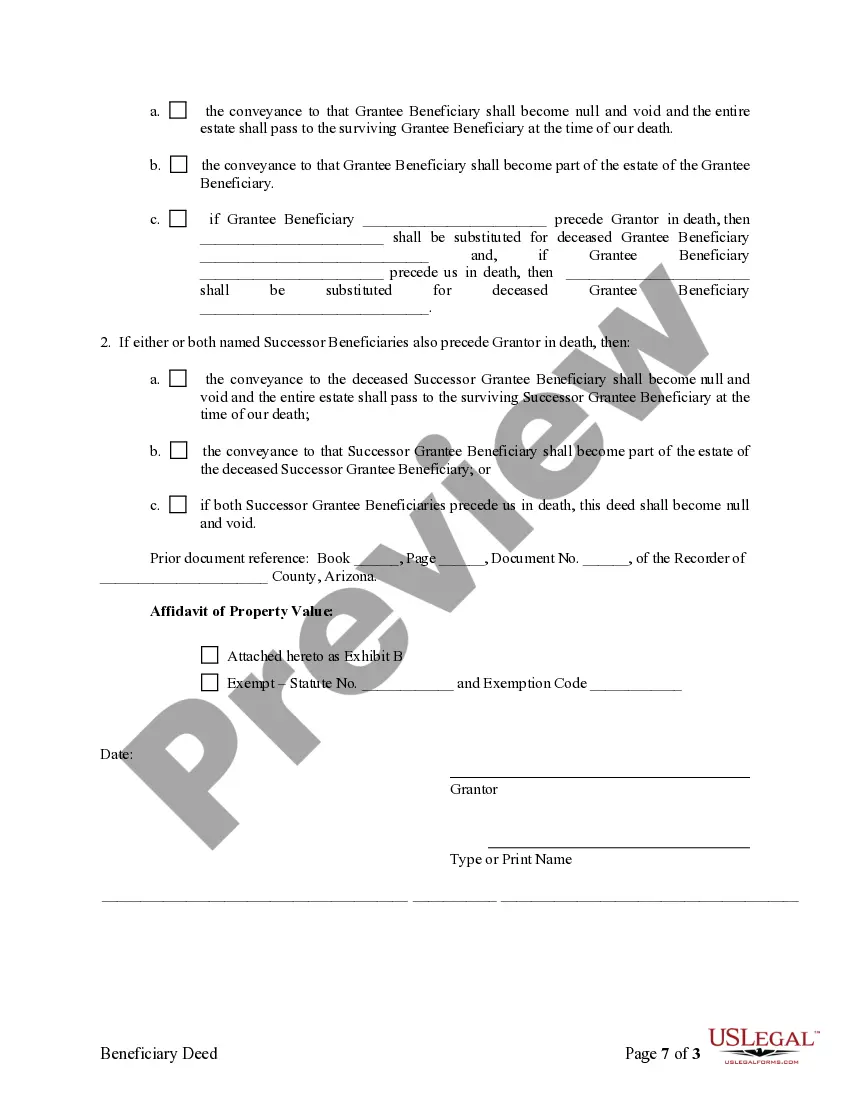

This form is a Transfer on Death Deed where the Grantor Owner is an individual and the Grantee Beneficiaries are two individuals. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Do you require a reliable and cost-effective legal forms provider to purchase the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals? US Legal Forms is your ideal choice.

Whether you seek a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce process through the courts, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business needs. All templates we provide are not generic and are tailored to meet the specifications of specific states and counties.

To acquire the document, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously acquired form templates at any moment from the My documents section.

Are you unfamiliar with our platform? Don’t worry. You can set up an account in just a few minutes, but prior to that, ensure to do the following.

Now you are ready to create your account. Next, choose a subscription plan and proceed to payment. Once the payment is finalized, download the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals in any available format. You can revisit the site at any time and re-download the document without any additional fees.

Acquiring current legal documents has never been simpler. Give US Legal Forms a try today, and stop wasting your precious time trying to understand legal documents online once and for all.

- Check if the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals aligns with the regulations of your state and locality.

- Review the form's details (if available) to understand who and what the document is meant for.

- Restart the search if the template is unsuitable for your legal circumstance.

Form popularity

FAQ

While it is not mandatory to hire an attorney for a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals, seeking professional advice can be beneficial. An attorney can offer insights that help avoid potential pitfalls and ensure the deed functions as intended. Additionally, using services like US Legal Forms can simplify the process by providing templates and guidance.

No, you do not have to be an attorney to prepare a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals. Many individuals choose to create these deeds on their own using user-friendly platforms like US Legal Forms. However, having legal guidance can help ensure that the deed complies with all state requirements and effectively meets your needs.

Yes, you can designate two beneficiaries on a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals. In this scenario, both beneficiaries would have equal rights to the property upon your passing. It is essential to clearly outline each beneficiary's share and their relationship to you to avoid future disputes.

You do not need a lawyer to complete a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals, as many people successfully manage the process themselves. That said, a lawyer can offer valuable guidance and ensure that all legal requirements are met. If you're uncertain about the steps or language, legal assistance can be a wise choice.

A Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals does not directly avoid inheritance tax, as Arizona does not impose an inheritance tax. However, it does facilitate the transfer of property without going through probate, which can simplify the process for your beneficiaries and potentially reduce costs associated with your estate settlement.

You may not need a lawyer to create a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals, as many individuals complete these deeds on their own. However, consulting with a lawyer can be beneficial if your situation is complex or if you have specific questions about the legal implications. Ultimately, seeking professional advice can provide peace of mind.

While a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals offers benefits, it also has disadvantages. One significant concern is that it does not provide protection from creditors after your death. Additionally, if the beneficiary does not survive you, the deed may not serve its intended purpose, and your estate could face probate.

To file a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals, you need to complete a deed form specific to Arizona. After filling out the form, sign it in the presence of a notary public. Finally, record the deed with your local county recorder's office to ensure it is legally binding.

While you do not necessarily need a lawyer to create a beneficiary deed, having legal assistance can provide peace of mind. A lawyer can help ensure that the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals meets all legal requirements. Utilizing platforms like US Legal Forms can also simplify the process, but legal expertise can clarify specific concerns related to your individual situation.

One disadvantage of the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Two Individuals is that it may not protect assets from creditors. Additionally, if the named beneficiaries predecease the owner, the deed could become ineffective, leading to complications. Estate planning can become more complex, requiring careful consideration of state laws. It's advisable to review these concerns with a legal professional.