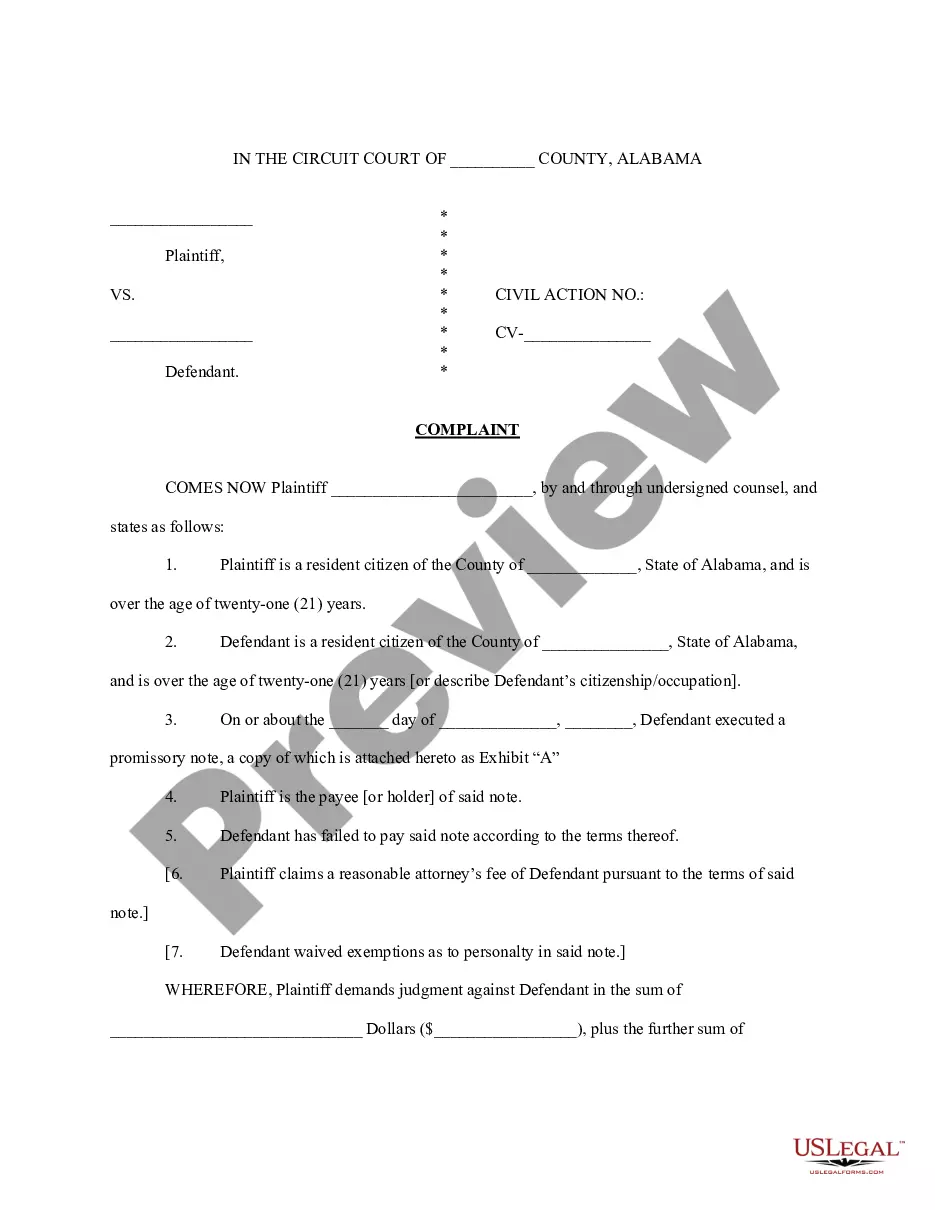

Alabama sample complaint filed in Circuit Court to Collect on a Promissory Notice.

Birmingham Alabama Complaint to Collect on a Promissory Note

Description

How to fill out Alabama Complaint To Collect On A Promissory Note?

Obtaining validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

This online resource contains over 85,000 legal forms for personal and professional requirements, covering a variety of real-world situations.

All documents are accurately grouped by usage area and jurisdiction, making it incredibly quick and straightforward to find the Birmingham Alabama Complaint to Collect on a Promissory Note.

Maintaining organized documentation that complies with legal standards is crucial. Utilize the US Legal Forms library to have key document templates readily available for any requirements!

- Examine the Preview mode and form description. Ensure you’ve chosen the correct one that fulfills your needs and precisely aligns with your local jurisdiction prerequisites.

- Look for another template, if necessary. If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it works for you, proceed to the next step.

- Acquire the document. Hit the Buy Now button and select your desired subscription plan. You will need to create an account for access to the library’s materials.

- Complete your purchase. Enter your credit card information or use your PayPal account to complete the subscription payment.

- Download the Birmingham Alabama Complaint to Collect on a Promissory Note. Save the template onto your device for completion and access it later in the My documents section of your profile whenever you need it again.

Form popularity

FAQ

A valid promissory note must include the principal amount, the interest rate (if applicable), the payment schedule, and the names of both the borrower and lender. The note should also specify what happens in case of default on payments. This information is essential when preparing a Birmingham Alabama Complaint to Collect on a Promissory Note, as it supports your claims in court.

Yes, a promissory note can go to collections if the borrower fails to fulfill their payment obligations. In Birmingham, Alabama, a lender may file a Birmingham Alabama Complaint to Collect on a Promissory Note to initiate the collection process. This legal action allows the lender to recover the amount owed through the court system. It's important to understand your rights and options when faced with this situation.

The statute of limitations on a promissory note in Alabama is also six years. This time frame must be adhered to if you plan to file a Birmingham Alabama Complaint to Collect on a Promissory Note. Waiting beyond this period may eliminate your chances of collection, making it essential to stay informed on these legal timelines. Knowledge of the statute can empower both lenders and borrowers in financial matters.

In Alabama, a debt generally becomes uncollectible after six years, which aligns with the statute of limitations for written contracts. This means if you wait too long to take action, you could lose the right to collect the debt. If you believe you have a valid claim, it's wise to act promptly and consider filing a Birmingham Alabama Complaint to Collect on a Promissory Note before the deadline expires. Timely action is crucial to securing your interests.

A promissory note in Alabama remains valid until it is settled or until the statute of limitations expires. Typically, this means it is enforceable for six years, similar to other written contracts. Therefore, if you find yourself needing to file a Birmingham Alabama Complaint to Collect on a Promissory Note, it's crucial to act before this period elapses. Keeping track of these timelines can help ensure you receive what you are owed.

In Alabama, the statute of limitations for a written contract is generally six years. This means that if you want to file a Birmingham Alabama Complaint to Collect on a Promissory Note, you must do so within this time frame. Failing to act within this period may prevent you from recovering what is owed. It is crucial to understand this timeline to protect your rights.

Once a default judgment is issued in Alabama, the creditor can take steps to collect the debt, such as garnishing wages or placing liens on property. The debtor will receive notice of this judgment, giving them limited time to respond. Having a Birmingham Alabama Complaint to Collect on a Promissory Note is essential, as it allows you to pursue these collection actions effectively and legally.

In Alabama, a promissory note does not need to be notarized to be legally binding. However, notarizing the document can add an extra layer of security and authenticity, especially in cases of disputes. When filing a Birmingham Alabama Complaint to Collect on a Promissory Note, having a properly executed note can greatly strengthen your position.

To enforce a judgment in Alabama, you can file an execution request with the court. This enables you to seize and sell the debtor's property to satisfy the debt. Additionally, obtaining a Birmingham Alabama Complaint to Collect on a Promissory Note can streamline this process and ensure your rights are protected.

Rule 34 in Alabama civil procedure allows parties in a lawsuit to request documents, electronically stored information, and tangible items from one another. This rule is vital when filing a Birmingham Alabama Complaint to Collect on a Promissory Note, as it enables you to obtain evidence that supports your case. Understanding this rule can help you gather the necessary information more effectively.