Wyoming Appliance Refinish Services Contract - Self-Employed

Description

How to fill out Appliance Refinish Services Contract - Self-Employed?

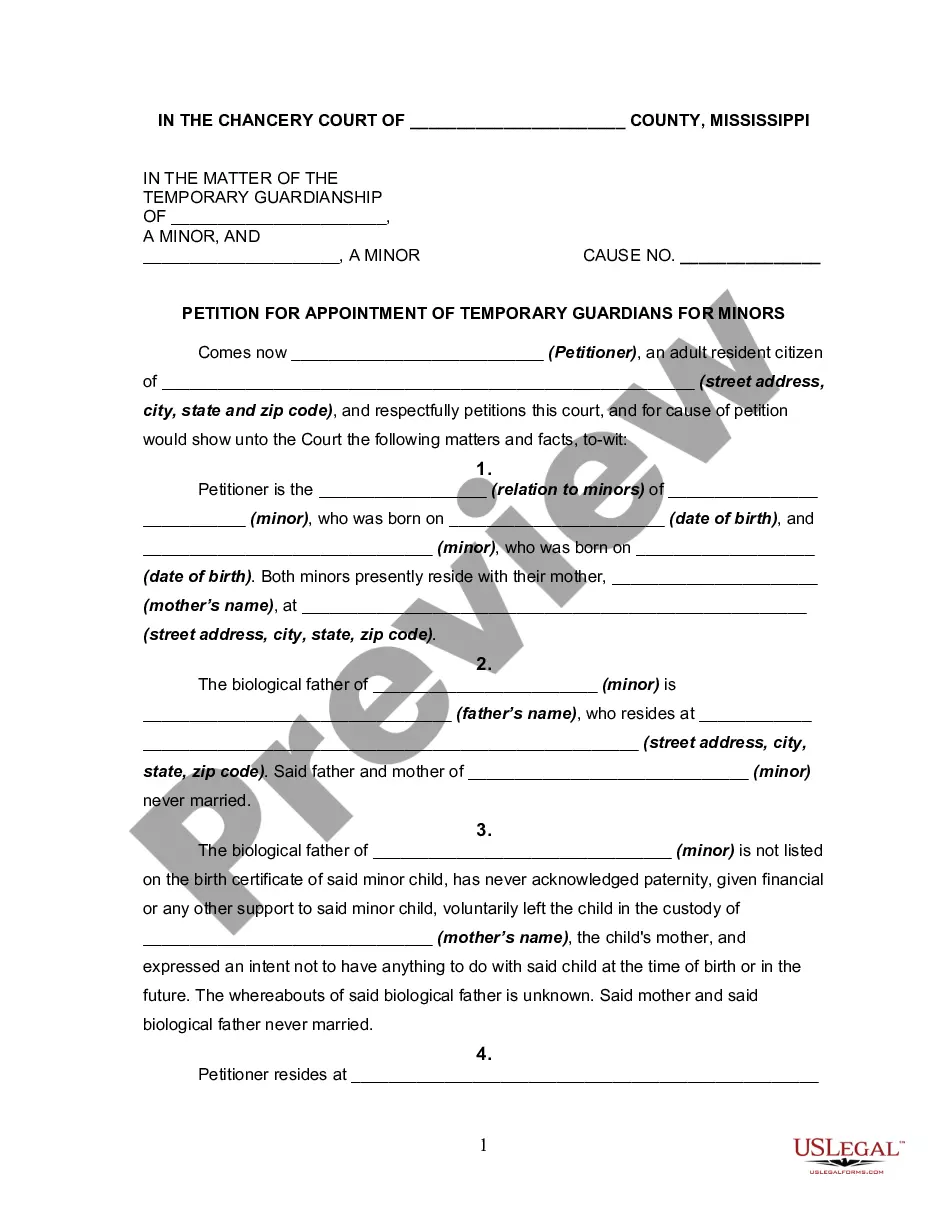

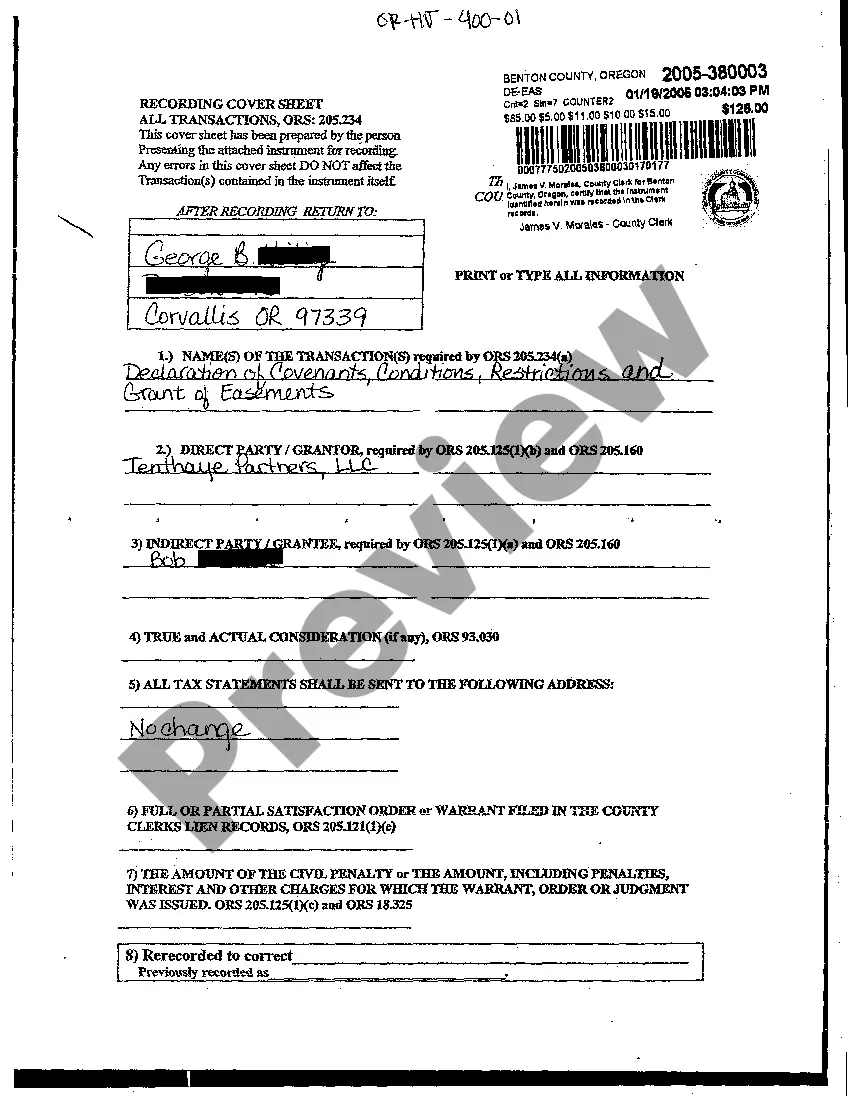

Selecting the optimal legal document template can be a challenge. Naturally, there are numerous templates available online, but how do you obtain the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Wyoming Appliance Refinish Services Contract - Self-Employed, which can be utilized for both business and personal purposes. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Wyoming Appliance Refinish Services Contract - Self-Employed. Use your account to browse the legal forms you have previously purchased. Visit the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and examine the form summary to confirm it is suitable for your needs. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is correct, select the Buy Now button to purchase the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Wyoming Appliance Refinish Services Contract - Self-Employed.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Utilize the service to acquire professionally crafted documents that adhere to state requirements.

- The templates are designed to meet various legal needs.

- Access a wide range of documents for different purposes.

- The platform is user-friendly and easy to navigate.

- Registration is simple, allowing you to get started quickly.

Form popularity

FAQ

To work as an independent contractor in the US, you typically need to register your business and obtain any necessary licenses or permits. Each state has specific requirements, but Wyoming offers a straightforward process. By securing a Wyoming Appliance Refinish Services Contract - Self-Employed, you can ensure you meet state regulations while providing quality services to your clients.

While Wyoming does not have a state income tax, self-employment tax is still applicable at the federal level. This tax primarily covers Social Security and Medicare contributions. For those operating under a Wyoming Appliance Refinish Services Contract - Self-Employed, understanding these tax obligations is crucial for financial planning and compliance.

Failure to file a 1099 for a contractor can lead to penalties from the IRS. Not only might you face fines, but it can also complicate your tax reporting. If you are working under a Wyoming Appliance Refinish Services Contract - Self-Employed, ensure you keep accurate records and file necessary forms to maintain compliance and avoid issues down the line.

Yes, you can start an LLC in Wyoming even if you do not reside there. Many entrepreneurs opt for this due to Wyoming's business-friendly regulations and tax advantages. By establishing your LLC, you can effectively operate under a Wyoming Appliance Refinish Services Contract - Self-Employed, giving your venture a solid legal foundation.

In Wyoming, self-employment tax is primarily based on federal rates, which currently stand at 15.3%. Since Wyoming does not impose a state income tax, your focus on a Wyoming Appliance Refinish Services Contract - Self-Employed becomes more financially beneficial. You can plan your finances better with lower overall taxation, allowing more investment back into your business.

Wyoming is an attractive option for self-employed individuals due to its lack of state income tax. This means that the overall tax burden for self-employed persons, including those working under a Wyoming Appliance Refinish Services Contract - Self-Employed, is lower compared to many other states. By choosing Wyoming, you can focus more on growing your business rather than worrying about high taxes.

Both terms have their uses, but context matters. 'Self-employed' applies broadly to anyone who works for themselves, while 'independent contractor' specifies a hiring relationship where one is contracted for specific services. When addressing your role in Wyoming appliance refinishing, consider your audience; using 'self-employed' can convey a broader range of responsibilities. Regardless of choice, having a solid Wyoming Appliance Refinish Services Contract - Self-Employed is key to protecting your interests.

Yes, an independent contractor is considered self-employed. This classification means that they work on a contract basis rather than being an employee of a firm. For those involved in Wyoming appliance refinishing, understanding this distinction can impact taxes and benefits. A clear Wyoming Appliance Refinish Services Contract - Self-Employed can help clarify responsibilities and rights.

Writing a self-employed contract, especially for Wyoming appliance refinish services, involves outlining essential details. Start with your name, the client’s name, and a clear description of the services provided. Include payment terms, deadlines, and any legal obligations. Utilizing platforms like US Legal Forms can simplify this process by offering templates that adhere to the Wyoming Appliance Refinish Services Contract - Self-Employed standards.

The new federal rule on independent contractors affects how individuals are classified for tax and employment purposes. It emphasizes the need for a broader evaluation of factors, such as control over work and independence in service delivery, like in a Wyoming Appliance Refinish Services Contract - Self-Employed. This change aims to protect workers while ensuring those who operate as independent contractors understand their status. Familiarizing yourself with these regulations is crucial for compliance in your agreements.