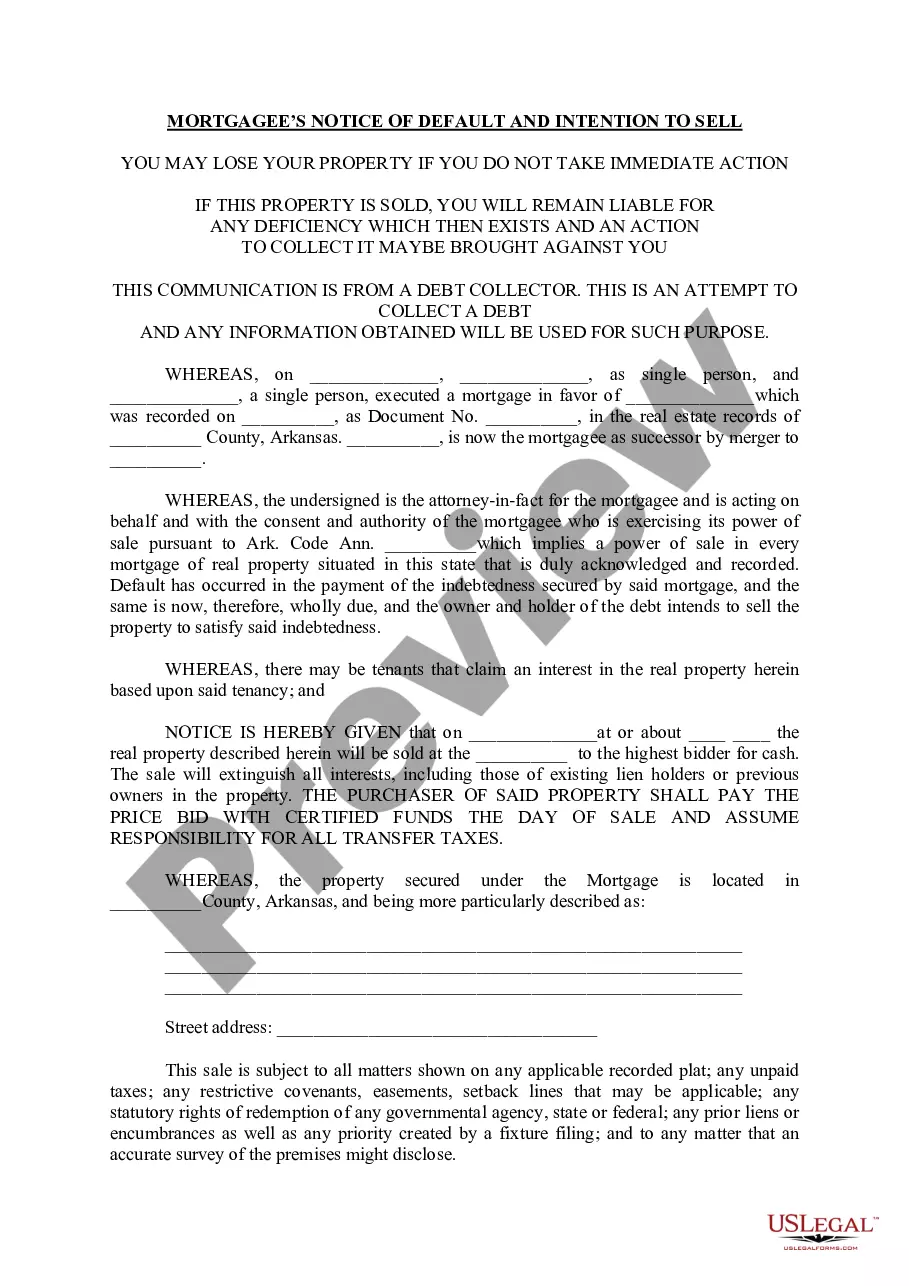

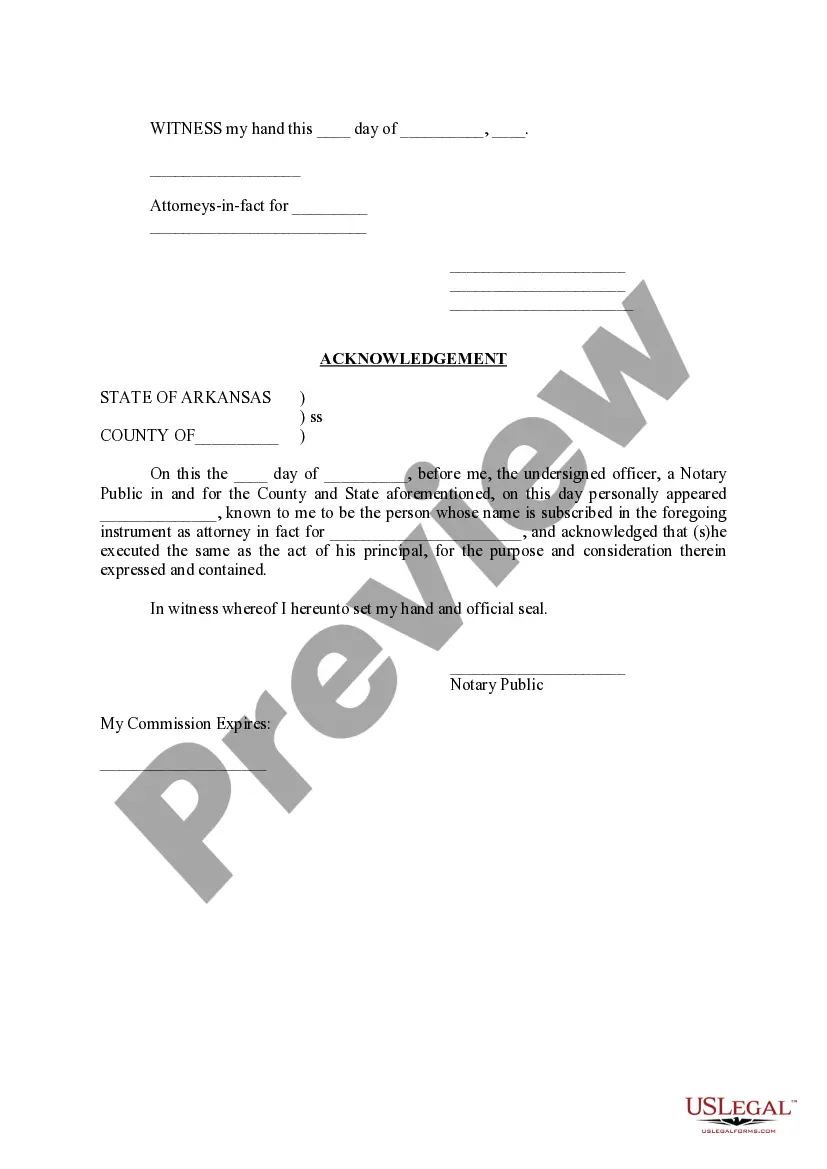

Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell is a legal document that is issued by the mortgagee (lender or creditor) in Arkansas when a borrower fails to make timely mortgage payments. This notice serves as a warning to the borrower that they are in default on their payments and that the mortgagee intends to sell the property to recover their outstanding debt. Keywords: Little Rock Arkansas, Mortgagee's Notice of Default, Intention to Sell, borrower, lender, creditor, mortgage payments, default, property, outstanding debt. There are two main types of Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell: 1. Preliminary Notice of Default: This notice is typically issued by the mortgagee as a formal notification to the borrower that they have failed to make the required mortgage payments within a specified timeframe. It includes details about the amount outstanding and the consequences of continued non-payment. The preliminary notice of default aims to give the borrower an opportunity to rectify the default and make arrangements to repay the overdue amount. 2. Notice of Intent to Sell: If the borrower fails to respond or resolve the default within the given time stated in the preliminary notice, the mortgagee proceeds to issue a Notice of Intent to Sell. This notice informs the borrower that the mortgagee intends to sell the property through a foreclosure sale or auction. It includes details such as the date, time, and location of the sale, as well as the outstanding debt and any additional costs associated with the foreclosure process. The Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell is a critical document in the foreclosure process. It establishes the mortgagee's legal right to sell the property and provides the borrower with final notice regarding the impending sale. If a borrower receives this notice, it is crucial to seek legal advice promptly to understand their options and potentially negotiate with the mortgagee to avoid foreclosure.

Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell

Description

How to fill out Little Rock Arkansas Mortgagee's Notice Of Default And Intention To Sell?

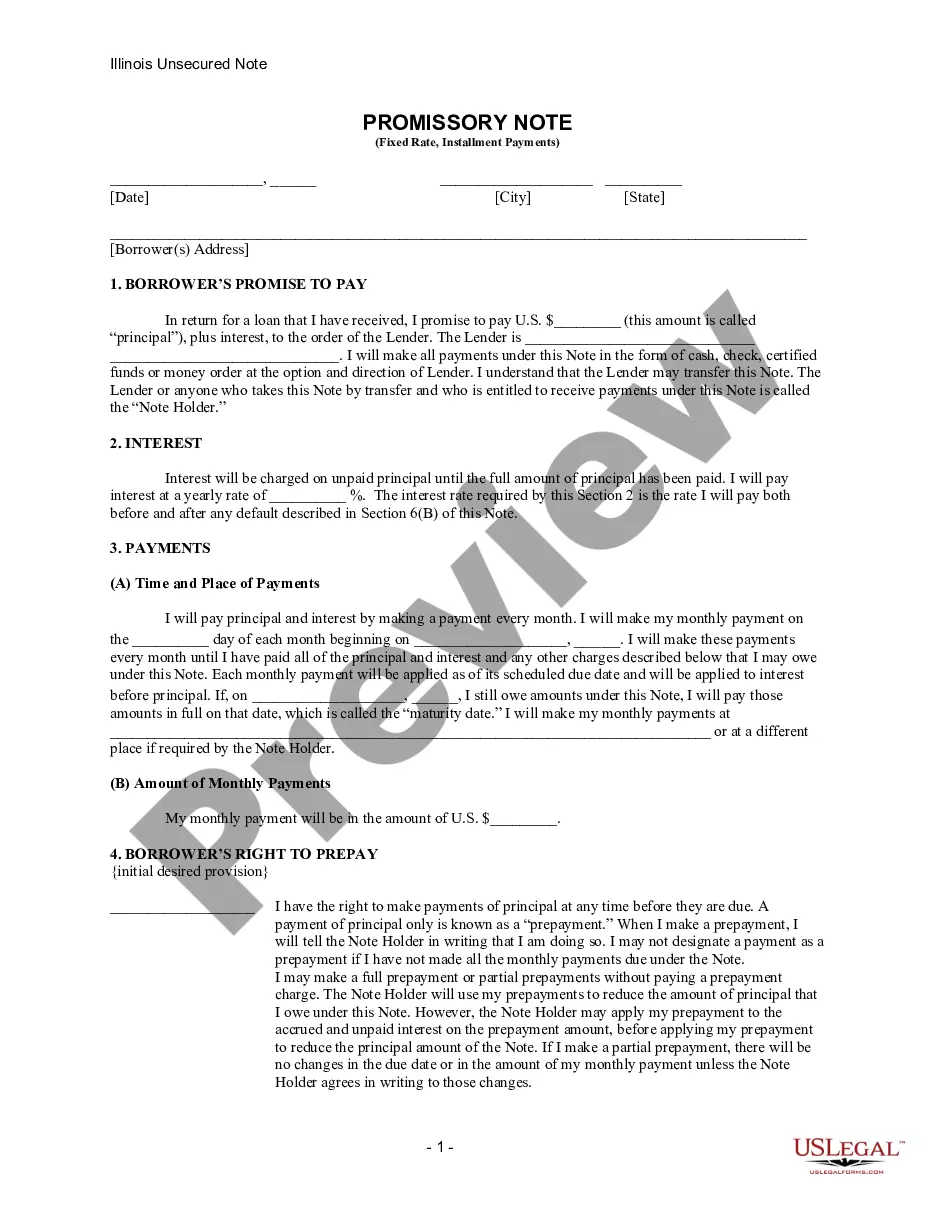

Regardless of one's social or professional standing, completing law-related documents is an unfortunate obligation in today’s work landscape. Far too frequently, it is nearly impossible for an individual lacking a legal background to create such documents from scratch, primarily due to the intricate terminology and legal subtleties they encompass.

This is where US Legal Forms can come to the rescue. Our platform boasts an extensive collection of over 85,000 state-specific forms that are ready for use, catering to nearly every legal situation. US Legal Forms also serves as an excellent resource for associates or legal advisors looking to enhance their efficiency with our DIY documents.

Whether you need the Little Rock Arkansas Mortgagee’s Notice of Default And Intention to Sell or any other document that is valid in your state or locality, with US Legal Forms, everything is readily available. Here’s how to obtain the Little Rock Arkansas Mortgagee’s Notice of Default And Intention to Sell in just minutes utilizing our dependable platform.

After registering or logging in with your credentials, choose the payment method and proceed to download the Little Rock Arkansas Mortgagee’s Notice of Default And Intention to Sell as soon as the transaction is completed.

You’re all set! Now you can either print the document or fill it out online. If you encounter any problems locating your purchased forms, you can easily find them in the My documents section. Regardless of the matter you are attempting to resolve, US Legal Forms has you covered. Give it a try today and see for yourself.

- If you are already a member, you can proceed to Log In to your account to access the appropriate form.

- However, if you are a newcomer to our platform, please make sure to follow these steps before downloading the Little Rock Arkansas Mortgagee’s Notice of Default And Intention to Sell.

- Ensure the form you selected is relevant to your area, as the regulations of one region do not apply to another.

- Examine the document and review a brief overview (if available) of situations where the paper can be utilized.

- If the form you have chosen does not suit your requirements, you can restart and search for the matching document.

- Click Buy now and select the subscription plan that fits you best.

Form popularity

FAQ

Arkansas follows a non-judicial foreclosure process, allowing lenders to expedite the foreclosure after a default. The Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell is crucial, as it serves as the formal notice to the borrower. Familiarizing yourself with these laws can empower homeowners to navigate challenging situations effectively.

In Arkansas, foreclosure can initiate after three consecutive missed payments. Once the lender files the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell, it may initiate a series of legal actions leading to foreclosure. Understanding these milestones can help homeowners stay proactive and informed regarding their mortgage standing.

In general, homeowners in Arkansas are considered delinquent after missing just one mortgage payment. It is crucial to be aware of this timeline because the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell can be triggered if payments are not made promptly. Taking timely action can prevent further complications in your mortgage journey.

The state with the longest foreclosure process in the U.S. is typically New Jersey. This process can take more than two years to complete, primarily due to the judicial nature of foreclosures there. Comparatively, understanding the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell is essential for homeowners in Arkansas, as it signifies the start of a different, often quicker process.

Yes, Arkansas does have a redemption period after foreclosure, lasting up to one year. During this period, you can redeem your property by settling the owed amount, making it an essential aspect of the process. Understanding the implications of the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell can help you navigate your options effectively. Engage with legal professionals to understand how to best utilize this period.

The redemption period in Arkansas is one year from the date of the foreclosure sale. During this time, homeowners can reclaim their property by paying the outstanding debt. This aspect plays a crucial role in understanding the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell, as it offers an opportunity to recover your home after foreclosure. Knowing your rights and options can make this challenging time more manageable.

In Arkansas, a 10-day pre-foreclosure notice highlights your mortgage default status. This notice serves to inform you about the impending actions the lender may take, including the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell. It is vital to take this notice seriously, as timely action could help you resolve the issue before it escalates into foreclosure. Consulting with experts can guide you through this stage.

A bank can initiate foreclosure in Arkansas as soon as the borrower defaults on their mortgage payments. However, they must follow specific procedures, which include sending the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell. Generally, if the situation progresses without intervention, the entire process can conclude in just a few months. It’s important to seek legal guidance early on to understand your rights.

The foreclosure process in Arkansas typically takes between three to six months. This duration depends on various factors including the lender's actions and the homeowner's response. During this time, you might receive a Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell, signaling the beginning of the foreclosure proceedings. It is crucial to act quickly to explore your options and avoid losing your home.

Foreclosing on a house in Arkansas can take several months, generally ranging from three to six months. This timeline may vary due to court schedules and any delays resulting from complications in the process. Once you receive the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell, it is crucial to act quickly to understand your options and seek assistance.

Interesting Questions

More info

In many jurisdictions, lenders have to close a loan if it is out of reach to the borrower. When a foreclosure has been commenced, the sheriff issues a writ of foreclosure to serve the lien upon the property and the lie nor is entitled to have possession of the property and recover the property value. If the mortgage and lien do not meet the requirements of Sec. 6.3-9.1, the lien may be transferred to the sheriff and executed as provided in Sec. 6.3-9.1 prior to the foreclosure proceeding. When the foreclosure procedure is complete, the lien will not be transferred to the creditor. The county auditor may not sell (receive for personal or company use without payment) any property which the county auditor believes to be covered by an expired lien of a type set forth in Sec. 6.3-9.1. The county auditor may not take possession of or enter into possession of any property unless and until the lien of the owner has been canceled, and payment has been made to the sheriff or creditor.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.