Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor

Description

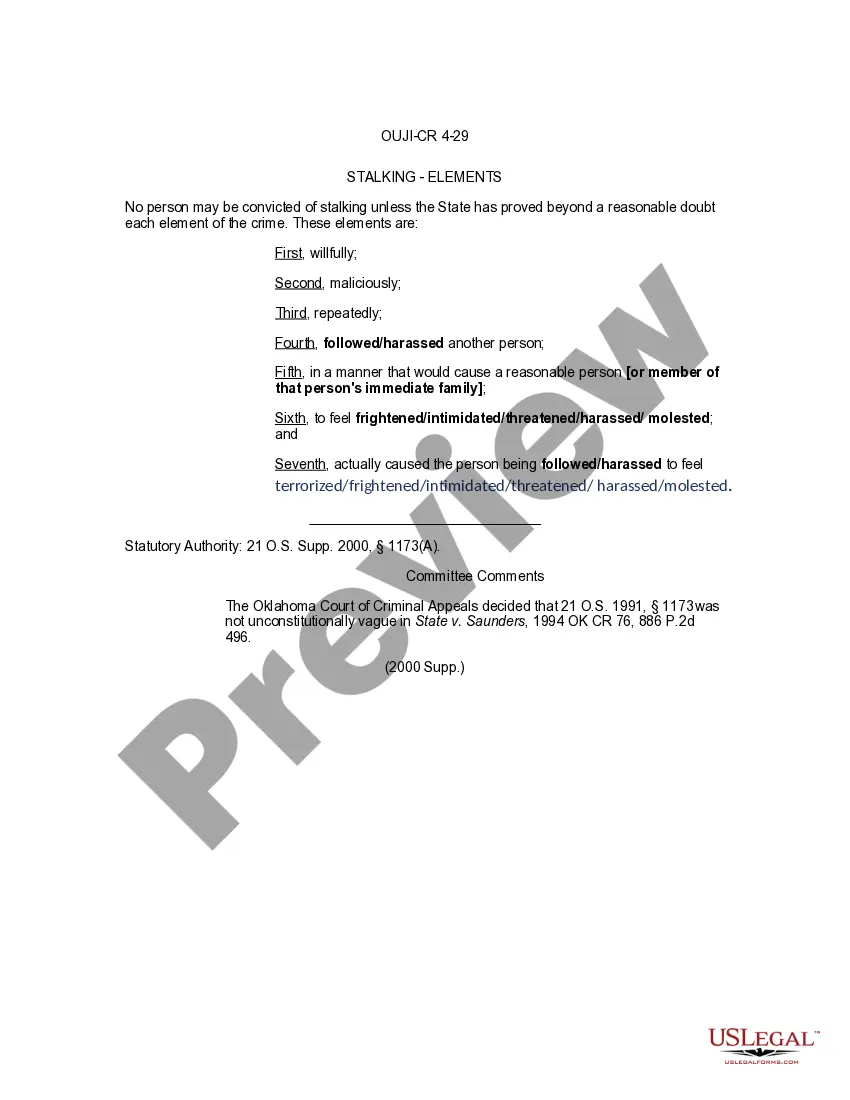

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the most extensive collections of legal documents in the United States - provides a variety of legal document templates you can acquire or generate.

While using the website, you will find thousands of forms for commercial and personal reasons, organized by categories, claims, or terms.

You can get the latest versions of forms like the Wyoming Data Entry Employment Agreement - Self-Employed Independent Contractor in just seconds.

Check the form details to confirm you have chosen the right document.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you already have a membership, Log In and access the Wyoming Data Entry Employment Agreement - Self-Employed Independent Contractor from the US Legal Forms library.

- The Get button will appear on each document you view.

- You can view all previously downloaded forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your town/county.

- Click the Preview button to review the form's content.

Form popularity

FAQ

Filling out an independent contractor agreement involves outlining the essential terms of your work arrangement. Start by specifying the services you will provide, payment terms, and the length of the contract. Use a Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor as a guide to ensure you cover all necessary details. This clarity helps both you and your client understand expectations and responsibilities.

Yes, you can certainly have a contract even when self-employed. In fact, a contract serves to protect your interests and outline the scope of your work. A solid Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor can enhance your business relationships and provide you with a clear framework for your offerings. This document can be instrumental in defining both your rights and responsibilities.

Recent updates to regulations for self-employed individuals can significantly impact how you operate. These changes may involve tax implications, benefit eligibility, and reporting requirements, making it crucial to stay informed. Always review your Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor to see how these new rules may apply to your agreements. Keeping abreast of these updates ensures you can adapt your strategies effectively.

To complete a declaration of independent contractor status form, start by providing your basic information, such as name and contact details. Next, outline the nature of your work and any relevant agreements you've established with clients. This form often helps clarify your self-employment status, and having a well-prepared Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor can be beneficial for reference.

Filling out a 1099 as an independent contractor involves several clear steps. First, you will need to gather your income records for the year. Then, you can accurately report your earnings from each client on this form, which is crucial for tax purposes. If you need guidance, consider utilizing USLegalForms to understand how to fill out a Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor accurately.

Absolutely, being self-employed does not prevent you from having a contract. In fact, a Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor formalizes your work agreements and outlines your responsibilities. Such contracts help establish clear expectations between you and your clients. They provide security and clarity for both parties involved.

Yes, if you work as a contractor, you are typically regarded as self-employed. As a self-employed independent contractor, you manage your own business operations and financials. This arrangement allows you the flexibility to set your own hours and decide which projects to take on. It's essential to understand this status fully, especially when dealing with a Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor.

Generally, an independent contractor must earn at least $600 from a single client in a calendar year to receive a 1099 form. This requirement applies when you engage in services outlined under agreements like the Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor. Receiving a 1099 indicates that you are recognized as a legitimate contractor in the eyes of the IRS.

An independent contractor indeed counts as self-employed. When operating under a Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor, you are responsible for your own taxes and business decisions. This allows for greater flexibility in your work life and the potential to earn more through various contracts.

Yes, contract work typically counts as self-employment. If you provide services based on a Wyoming Data Entry Employment Contract - Self-Employed Independent Contractor, you operate as a self-employed individual. This status allows you to manage your work schedule, select your clients, and control your income, all while adhering to self-employment tax obligations.