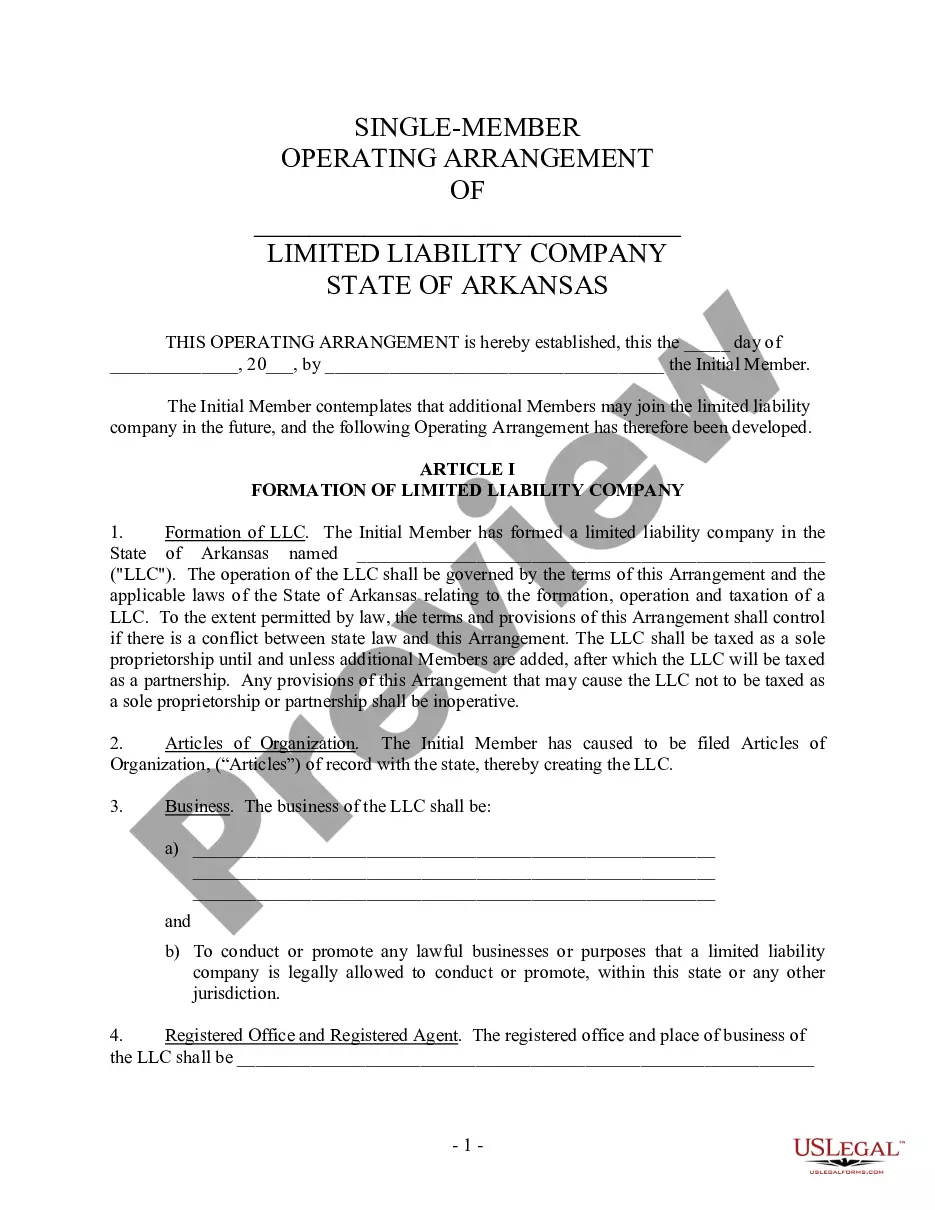

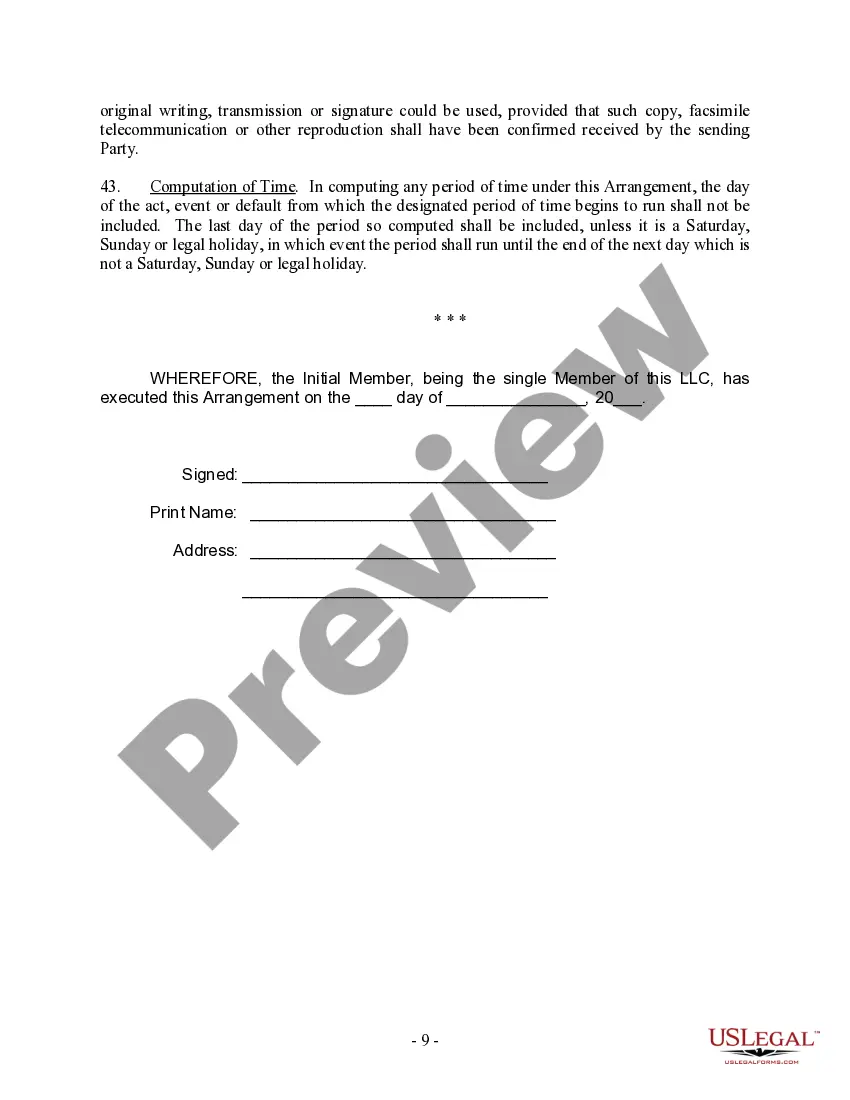

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Little Rock Arkansas Single Member Limited Liability Company LLC Operating Agreement

Description

How to fill out Arkansas Single Member Limited Liability Company LLC Operating Agreement?

Regardless of the social or professional rank, completing legal documents is an unfortunate requirement in the current professional landscape.

Frequently, it is nearly impossible for an individual lacking any legal background to create these types of documents from scratch, primarily due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms proves to be beneficial.

Verify that the template you have located is tailored to your region since the laws of one state or county do not apply to another state or county.

Review the document and peruse a brief overview (if available) of situations for which the paper can be utilized.

- Our platform offers an extensive library of over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to save time with our DIY forms.

- Regardless of whether you require the Little Rock Arkansas Single Member Limited Liability Company LLC Operating Agreement or any other document essential for your state or county, with US Legal Forms, everything is right at your fingertips.

- Here’s how to acquire the Little Rock Arkansas Single Member Limited Liability Company LLC Operating Agreement in minutes using our dependable platform.

- If you are currently an existing customer, feel free to Log In to your account to download the necessary form.

- However, if you are not acquainted with our platform, be sure to follow these steps before obtaining the Little Rock Arkansas Single Member Limited Liability Company LLC Operating Agreement.

Form popularity

FAQ

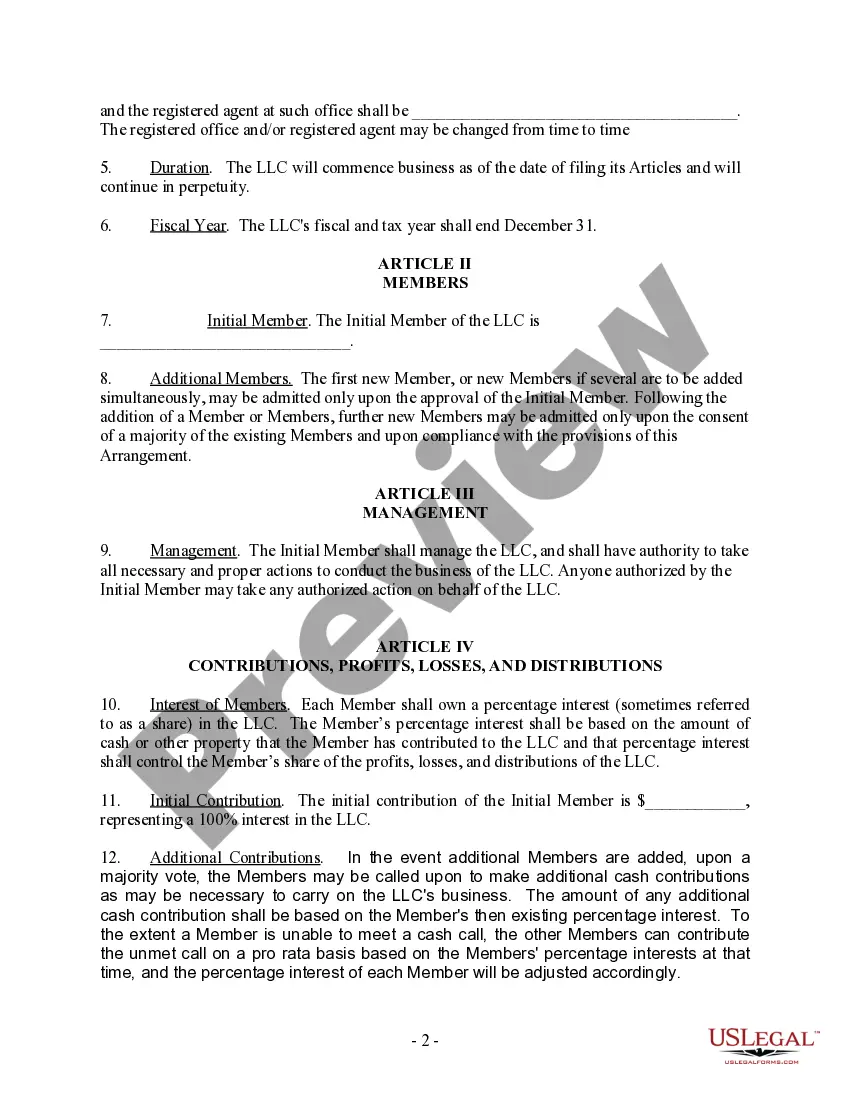

For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

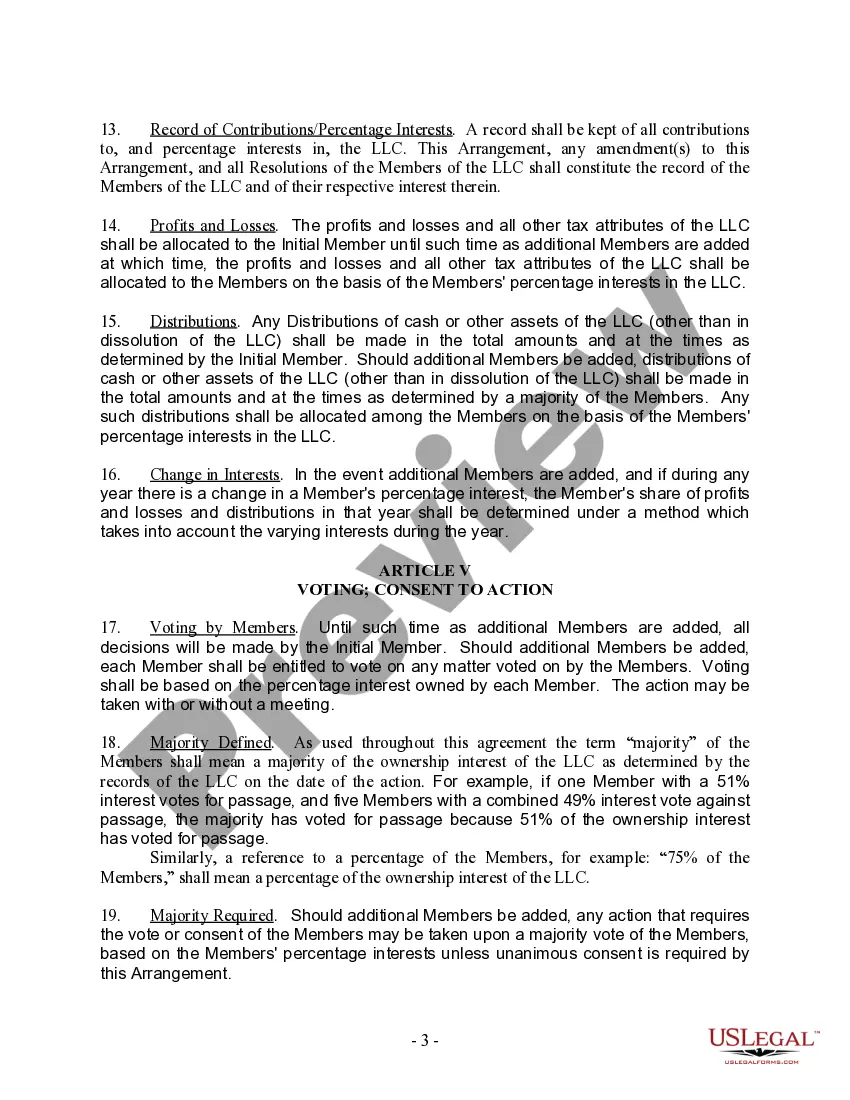

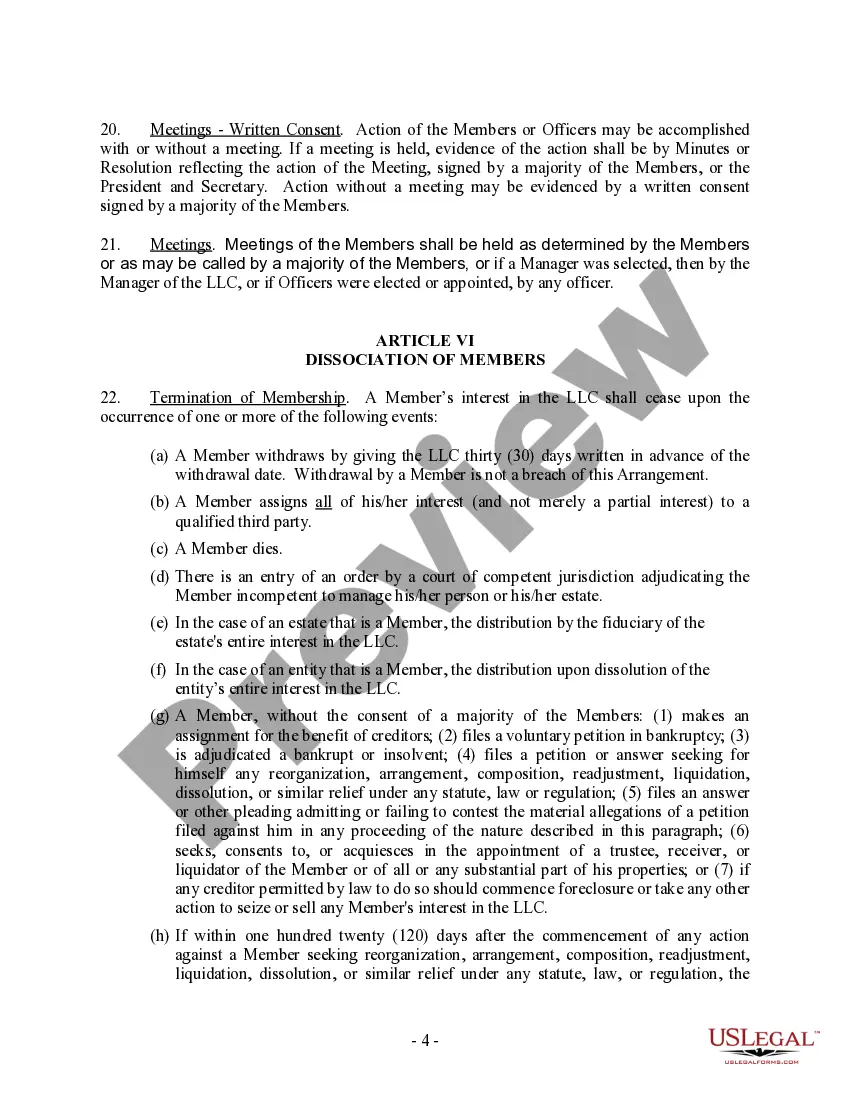

What should an LLC operating agreement include? Basic company information. Member and manager information. Additional provisions. Protect your LLC status. Customize the division of business profits. Prevent conflicts among owners. Customize your governing rules. Clarify the business's future.

Operating agreements are contract documents that are generally between five and twenty pages long.

An LLC operating agreement is not required in Arkansas, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

How to Write an Operating Agreement ? Step by Step Step One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

Updated July 29, 2022. An Arkansas LLC operating agreement outlines the internal day-to-day operations of a company and records each member's ownership interest. The agreement can include any rules the members agree upon such as management, capital contributions, and when distributions of the company are paid.

The LLC operating agreement, also known as an LLC agreement, establishes the rules and structure for the LLC and can help address any issues that arise during business operations. Most states have default provisions that address many of these difficulties, but the operating agreement can override these presumptions.

State Business Tax By default, LLCs themselves do not pay federal income taxes, only their members do. However, as mentioned above, Arkansas imposes an annual $150 franchise tax on LLCs for the privilege of doing business in the state.

Arkansas LLC Organizers: An Arkansas limited liability company can be formed by one (1) or more individuals. Arkansas LLC Members: Arkansas LLCs require 1 or more members.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.