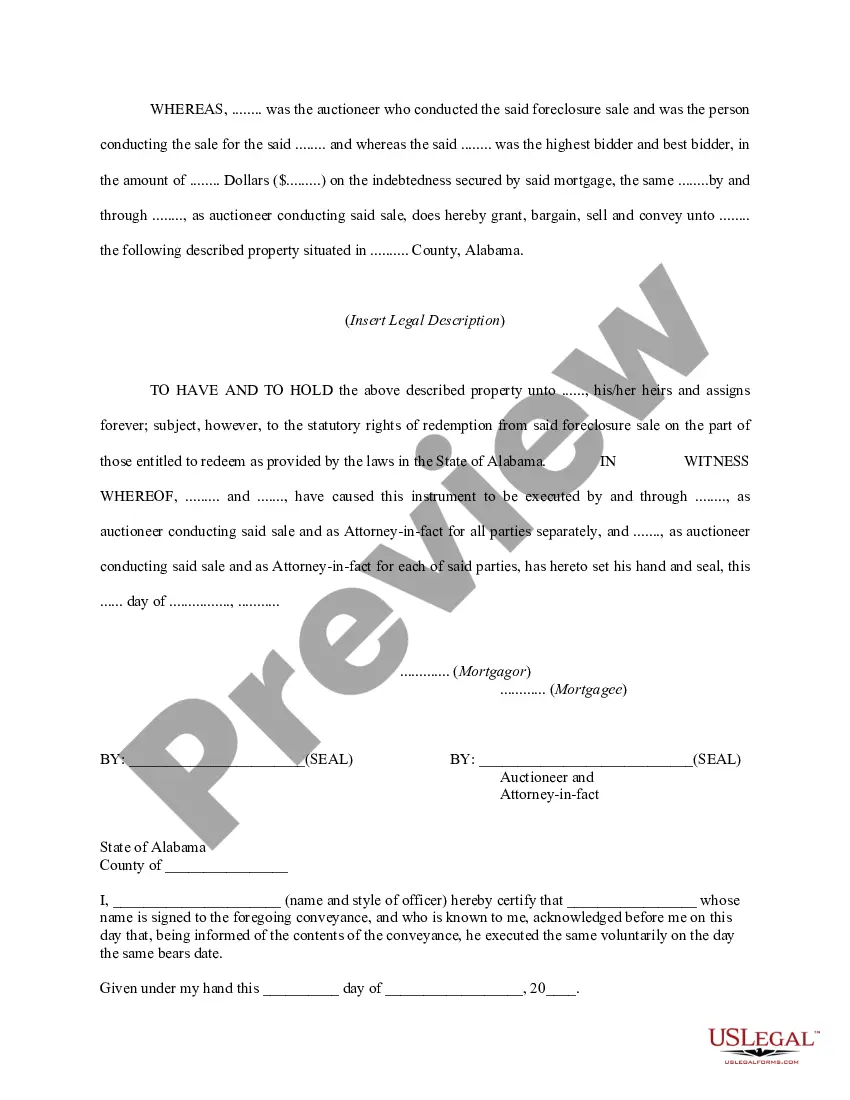

This is a sample notice filed by a mortgagee who successfully completed a foreclosure sale on a particular piece of real estate.

Huntsville Alabama Auctioneer's Deed for Foreclosure Sale

Description

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

Locating validated templates tailored to your local statutes can be difficult unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

All the papers are properly organized by usage area and jurisdictional domains, making the search for the Huntsville Alabama Auctioneer's Deed for Foreclosure Sale as swift and straightforward as 1-2-3.

Maintaining documentation tidy and compliant with legal standards holds substantial significance. Leverage the US Legal Forms library to consistently have crucial document templates for any requirements right at your fingertips!

- Ensure to preview the mode and document description.

- Confirm you’ve selected the correct one that fulfills your needs and fully aligns with your local jurisdiction standards.

- Seek an alternative template, if necessary.

- If you notice any discrepancies, utilize the 'Search tab' above to find the accurate one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

In Alabama, the homeowner, as well as any other party that has an interest in the property (think second mortgage, ex-wife, contractor with a lien on the property) may redeem the property for a period of either 180 days or one year, depending on when the foreclosed mortgage was executed.

The Right to Redeem After Foreclosure in Alabama Alabama law generally gives homeowners a one-year redemption period after a foreclosure sale.

If the foreclosure takes place outside of the court system and is not contested by the borrower then the foreclosure can take place in as little as 60 days from the time that the borrower is first notified about the lender's intent to foreclose on the property.

Foreclosed properties are real estate properties that have been taken over by the lender because the renter/owner of the property failed to make payments for a loan. Properties can also get foreclosed if a property owner failed to pay real property tax from the government.

The right of redemption allows the original owner to redeem the property by paying off back taxes and/or liens against the property within one year of the date of the foreclosure sale. The redemption period for homestead property is 180 days.

Alabama law generally gives homeowners a one-year redemption period after a foreclosure sale. But state law gives homeowners a 180-day redemption period after the foreclosure sale for homestead properties?if proper notice about the right to redeem was given and the mortgage was taken out on or after January 1, 2016.

The right of redemption allows the original owner to redeem the property by paying off back taxes and/or liens against the property within one year of the date of the foreclosure sale. The redemption period for homestead property is 180 days.

The title to the land sold under mortgage foreclosure remains in the mortgagor until the expiration of the redemption period and conveyance by a master deed.

Once the loan is delinquent for 120 days, the lender can start the foreclosure using the process allowed by state foreclosure laws. In Alabama, a lender can choose between judicial or non-judicial foreclosure. Under judicial foreclosure, the mortgage lender files a lawsuit in the borrower in the local state court.

Alabama is a non-judicial foreclosure state, which means that a mortgage holder doesn't have to take the homeowner to court to reclaim the home if the mortgage falls behind. There are still steps the mortgage holder has to take to foreclose on the home.