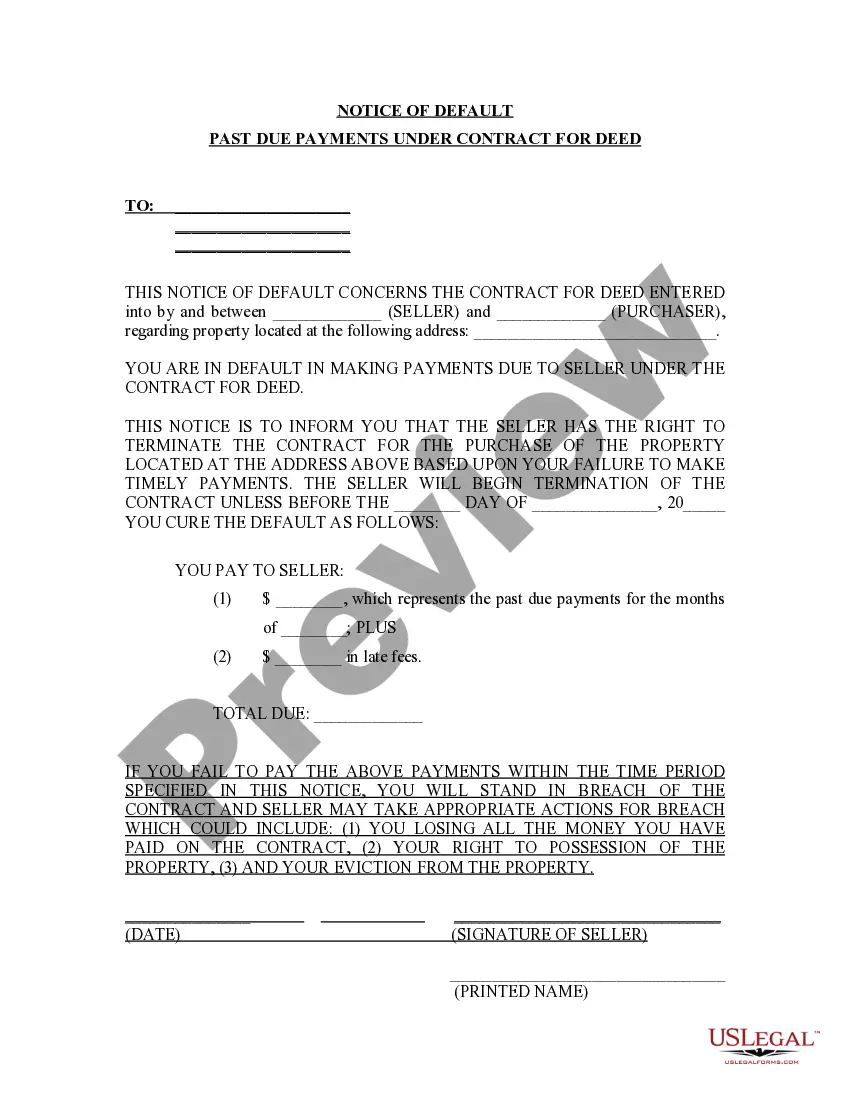

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Birmingham Alabama Notice of Default for Past Due Payments in connection with Contract for Deed

Description

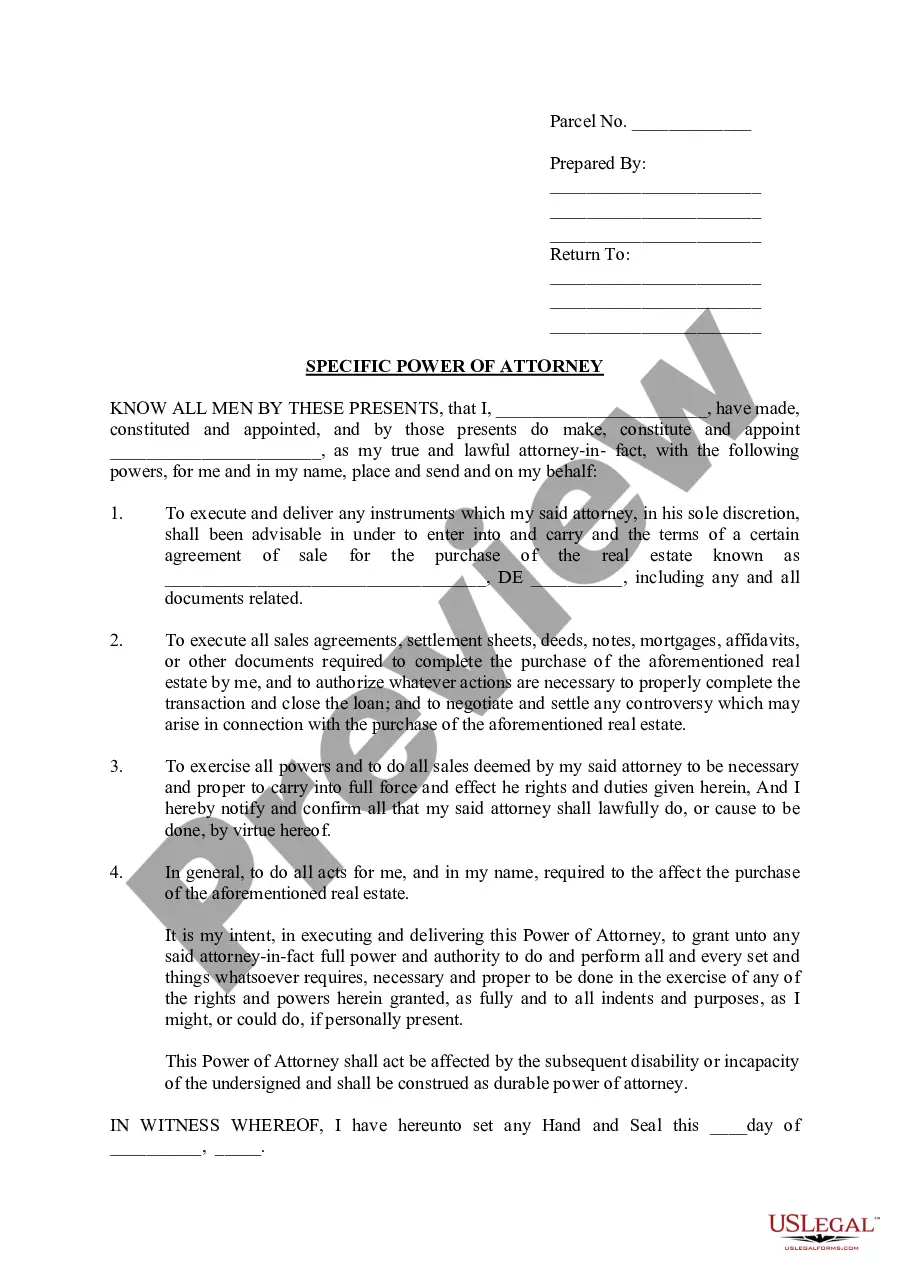

How to fill out Alabama Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize the US Legal Forms and gain prompt access to any form example you need.

Our helpful website featuring thousands of templates enables you to locate and acquire nearly any document example you need.

You can store, complete, and authenticate the Birmingham Alabama Notice of Default for Past Due Payments related to Contract for Deed in just a few minutes instead of scouring the internet for hours seeking the appropriate template.

Leveraging our catalog is an effective method to enhance the security of your record filing.

If you haven’t created an account yet, follow the instructions outlined below.

Access the page with the template you require. Verify that it is the form you were seeking: confirm its title and description, and use the Preview option if available. If not, use the Search feature to locate the necessary one.

- Our skilled attorneys routinely review all documents to ensure that the forms are pertinent for a specific area and compliant with updated regulations and policies.

- How can you procure the Birmingham Alabama Notice of Default for Past Due Payments linked to Contract for Deed.

- If you already possess an account, simply Log In to your profile.

- The Download option will be visible on all the examples you examine.

- Additionally, you can access all the previously saved files in the My documents section.

Form popularity

FAQ

In Alabama, property owners usually have three years to redeem a tax lien after it has been sold. However, the timeline may vary based on specific circumstances and the type of property involved. Staying informed about the Birmingham Alabama Notice of Default for Past Due Payments in connection with Contract for Deed is essential during this period. For clarity on redemptions and filings, you can utilize the resources available through uslegalforms.

The deadline to file Alabama state taxes typically aligns with the federal tax deadline, which is usually April 15th. However, extensions can be filed, allowing additional time to submit payment. Keep in mind that any outstanding payments could lead to a Birmingham Alabama Notice of Default for Past Due Payments in connection with Contract for Deed. It’s advisable to check with uslegalforms for assistance in meeting all tax obligations timely.

In Alabama, property tax does not automatically end at the age of 65, but seniors may qualify for exemptions. These exemptions can reduce the amount of property tax owed. Conversely, it is essential to stay informed about the Birmingham Alabama Notice of Default for Past Due Payments in connection with Contract for Deed to avoid complications. Utilizing resources from uslegalforms can simplify this process for seniors navigating property taxation.

Alabama operates as a tax lien state, which means that unpaid property taxes can lead to the sale of a tax lien certificate. These certificates allow the purchaser to collect interest from the property owner. In addition, understanding the Birmingham Alabama Notice of Default for Past Due Payments in connection with Contract for Deed is vital for homeowners. It helps you navigate potential tax issues on your property effectively.

Yes, Alabama conducts tax deed auctions where tax-delinquent properties are sold to the highest bidder. These auctions typically occur through local counties, and it’s important to understand the rules before participating. The Birmingham Alabama Notice of Default for Past Due Payments in connection with Contract for Deed may be relevant to potential buyers, as it could influence the property’s status.

To take ownership of abandoned property in Alabama, you typically need to demonstrate continuous and open possession. This often involves maintaining the property and paying any applicable taxes. Keep in mind that the Birmingham Alabama Notice of Default for Past Due Payments in connection with Contract for Deed can impact your ability to claim ownership, making it essential to know the legal process involved.