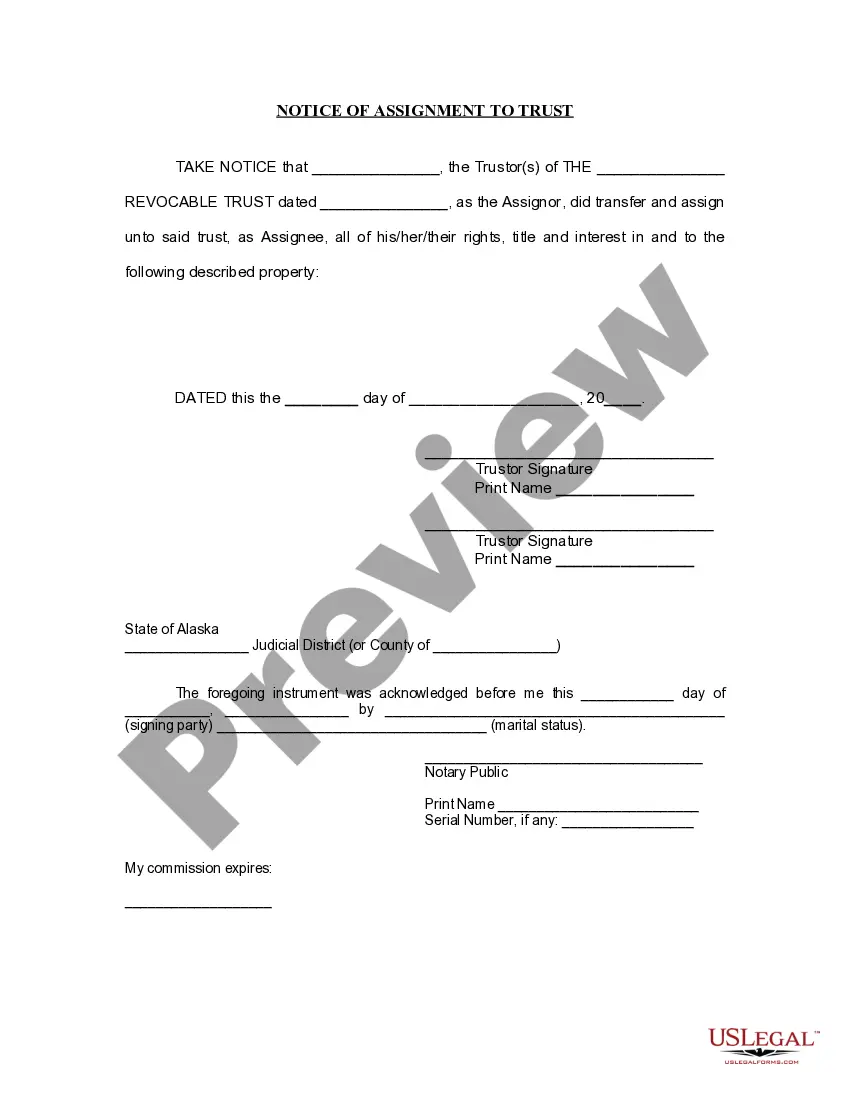

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

An Anchorage Alaska Notice of Assignment to Living Trust is a legal document used for the purpose of transferring ownership of a property or asset into a living trust in Anchorage, Alaska. This notice serves as an official record and proof of the transfer, ensuring that the trust is properly established and all interested parties are informed. The Anchorage Alaska Notice of Assignment to Living Trust encompasses various types, including: 1. Real Estate Assignment to Living Trust: This type of notice involves the transfer of real estate properties, such as residential homes, commercial buildings, or land, into a living trust. The notice specifies the property details, name(s) of the granter(s), and beneficiaries. 2. Financial Asset Assignment to Living Trust: This category includes the transfer of financial assets into a living trust, such as bank accounts, stocks, bonds, or retirement savings. The notice identifies the specific assets being assigned, the relevant financial institutions, and the individuals involved. 3. Personal Property Assignment to Living Trust: Here, personal belongings with significant value, such as vehicles, jewelry, artwork, or collectibles, are transferred into a living trust. The notice outlines the items being assigned, the granter(s) involved, and the beneficiaries. 4. Business Interest Assignment to Living Trust: In cases where a person holds ownership in a business, this type of notice transfers the business interests, shares, or partnership rights into the living trust. The notice details the business name, type of interest being assigned, and the individuals involved. When drafting an Anchorage Alaska Notice of Assignment to Living Trust, it is crucial to include relevant keywords. Some essential keywords to consider may include: — Anchorage Alaska livinthusus— - Notice of assignment — Living trust assignment to Anchorage Alaska — Trust transfer in AnchoragAlaskask— - Living trust document — Real estate assignment to living trust — Financial asset assignment to living trust — Personal property assignment to living trust — Business interest assignment to living trust Trustte— - Beneficiary - Grantor - Legal document — Anchorage Alaska property transfer By incorporating these keywords, the description will be optimized for search engines and easily accessible to individuals seeking information regarding Anchorage Alaska Notice of Assignment to Living Trust, its types, and its legal implications.