Wyoming Due Diligence Memorandum Based on Files Examined

Description

How to fill out Due Diligence Memorandum Based On Files Examined?

You are able to commit hrs on the Internet looking for the lawful document format that meets the federal and state specifications you need. US Legal Forms gives a large number of lawful types that are examined by specialists. You can easily down load or print the Wyoming Due Diligence Memorandum Based on Files Examined from your service.

If you already have a US Legal Forms bank account, you may log in and click the Down load key. Following that, you may full, modify, print, or sign the Wyoming Due Diligence Memorandum Based on Files Examined. Every lawful document format you purchase is the one you have for a long time. To acquire one more duplicate for any obtained form, visit the My Forms tab and click the related key.

If you are using the US Legal Forms internet site for the first time, adhere to the straightforward guidelines below:

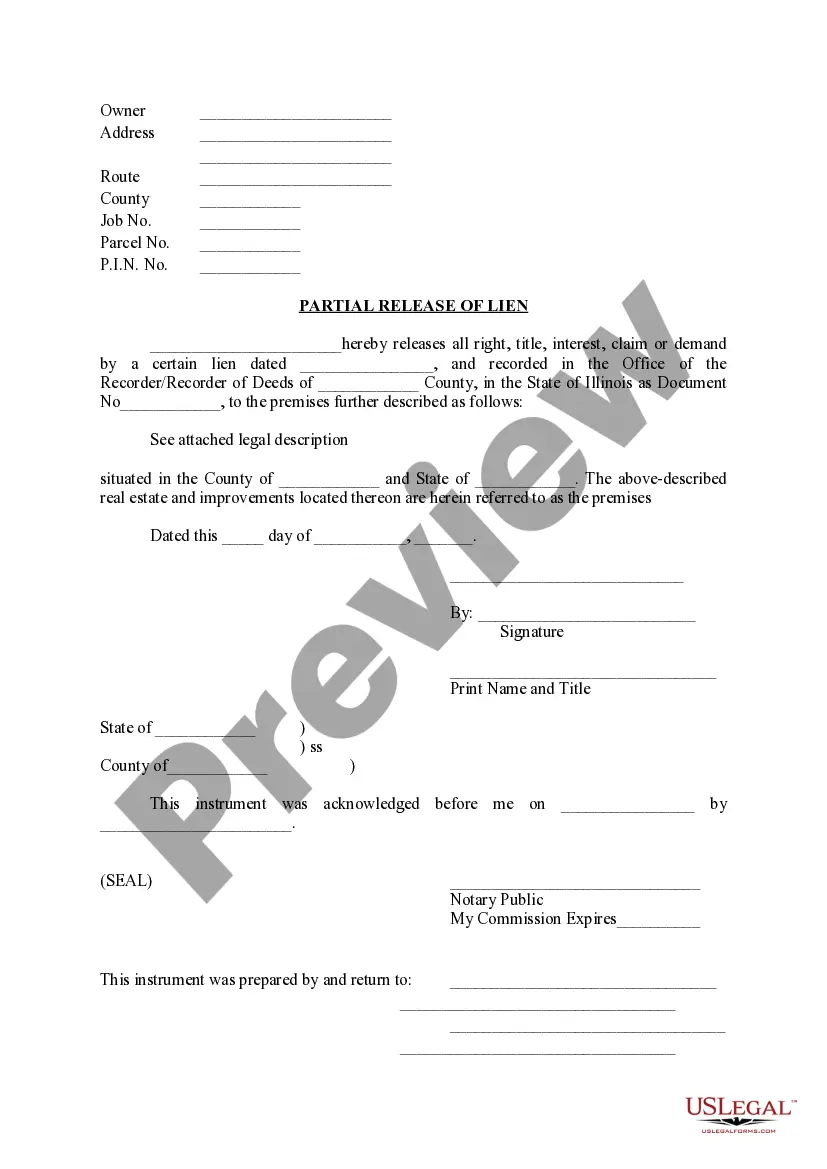

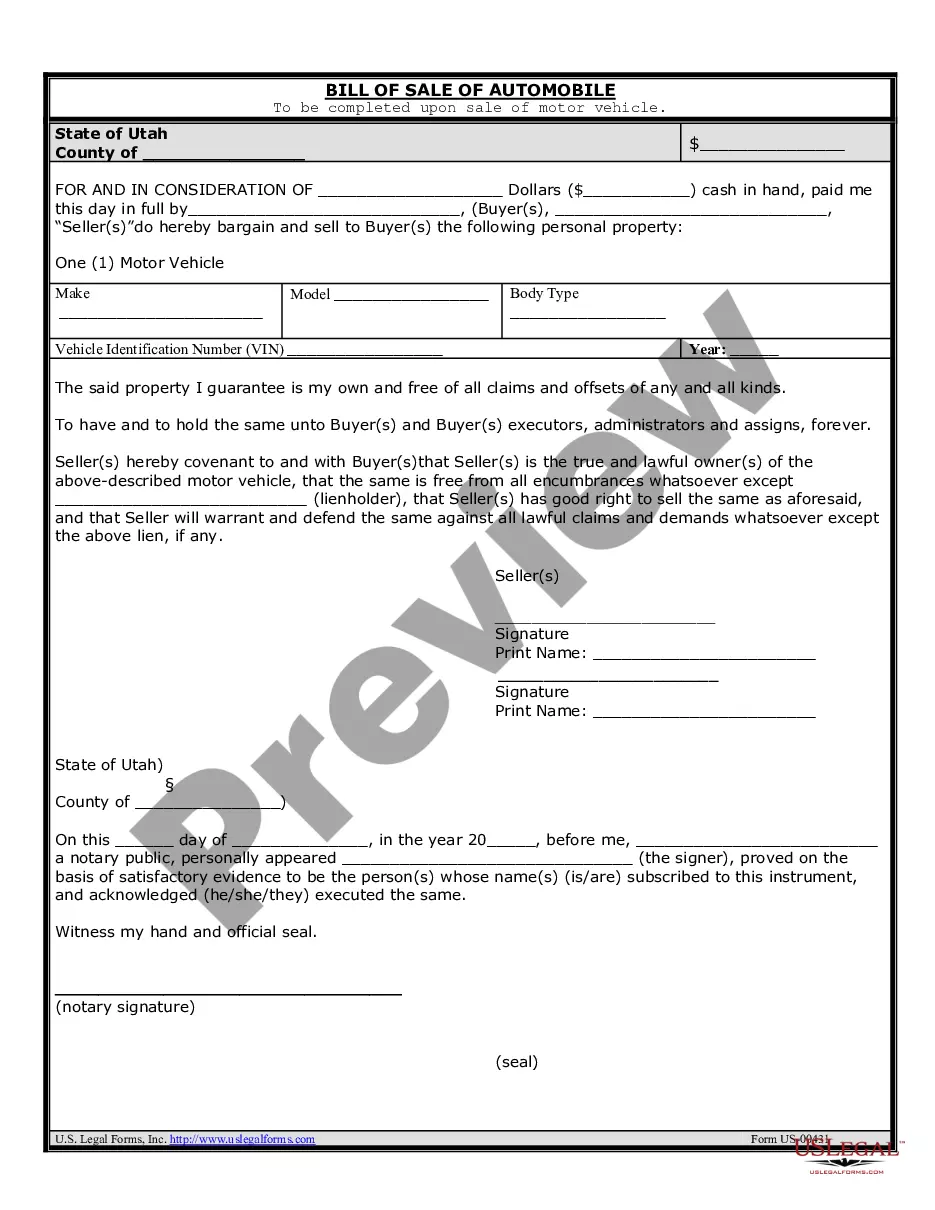

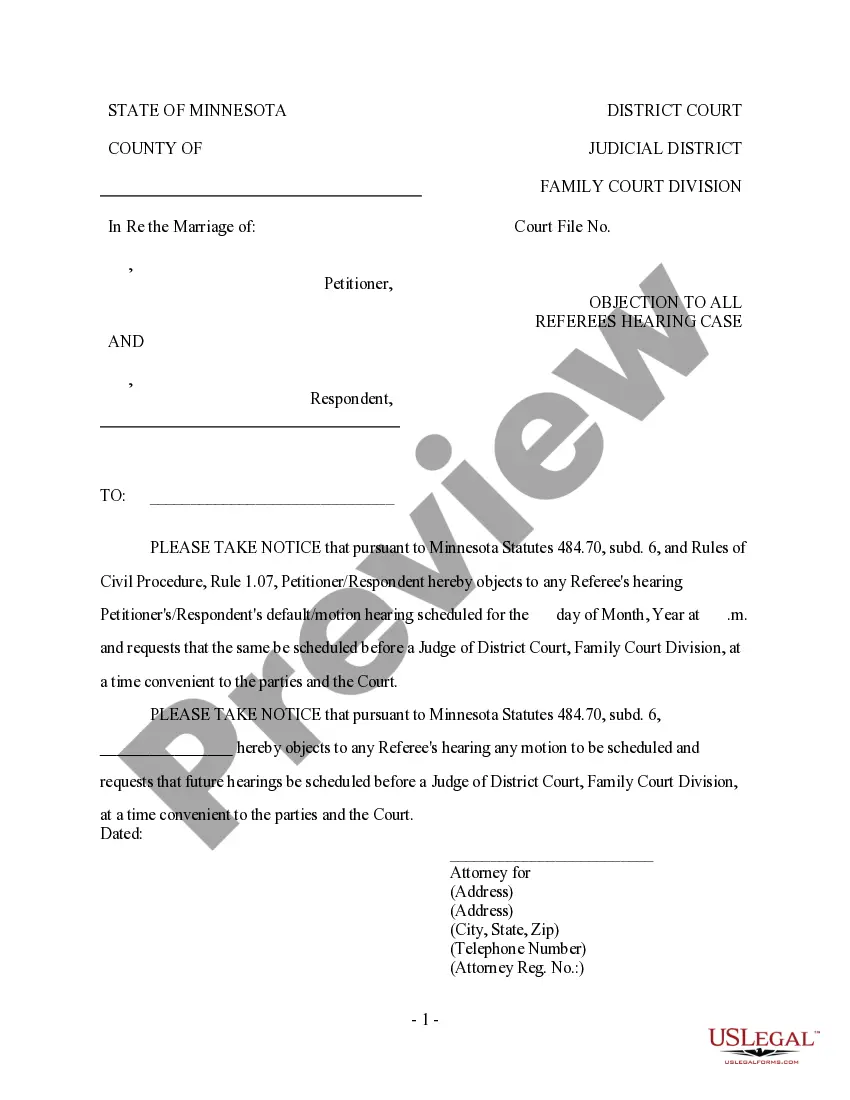

- Very first, be sure that you have selected the right document format to the area/area that you pick. Browse the form description to ensure you have picked out the appropriate form. If readily available, use the Review key to check from the document format as well.

- If you wish to get one more edition of the form, use the Search discipline to obtain the format that fits your needs and specifications.

- When you have found the format you would like, just click Buy now to move forward.

- Choose the pricing plan you would like, enter your qualifications, and sign up for your account on US Legal Forms.

- Complete the transaction. You may use your bank card or PayPal bank account to purchase the lawful form.

- Choose the structure of the document and down load it in your system.

- Make modifications in your document if required. You are able to full, modify and sign and print Wyoming Due Diligence Memorandum Based on Files Examined.

Down load and print a large number of document layouts while using US Legal Forms Internet site, that provides the greatest assortment of lawful types. Use specialist and express-particular layouts to take on your company or individual requirements.

Form popularity

FAQ

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.

What Should Be in a Due Diligence Report Checklist? Information on the finances of the company. ... Information about the company's employees. ... Information on the assets of the company. ... Information on partners, suppliers, and customers. ... Legal information about the company.

Due Diligence Checklist Template A due diligence checklist can be used as a guide in conducting an analysis on a company with potential for investment. Use this due diligence checklist to determine profitability and risk during the decision-making process before a merger or acquisition.

The Due Diligence Report includes a format and sample of information used in business transactions such as a merger or acquisition, partnership, investment, etc. The report requires research carried out prior to a financial transaction to assess commercial and legal risks, as well as opportunities.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

However, a standard due diligence report should include the following components: Executive summary. Company overview. Purpose and objective of the diligence. Financial due diligence. Legal due diligence. Operational due diligence. Market and commercial due diligence. Risk assessment.

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.