Wyoming Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

Are you currently in the location where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but locating reliable versions is not easy.

US Legal Forms provides a vast array of form templates, including the Wyoming Educator Agreement - Self-Employed Independent Contractor, which are designed to meet state and federal requirements.

When you acquire the correct form, click Buy now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and pay for the order using PayPal or a credit card. Choose a convenient document format and download your copy. Find all the document templates you have purchased in the My documents list. You can obtain another version of the Wyoming Educator Agreement - Self-Employed Independent Contractor anytime if needed. Just click the desired form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service offers professionally created legal document templates for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wyoming Educator Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/state.

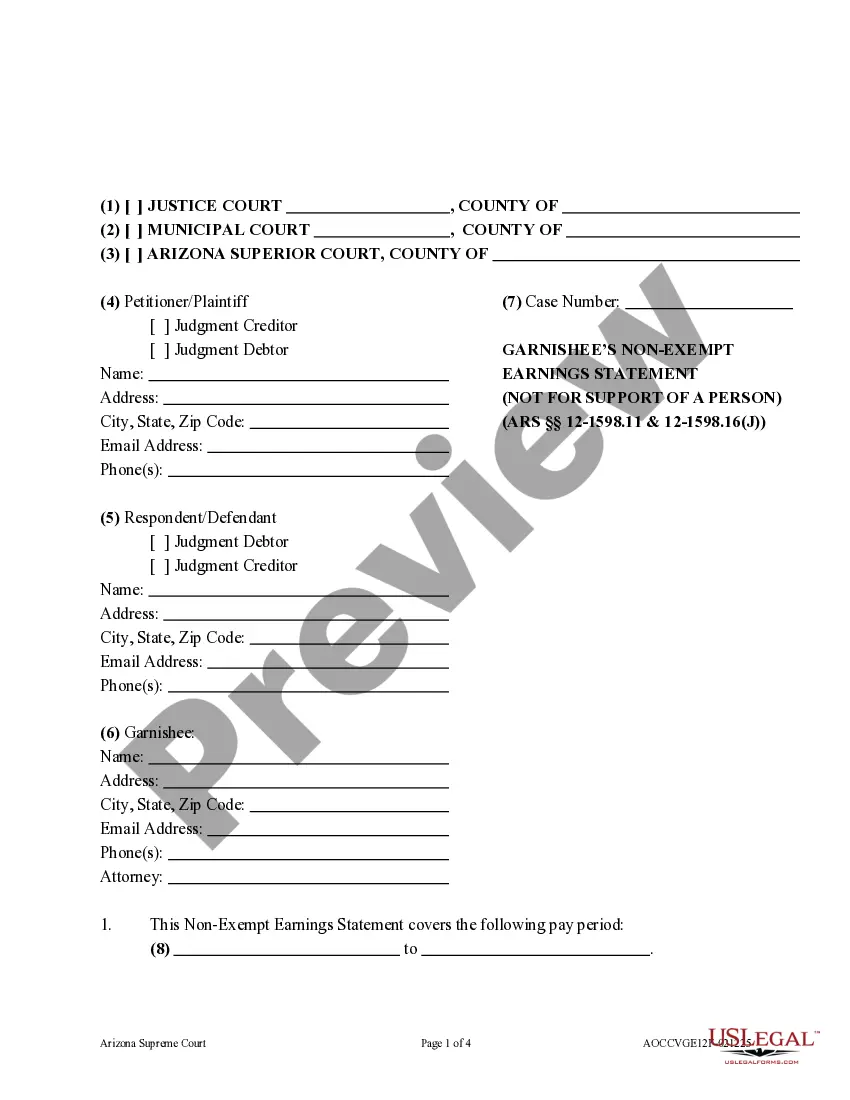

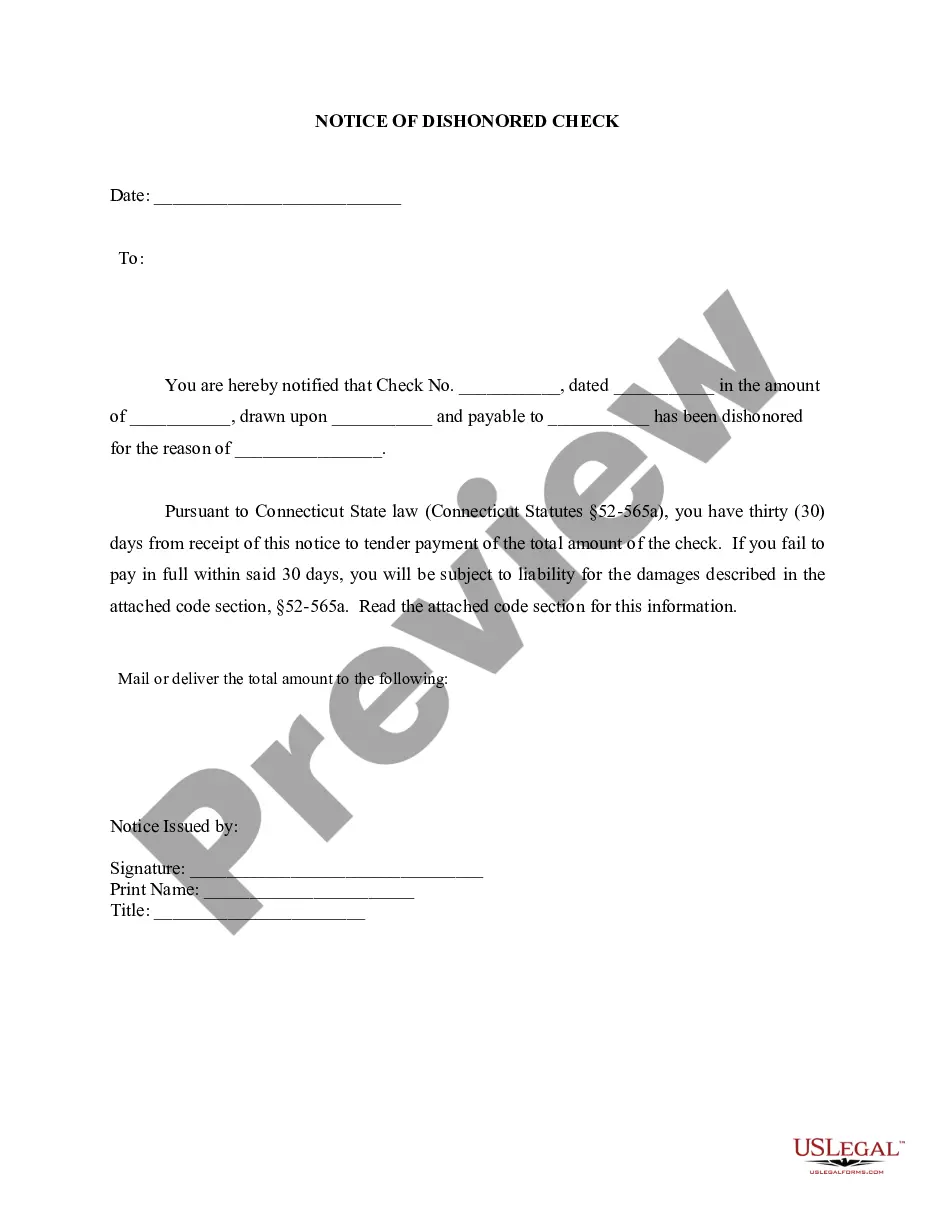

- Utilize the Review button to evaluate the form.

- Check the details to confirm you have selected the right form.

- If the form is not what you need, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

To provide proof of employment as a self-employed independent contractor, you can utilize several documents. First, you may include your signed Wyoming Educator Agreement - Self-Employed Independent Contractor, which outlines your work arrangement with the hiring party. Additionally, you can present invoices you have issued for services rendered, along with any relevant payment records or bank statements that show deposits. Using these documents will help you clearly demonstrate your independent contractor status.

Yes, an independent contractor is indeed considered self-employed. This status allows for greater flexibility in work arrangements and the ability to engage multiple clients. The Wyoming Educator Agreement - Self-Employed Independent Contractor is designed to streamline this relationship, making it easier for educators to operate as independent professionals.

Both terms, self-employed and independent contractor, have specific meanings, but they can be used interchangeably in many contexts. 'Self-employed' often emphasizes the overall independence of an individual, while 'independent contractor' denotes a specific working arrangement. In the context of the Wyoming Educator Agreement - Self-Employed Independent Contractor, either term can be suitable, depending on the focus of your discussion.

A person qualifies as self-employed when they run their own business or provide services independently, without an employer. This means earning income directly from clients or customers and managing one's own finances and taxes. The Wyoming Educator Agreement - Self-Employed Independent Contractor clearly outlines the responsibilities and rights of a self-employed individual in the education field.

Yes, it is possible for someone to be labeled as an independent contractor but functionally operate as an employee. This situation often arises when an individual works under strict control and direction from a single employer. Understanding these distinctions is crucial, especially when engaging in a Wyoming Educator Agreement - Self-Employed Independent Contractor.

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and deadlines. Include details such as the duration of the contract and any confidentiality clauses. Utilizing a template specifically designed for the Wyoming Educator Agreement - Self-Employed Independent Contractor can simplify this process and ensure compliance with relevant laws.

Yes, receiving a 1099 form signifies that you are considered self-employed. This form reports income earned as an independent contractor, which means you are responsible for your taxes. Under the Wyoming Educator Agreement - Self-Employed Independent Contractor framework, this income classification allows for more autonomy in your professional life.

Yes, an independent contractor does count as self-employed. When you operate as an independent contractor, you have more control over your work and typically manage your own taxes. This classification allows you to work with multiple clients under the Wyoming Educator Agreement - Self-Employed Independent Contractor model, providing both flexibility and independence in your career.

To write an independent contractor agreement, begin by stating the names and roles of the parties involved. Clearly define the work to be performed, payment terms, and ownership of any created content. Including legal clauses is essential, so using a structured template like the Wyoming Educator Agreement - Self-Employed Independent Contractor from USLegalForms can provide guidance and ensure you cover all important aspects.

An independent contractor typically needs to fill out a W-9 form for tax purposes, along with an independent contractor agreement. These forms help define your work relationship and secure your payment. To ease the process, consider utilizing the Wyoming Educator Agreement - Self-Employed Independent Contractor template available on USLegalForms.