Wyoming Bodyguard Services Contract - Self-Employed

Description

How to fill out Bodyguard Services Contract - Self-Employed?

Have you ever found yourself in a circumstance where you require documents for both organizational or particular purposes almost every time.

There are numerous legal document templates accessible online, but locating ones you can trust isn't simple.

US Legal Forms offers thousands of document templates, such as the Wyoming Bodyguard Services Contract - Self-Employed, which can be printed to meet federal and state requirements.

Once you find the appropriate form, click on Buy now.

Choose the pricing plan you want, enter the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Wyoming Bodyguard Services Contract - Self-Employed template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for your correct area/state.

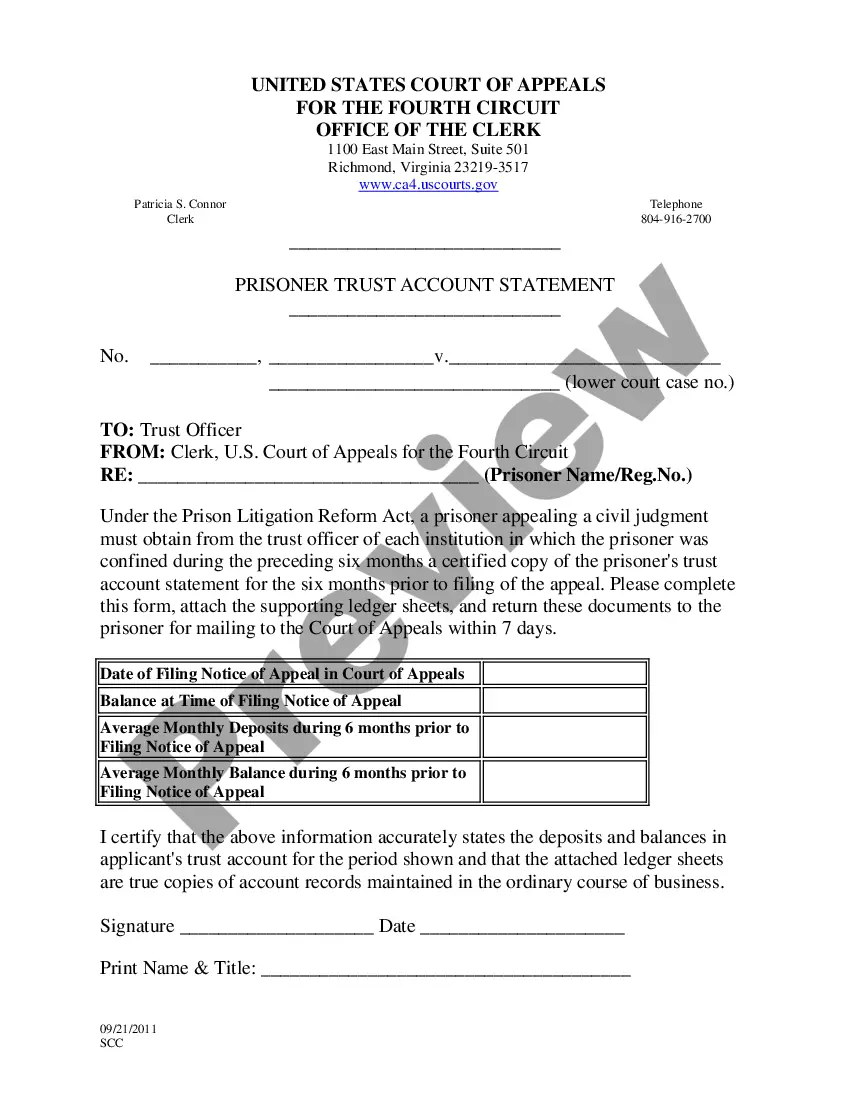

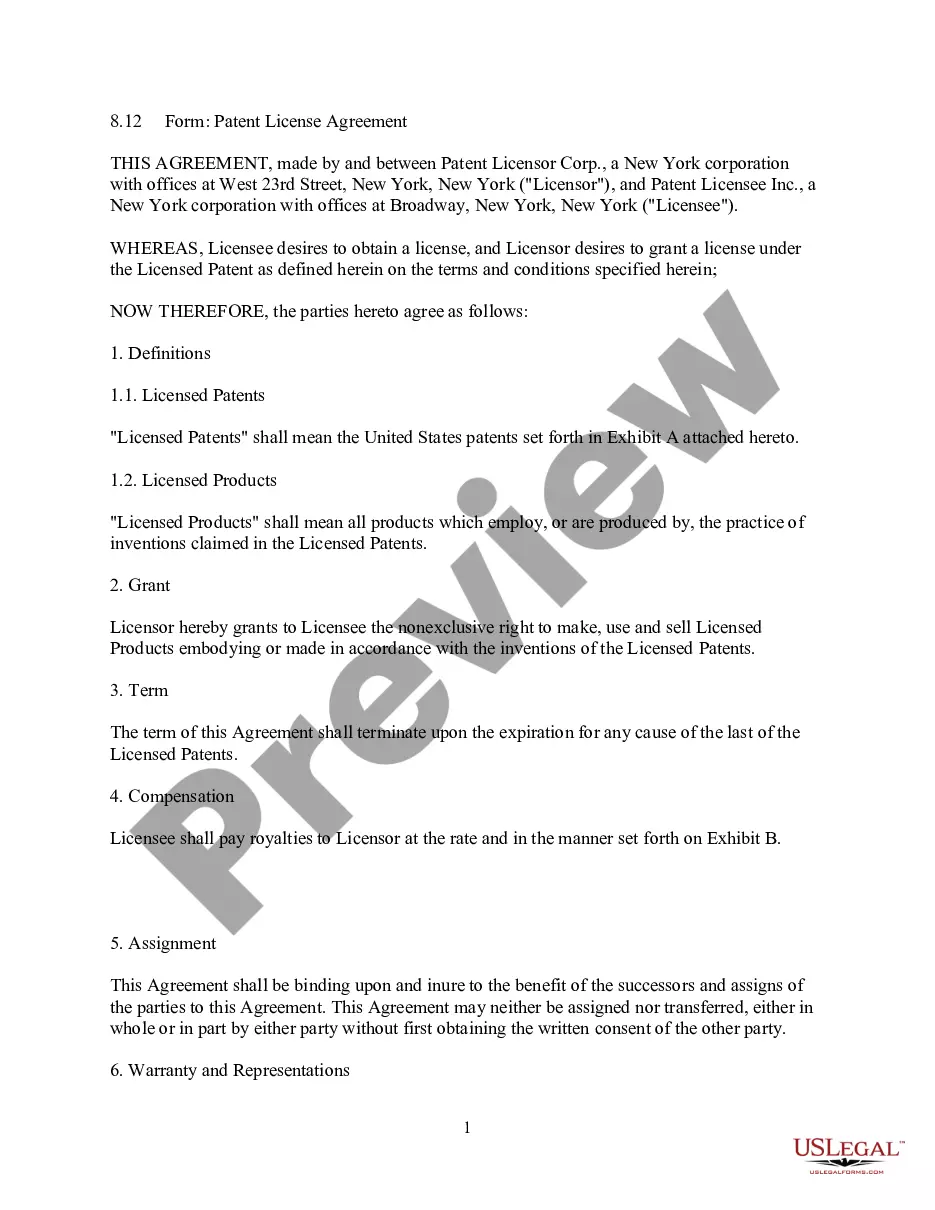

- Use the Review button to inspect the form.

- Check the summary to confirm you have selected the correct form.

- If the form isn't what you're looking for, utilize the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Absolutely, you can work as an independent contractor without forming an LLC. Many professionals in Wyoming Bodyguard Services Contract - Self-Employed successfully operate as sole proprietors. This option allows you to maintain flexibility as you grow your services. Focus on managing your income and adhering to tax regulations while utilizing platforms like uslegalforms to guide your path.

Wyoming does not require LLCs to have an operating agreement. However, drafting one is advisable as it can outline management structures and operational guidelines. If you plan to operate under Wyoming Bodyguard Services Contract - Self-Employed as an LLC, having this document can help solidify your business practices and clarify responsibilities. Consider using uslegalforms to create a comprehensive operating agreement tailored to your needs.

Yes, you can serve as your own registered agent in Wyoming if you establish an LLC. However, for those working in Wyoming Bodyguard Services Contract - Self-Employed without an LLC, this concern does not apply. Having a registered agent ensures you receive important legal documents, and acting as your own agent can save costs, but be aware of the responsibilities involved.

Yes, you can receive a 1099 form for services rendered without having an LLC. Many independent contractors in Wyoming Bodyguard Services Contract - Self-Employed operate on a 1099 basis as sole proprietors. Ensure you report your income accurately when filing your taxes. Using platforms like uslegalforms can help you understand your obligations and streamline your paperwork.

You do not need to launch a formal business to work as an independent contractor. Engaging in Wyoming Bodyguard Services Contract - Self-Employed allows you to operate under your own name or as a sole proprietor. Just keep in mind that you should keep track of your earnings and expenses for tax purposes. While starting a business can provide additional structure, it’s not a strict requirement.

No, you do not need to establish an LLC to work as a contractor. Many individuals operate as sole proprietors without forming an LLC, especially in fields like Wyoming Bodyguard Services Contract - Self-Employed. However, forming an LLC can offer personal liability protection and may provide tax benefits. It's worth considering your specific needs and how an LLC might support your business strategy.

To write a security contract agreement, begin with a detailed description of the services provided and the duration of the contract. Include payment terms and any stipulations specific to your situation. Using a sample Wyoming Bodyguard Services Contract - Self-Employed from US Legal Forms can make this task easier and more effective.

Writing a simple contract agreement involves outlining the purpose, terms, and conditions clearly. Be sure to include signatures and dates for validity. For a structured approach, you can utilize templates available from US Legal Forms, especially when creating a Wyoming Bodyguard Services Contract - Self-Employed.

The 5 C's of security guards refer to Competence, Communication, Courage, Courtesy, and Common Sense. These attributes are essential in selecting a capable security professional. When drafting a Wyoming Bodyguard Services Contract - Self-Employed, it's important to emphasize these qualities to guarantee the performance you expect from your guards.

To write a contract for security services, start by defining the scope of work and responsibilities. Make sure to include terms about compensation, duration, and any required licenses. A well-structured Wyoming Bodyguard Services Contract - Self-Employed can help protect both you and your client, ensuring all expectations are clear.