Wyoming Self-Employed Seasonal Picker Services Contract

Description

How to fill out Self-Employed Seasonal Picker Services Contract?

Are you in a scenario where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but locating ones you can rely on is not easy.

US Legal Forms offers thousands of form templates, including the Wyoming Self-Employed Seasonal Picker Services Contract, which can be filled out to meet state and federal requirements.

Once you find the right form, click Acquire now.

Choose the pricing plan you prefer, fill in the required information to complete your purchase, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wyoming Self-Employed Seasonal Picker Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

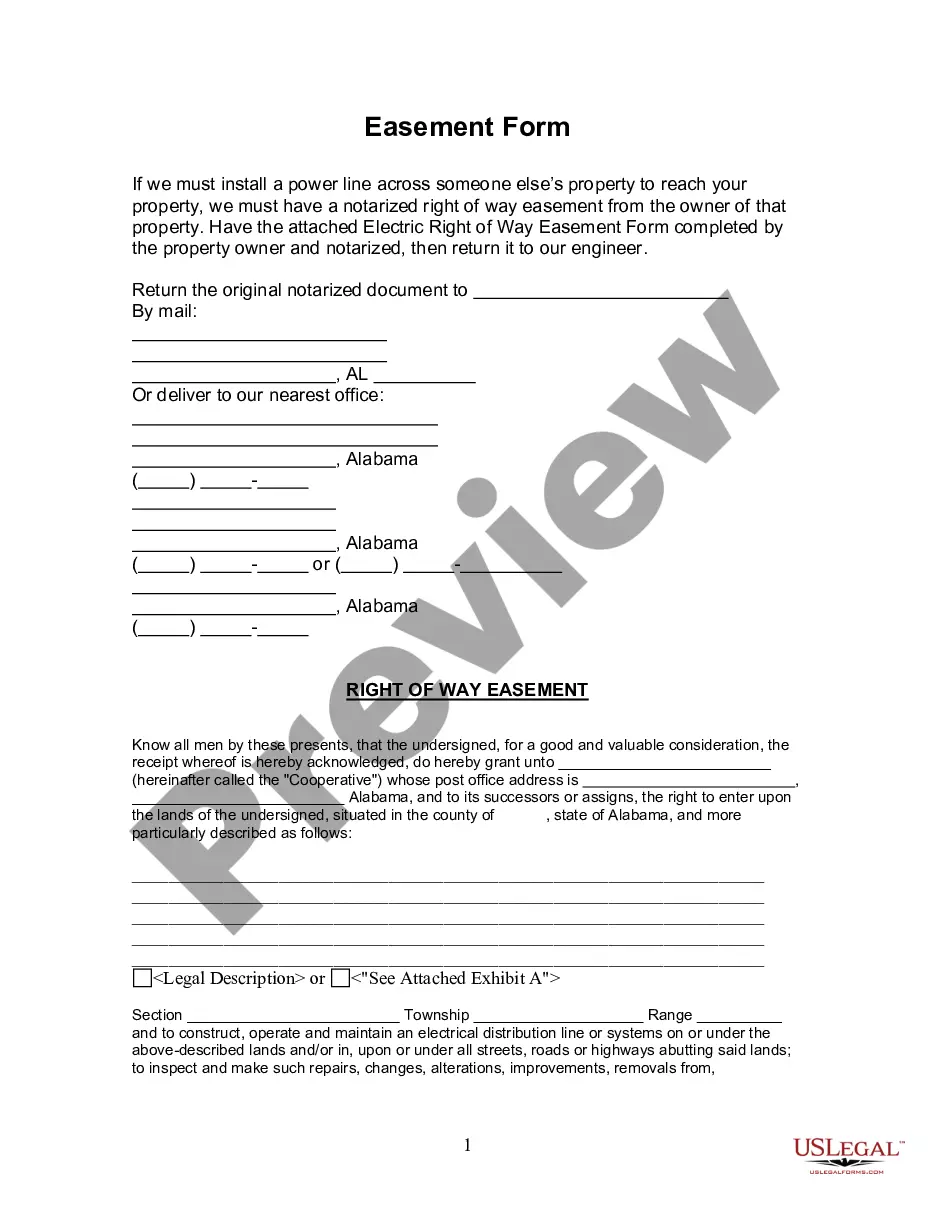

- Utilize the Review button to examine the form.

- Check the details to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

To qualify as an independent contractor under a Wyoming Self-Employed Seasonal Picker Services Contract, you must demonstrate control over your work schedule and methods. Unlike employees, independent contractors operate their own businesses and are responsible for their own taxes. You should also maintain a degree of independence in your operations, such as providing your own tools and materials. By clearly outlining these elements in your contract, you establish your status as an independent contractor in Wyoming.

Starting a formal business structure is not a requirement to be an independent contractor. You can operate as a sole proprietor, which is a straightforward approach. However, establishing a business can help you manage taxes better and protect your personal assets. If you're seeking a Wyoming Self-Employed Seasonal Picker Services Contract, uslegalforms can provide the necessary documentation to support your independent work.

No, you do not need an LLC to operate as a contractor. Many contractors successfully work as sole proprietors. However, forming an LLC can provide personal liability protection and may enhance your credibility with clients. If you're interested in a Wyoming Self-Employed Seasonal Picker Services Contract, our resources can guide you through the necessary steps.

Legal requirements for independent contractors include obtaining any necessary licenses or permits, properly reporting income, and paying self-employment taxes. You should also maintain clear contracts with clients to define the scope of work and payment terms. If you are looking for a Wyoming Self-Employed Seasonal Picker Services Contract, uslegalforms offers templates that can help ensure compliance with legal standards.

Yes, working as an independent contractor without an LLC is possible. You can operate as a sole proprietor, which often simplifies the process. However, an LLC can provide additional liability protection and may offer some tax advantages. If you need a Wyoming Self-Employed Seasonal Picker Services Contract, our platform can help you navigate the options available to you.

Yes, you can work on a 1099 without forming an LLC. Many independent contractors choose to operate as sole proprietors, which allows them to receive 1099 forms for their income. However, it's essential to understand the tax implications and ensure you comply with local regulations. If you are considering a Wyoming Self-Employed Seasonal Picker Services Contract, it's wise to consult a tax professional to guide you through the process.

The processing time for the Secretary of State (SOS) in Wyoming can vary depending on the type of filing. Typically, online filings are processed within one to three business days, while paper filings may take longer. To ensure your Wyoming Self-Employed Seasonal Picker Services Contract is processed quickly, consider submitting your documents online through a reliable platform like uslegalforms.

While Wyoming does not legally require an operating agreement for LLCs, having one is highly recommended. An operating agreement outlines the management structure and operating procedures of your business. This document can protect your interests and clarify expectations among members. If you are entering into a Wyoming Self-Employed Seasonal Picker Services Contract, it is wise to have an operating agreement in place.

The self-employment tax in Wyoming is similar to the federal self-employment tax rate, which is currently set at 15.3%. This tax covers Social Security and Medicare contributions. As a self-employed individual, you should plan for this tax when managing your finances. Utilizing a Wyoming Self-Employed Seasonal Picker Services Contract can help you outline your earnings and expenses clearly.

Yes, as a business owner, you must file an annual report for your LLC in Wyoming. This report helps maintain your good standing with the state. While the process is straightforward, it’s important to stay organized to avoid any issues. If you’re using a Wyoming Self-Employed Seasonal Picker Services Contract, make sure to keep track of your filings.