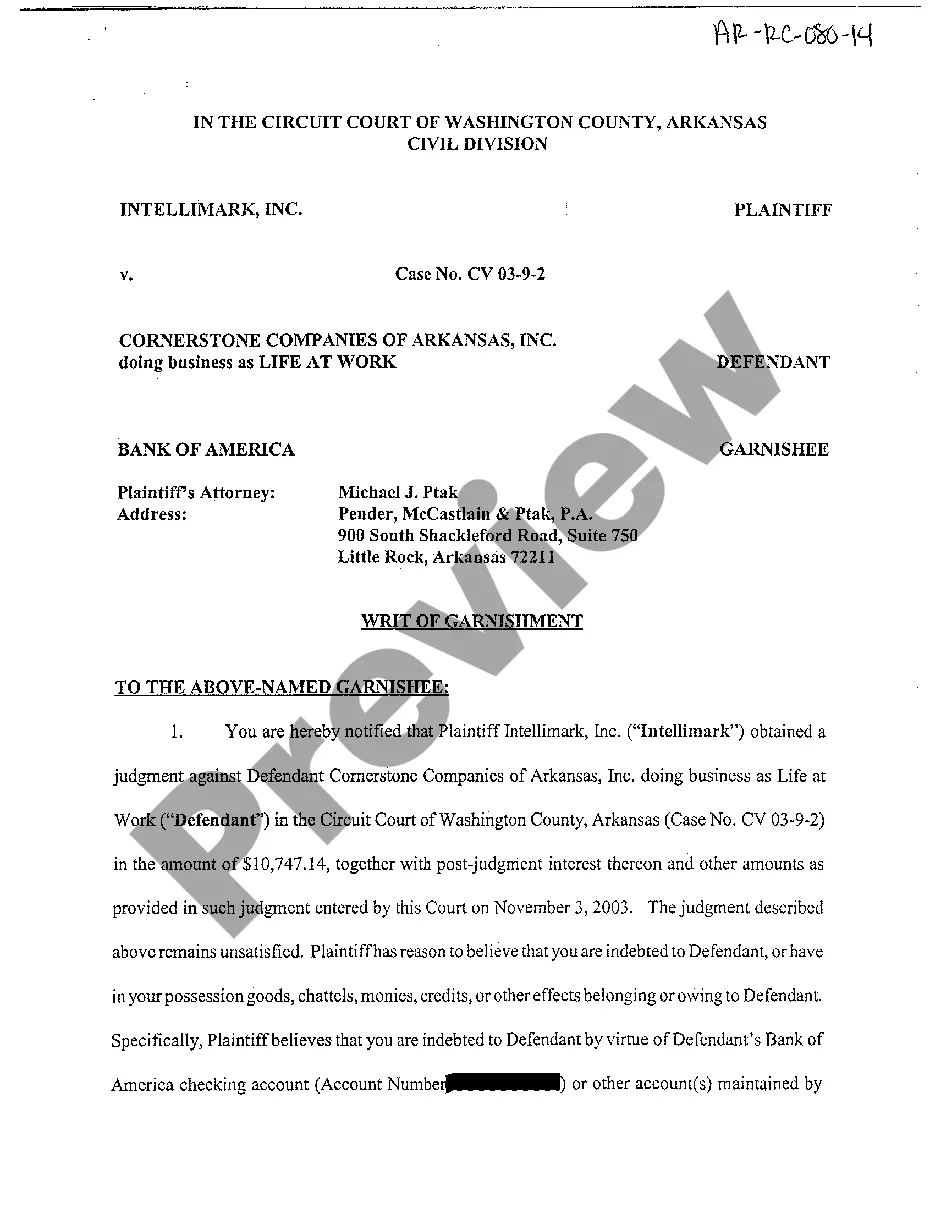

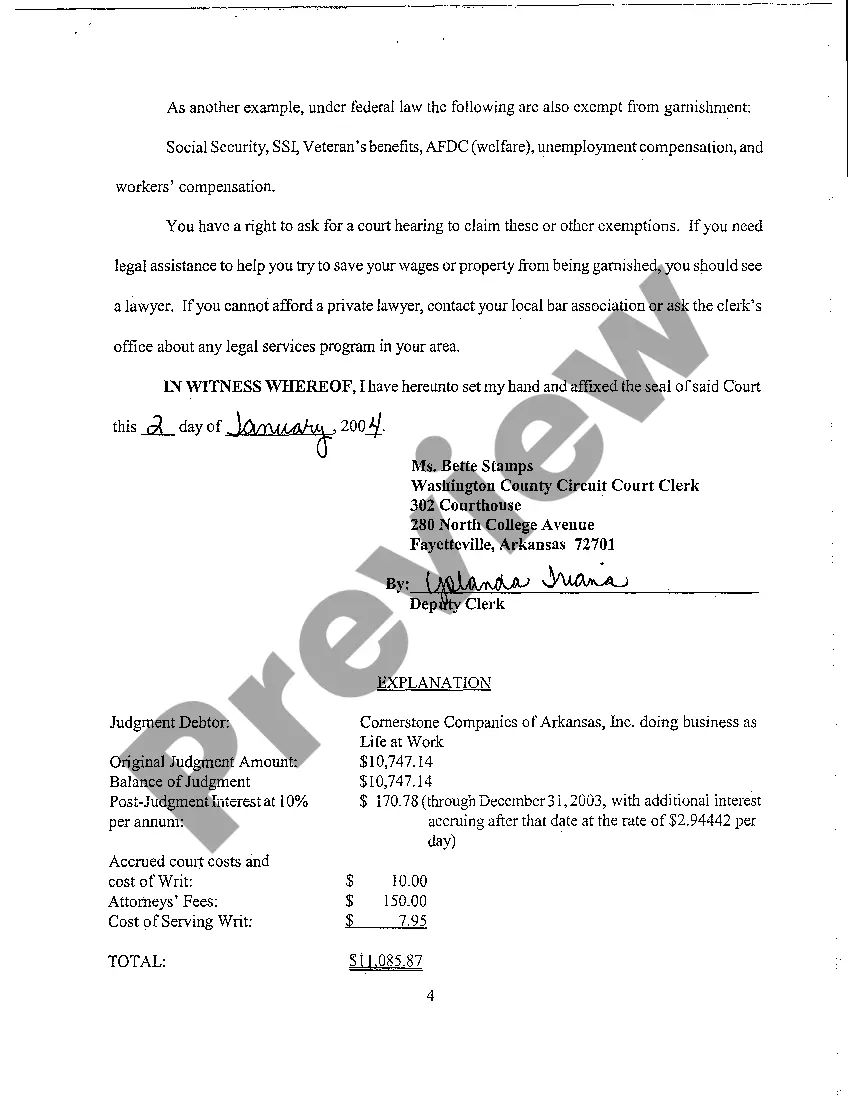

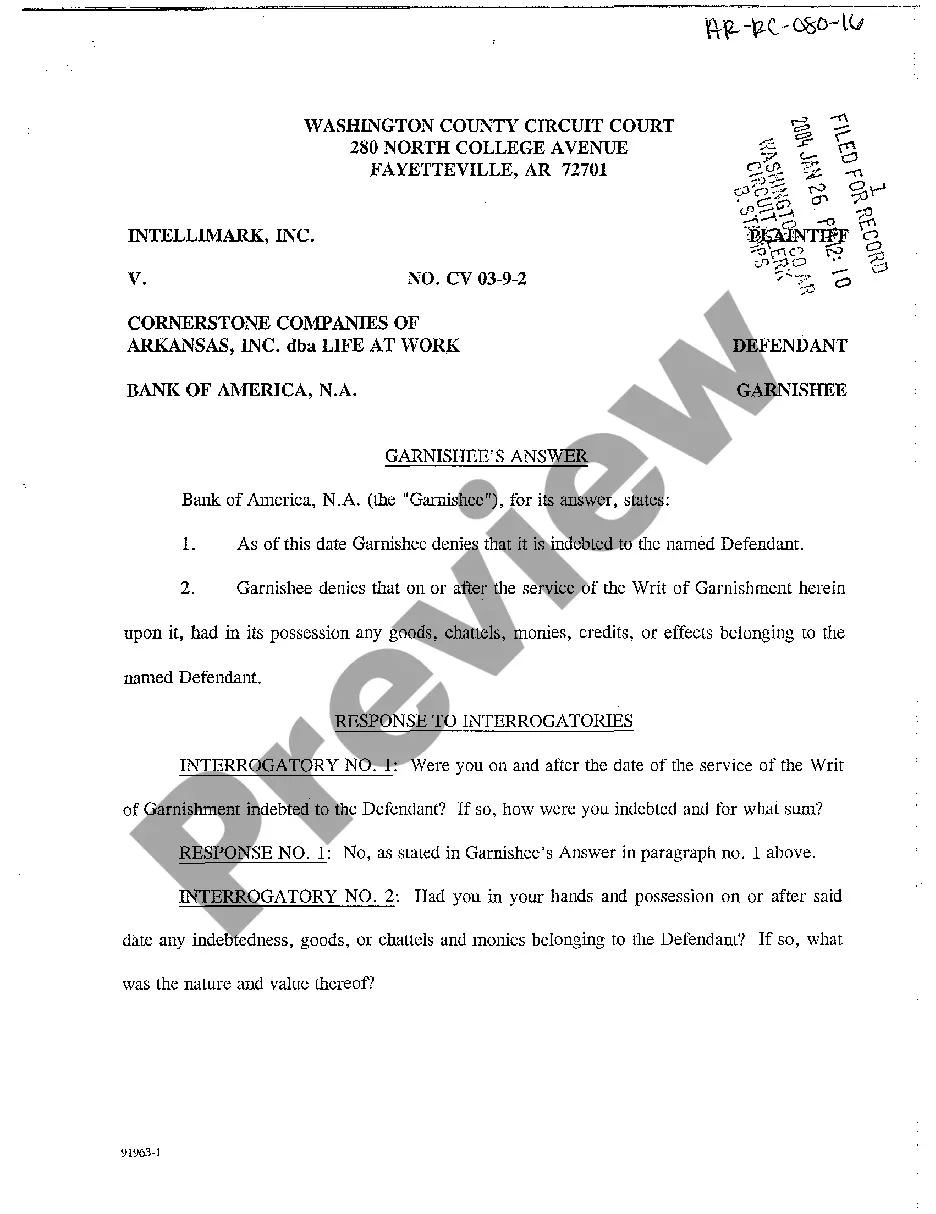

Little Rock Arkansas Writ of Garnishment

Description

How to fill out Arkansas Writ Of Garnishment?

We consistently endeavor to reduce or evade legal repercussions when engaging with intricate legal or financial issues.

To achieve this, we seek legal services that, typically, are exceptionally expensive.

Nevertheless, not every legal issue is as intricate. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal forms covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions. Our collection enables you to take control of your affairs without needing to consult legal advice.

Ensure to verify if the Little Rock Arkansas Writ of Garnishment complies with the laws and regulations of your state and locality.

- Utilize US Legal Forms whenever you require to obtain and download the Little Rock Arkansas Writ of Garnishment or any other document effortlessly and securely.

- Just sign in to your account and click the Get button next to it.

- If you misplace the document, you can always retrieve it again in the My documents section.

- The procedure is equally simple if you are new to the website!

Form popularity

FAQ

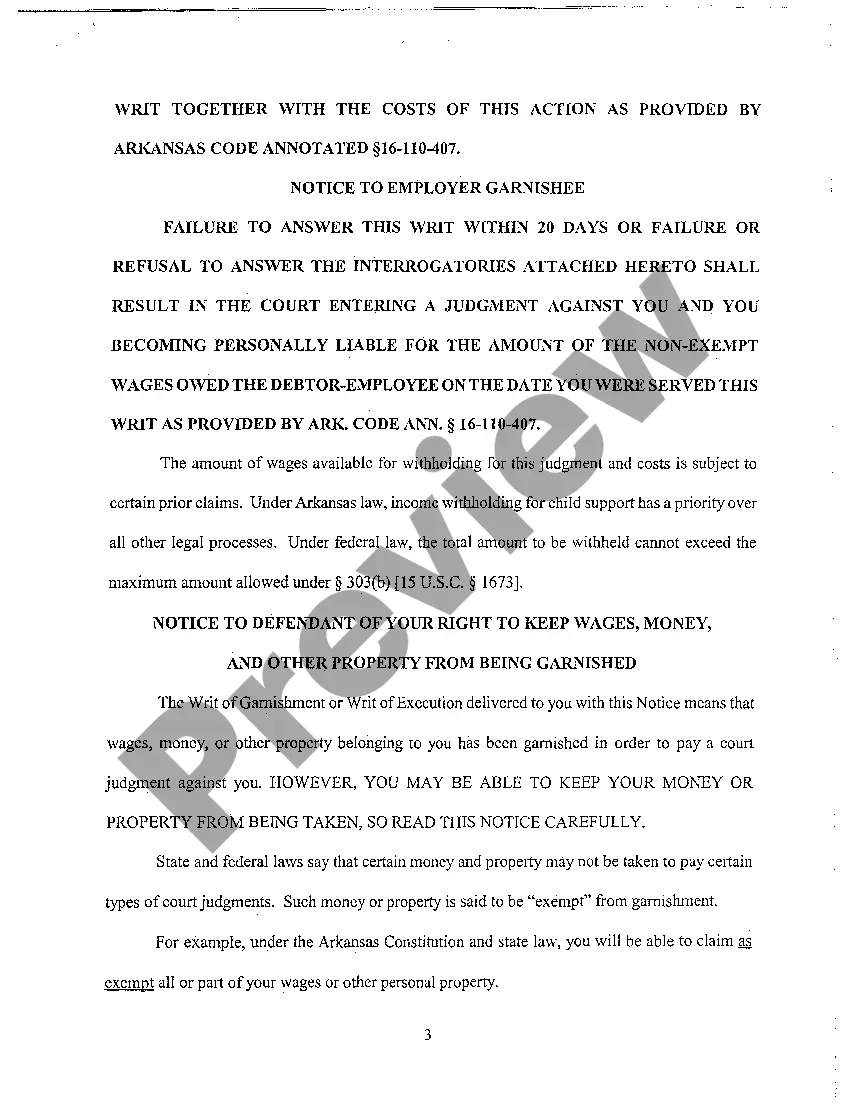

Yes, there are ways to navigate around wage garnishment in Arkansas. For example, you can negotiate a payment plan with the creditor or file for bankruptcy, which can halt garnishments temporarily. It's essential to understand your rights and obligations during this process. The USLegalForms platform offers comprehensive resources to help you understand your options and take the steps needed to protect your income effectively.

In Arkansas, wage garnishment is regulated by state law, which allows creditors to collect a portion of your paycheck under specific circumstances. Generally, 25% of your disposable income can be garnished unless your income falls below a certain threshold. Understanding these laws is critical, as they provide protections and limits. Exploring resources like USLegalForms can help clarify these legal aspects and ensure you remain informed.

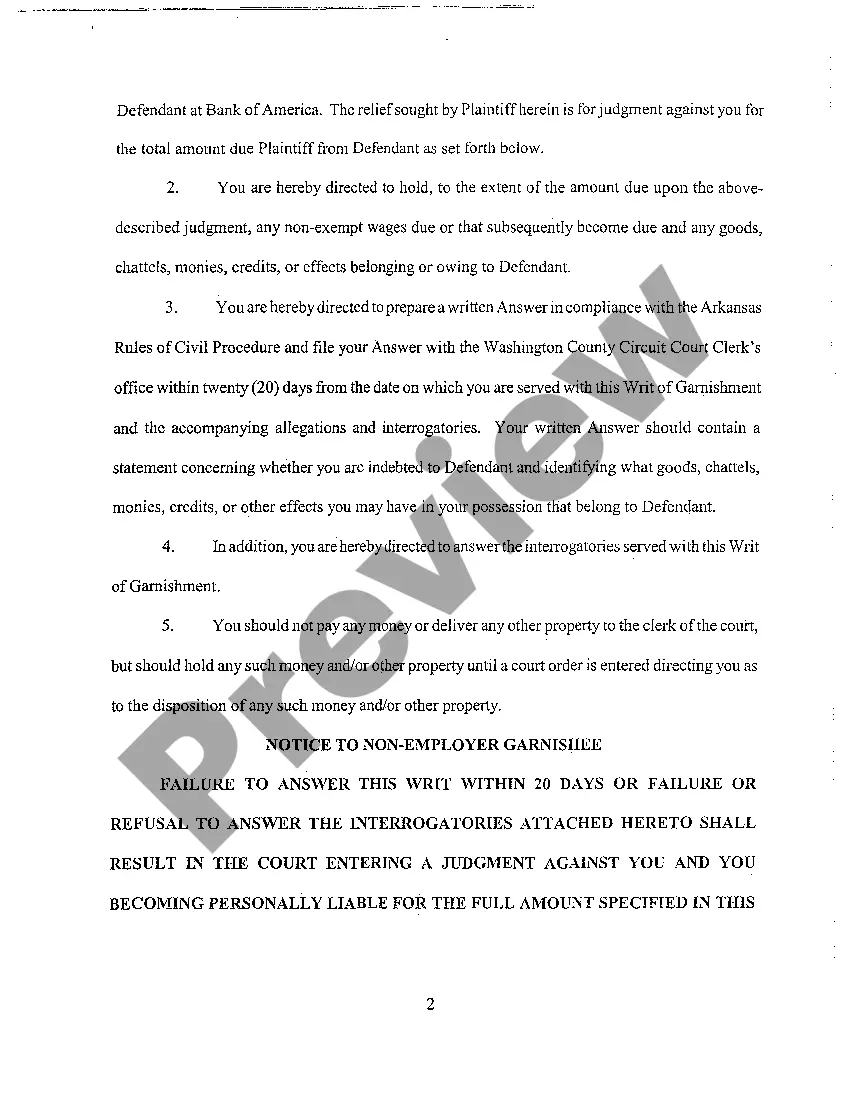

When you receive a writ of garnishment in Little Rock, Arkansas, it’s important to act quickly. Begin by reviewing the document to understand who issued it and why. You may want to consult with a legal professional to explore your options, such as responding with a motion to contest the garnishment. Additionally, platforms like USLegalForms offer resources and legal forms that guide you on the best ways to respond effectively.

To stop a writ of garnishment in Arkansas, you can file a motion with the court that issued the writ. First, gather your documents that support your claim, such as proof of payment or an argument for financial hardship. Then, present your case during a hearing where you can explain why the garnishment should be stopped. Using resources like USLegalForms can help provide the necessary forms and guidance through this process.

In Arkansas, attorneys generally cannot represent clients in Small Claims Court, which aims to simplify the process for individuals. However, you can consult an attorney for guidance before your hearing. If your case may lead to a Little Rock Arkansas Writ of Garnishment, having a lawyer's advice can be invaluable to ensure you understand your rights and obligations. It’s wise to equip yourself with as much knowledge as possible.

The maximum amount you can sue for in civil court in Arkansas is not capped universally but varies based on the nature of the claim. For instance, small claims court typically allows claims up to $5,000. If your situation involves a Little Rock Arkansas Writ of Garnishment, you may want to know how this affects your financial recovery options. Understanding these limits can guide your decisions significantly.

In Arkansas, the timeframe for filing a lawsuit generally depends on the type of case you are pursuing. Most civil claims must be filed within three years from the date of the incident. However, if your case involves a Little Rock Arkansas Writ of Garnishment, it's important to check specific deadlines because they can vary based on the underlying issue. Consulting with a legal expert can help clarify any concerns about timelines.

In Arkansas, the maximum amount that can be garnished from a paycheck is 25% of your disposable earnings, or the amount by which your weekly wages exceed 30 times the federal minimum wage, whichever is less. This provision protects consumers while allowing creditors to collect owed amounts. If you are facing a Little Rock Arkansas Writ of Garnishment, knowing these limits is beneficial.

In Arkansas, the statute of limitations for debt collection is typically three years for most contracts. This means that creditors have three years from the date of the last payment or acknowledgement of the debt to file a lawsuit. For those dealing with a Little Rock Arkansas Writ of Garnishment, understanding these time limits is important for effective debt recovery.

To file a lawsuit in Arkansas, you must start by drafting a complaint that outlines your claim and the relief you seek. After this, you file your complaint with the appropriate court and serve it to the defendant. If your claim involves a Little Rock Arkansas Writ of Garnishment, ensuring proper procedure is crucial to achieving a favorable outcome.