Wyoming Term Sheet - Simple Agreement for Future Equity (SAFE)

Description

How to fill out Term Sheet - Simple Agreement For Future Equity (SAFE)?

Have you been inside a position the place you require paperwork for possibly business or person reasons almost every day time? There are a variety of authorized record themes accessible on the Internet, but getting kinds you can trust isn`t straightforward. US Legal Forms provides thousands of type themes, just like the Wyoming Term Sheet - Simple Agreement for Future Equity (SAFE), that happen to be written in order to meet state and federal requirements.

In case you are previously informed about US Legal Forms internet site and have your account, merely log in. Following that, you can download the Wyoming Term Sheet - Simple Agreement for Future Equity (SAFE) design.

If you do not have an profile and wish to start using US Legal Forms, adopt these measures:

- Obtain the type you want and ensure it is for that right metropolis/county.

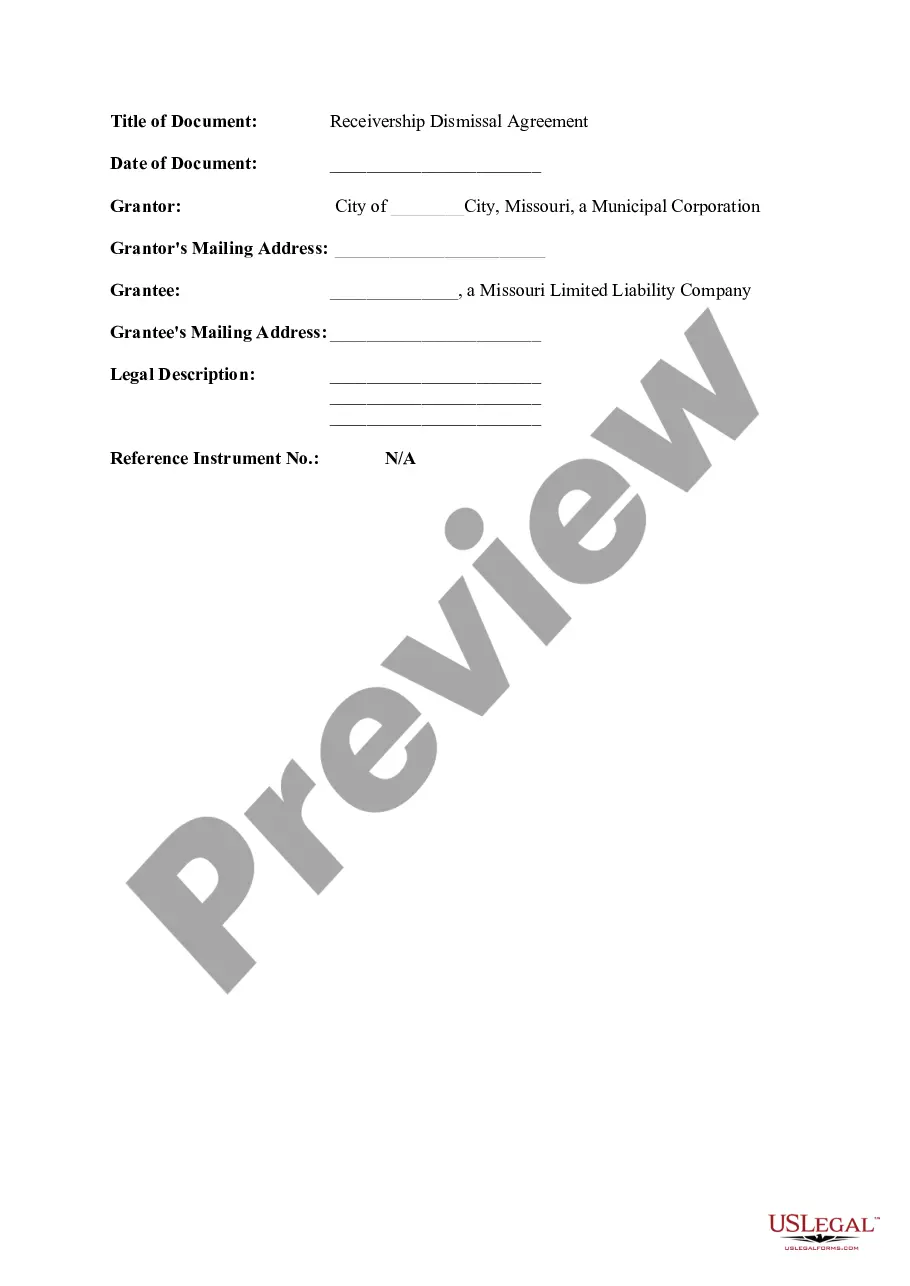

- Use the Preview key to check the shape.

- See the information to ensure that you have selected the right type.

- If the type isn`t what you`re seeking, use the Lookup area to find the type that meets your requirements and requirements.

- Whenever you obtain the right type, simply click Acquire now.

- Select the costs strategy you would like, submit the required info to make your money, and buy the order with your PayPal or bank card.

- Select a convenient document formatting and download your backup.

Discover each of the record themes you might have bought in the My Forms food list. You can obtain a extra backup of Wyoming Term Sheet - Simple Agreement for Future Equity (SAFE) anytime, if required. Just go through the essential type to download or printing the record design.

Use US Legal Forms, by far the most comprehensive collection of authorized kinds, to save time as well as steer clear of blunders. The support provides appropriately created authorized record themes which you can use for a range of reasons. Generate your account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Is a SAFE Note a Loan? No, a SAFE note is not a loan or debt, it is accounted for an equity on the balance sheet. Unlike convertible debt - or pretty much any debt, it does not have an interest rate nor does it have a maturity date.

SAFE Note Example For example, an investor purchases a SAFE note from your startup with a valuation cap of $10M. Your company's value is set at $20M at $10/share during the subsequent funding round. The SAFE note will convert based on the valuation cap of $10M.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A SAFE is an agreement to provide you a future equity stake based on the amount you invested if?and only if?a triggering event occurs, such as an additional round of financing or the sale of the company.

Term sheets are also often used for SAFE or convertible note rounds, but are used less frequently than for priced rounds because of the relative simplicity of SAFE and convertible note legal documents.

A safe (Simple Agreement for Future Equity) term sheet is a type of investment instrument used in early-stage startup funding. It allows investors to provide capital to a startup in exchange for the right to receive equity at a later date.

In a Liquidity Event, a safe holder is entitled to receive a portion of the proceeds equal to the greater of (1) a return of its Purchase Amount and (2) the as-converted proceeds it is entitled to in connection with a Liquidity Event (i.e., the proceeds it would be entitled to had its Purchase Amount been converted ...

A SAFE note term sheet is a legal document that aligns early-stage startup funding interests by outlining the key investment agreement terms for entrepreneurs.