Wyoming Self-Employed Excavation Service Contract

Description

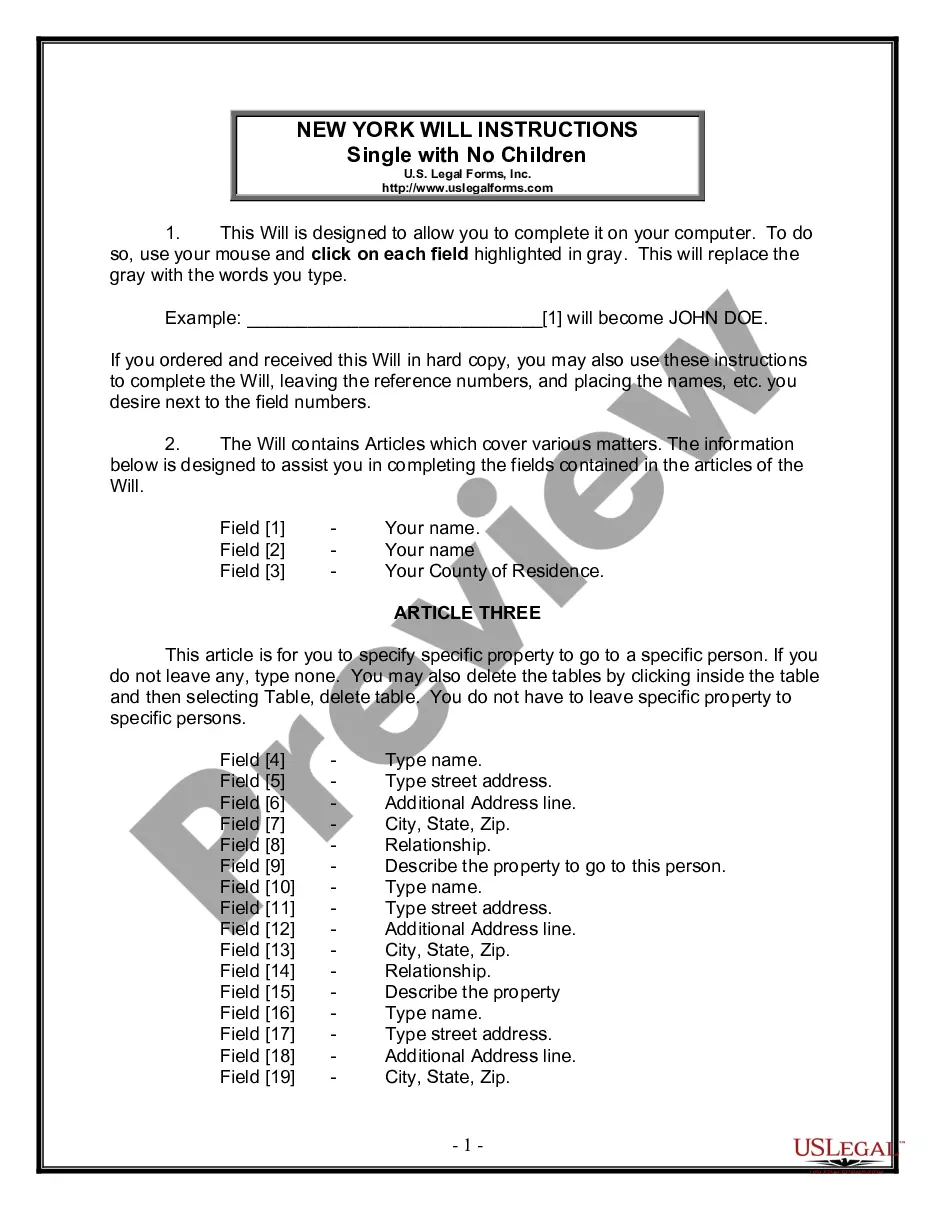

How to fill out Self-Employed Excavation Service Contract?

If you wish to finalize, retrieve, or generate sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by type and state or by keywords.

Every legal document template you purchase is yours permanently. You have access to every form you obtained with your account. Click on the My documents section and choose a form to print or download again.

Compete, download, and print the Wyoming Self-Employed Excavation Service Agreement with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the Wyoming Self-Employed Excavation Service Agreement in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Wyoming Self-Employed Excavation Service Agreement.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate region/land.

- Step 2. Use the Preview option to review the form's details. Remember to read through the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative models in the legal form design.

- Step 4. Once you have found the form you need, click the Order now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Wyoming Self-Employed Excavation Service Agreement.

Form popularity

FAQ

Wyoming does not legally require an operating agreement for LLCs, but having one is highly recommended. An operating agreement outlines the management structure and operational procedures of your business. This document is especially beneficial for clarifying roles and responsibilities, making it easier to handle disputes. If you're drafting a Wyoming Self-Employed Excavation Service Contract, an operating agreement can provide clarity and structure to your business dealings.

The need for a contractor license in Wyoming varies based on the nature of the work. For those working under a Wyoming Self-Employed Excavation Service Contract, a license may not always be necessary, especially for smaller jobs. Larger or more complex projects often require licensing to ensure quality and safety standards. Always check local laws and consider using resources like USLegalForms to help navigate these requirements.

Engaging in contractor work without a license can be illegal, depending on the state and the type of work. In Wyoming, for example, operating under a Wyoming Self-Employed Excavation Service Contract may not require a license for all projects. However, failing to comply with local regulations can lead to penalties. Always verify your specific situation to avoid any legal issues.

In Wyoming, a contractor license is not required for all types of contractor work. Specifically, if you are providing services under a Wyoming Self-Employed Excavation Service Contract, you may not need a license for smaller projects. However, larger projects or specialized work might still require licensing. It's best to understand the scope of your work to ensure you comply with state requirements.

Some states do not require a contractor's license for certain types of work, including Wyoming. This means you can operate under a Wyoming Self-Employed Excavation Service Contract without a formal license, provided you meet local regulations. However, it's essential to check specific local laws to ensure compliance. Always consider consulting with a legal expert to navigate these regulations effectively.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.