Wyoming Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

It is feasible to invest time online searching for the valid document template that complies with the state and federal regulations you require.

US Legal Forms offers a vast array of legitimate documents that are examined by professionals.

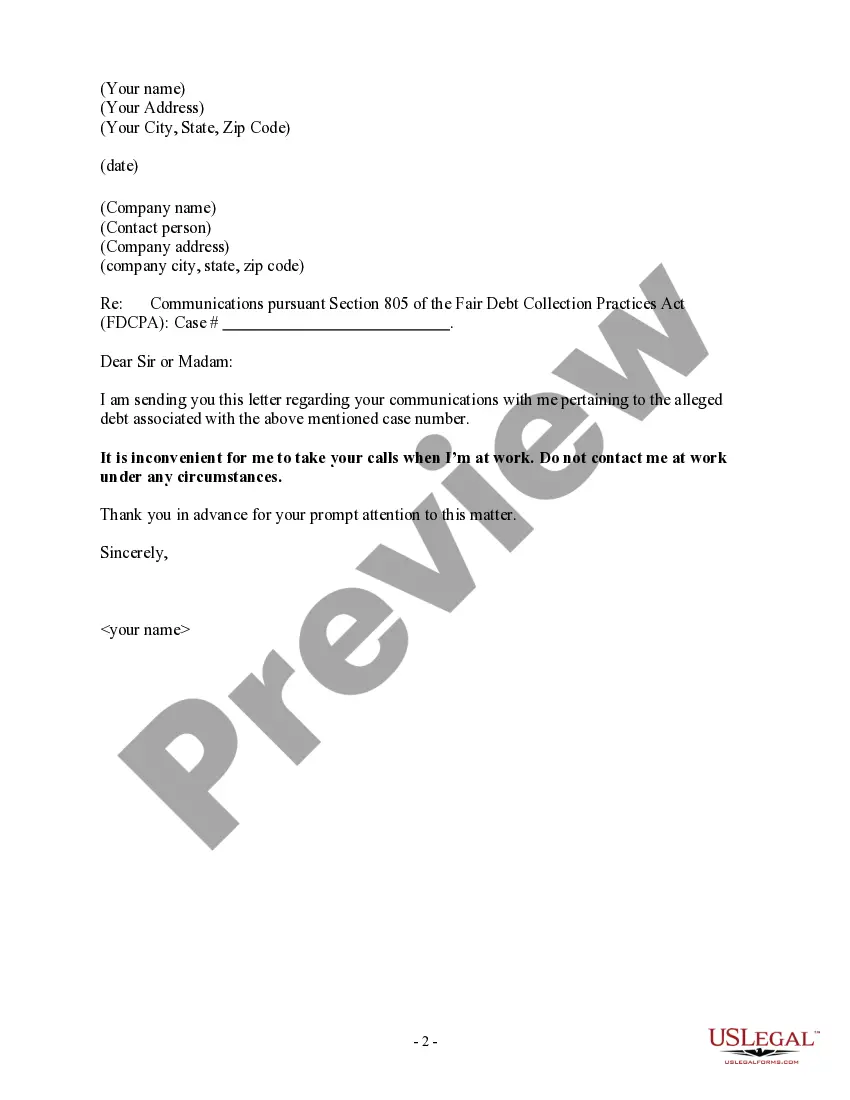

You can obtain or print the Wyoming Notice of Violation of Fair Debt Act - Improper Contact at Work from my assistance.

If available, use the Review button to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- Afterwards, you can complete, modify, print, or sign the Wyoming Notice of Violation of Fair Debt Act - Improper Contact at Work.

- Each legal document template you buy is yours forever.

- To get another version of a purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Read the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

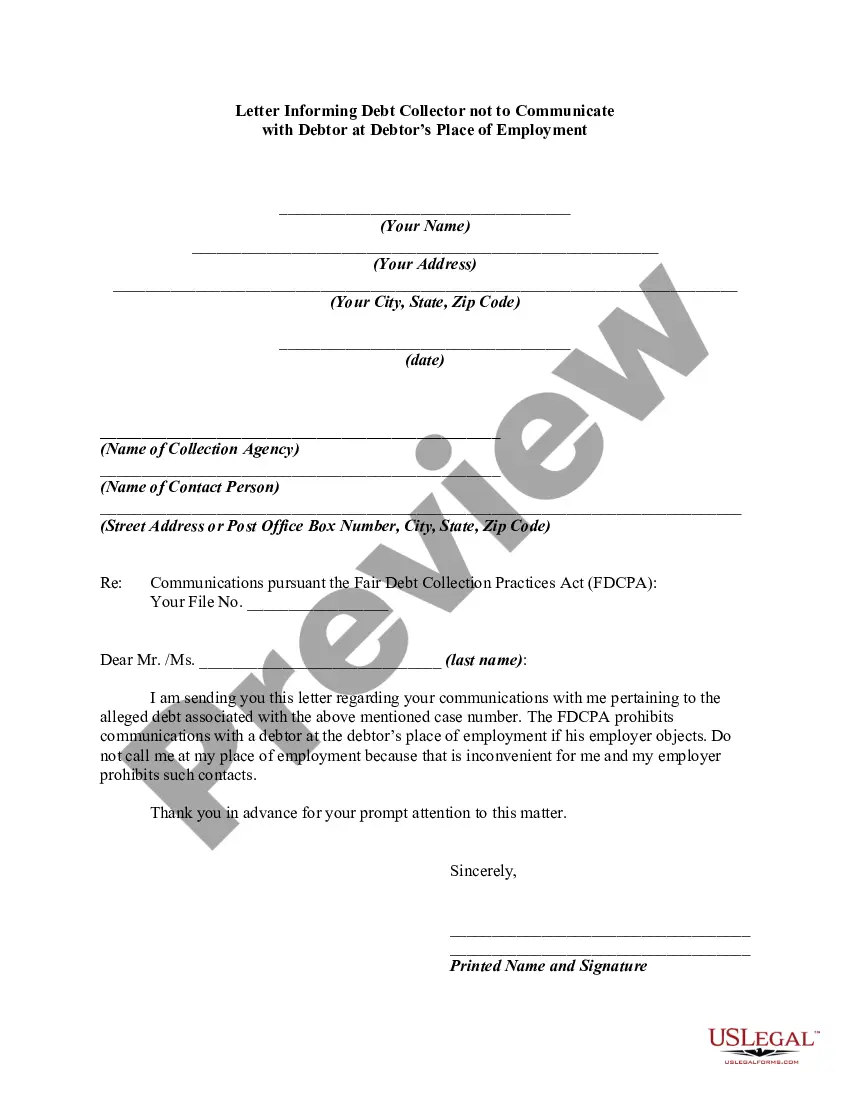

Can debt collectors contact me at any time or place? No. Debt collectors can't contact you before 8 a.m. or after 9 p.m., unless you agree to it. They also can't contact you at work if you tell them you're not allowed to get calls there.

Simply tell the debt collector to stop calling you at work. You don't need to ask the debt collector in writing, but it helps to keep a written record in the event of future problems.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

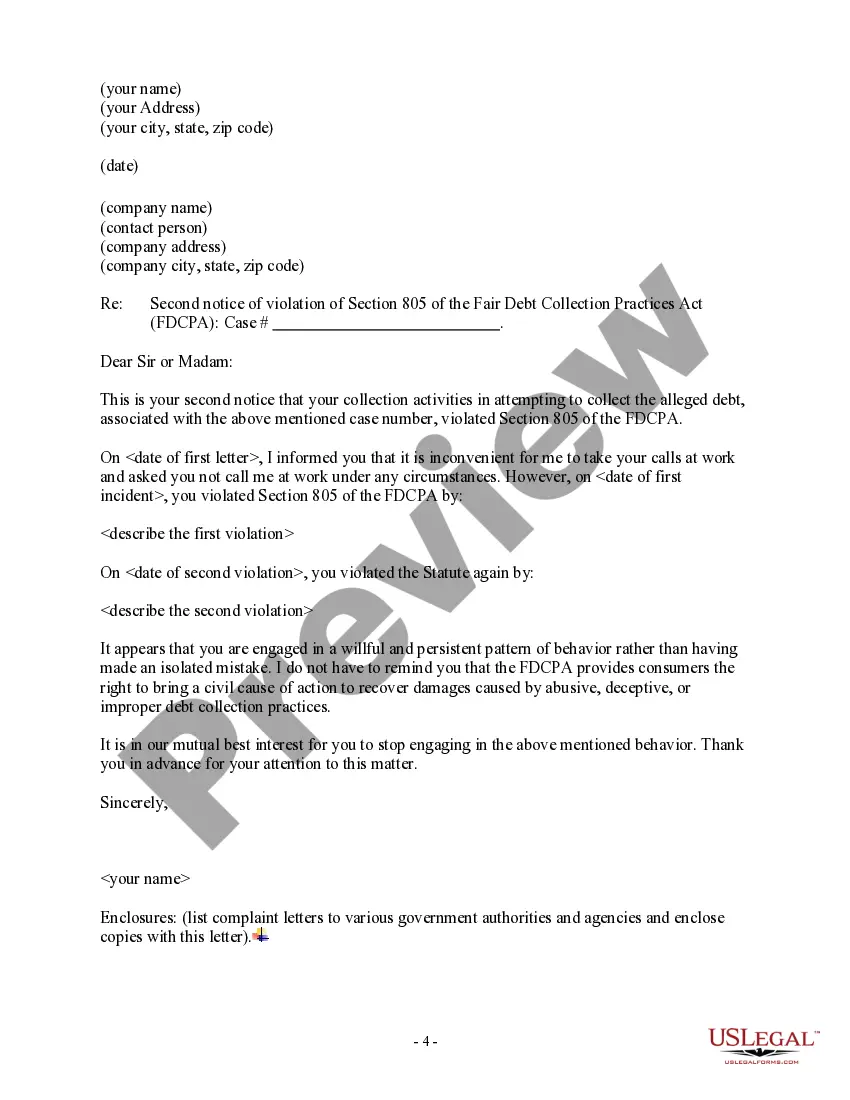

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

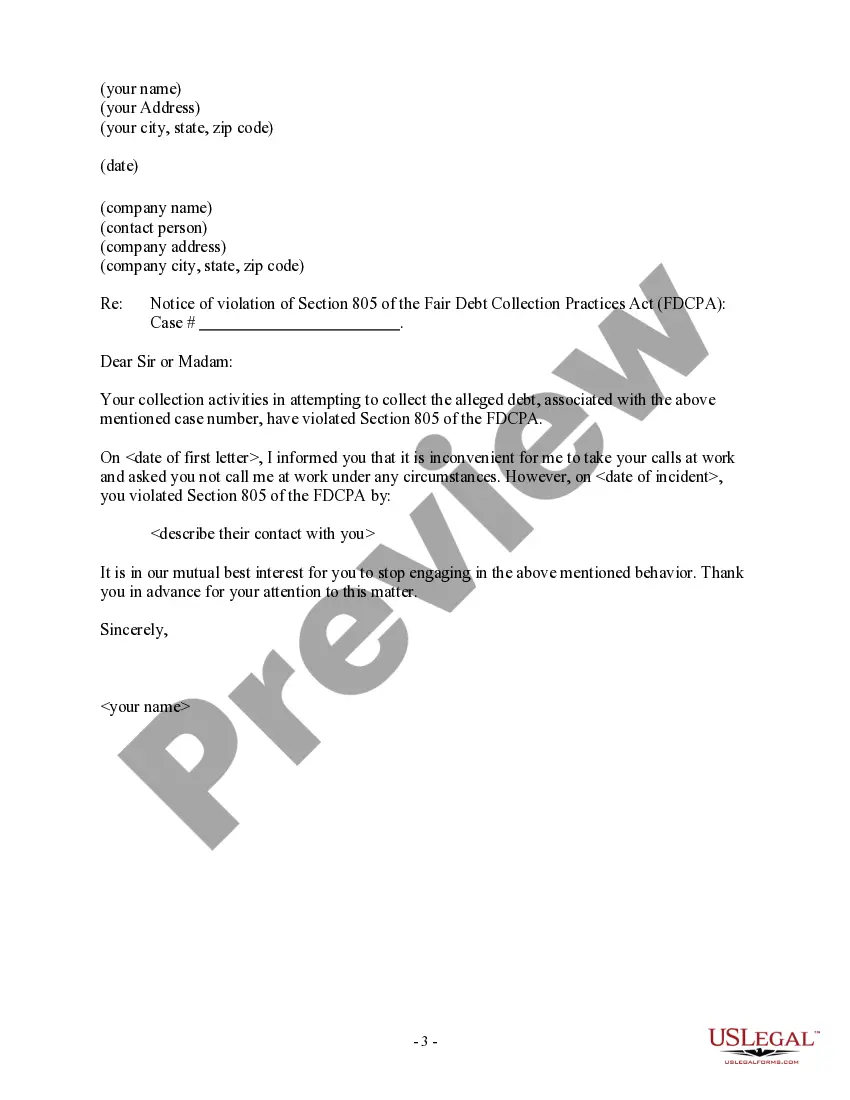

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

For example, a debt collector may not: Try to collect charges in addition to the debt unless they are allowed by the contract or state law. Deposit a post-dated check early. Communicate with you about a debt by postcard.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

The law makes it illegal for debt collectors to harass debtors in other ways, including threats of bodily harm or arrest. They also cannot lie or use profane or obscene language. Additionally, debt collectors cannot threaten to sue a debtor unless they truly intend to take that debtor to court.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020