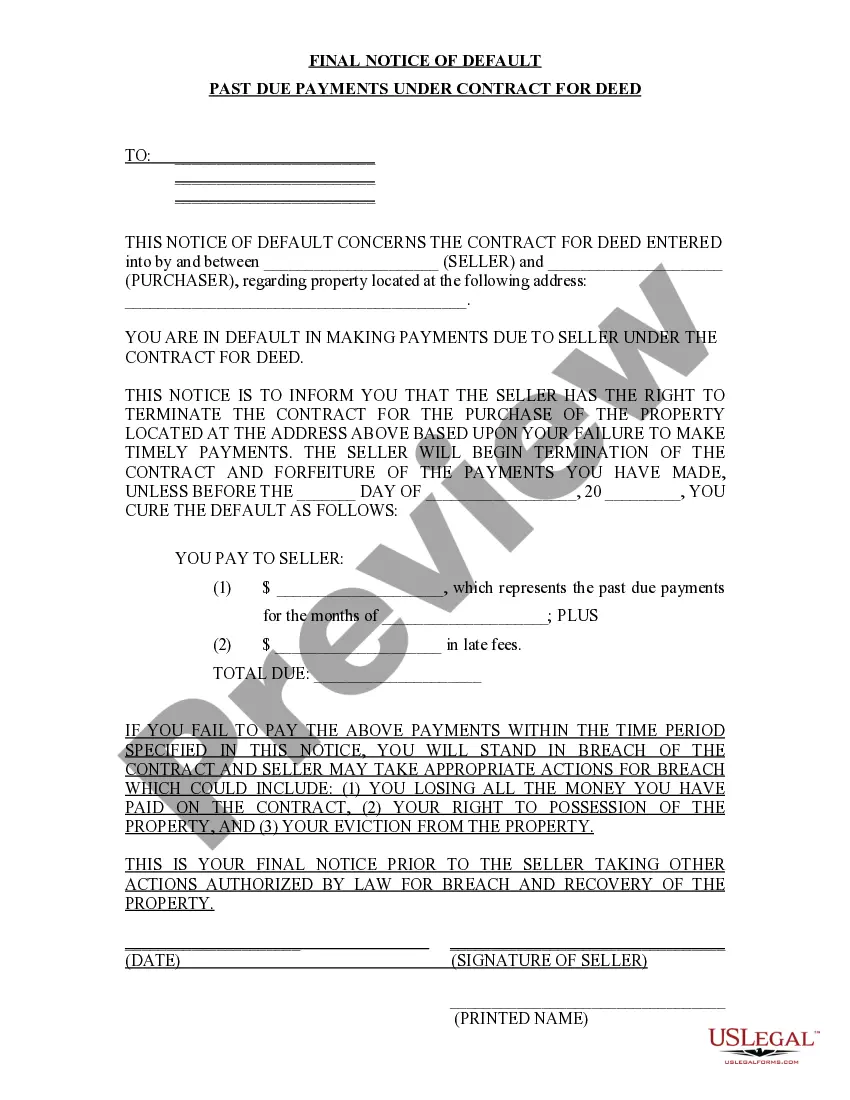

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

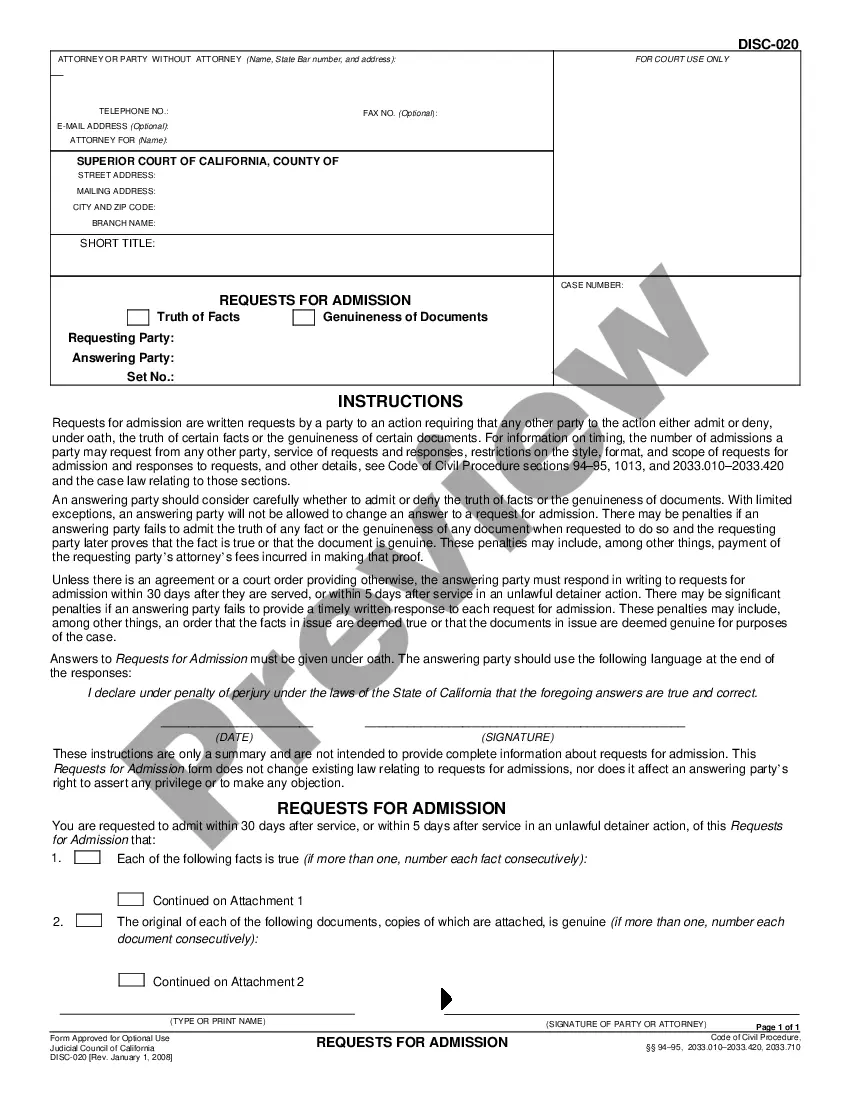

How to fill out Arizona Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our advantageous platform with thousands of document samples streamlines the process of locating and obtaining nearly any document template you require.

You can download, fill out, and endorse the Glendale Arizona Final Notice of Default for Overdue Payments related to Contract for Deed in just a few minutes rather than browsing the Internet for hours in search of a suitable template.

Using our repository is an excellent method to enhance the security of your document filing.

If you haven't created an account yet, follow the steps below.

Access the page containing the required form. Ensure that it is the template you intended to find: check its title and description, and use the Preview feature if available. Otherwise, utilize the Search bar to seek out the desired document.

- Our experienced legal experts routinely assess all records to confirm that the templates are pertinent to a specific area and adhere to new regulations and rules.

- How can you obtain the Glendale Arizona Final Notice of Default for Overdue Payments associated with Contract for Deed.

- If you possess an account, simply Log In to your profile.

- The Download option will show on all the templates you review.

- Additionally, you can access all your previously saved documents under the My documents section.

Form popularity

FAQ

Yes, Arizona operates as a tax lien state, allowing municipalities to place liens on properties for unpaid taxes. This means that property owners may receive a Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed when they have overdue taxes. Addressing these notices quickly can prevent further legal action. Platforms like USLegalForms offer valuable information on dealing with tax liens effectively.

In Arizona, the statute of limitations for foreclosing on tax liens generally spans three years. This may differ based on specific circumstances, but adhering to the timeline is crucial. If you receive a Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, understanding this timeline becomes essential for taking appropriate actions. Always consult legal resources to ensure compliance.

Settling a tax lien requires communication with the taxing authority. Begin by reviewing your tax payments and confirming your balance. It’s beneficial to address the Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed as it may help resolve any outstanding payments. Consider using the resources available on USLegalForms to guide you through the settlement process.

Foreclosing on a property lien involves several steps, starting with a review of the lien's details. Ensure you send a Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed to the property owner. If the owner does not respond or settle, you may proceed to file a foreclosure action in court. Resources like USLegalForms can provide the necessary forms and guidance for this process.

To foreclose on a tax lien property, first check if the property has overdue taxes. Then, you must follow the procedures mandated by Arizona law. This typically involves sending a Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed to notify the property owner. You may also want to consult with legal experts or platforms like USLegalForms for detailed guidance.

Yes, a contract for deed is legal in Arizona and is used for financing real estate transactions. This arrangement allows buyers to make payments directly to the seller while obtaining possession of the property. However, it is crucial to understand the terms of any Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed before entering into such an agreement to avoid potential legal complications.

You can check if back taxes are owed on a property by contacting your local tax assessor's office or searching their online databases. Many counties provide easy access to property tax records, which can indicate any outstanding payments. It’s essential to be aware of any back taxes, particularly when dealing with a Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, as this could impact your investment in the property.

To determine if liens exist on a specific property, you can conduct a title search through county recorder or assessor offices. These searches will reveal any existing liens, including mortgages or tax liens. Knowing about any liens is vital, especially if you receive a Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed, as this can affect your financial obligations and property rights.

To search for tax liens in Arizona, you can start by visiting local county assessor websites or the Arizona Department of Revenue's site. These resources often provide access to lien records. Additionally, a Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed may highlight any outstanding tax issues related to the property. Using these methods can streamline your search and help you stay informed.

In Arizona, if someone pays the property taxes on your behalf, they can potentially obtain rights to your property through a tax lien. This means they could later foreclose on the property if the taxes remain unpaid. Therefore, keeping up with your tax payments is essential to avoid receiving a Glendale Arizona Final Notice of Default for Past Due Payments in connection with Contract for Deed. Legal resources from US Legal Forms can offer information and forms to manage this situation effectively.