This office lease clause is a more detailed form giving the tenant additional rights and the landlord further obligations as it relates to tax increases.

Wyoming Detailed Tax Increase Clause

Description

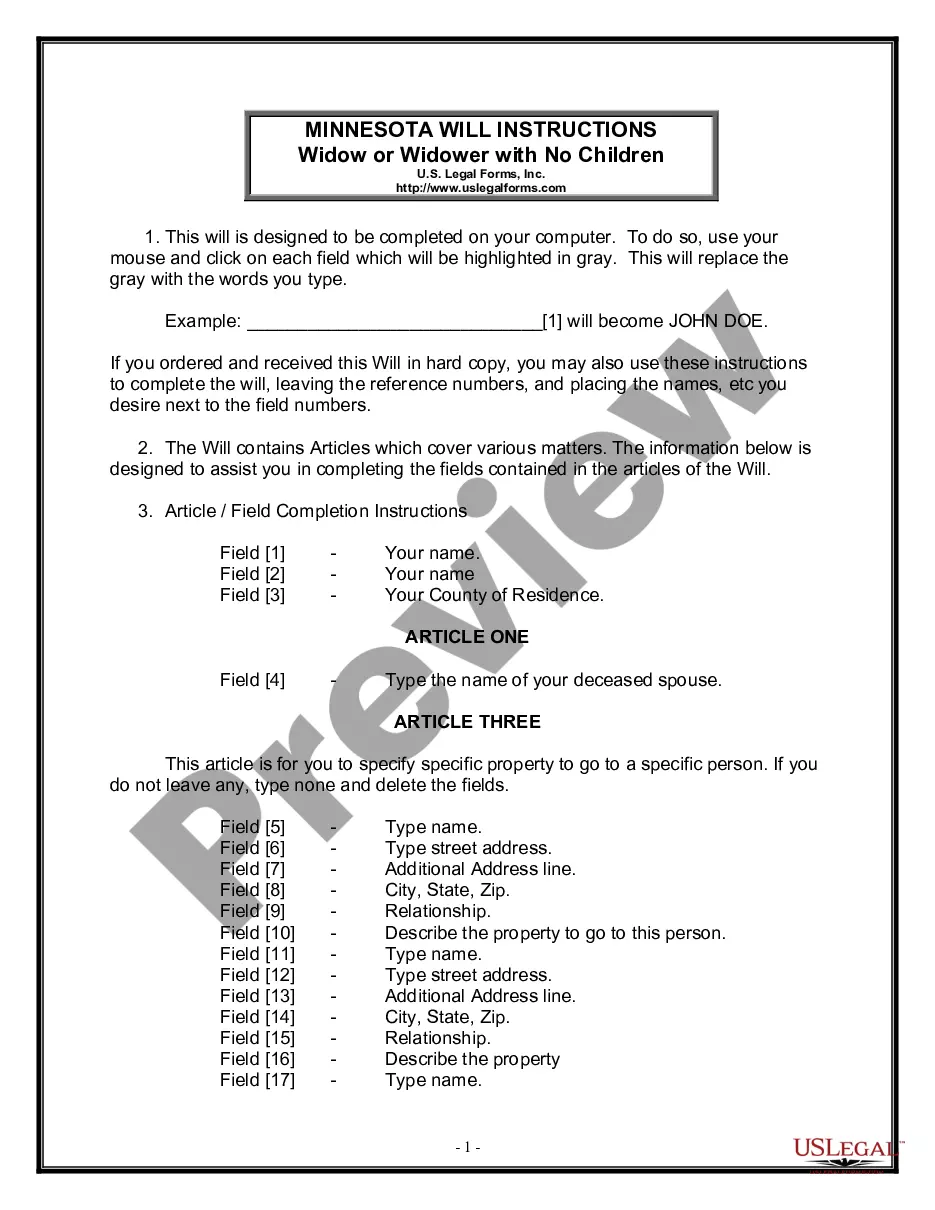

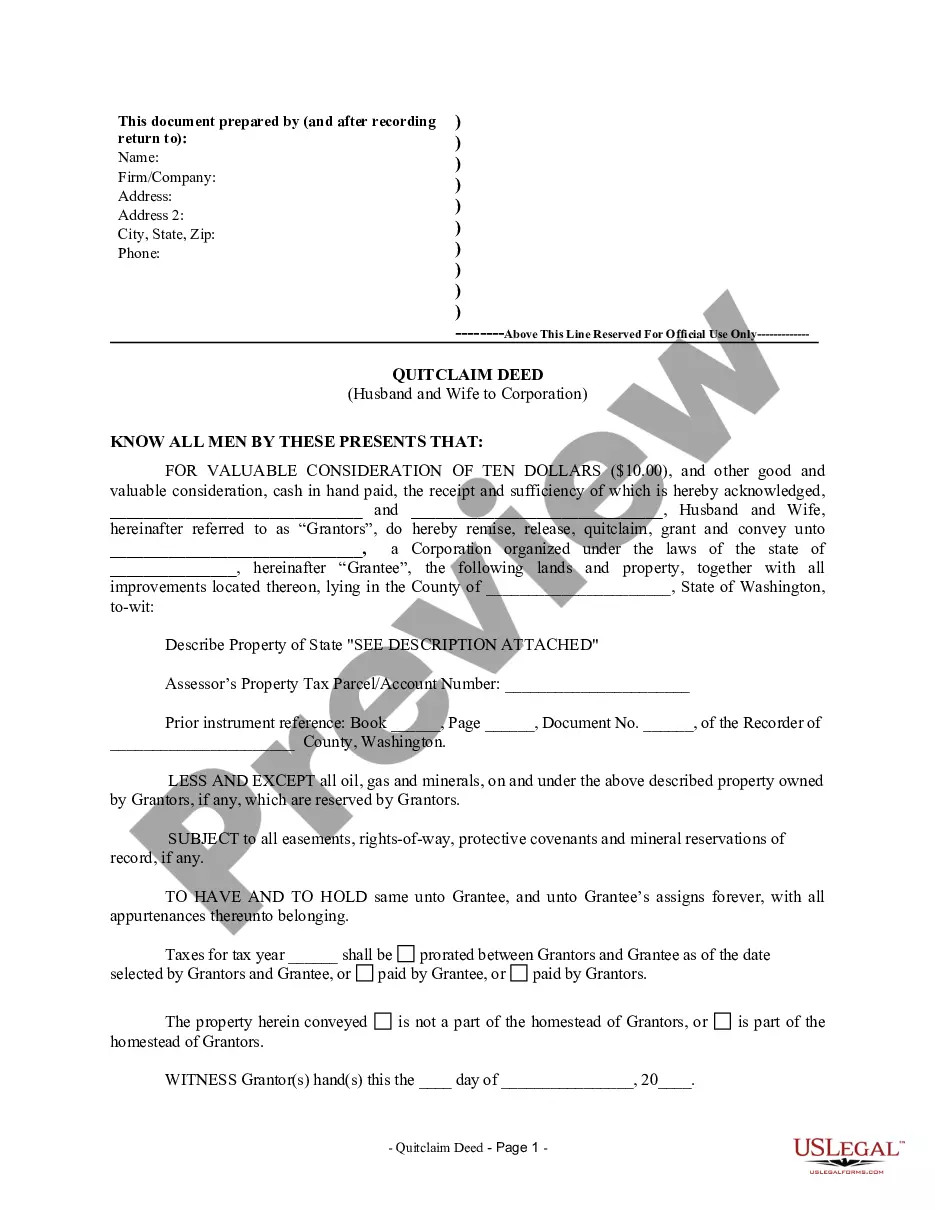

How to fill out Detailed Tax Increase Clause?

If you wish to complete, acquire, or print legal file templates, use US Legal Forms, the biggest collection of legal types, that can be found online. Utilize the site`s simple and easy handy search to obtain the files you will need. Numerous templates for organization and specific functions are sorted by classes and suggests, or keywords. Use US Legal Forms to obtain the Wyoming Detailed Tax Increase Clause in just a number of mouse clicks.

Should you be currently a US Legal Forms customer, log in to your account and click the Acquire button to get the Wyoming Detailed Tax Increase Clause. You may also gain access to types you formerly downloaded in the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for that appropriate area/nation.

- Step 2. Make use of the Preview method to look over the form`s information. Don`t overlook to learn the explanation.

- Step 3. Should you be unhappy with all the kind, utilize the Research area towards the top of the display screen to locate other models from the legal kind design.

- Step 4. When you have located the shape you will need, click on the Buy now button. Pick the prices plan you choose and put your accreditations to register for the account.

- Step 5. Approach the deal. You can use your bank card or PayPal account to finish the deal.

- Step 6. Select the structure from the legal kind and acquire it on your own gadget.

- Step 7. Full, modify and print or signal the Wyoming Detailed Tax Increase Clause.

Each and every legal file design you buy is your own forever. You possess acces to every kind you downloaded with your acccount. Click on the My Forms segment and choose a kind to print or acquire yet again.

Compete and acquire, and print the Wyoming Detailed Tax Increase Clause with US Legal Forms. There are thousands of skilled and status-certain types you can utilize for the organization or specific needs.

Form popularity

FAQ

Certificate of restoration of rights; procedure for restoration in general; procedure for restoration of voting rights for nonviolent felonies; filing requirements. (ii) He satisfactorily completes a probation period. (ii) The person has completed all of his sentence, including probation or parole.

Section 39-13-105 - Exemptions. 39-13-105. Exemptions. (a) The following persons who are bona fide Wyoming residents for at least three (3) years at the time of claiming the exemption are entitled to receive the tax exemption provided by W.S. 39-11-105(a)(xxiv):

The following shall apply: (i) Taxes upon real property are a perpetual lien thereon against all persons excluding the United States and the state of Wyoming. Taxes upon personal property are a lien upon all real property owned by the person against whom the tax was assessed subject to all prior existing valid liens.

W.S. 39-15-103 imposes the tax on the sale of tangible personal property and certain services.

Wyoming Statute 39-13-107 requires that all personal property for a business in Albany County be reported to the Assessor`s Office by March 1st of the tax-reporting year.