Wyoming I.R.S. Form SS-4 (to obtain your federal identification number)

Description

How to fill out I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

You may spend time on the web trying to find the legitimate document format that fits the federal and state specifications you require. US Legal Forms supplies thousands of legitimate types that are examined by specialists. You can easily acquire or print out the Wyoming I.R.S. Form SS-4 (to obtain your federal identification number) from my support.

If you currently have a US Legal Forms account, you can log in and click the Acquire button. After that, you can comprehensive, change, print out, or indicator the Wyoming I.R.S. Form SS-4 (to obtain your federal identification number). Each legitimate document format you get is the one you have permanently. To have yet another version associated with a obtained type, visit the My Forms tab and click the corresponding button.

If you are using the US Legal Forms internet site initially, stick to the simple instructions under:

- Very first, ensure that you have selected the correct document format for your area/metropolis of your liking. Look at the type information to ensure you have chosen the correct type. If available, use the Review button to check through the document format as well.

- If you would like discover yet another variation of your type, use the Lookup discipline to obtain the format that meets your requirements and specifications.

- After you have located the format you want, simply click Buy now to carry on.

- Select the pricing program you want, enter your credentials, and register for an account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal account to cover the legitimate type.

- Select the formatting of your document and acquire it for your device.

- Make modifications for your document if needed. You may comprehensive, change and indicator and print out Wyoming I.R.S. Form SS-4 (to obtain your federal identification number).

Acquire and print out thousands of document templates utilizing the US Legal Forms website, which offers the largest variety of legitimate types. Use professional and condition-specific templates to tackle your business or specific requirements.

Form popularity

FAQ

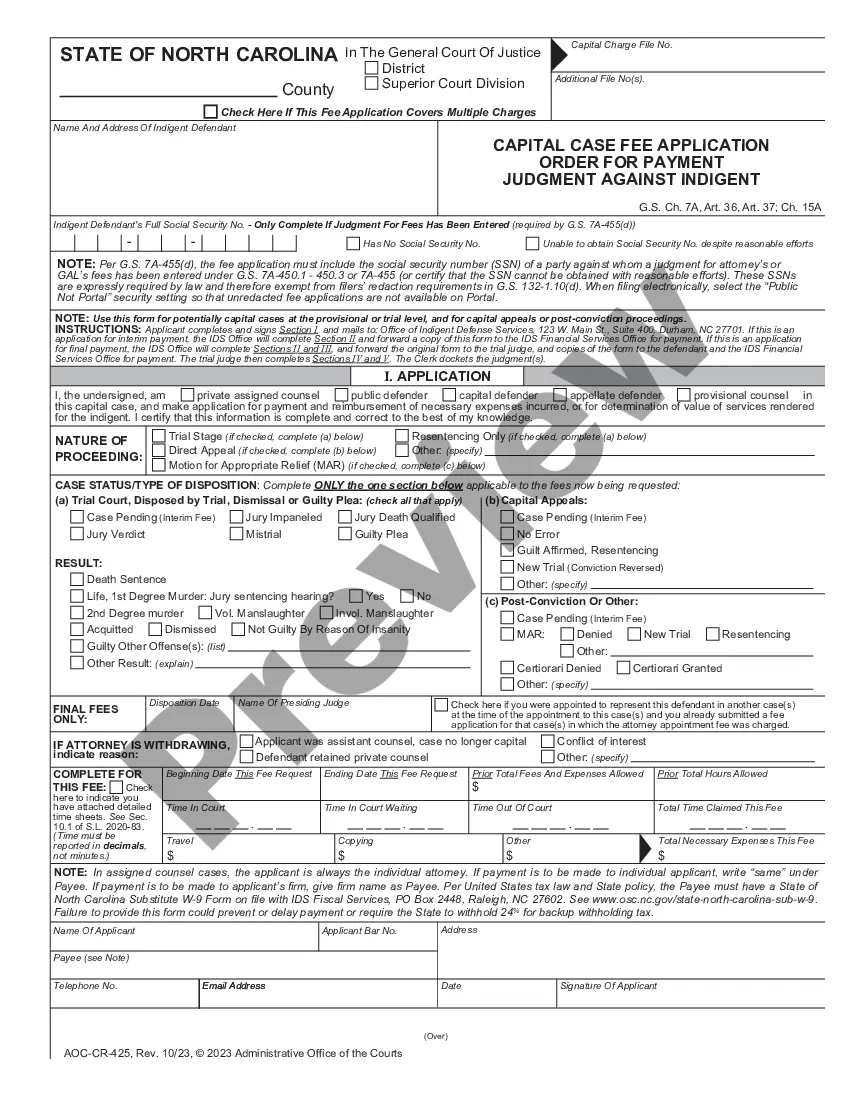

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories.

You can obtain a copy of your verified SS-4 by: Returning to the IRS online portal where you applied for an EIN. From here, you can re-download the form as a PDF. Contacting the IRS at its Business and Specialty Tax Line and EIN Assignment line. The number is: (800) 829-4933.

Employer Identification Numbers for Wyoming Companies Go to the IRS Website. Click ?Apply for an Employer ID Number.? beneath the Tools Menu. Click Apply Online. If you already have a Social Security Number, Individual Taxpayer Identification Number or another Employer ID, you'll qualify. ... Begin Application.

SS-4 Confirmation Letter: This letter acts as an official statement from the IRS, confirming your authorized EIN. It outlines your entity's legal name, address, EIN, and the date of issuance.

Simply call (800) 829-4933 and select EIN from the list of options.

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

Unfortunately, looking up your EIN on IRS.gov isn't an option, as there's no EIN lookup tool. Still, that doesn't mean you're entirely out of luck. You can find it on the official IRS notice you received when it was issued, call the IRS directly or locate your EIN on business documents.

The IRS sends out an EIN confirmation letter for every EIN application it processes. This EIN confirmation letter is called CP 575, and the IRS only mails the letter to the mailing address listed on line 4 of the SS-4 application. Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online.