Wyoming Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

You can spend hrs on the web searching for the authorized record format that suits the state and federal specifications you want. US Legal Forms gives thousands of authorized kinds that happen to be evaluated by pros. It is simple to down load or print out the Wyoming Term Sheet - Series A Preferred Stock Financing of a Company from our service.

If you already have a US Legal Forms account, you may log in and then click the Download switch. Next, you may comprehensive, change, print out, or sign the Wyoming Term Sheet - Series A Preferred Stock Financing of a Company. Every authorized record format you get is your own eternally. To obtain one more copy of any obtained type, proceed to the My Forms tab and then click the related switch.

If you are using the US Legal Forms web site initially, stick to the easy instructions below:

- Initially, make certain you have chosen the proper record format for that state/city of your choice. Look at the type explanation to ensure you have picked out the proper type. If accessible, make use of the Preview switch to appear from the record format too.

- If you wish to locate one more version of your type, make use of the Research field to find the format that meets your requirements and specifications.

- Upon having identified the format you need, just click Purchase now to proceed.

- Find the prices plan you need, key in your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal account to pay for the authorized type.

- Find the formatting of your record and down load it to the device.

- Make alterations to the record if required. You can comprehensive, change and sign and print out Wyoming Term Sheet - Series A Preferred Stock Financing of a Company.

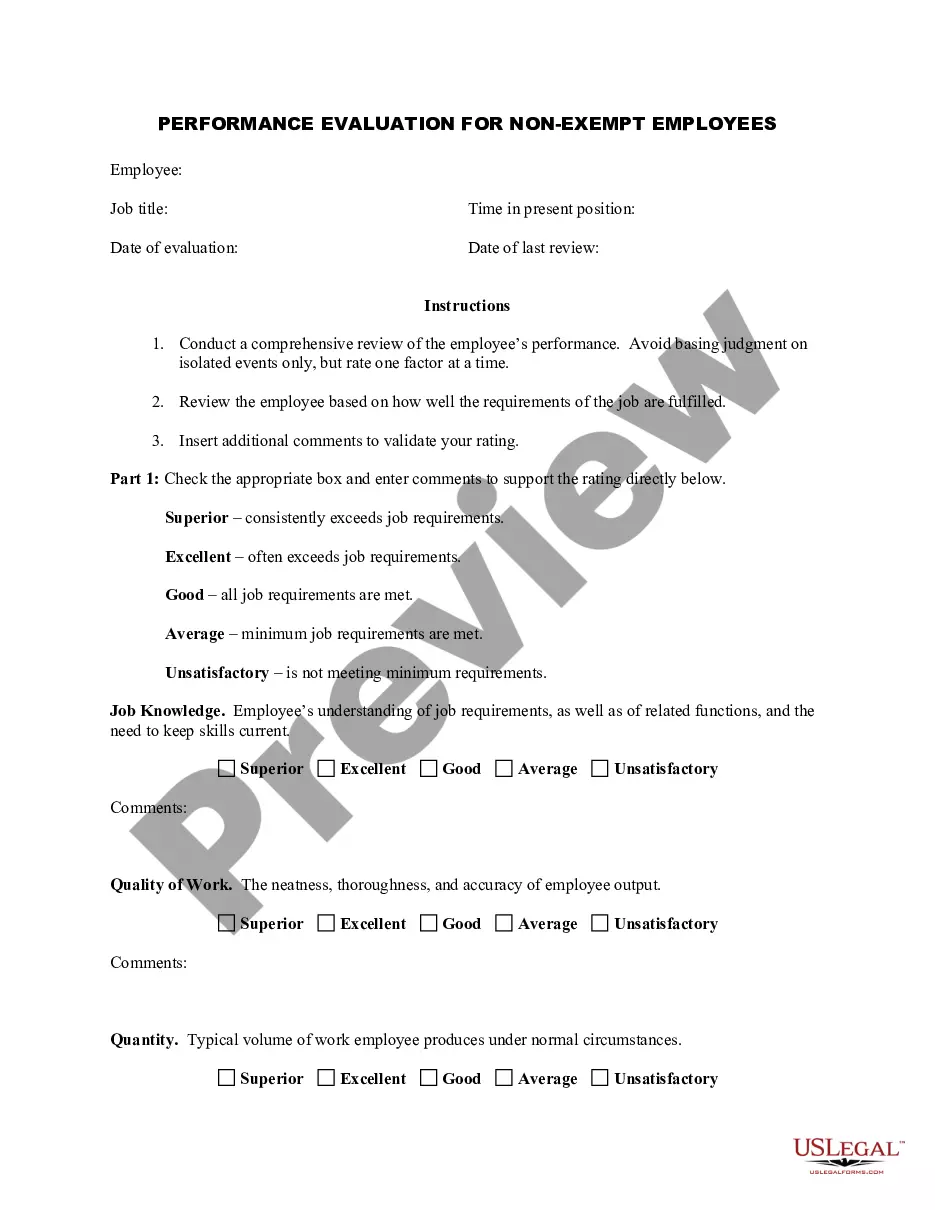

Download and print out thousands of record web templates utilizing the US Legal Forms site, that provides the most important collection of authorized kinds. Use specialist and condition-particular web templates to deal with your small business or specific requirements.

Form popularity

FAQ

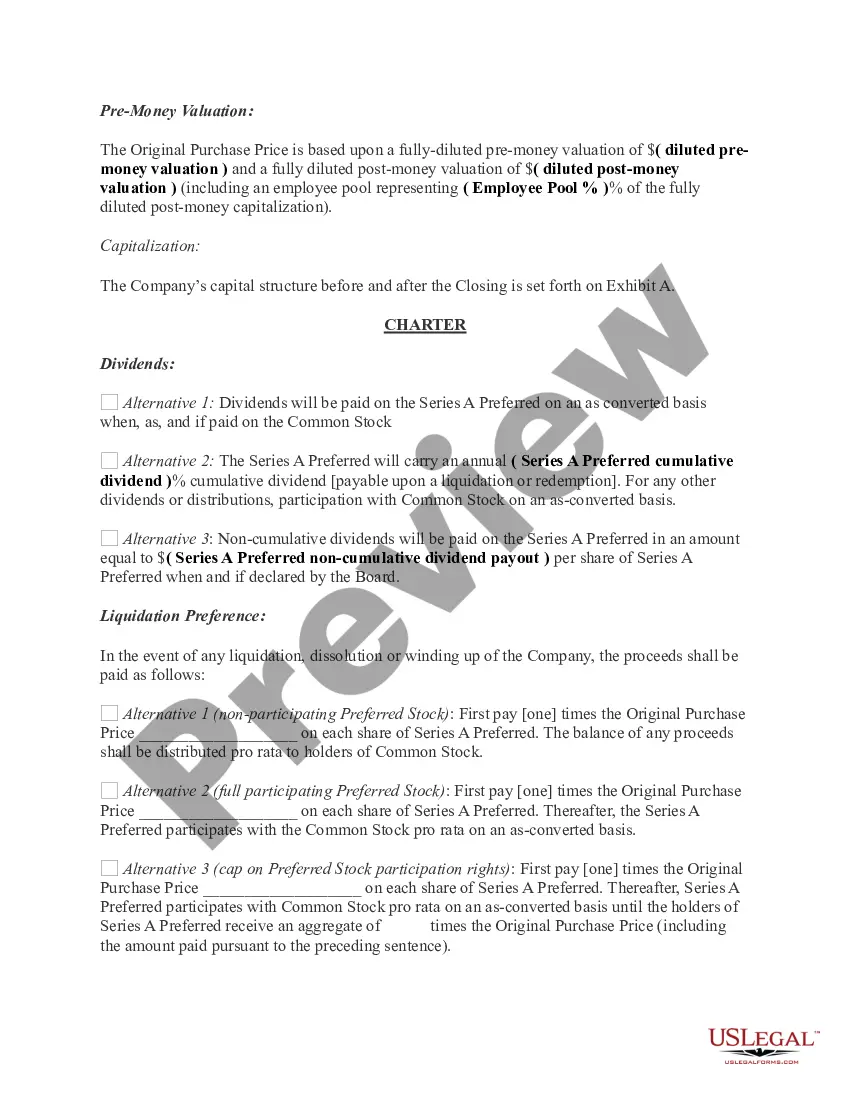

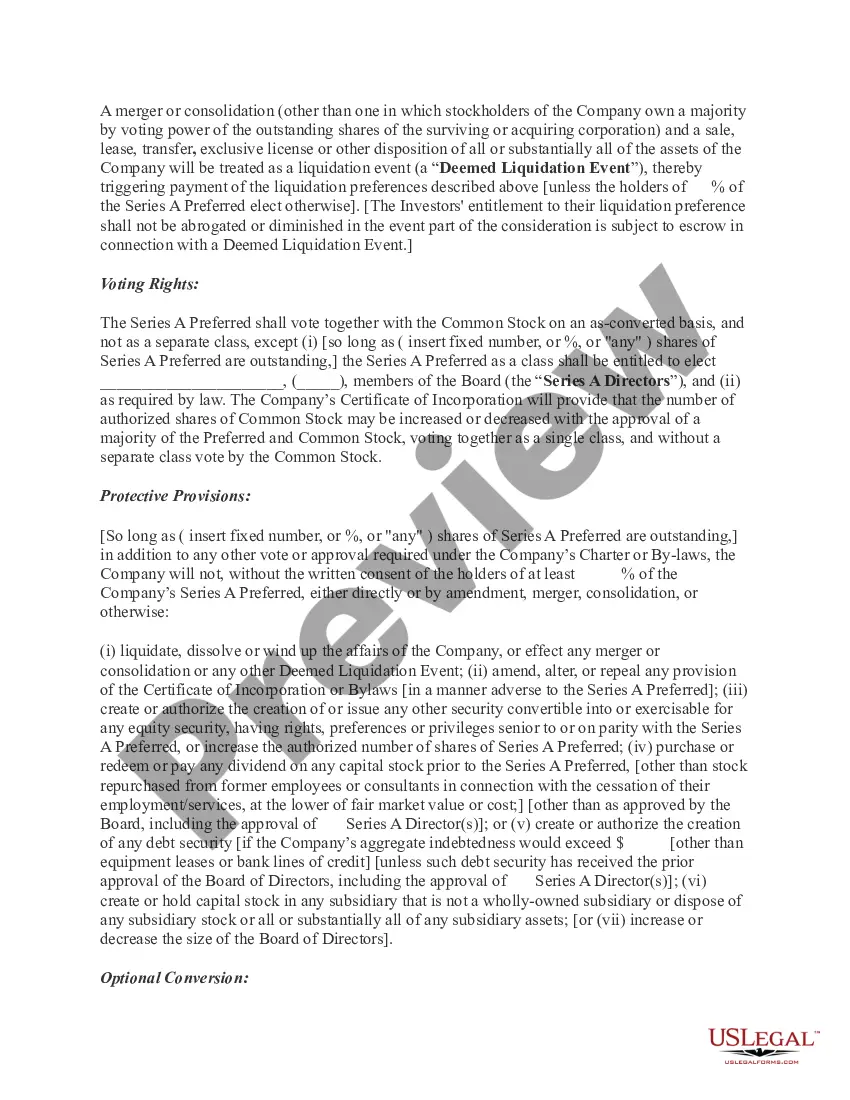

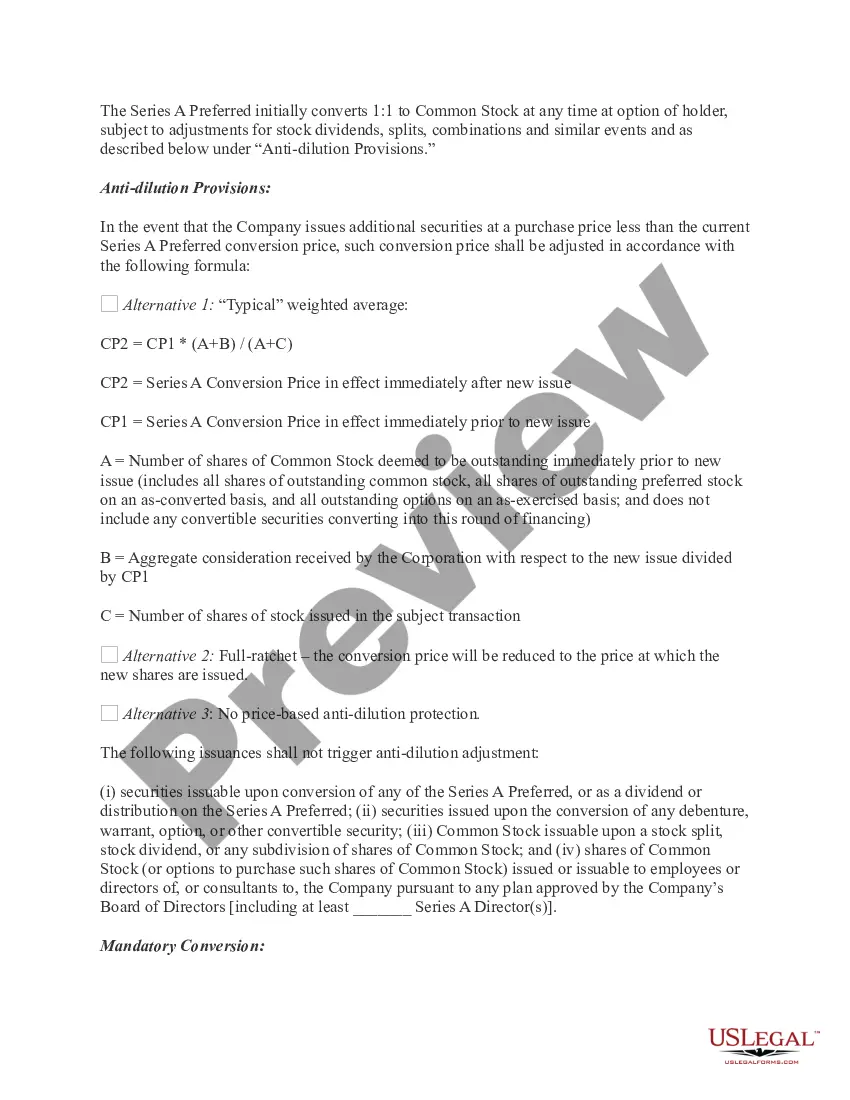

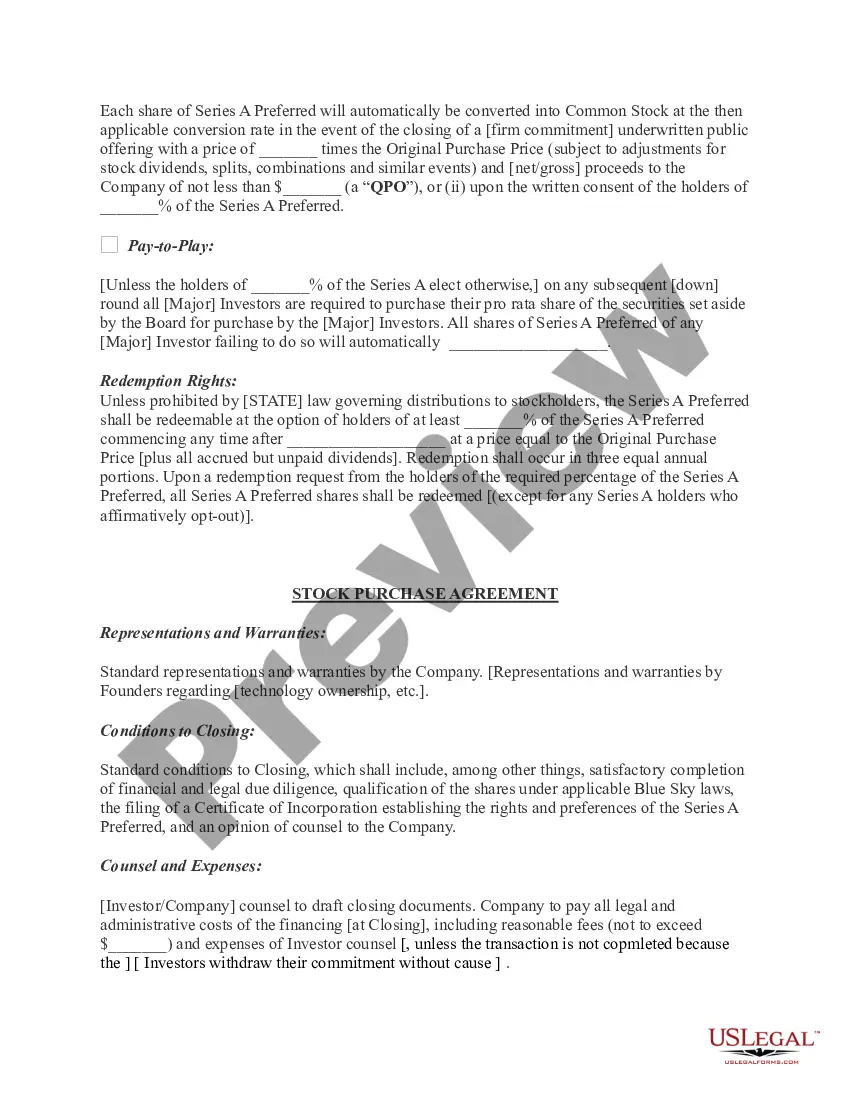

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

The valuation is one of the most important elements of a term sheet and distinguishes it from similar documents, such as SAFEs, which are used in earlier funding rounds when your company's valuation is not yet known. Term Sheets for Startups: Uses & Examples - Carta Carta ? blog ? term-sheets Carta ? blog ? term-sheets

Key Takeaways The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet. Term Sheets: Definition, What's Included, Examples, and Key ... Investopedia ? ... ? Investing Basics Investopedia ? ... ? Investing Basics

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

While drafting a term sheet, a few things should be kept in mind like, keeping it simple and clear, knowing your audience, defining the key terms of the agreement, having a scope for flexibility, having set timelines, defining confidentiality and exclusivity clauses, and addressing potential contingencies. 7 Tips for Writing a Term Sheet and Its Importance - BimaKavach bimakavach.com ? blog ? 7-tips-for-writing... bimakavach.com ? blog ? 7-tips-for-writing...

The key clauses of a term sheet can be grouped into four categories; deal economics, investor rights and protection, governance management and control, and exits and liquidity. The Ultimate Term Sheet Guide - all terms and clauses ... Salesflare Blog ? term-sheet-guide Salesflare Blog ? term-sheet-guide

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.