Wyoming Notice of Violation of Fair Debt Act - False Information Disclosed

Description

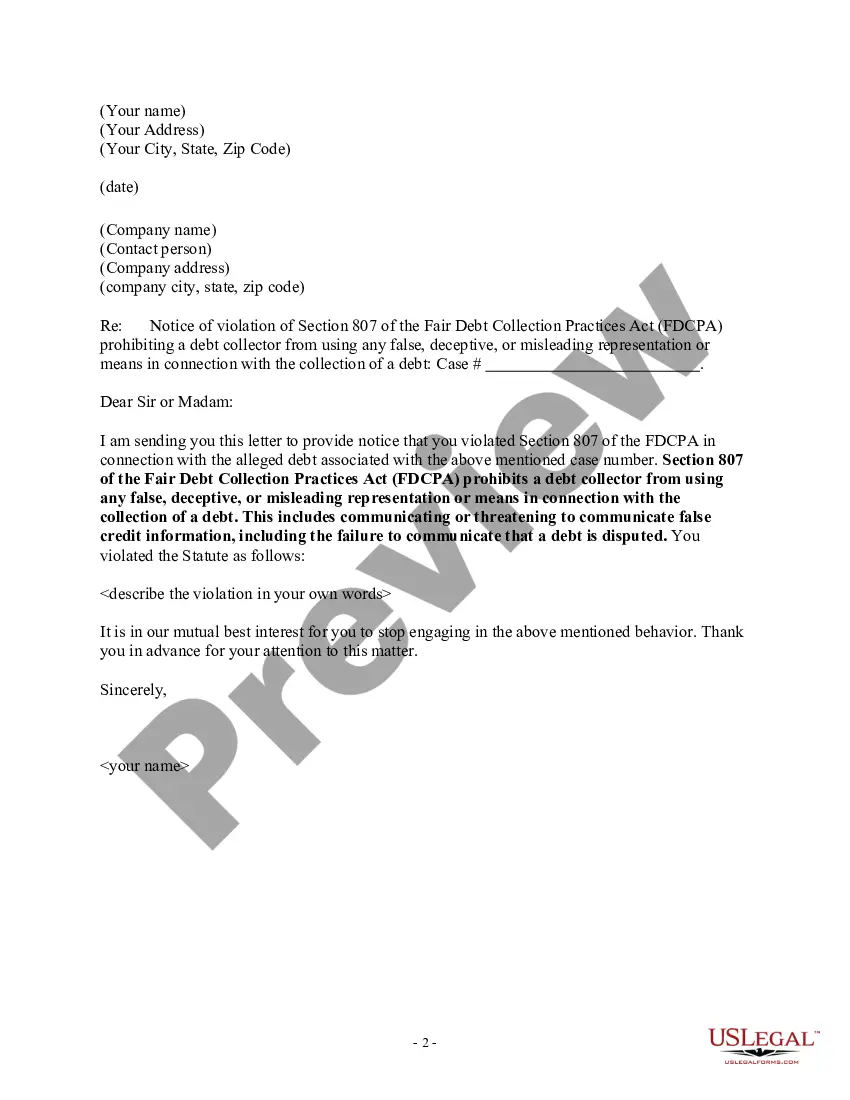

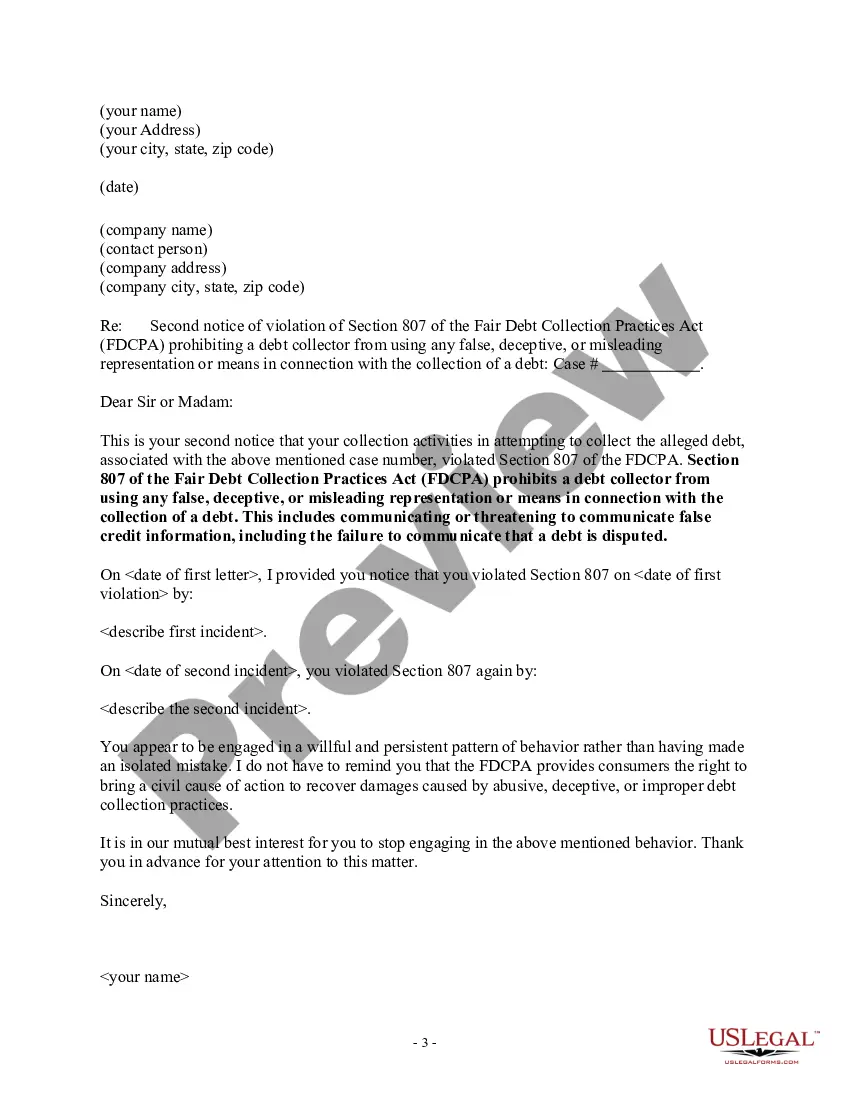

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

Locating the appropriate valid document template can be somewhat challenging.

Naturally, there are numerous templates accessible online, but how can you find the authentic form you require.

Utilize the US Legal Forms website. This platform offers a vast array of templates, such as the Wyoming Notice of Violation of Fair Debt Act - False Information Disclosed, which can be utilized for both professional and personal purposes.

If the form does not fulfill your requirements, use the Search field to find the appropriate form. Once you are confident the form is suitable, click the Get Now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and process the payment using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, customize, print, and sign the acquired Wyoming Notice of Violation of Fair Debt Act - False Information Disclosed. US Legal Forms is the largest collection of legal forms where you can explore numerous document templates. Leverage the service to obtain professionally crafted documents that adhere to state requirements.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log Into your account and click the Download button to obtain the Wyoming Notice of Violation of Fair Debt Act - False Information Disclosed.

- Use your account to search through the legal forms you have previously acquired.

- Navigate to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have chosen the correct form for your city/state. You can browse the form using the Preview button and review the form description to confirm it suits your needs.

Form popularity

FAQ

The 11-word credit phrase loophole refers to a strategy that highlights specific rights you have regarding debt management. It can empower you to challenge misleading information shared by debt collectors. When you leverage this loophole, you can effectively combat false information in your credit report. Remember, understanding such strategies is vital when dealing with a Wyoming Notice of Violation of Fair Debt Act - False Information Disclosed.

The 11-word phrase from Credit Secrets emphasizes your rights under debt collection laws. This phrase helps you understand how to protect yourself from false information disclosed by debt collectors. By recognizing these rights, you gain confidence in managing your debt. It's crucial when addressing issues like a Wyoming Notice of Violation of Fair Debt Act - False Information Disclosed.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

When writing the letter, request that the collection agency or creditor provide you with: Documentation that you owed the debt at some point, such as a contract you signed. How much you owe and the last outstanding action on the debt, which can be shown by documents such as the last statement or bill.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

A copy of the original written agreement between the parties, such as the loan note or credit card agreement, preferably signed by you. If the account has been sold to another creditor, then that creditor must prove that it has the right to sue to collect the debt.