Wyoming Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

If you require to acquire, download, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms, which are available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your details to sign up for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Wyoming Door Contractor Agreement - Self-Employed with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to download the Wyoming Door Contractor Agreement - Self-Employed.

- You can also find forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

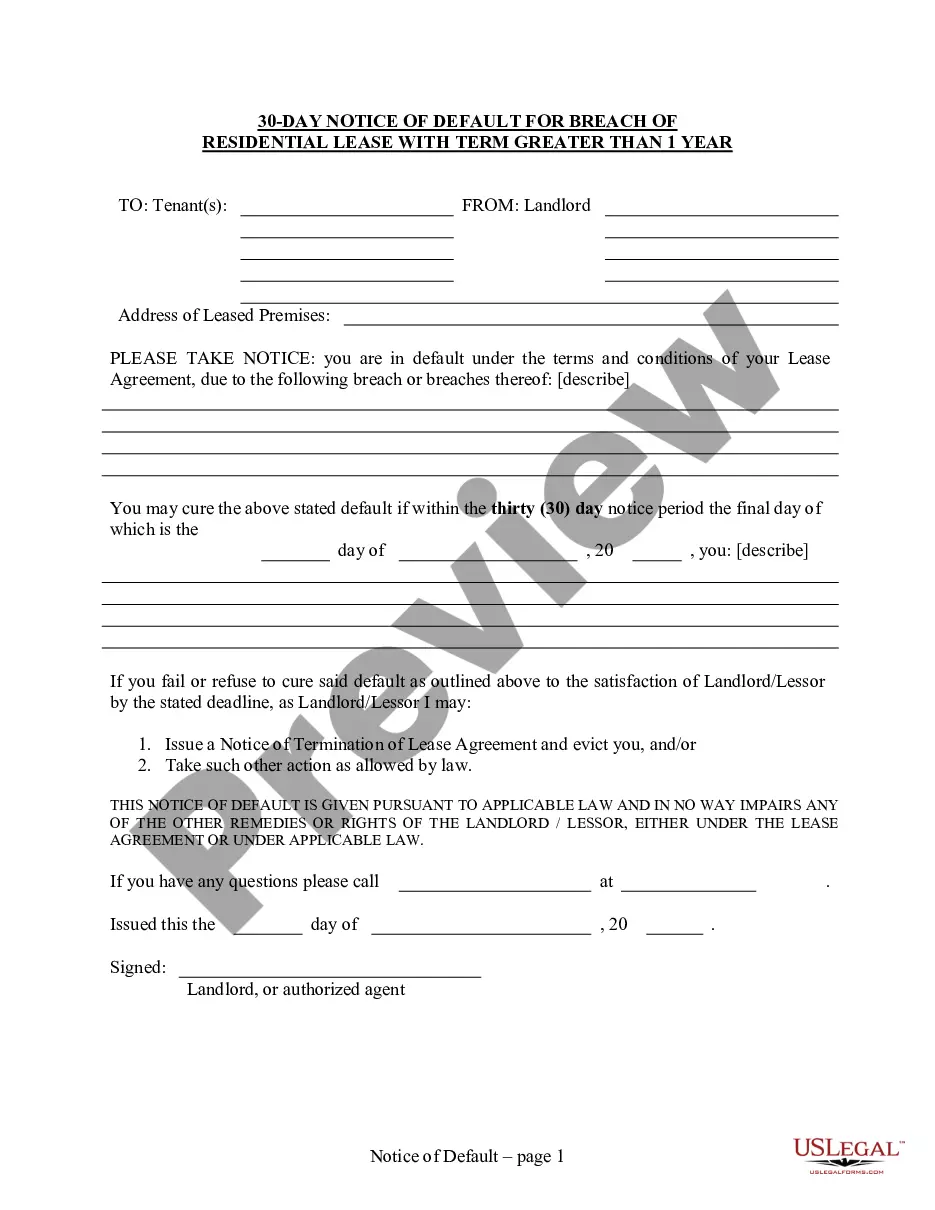

- Step 2. Use the Review option to browse the form’s content. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Filling out an independent contractor form involves providing accurate information about yourself and the nature of your work. Start with your contact details, followed by the services you will provide under the Wyoming Door Contractor Agreement - Self-Employed. Be sure to read the entire form carefully, ensuring you meet all legal requirements. Utilizing uslegalforms can help you navigate this process smoothly.

Writing an independent contractor agreement is straightforward and essential for your business. Begin by including the parties involved, the project details, and the compensation terms. A Wyoming Door Contractor Agreement - Self-Employed should also specify deadlines, liability clauses, and conditions for termination. Platforms like uslegalforms offer templates that simplify this process.

Yes, you can certainly have a contract when you are self-employed. A Wyoming Door Contractor Agreement - Self-Employed outlines the terms and expectations for your work. This contract provides clarity on payment, project scope, and deadlines, protecting both you and your client. It's essential to have this document in place to avoid misunderstandings.

Yes, an independent contractor is indeed considered self-employed. This classification allows them to manage their business independently, taking control of their work and finances. Understanding your classification, especially in a Wyoming Door Contractor Agreement - Self-Employed, is essential for tax purposes and establishing your professional identity.

While Wyoming does not mandate an operating agreement for all businesses, having one may benefit your structure. An operating agreement outlines how your business will operate and clarifies roles among members. If you are working as a self-employed contractor, such as through a Wyoming Door Contractor Agreement - Self-Employed, having this document can provide additional clarity in your business operations.

Filling out an independent contractor agreement requires careful attention to detail. Start by including your name, the client's name, and a description of the services provided. Finally, specify payment terms and conditions, as well as any other essentials that will tie into the Wyoming Door Contractor Agreement - Self-Employed to protect both parties involved.

Yes, receiving a 1099 form usually indicates that you are self-employed or an independent contractor. This form reports the income you received from a business, which is different from being a traditional employee. If you are working under a Wyoming Door Contractor Agreement - Self-Employed, you should expect to receive 1099s for the services you provide.

To qualify as self-employed, an individual must typically earn income from their own business or through freelancing, rather than working for an employer. Characteristics include having control over work hours, choosing clients, and managing business expenses. In the context of a Wyoming Door Contractor Agreement - Self-Employed, you will confirm your self-employed status by outlining your business obligations and responsibilities.

Yes, an independent contractor is generally considered self-employed because they work for themselves and have a degree of control over their work. Whenever you enter into a formal agreement, such as the Wyoming Door Contractor Agreement - Self-Employed, you establish a professional relationship that solidifies your status. It’s important to understand this distinction for tax purposes and other legal implications.

When discussing your work status, the terms self-employed and independent contractor can often be used interchangeably. However, self-employed is a broader term that encompasses various types of independent work arrangements. Choosing which term to use might depend on your specific situation and legal agreements, like the Wyoming Door Contractor Agreement - Self-Employed, that clarify your rights and responsibilities.