Wyoming Self-Employed Ceiling Installation Contract

Description

How to fill out Self-Employed Ceiling Installation Contract?

Are you in a situation where you need to have documentation for occasional business or particular purposes almost every workday.

There are numerous legal document templates available online, but locating reliable ones isn't straightforward.

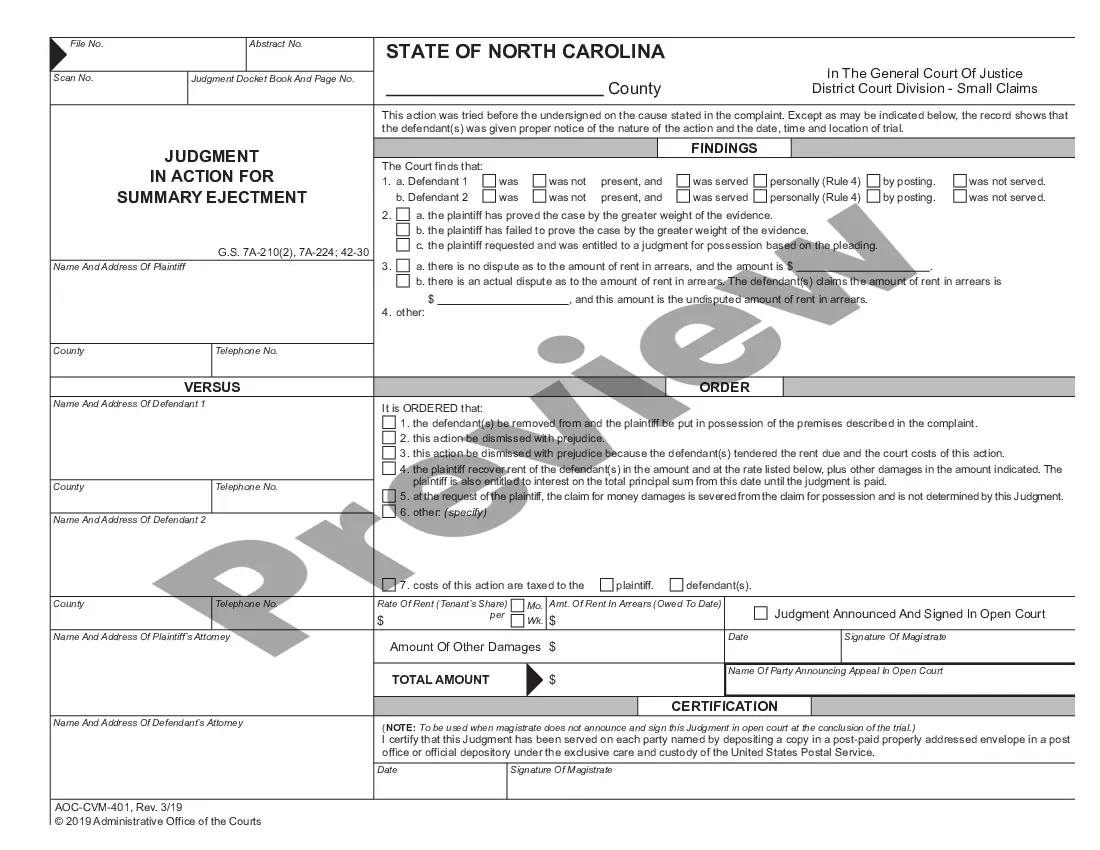

US Legal Forms provides a vast selection of form templates, such as the Wyoming Self-Employed Ceiling Installation Contract, designed to meet state and federal requirements.

Once you find the correct form, click Buy now.

Select the pricing plan you want, fill in the required information to create your account, and pay for your order using PayPal or Visa or Mastercard. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Wyoming Self-Employed Ceiling Installation Contract at any time, if necessary. Simply select the desired form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and prevent errors. The service offers professionally created legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are currently familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can obtain the Wyoming Self-Employed Ceiling Installation Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

- Utilize the Review button to inspect the form.

- Read the details to make sure you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

In Wyoming, a contractor license is generally required for most construction-related work, including ceiling installation. If you plan to work as a self-employed contractor, obtaining the proper license ensures compliance with state regulations. For those interested in a Wyoming Self-Employed Ceiling Installation Contract, having a license can also enhance your credibility. You can find resources and assistance for obtaining your license on platforms like US Legal Forms, which provide tailored legal documents.

One disadvantage of forming an LLC in Wyoming is the annual fees associated with maintaining the business entity. While Wyoming offers several benefits, such as low taxes and privacy, the costs can add up over time. Additionally, if you are not familiar with the requirements, it can be challenging to navigate the compliance landscape. A Wyoming Self-Employed Ceiling Installation Contract can simplify your operations and help you stay organized, reducing the burden of these disadvantages.

Yes, a Wyoming LLC does require an annual report. This report is essential for maintaining your business's good standing with the state. It includes basic information about your LLC, such as its name, address, and registered agent. Utilizing a Wyoming Self-Employed Ceiling Installation Contract can help streamline your business processes and ensure you meet all necessary compliance requirements.

Yes, you can absolutely work as an independent contractor without an LLC. Many contractors choose to operate as sole proprietors, allowing them to focus on their work without the additional paperwork. A Wyoming Self-Employed Ceiling Installation Contract can streamline your contracting process and keep everything organized. Just remember to comply with tax regulations as you grow your independent contracting business.

No, having an LLC is not a requirement to work as a contractor. While forming an LLC can provide legal protection and tax benefits, you can still operate as a sole proprietor. By using a Wyoming Self-Employed Ceiling Installation Contract, you can outline your terms clearly and maintain professionalism without the need for an LLC. It’s important to weigh your options based on your business goals.

Yes, you can work on a 1099 without forming an LLC. As long as you meet the requirements for independent contracting, you can operate under your name. Utilizing a Wyoming Self-Employed Ceiling Installation Contract can help you manage your projects effectively without the need for an LLC. Just keep track of your income and expenses to simplify your tax process.

No, you do not need to start a formal business to become an independent contractor. However, if you want to manage your finances better and protect your personal assets, consider forming an LLC. With a Wyoming Self-Employed Ceiling Installation Contract, you can work as an independent contractor and enjoy the flexibility that comes with it. Remember, keeping your finances organized is crucial for success.

Independent contractors must adhere to specific legal requirements, especially when entering into a Wyoming Self-Employed Ceiling Installation Contract. This includes obtaining the necessary licenses and permits to operate legally in Wyoming. Additionally, it is essential to understand tax obligations, as independent contractors are responsible for reporting their income and paying self-employment taxes. Using a reliable platform like US Legal Forms can guide you in drafting a compliant contract that meets all legal standards.