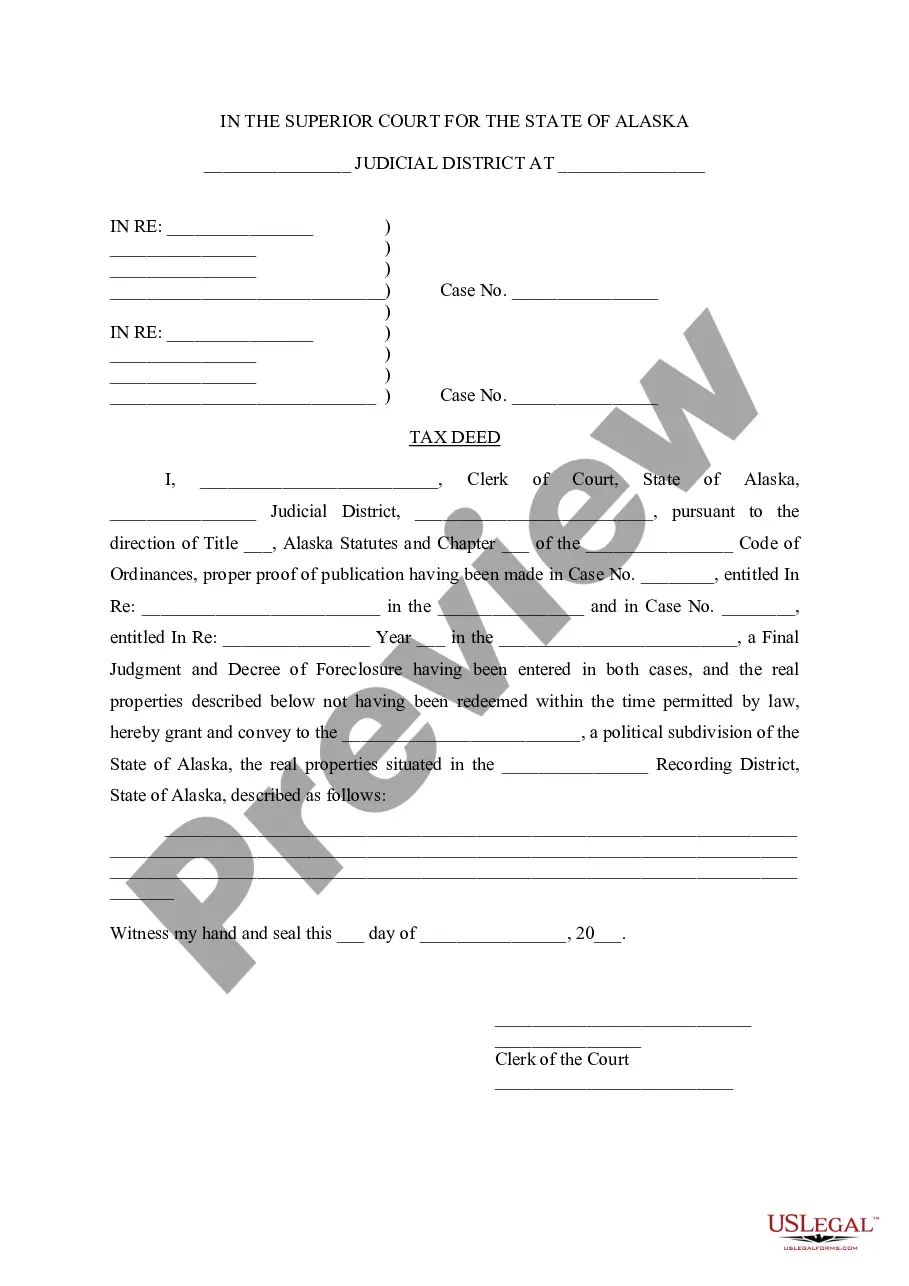

Anchorage Alaska Tax Deed

Description

How to fill out Alaska Tax Deed?

Do you require a dependable and cost-effective provider of legal forms to acquire the Anchorage Alaska Tax Deed? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish rules for living with your partner or a collection of documents to finalize your separation or divorce in court, we have you covered. Our platform presents over 85,000 current legal document templates for personal and business needs. All templates that we provide are tailored and crafted based on the specifications of particular states and regions.

To obtain the form, you must Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can download your previously acquired form templates at any moment in the My documents section.

Is this your first visit to our website? No problem. You can create an account with great ease, but prior to that, ensure to do the following.

Now, you can register your account. Then select the subscription plan and proceed to payment. Once your payment is processed, download the Anchorage Alaska Tax Deed in any available file format. You can revisit the website whenever you need to and redownload the form at no additional charge.

Locating current legal documents has never been simpler. Try US Legal Forms today and eliminate the need to spend hours researching legal paperwork online.

- Verify that the Anchorage Alaska Tax Deed complies with the laws of your state and local jurisdiction.

- Review the form's description (if available) to understand who it's for and its intended use.

- Restart your search if the template does not suit your legal circumstances.

Form popularity

FAQ

Property tax in Alaska is based on the value of the property you own. Local governments assess properties to determine their market value, which is then multiplied by the local tax rate to calculate your tax bill. Understanding this process is essential for anyone interested in Anchorage Alaska Tax Deed properties, as unpaid taxes can lead to the sale of the property at tax deed auctions. For detailed information and forms related to property taxes, consider using the US Legal Forms platform.

The property tax rate in Anchorage varies based on property classification, but it generally hovers around 1.2% of assessed value. This means that understanding your property's classification is crucial for accurate tax assessments. If you're thinking about investing in an Anchorage Alaska Tax Deed, being aware of these rates can help you make informed decisions and plan wisely for future expenses. Aim to educate yourself on the financial implications.

In Alaska, property owners can apply for an exemption program that allows senior citizens aged 65 and older to reduce or eliminate property taxes. This offers significant relief for eligible residents. It's important to stay informed about local regulations related to the Anchorage Alaska Tax Deed, as they can provide additional benefits to seasoned property owners. You should definitely explore these options.

If you are looking for a copy of your house deed, start by contacting your local recorder's office where the property is located. They can guide you on the necessary steps and any fees associated with getting a copy. Moreover, the Anchorage Alaska Tax Deed process can help clarify details related to your property's history, ensuring that you have the correct documentation for your records.

To obtain a copy of a deed in Alaska, visit the local recorder's office or search through their official website if they offer online services. You'll need to know specific details such as the property's location or the names of the parties involved. Remember, the Anchorage Alaska Tax Deed data can offer additional context about property ownership and any liens that might exist.

To identify the owner of a property in Alaska, start by accessing the local property records held by the borough or city of that area. Many jurisdictions provide online databases or offices where you can search using the property address or tax parcel number. Furthermore, utilizing the Anchorage Alaska Tax Deed process allows you to examine ownership details and get insights into property history.

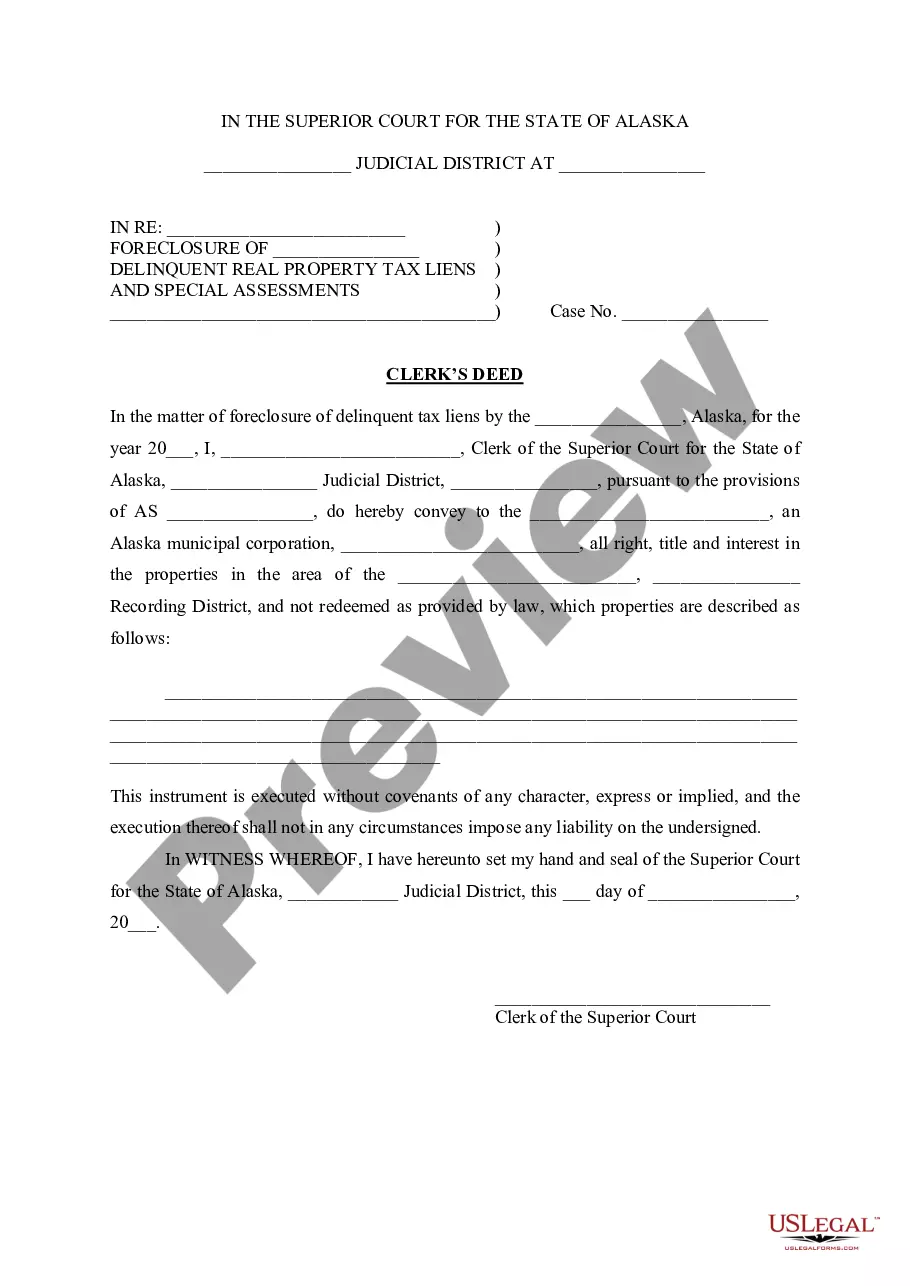

Alaska is a tax deed state, meaning that unpaid property taxes result in property sales through tax deeds. When property taxes remain unpaid, the state can auction the property to recover owed amounts. For those interested in acquiring properties, knowing that Alaska operates through tax deeds is essential for your real estate strategies.

The best tax deed state often depends on individual investment goals, but many investors find states with low competition and good property values favorable. Arizona and Florida are popular for their auction processes and potential returns. If you're considering Anchorage Alaska Tax Deed, research local trends to make informed decisions.

The property tax rate in Anchorage, Alaska, generally hovers around 1.32% of the assessed value. However, this rate can vary slightly depending on local regulations and property classifications. Knowing the property tax landscape is crucial for investors considering Anchorage Alaska Tax Deed.

A tax deed state allows the sale of property to recover unpaid taxes, while a tax lien state places a lien on the property for the owed tax amount. In tax deed states, ownership transfers directly to the buyer at auction. Understanding these distinctions is essential for anyone exploring opportunities with Anchorage Alaska Tax Deed.