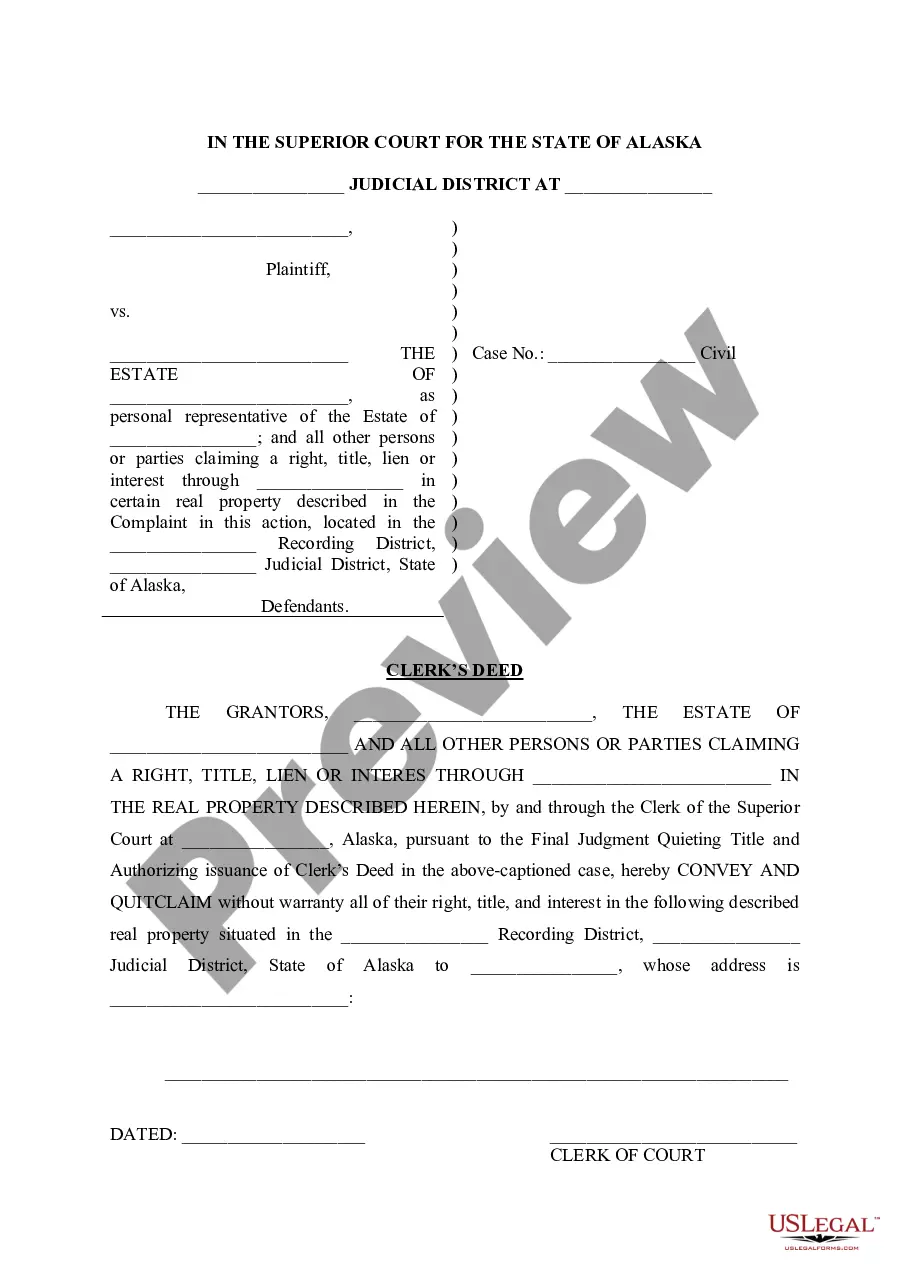

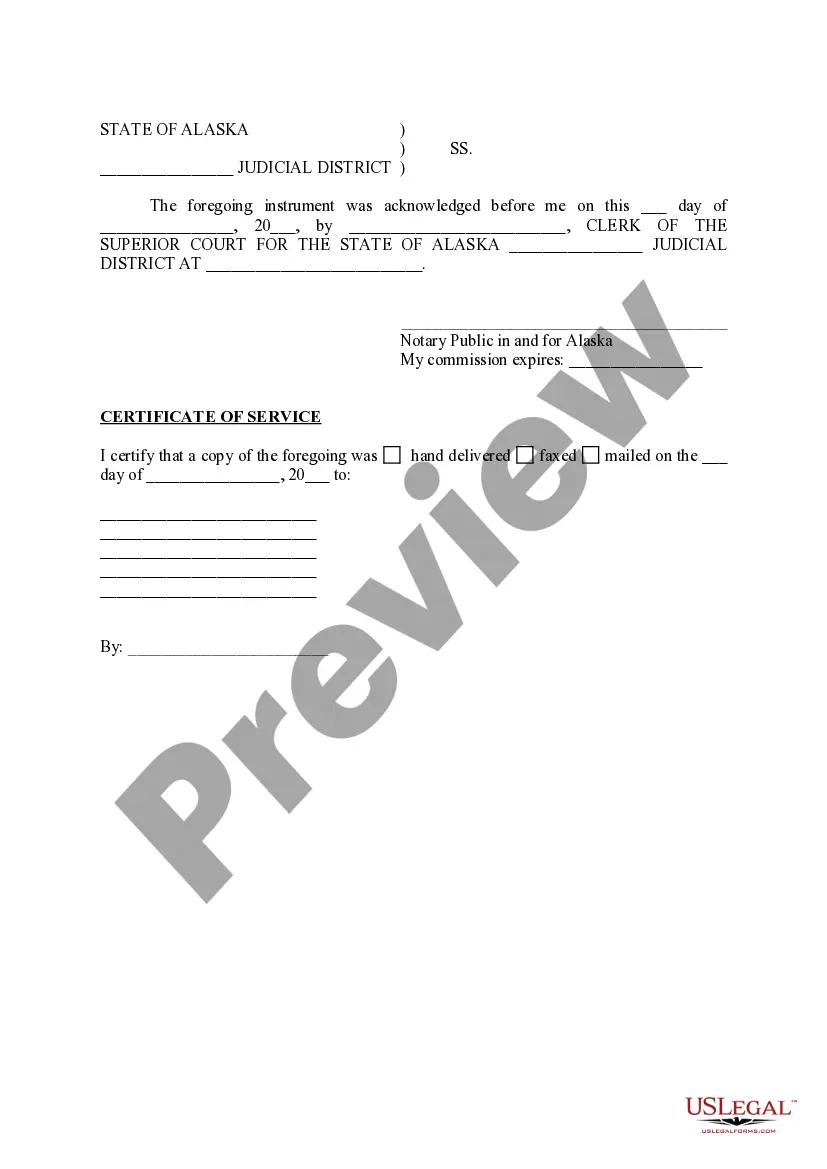

Anchorage Alaska Clerk's Deed for the Representative of an Estate

Description

How to fill out Anchorage Alaska Clerk's Deed For The Representative Of An Estate?

Acquiring verified templates suited to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It’s an online repository of over 85,000 legal documents for both personal and business purposes, addressing various real-life scenarios.

All the paperwork is methodically categorized by usage area and jurisdiction, simplifying the process of finding the Anchorage Alaska Clerk's Deed for the Representative of an Estate.

Maintaining organized paperwork in accordance with legal requirements is crucial. Utilize the US Legal Forms library to have vital document templates readily available for any requirements!

- Review the Preview mode and form description.

- Ensure that you’ve selected the correct version that fulfills your needs and aligns with your local jurisdiction criteria.

- Look for an alternative template, if required.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it’s satisfactory, proceed to the subsequent step.

- Purchase the document.

Form popularity

FAQ

Yes. If you have not yet recorded the deed and want to change your mind, simply tear up or otherwise destroy the deed.

In Alaska, spouses can agree in writing to hold property as community property with the right of survivorship. As with tenancy by the entirety, if you and your spouse own real estate as CPWROS, then the property will go to the TOD deed beneficiary after both of you have died.

Once the Grant has been received the personal representative has a duty to collect in the assets of the deceased, pay the liabilities and distribute the estate to the beneficiaries. They have many powers to assist them when dealing with an estate e.g. power to sell property, insure property and invest monies, etc.

Alaska has two ways of avoiding probate. One is an affidavit procedure that allows heirs to completely skip probate when the value of the estate is $50,000 or less after liens, encumbrances, and the value of vehicles that are $100,000 or less have been subtracted.

Read more in the Personal Representative section about the tax forms. Within 9 months from date of death. File any Disclaimers with the probate court. Within 9 months from date of death.

In Alaska, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

When is a probate required? A probate is required when a person dies and owns property that does not automatically pass to someone else, or the estate doesn't qualify to use the Affidavit for Collection of Personal Property procedure.

Like the compensation laws in many other states, Alaska's executor compensation laws stipulate that an executor must be paid fairly for services provided. Many people think $25-$35/hour is reasonable, but a personal representative can also suggest different forms of payment in Alaska.

Recording ? A quitclaim deed must be filed in the Recorder's District where the property is located. There is usually a fee associated with the filing and it is recommended to bring a blank check or contact the recorder before your arrival.

A probate is required when a person dies and owns property that does not automatically pass to someone else, or the estate doesn't qualify to use the Affidavit for Collection of Personal Property procedure. A probate allows a Personal Representative to transfer legal title of that property to the proper persons.