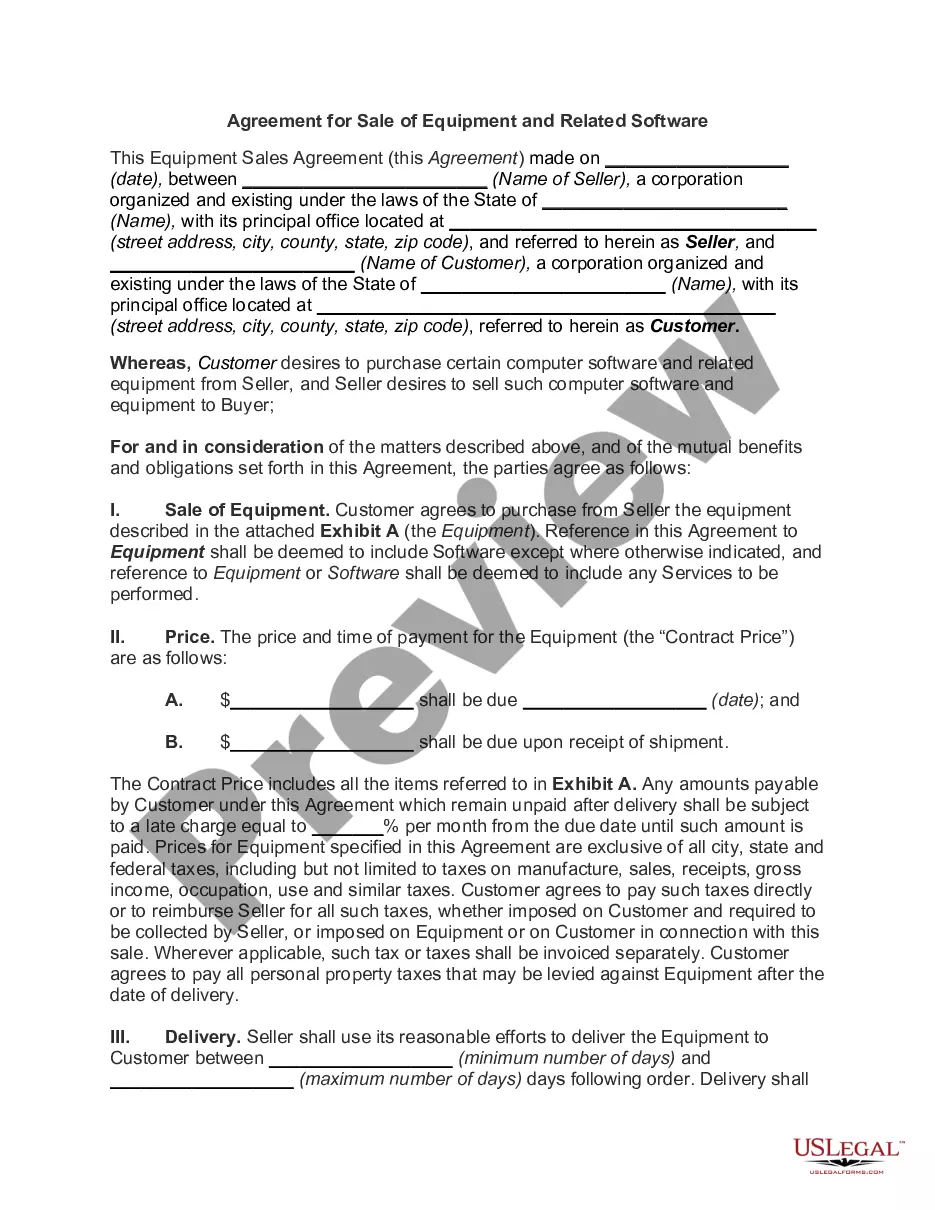

Wyoming Agreement for Sales of Data Processing Equipment

Description

How to fill out Agreement For Sales Of Data Processing Equipment?

Selecting the finest legal document template can be a challenge. Naturally, there are numerous designs available online, but how can you locate the legal form you need? Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Wyoming Agreement for Sale of Data Processing Equipment, suitable for business and personal purposes. All documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the Wyoming Agreement for Sale of Data Processing Equipment. Use your account to browse the legal documents you have previously obtained. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your area/state. You can preview the form using the Review button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the right form. Once you are confident that the form will work, click the Get Now button to obtain the form. Choose the pricing plan you prefer and provide the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained Wyoming Agreement for Sale of Data Processing Equipment.

- US Legal Forms is the largest repository of legal documents that you will discover various document templates.

- Utilize the service to acquire professionally-crafted files that comply with state regulations.

- Access a wide variety of templates for different legal purposes.

- Ensure that all documents meet legal standards before use.

- Enjoy a user-friendly interface for easy navigation.

- Get support from legal experts if needed.

Form popularity

FAQ

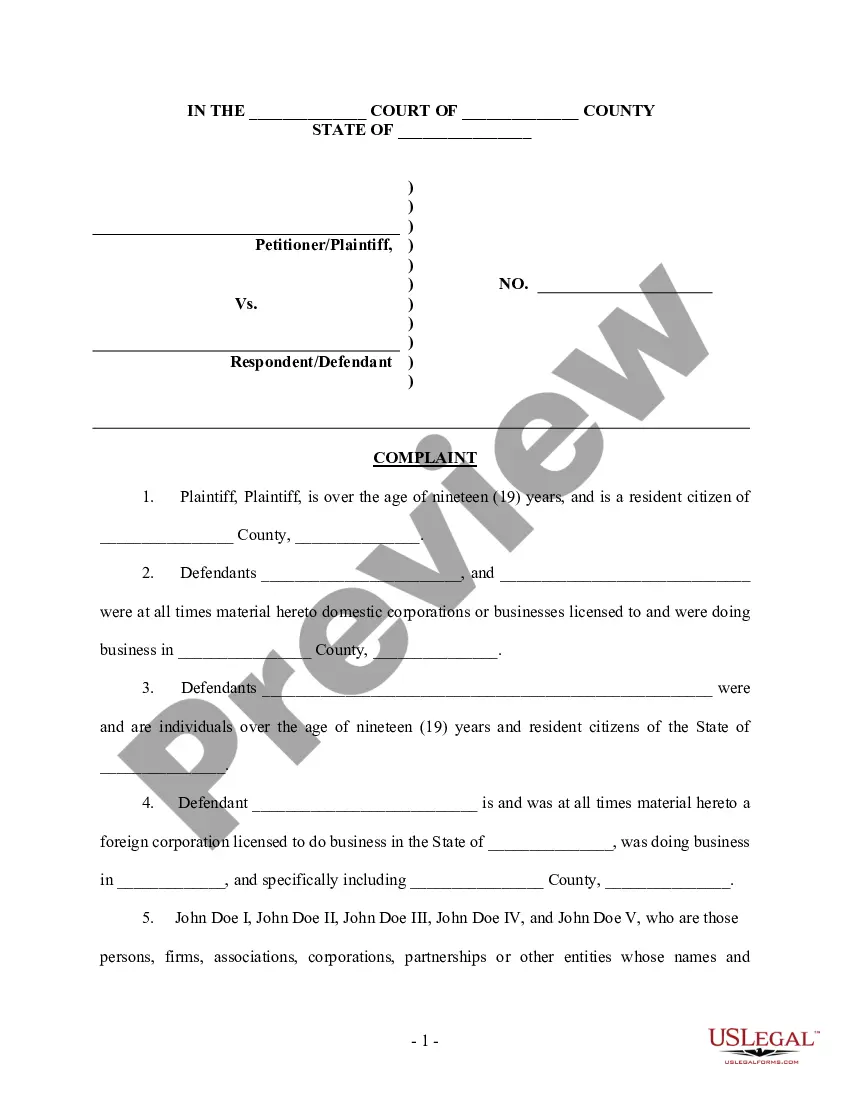

Yes, Wyoming requires a seller's permit for businesses that sell tangible goods or certain services. This permit allows you to collect sales tax from customers, which is vital for compliance with state regulations. If you are involved in the Wyoming Agreement for Sales of Data Processing Equipment, securing a seller's permit is important to ensure that your transactions are legal and efficient. For more guidance on obtaining the necessary permits, consider using the resources available on the uslegalforms platform.

While Wyoming does not mandate an operating agreement for LLCs, having one is beneficial for all members. An operating agreement can specify how your LLC will conduct business, manage finances, and make decisions, which can enhance organization and prevent potential conflicts. Additionally, incorporating aspects of the Wyoming Agreement for Sales of Data Processing Equipment into your agreement can solidify your commitment to compliance and best practices in your industry.

An operating agreement is not legally required for an LLC in Wyoming, but it is highly recommended. This document outlines the management structure and operating procedures of the LLC, serving as a foundation for the business. By creating an operating agreement, you can provide clarity and prevent disputes among members. Consider including reference to how the Wyoming Agreement for Sales of Data Processing Equipment plays a role in your LLC's operations.

In Wyoming, a bill of sale does not typically need to be notarized to be valid. However, having it notarized may enhance its acceptance and serve as proof in case of disputes. When dealing with the sale of data processing equipment, ensuring your documentation is correct can help safeguard your transaction and clarify ownership.

Tax-exempt purchases in Wyoming generally apply to non-profit organizations, government entities, and specific industries. If your business operates under the Wyoming Agreement for Sales of Data Processing Equipment, you may qualify for exemptions. It’s best to review your eligibility to optimize your tax strategy.

In Wyoming, property tax exemptions apply to individuals aged 65 or older. This exemption can significantly relieve financial burdens for senior citizens. If you are managing property related to data processing equipment, knowing these tax rules can help you budget better.

Generally, Wyoming does not impose sales tax on groceries, making it a favorable location for families and individuals. However, prepared foods are subject to sales tax. If you are involved in the sale of data processing equipment, knowing the tax implications on your purchases can help you navigate the costs associated with receiving this equipment.

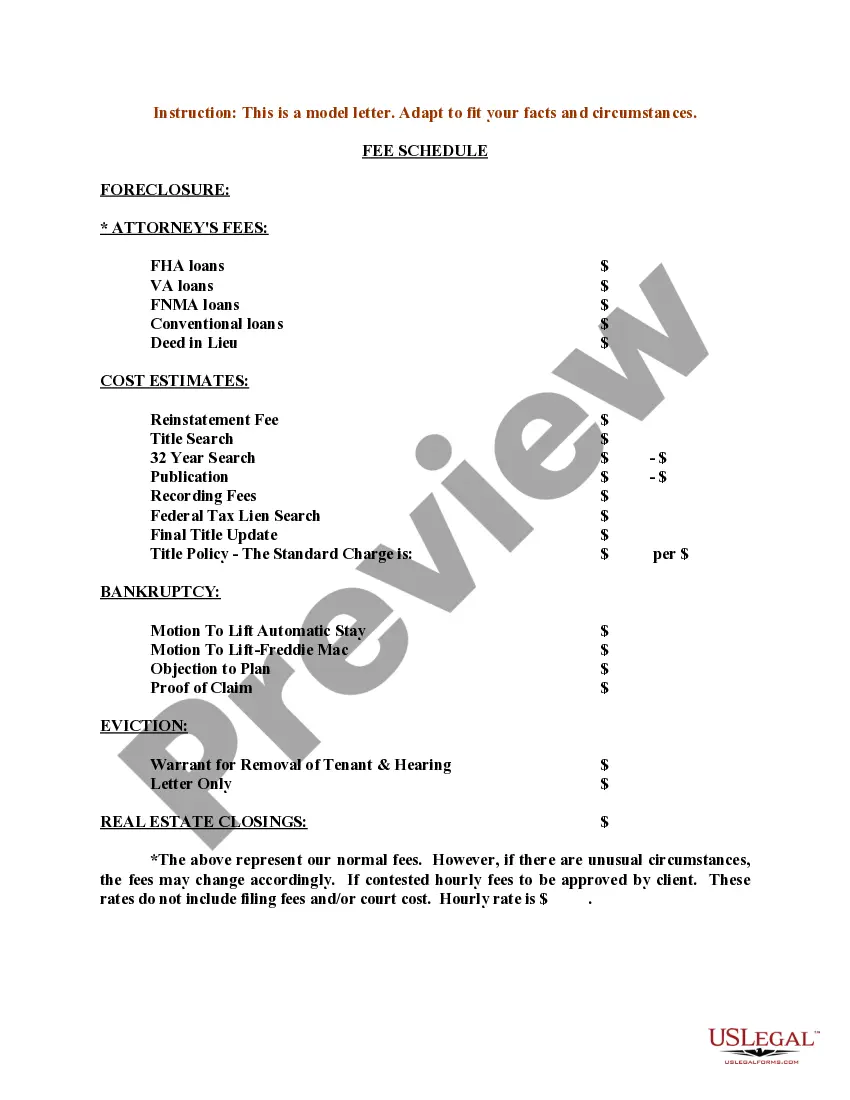

In Wyoming, certain items are exempt from sales tax, including specific types of machinery, equipment, and some services. Notably, the Wyoming Agreement for Sales of Data Processing Equipment may qualify for exemption under certain conditions. It is crucial to understand these exemptions, as they can affect your purchasing decisions and overall business expenses.